High Voltage: What does Trump 2.0 mean for the inflation reduction act?

Analysts say the Republican party could temper Trump’s potential for a legislative repeal rampage. Pic: Getty Images

- Trump administration could repeal elements of Biden’s Inflation Reduction Act

- Benchmark analyst says fossil fuels likely to be in the spotlight

- Any impact on electric vehicle and battery sector could be years away

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

Donald Trump is back in the White House and with a Republican majority in the Senate, that means he’s got the backing to repeal legislation – including parts of President Joe Biden’s Inflation Reduction Act.

A serial repealer, last time Trump took office he was focused on dismantling Barack Obama’s legislative legacy, and reduced Environmental Protection Agency emissions standards – including softening vehicle efficiency targets.

The idea was to slash environmental red tape that he viewed as an obstacle to business and fossil fuel players in particular.

Benchmark Mineral Intelligence policy analyst Bryan Bille reckons with his second term, fossil fuels will definitely be back on Trump’s agenda.

“Trump’s return to the White House is likely to result in a pivot towards fossil fuels and a relaxation of environmental regulations,” Bille said.

“Donald Trump has reportedly promised to scrap pro-EV rules, mandates, and has regularly criticised the IRA’s tax policy, especially Section 30D, which provides tax credits.”

That would be a bit hit to the electric vehicle and battery sectors, which have enjoyed more than US$110bn of investment since President Biden enacted the IRA in August 2022.

At the start of Biden’s term, BMI’s 2030 gigafactory pipeline sat at around 360 gigawatt-hours, now it’s more than three times that at 1310 gigawatt-hours.

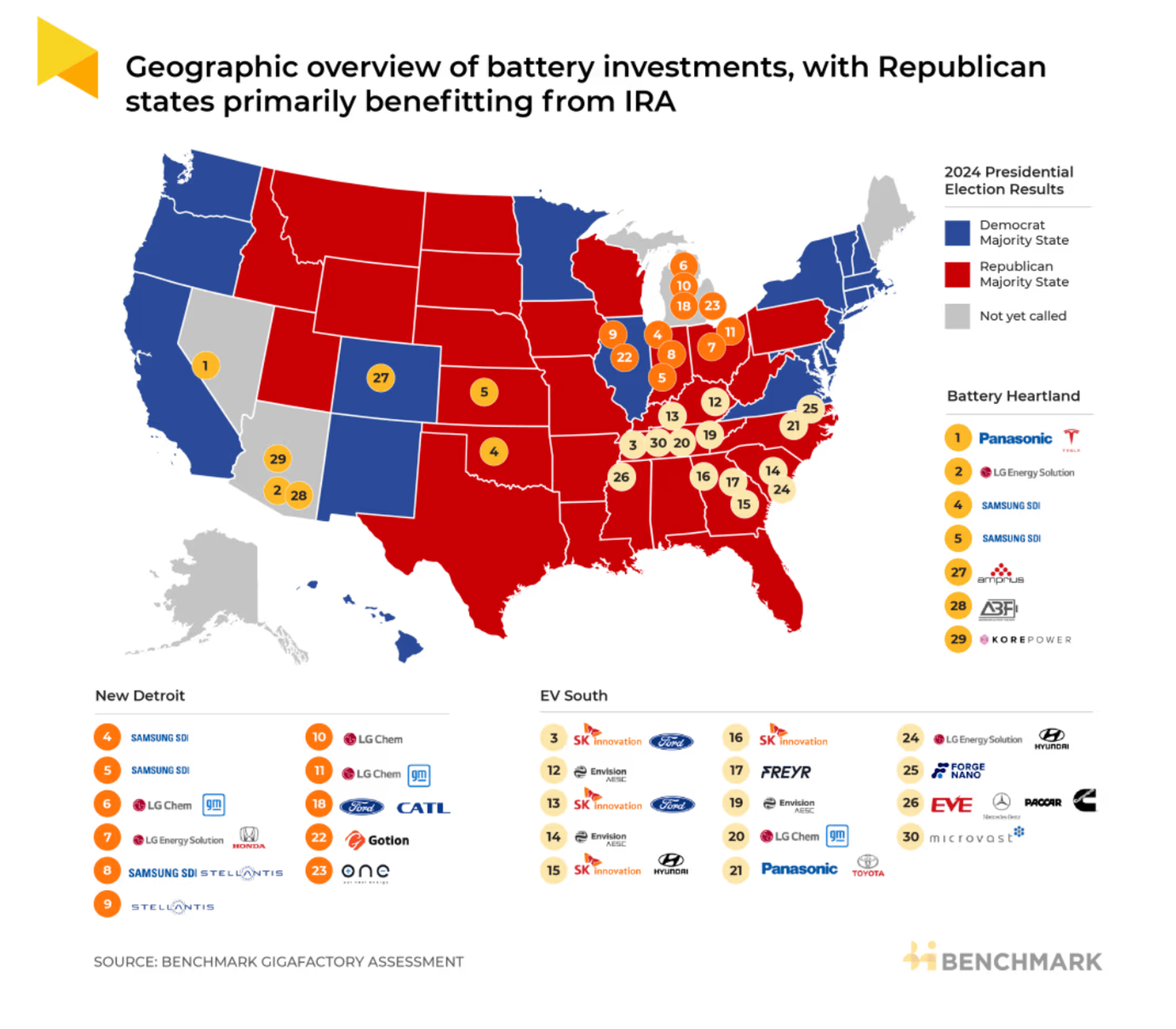

But interestingly, the majority of US states – 92% in fact – enjoying this bumper battery investment have been red.

That means Trump could face a bit of an uphill battle from his own Republican Party, Bille says.

“Mainly Republican states have significantly benefited from clean tech investments resulting from the Inflation Reduction Act,” Bille said.

“Watering down or cancelling these investments would affect the US’ catch up efforts vis-a-vis China.”

Trump may simmer down on the repealing, but Bille says he could still change the implementation of the IRA, according to Bille, such as changing foreign entity of concern (FEOC) rules.

Miners needn’t worry, Trump’s pretty keen on domestic critical mineral production.

“Trump voiced his support for domestic mining, which could result in a more profound permitting reform and further financial support for domestic mining projects,” Bille said.

Don’t worry about EV demand, yet

Bloomberg Hyperdrive’s Craig Trudell says Trump is nothing if not unpredictable, so don’t worry about it too much because its “exceedingly difficult to prognosticate about what’s in store for the global auto industry once he returns to the White House.”

Plus, Trudell notes that the IRA is more MAGA-friendly than meets the eye.

“Plug-in cars have to have been made in North America in order to qualify for purchase credits, for one,” he said.

“Even if fears about the IRA’s demise prove unfounded, there are other policy levers Trump is likely to pull that would undermine the law and what its authors aimed to accomplish.

“His first administration weakened fuel-economy rules that play a role in compelling manufacturers to make more EVs, and also battled California over the state’s ability to set its own stricter auto-emission standards.

“Assuming a second Trump administration makes similar moves, automakers are unlikely to go electric with as much gusto as they otherwise would.”

Bille says despite Trump’s aversion to EVs, it’s notable that Elon Musk – the chief executive of Tesla, the US’ largest EV company – is a staunch supporter and backup dancer.

I’m sorry, this is the funniest single photo of the entire election cycle. pic.twitter.com/w6PuJlPPmW

— Sonny Bunch (@SonnyBunch) October 6, 2024

Trump has expressed an ambition to roll back emission reduction standards, which would reduce demand for EVs.

However, making such changes won’t come quickly.

“Rolling back these standards takes time, typically, years,” Bille said.

“Moreover, another thing to remember is that some federal states have already implemented stringent emission standards and EV adoption programs beyond federal control.”

More tariffs on Chinese imports?

Earlier in 2024, Biden added 100% tariffs to imported Chinese EVs and also increased the tariffs on Chinese critical minerals.

The FEOC rules of the IRA currently only apply for the 30D tax credits when consumers purchase an EV, but Bille says Trump could strengthen these and potentially extend them to apply to the 45X production tax credits.

“There is an expectation of more domestic and foreign policy uncertainty and turbulence,” Bille said.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing >>>

CODE COMPANY PRICE WEEK % MONTH % 6 MONTH % YEAR % YTD % MARKET CAP PVW PVW Res Ltd 0.02 -17% -9% -20% -65% -58% $ 4,375,905.12 A8G Australasian Metals 0.08 -16% -41% 0% -53% -53% $ 4,169,639.52 INF Infinity Lithium 0.033 6% 3% -37% -62% -67% $ 17,115,907.44 PSC Prospect Res Ltd 0.092 19% -8% -37% 2% 3% $ 51,359,893.29 PAM Pan Asia Metals 0.065 7% 18% -59% -55% -48% $ 12,925,364.01 CXO Core Lithium 0.105 -9% -9% -25% -72% -58% $ 235,731,709.84 LOT Lotus Resources Ltd 0.24 -8% -9% -45% -8% -16% $ 535,680,551.22 AGY Argosy Minerals Ltd 0.036 -14% -5% -70% -79% -73% $ 53,869,074.56 NWC New World Resources 0.02 0% -5% -44% -29% -49% $ 53,965,352.74 QXR Qx Resources Limited 0.005 0% -17% -62% -78% -78% $ 5,550,389.27 CAE Cannindah Resources 0.039 -7% -25% -26% -60% -61% $ 26,717,038.21 AZL Arizona Lithium Ltd 0.016 0% 0% -27% -16% -48% $ 71,581,032.45 RIL Redivium Limited 0.004 0% -20% 33% -43% -43% $ 10,987,419.24 COB Cobalt Blue Ltd 0.095 2% 7% 7% -62% -60% $ 39,712,626.03 LPD Lepidico Ltd 0.002 0% 0% -33% -77% -74% $ 17,178,249.77 MRD Mount Ridley Mines 0.001 0% 0% 0% -50% -50% $ 7,784,882.87 CZN Corazon Ltd 0.006 20% 20% -33% -60% -60% $ 4,007,433.53 LKE Lake Resources 0.056 -10% 44% -10% -66% -57% $ 105,964,685.57 DEV Devex Resources Ltd 0.125 -4% -11% -58% -54% -48% $ 53,002,880.52 INR Ioneer Ltd 0.21 -30% 2% 8% 24% 40% $ 538,087,420.52 MAN Mandrake Res Ltd 0.026 -4% -10% -30% -28% -40% $ 16,936,017.84 RLC Reedy Lagoon Corp. 0.002 0% 0% -33% -50% -60% $ 1,523,413.35 GBR Greatbould Resources 0.043 -20% -25% -30% -37% -34% $ 33,391,080.27 FRS Forrestaniaresources 0.012 -14% -20% -33% -61% -57% $ 2,787,966.90 STK Strickland Metals 0.073 11% -18% -27% -58% -23% $ 154,519,031.94 MLX Metals X Limited 0.47 1% 7% 8% 68% 62% $ 430,385,189.76 CLA Celsius Resource Ltd 0.01 -9% -17% 0% -13% -17% $ 25,710,245.01 FGR First Graphene Ltd 0.039 -9% -9% -34% -50% -45% $ 26,123,237.52 HXG Hexagon Energy 0.024 0% -4% 14% 167% 100% $ 11,797,065.72 TLG Talga Group Ltd 0.53 31% 45% -26% -48% -32% $ 248,819,768.58 MNS Magnis Energy Tech 0.042 0% 0% 0% -48% 0% $ 50,378,922.34 PLL Piedmont Lithium Inc 0.19 -3% 31% -3% -57% -56% $ 84,948,925.00 EUR European Lithium Ltd 0.028 -24% -24% -44% -67% -73% $ 40,545,556.56 BKT Black Rock Mining 0.052 0% 0% -21% -57% -38% $ 65,106,526.42 QEM QEM Limited 0.055 0% -45% -63% -72% -68% $ 9,732,518.09 LYC Lynas Rare Earths 8.02 5% 5% 23% 15% 12% $ 7,384,273,661.50 ESR Estrella Res Ltd 0.017 42% 42% 278% 183% 240% $ 28,015,578.03 ARL Ardea Resources Ltd 0.39 -7% 4% -42% -26% -18% $ 77,876,336.85 GLN Galan Lithium Ltd 0.155 -14% 35% -43% -76% -77% $ 109,296,387.00 JLL Jindalee Lithium Ltd 0.245 9% 4% -58% -79% -76% $ 18,911,910.77 VUL Vulcan Energy 4.7 -10% 12% 34% 87% 65% $ 948,470,397.84 SBR Sabre Resources 0.012 -8% -20% -29% -68% -64% $ 4,715,543.20 CHN Chalice Mining Ltd 1.585 -15% 3% 35% -17% -6% $ 692,467,682.64 VRC Volt Resources Ltd 0.004 0% 14% -20% -33% -38% $ 16,634,712.51 NMT Neometals Ltd 0.091 -2% -20% -13% -62% -56% $ 70,017,682.64 AXN Alliance Nickel Ltd 0.037 -3% -20% 3% -40% -14% $ 26,856,065.76 PNN Power Minerals Ltd 0.096 -9% -20% -17% -64% -54% $ 10,900,398.76 IGO IGO Limited 5.28 0% -7% -34% -45% -42% $ 3,831,775,133.78 GED Golden Deeps 0.03 0% -25% -21% -42% -35% $ 4,545,670.47 ADV Ardiden Ltd 0.135 -7% 0% -13% -43% -23% $ 8,439,863.31 SRI Sipa Resources Ltd 0.017 0% 13% 0% -19% -32% $ 3,878,688.30 NTU Northern Min Ltd 0.02 0% -5% -44% -39% -33% $ 147,024,152.14 AXE Archer Materials 0.305 20% 42% -35% -27% -20% $ 66,260,223.38 PGM Platina Resources 0.02 -13% -9% -5% -26% -5% $ 13,086,786.95 AAJ Aruma Resources Ltd 0.017 0% -6% 13% -47% -37% $ 3,997,047.10 IXR Ionic Rare Earths 0.01 0% 0% -23% -50% -62% $ 46,262,745.15 NIC Nickel Industries 0.93 -4% 2% -6% 13% 34% $ 3,968,074,139.00 EVG Evion Group NL 0.037 23% 32% 37% -3% 9% $ 12,490,674.73 CWX Carawine Resources 0.1 9% 3% 0% -17% -9% $ 23,612,544.90 PLS Pilbara Min Ltd 3.01 5% -1% -28% -21% -24% $ 8,763,421,105.56 HAS Hastings Tech Met 0.29 16% 0% -12% -64% -58% $ 52,439,578.86 BUX Buxton Resources Ltd 0.065 -13% 8% -46% -73% -62% $ 13,707,026.26 ARR American Rare Earths 0.24 -6% -16% -16% 66% 45% $ 119,381,591.76 SGQ St George Min Ltd 0.025 0% -19% 32% -44% -26% $ 27,213,510.80 TKL Traka Resources 0.001 -50% 0% -33% -68% -67% $ 3,891,317.11 PRL Province Resources 0.041 0% 0% 0% 0% 0% $ 48,441,218.86 IPT Impact Minerals 0.012 -4% -4% -48% 9% 9% $ 36,713,204.62 LIT Livium Ltd 0.02 0% -5% -29% -39% -33% $ 26,291,875.20 ARN Aldoro Resources 0.086 -5% 13% 32% 0% -31% $ 11,577,641.90 JRV Jervois Global Ltd 0.012 9% -8% -20% -65% -73% $ 29,730,401.64 SYR Syrah Resources 0.275 -2% -7% -44% -64% -57% $ 310,467,529.80 FBM Future Battery 0.019 0% 0% -65% -78% -74% $ 12,641,762.63 ADD Adavale Resource Ltd 0.002 -33% -33% -64% -78% -71% $ 2,447,530.73 LTR Liontown Resources 0.815 -4% 10% -34% -50% -51% $ 1,903,709,889.90 CTM Centaurus Metals Ltd 0.455 -5% -12% 20% -15% -15% $ 218,548,533.72 VML Vital Metals Limited 0.003 50% 20% -40% -70% -54% $ 11,790,133.90 BSX Blackstone Ltd 0.027 -19% -5% -46% -69% -61% $ 14,864,076.36 POS Poseidon Nick Ltd 0.005 0% 25% -9% -68% -55% $ 21,019,377.46 CHR Charger Metals 0.068 1% -24% -20% -77% -59% $ 5,187,156.75 AVL Aust Vanadium Ltd 0.015 0% -6% 15% -38% -29% $ 138,154,529.22 AUZ Australian Mines Ltd 0.013 -13% 63% 30% 0% 30% $ 18,180,657.61 RXL Rox Resources 0.16 -18% 28% -3% -29% -13% $ 73,907,151.66 RNU Renascor Res Ltd 0.071 0% -9% -29% -56% -45% $ 180,469,906.64 GL1 Globallith 0.215 -2% -10% -41% -83% -82% $ 56,026,395.49 ASN Anson Resources Ltd 0.065 -13% -12% -50% -65% -54% $ 95,541,071.21 SYA Sayona Mining Ltd 0.03 -17% -3% -9% -64% -58% $ 319,092,176.43 EGR Ecograf Limited 0.082 5% -9% -43% -54% -41% $ 37,692,940.98 ATM Aneka Tambang 0.86 -5% -16% -22% -27% -27% $ 1,121,138.14 TVN Tivan Limited 0.051 6% 11% -4% -39% -15% $ 91,967,910.53 ALY Alchemy Resource Ltd 0.007 0% 0% -13% -36% -30% $ 8,246,533.79 GAL Galileo Mining Ltd 0.14 -7% 4% -49% -54% -51% $ 27,667,489.78 BHP BHP Group Limited 42.99 0% -4% 1% -5% -15% $ 216,148,190,608.80 LEL Lithenergy 0.37 0% 12% -27% -44% -36% $ 41,440,580.53 ASL Andean Silver 1.105 -22% 0% 91% 439% 309% $ 191,263,981.10 RMX Red Mount Min Ltd 0.01 -17% 11% 0% -71% -62% $ 3,873,577.96 GW1 Greenwing Resources 0.054 -17% 20% -27% -61% -60% $ 13,717,134.47 AQD Ausquest Limited 0.008 -11% -25% -36% -25% -25% $ 6,609,193.78 LML Lincoln Minerals 0.007 17% 17% 8% -7% 17% $ 14,393,816.64 1MC Morella Corporation 0.031 -3% 3% -59% -79% -77% $ 9,395,745.98 REE Rarex Limited 0.012 0% -8% -14% -57% -57% $ 9,610,150.03 MRC Mineral Commodities 0.026 0% 0% 4% -21% -19% $ 25,596,287.57 PUR Pursuit Minerals 0.0025 -17% 25% -50% -75% -69% $ 10,906,199.96 QPM Queensland Pacific 0.034 -3% -8% -23% -43% -38% $ 86,980,670.60 EMH European Metals Hldg 0.155 -11% -6% -61% -76% -64% $ 32,153,929.28 BMM Balkanminingandmin 0.054 0% -11% -2% -55% -51% $ 4,388,066.16 PEK Peak Rare Earths Ltd 0.115 -43% -38% -49% -70% -67% $ 30,639,525.79 LEG Legend Mining 0.013 8% 0% 0% -38% -7% $ 34,913,726.22 MOH Moho Resources 0.007 40% 17% 75% 0% -30% $ 3,774,247.38 AML Aeon Metals Ltd. 0.005 0% 0% -29% -55% -55% $ 5,482,003.11 G88 Golden Mile Res Ltd 0.012 -25% -8% 9% -50% -37% $ 7,092,342.83 WKT Walkabout Resources 0.095 -3% -2% -27% -37% -32% $ 63,769,837.85 TON Triton Min Ltd 0.009 0% -18% -31% -69% -61% $ 14,115,498.61 AR3 Austrare 0.1125 7% -20% 13% -42% -25% $ 17,450,032.82 ARU Arafura Rare Earths 0.14 -3% -22% -26% -32% -15% $ 345,006,016.74 MIN Mineral Resources. 38.46 7% -25% -50% -37% -45% $ 7,320,317,999.00 VMC Venus Metals Cor Ltd 0.069 8% 3% -23% -37% -31% $ 13,729,007.81 S2R S2 Resources 0.073 -1% -11% -39% -63% -56% $ 33,511,491.48 CNJ Conico Ltd 0.001 0% 0% 0% -80% -80% $ 2,201,527.53 VR8 Vanadium Resources 0.035 -15% -31% -20% -20% -35% $ 21,942,382.96 PVT Pivotal Metals Ltd 0.009 0% -10% -47% -53% -64% $ 7,870,282.88 BOA Boadicea Resources 0.022 0% 0% -15% -45% -39% $ 2,713,762.63 IPX Iperionx Limited 3.37 8% -1% 53% 141% 142% $ 963,677,622.99 SLZ Sultan Resources Ltd 0.009 0% 50% -18% -43% -60% $ 2,314,699.10 SMX Strata Minerals 0.023 -4% -15% 28% -59% -38% $ 4,579,564.06 NVA Nova Minerals Ltd 0.205 -11% 32% -25% -23% -43% $ 61,455,798.23 MLS Metals Australia 0.024 9% -11% 14% -35% -35% $ 17,453,268.58 MQR Marquee Resource Ltd 0.016 0% -6% 14% -41% -38% $ 6,662,150.11 MRR Minrex Resources Ltd 0.008 0% 0% -27% -47% -53% $ 8,678,940.02 EVR Ev Resources Ltd 0.003 -35% -18% -59% -70% -70% $ 5,585,085.94 EFE Eastern Resources 0.004 0% 0% -43% -43% -50% $ 4,967,785.84 CNB Carnaby Resource Ltd 0.355 -7% -10% -48% -48% -55% $ 63,616,781.02 BNR Bulletin Res Ltd 0.042 -7% -11% -21% -77% -70% $ 12,331,759.57 AX8 Accelerate Resources 0.008 -11% -6% -80% -80% -81% $ 4,974,031.46 AM7 Arcadia Minerals 0.035 0% 3% -52% -57% -52% $ 4,096,753.50 AS2 Askarimetalslimited 0.026 -10% -13% -46% -85% -85% $ 2,451,753.65 BYH Bryah Resources Ltd 0.004 33% 0% -50% -67% -69% $ 2,013,147.42 DTM Dart Mining NL 0.011 -15% -27% -57% -33% -29% $ 4,307,222.45 EMS Eastern Metals 0.019 -5% -17% -42% -37% -46% $ 2,159,848.66 FG1 Flynngold 0.03 -6% 7% 11% -49% -34% $ 8,362,127.04 GSM Golden State Mining 0.009 -18% -10% -25% -55% -40% $ 3,073,076.93 IMI Infinitymining 0.021 -16% -51% -69% -81% -85% $ 5,313,153.15 LRV Larvottoresources 0.575 -19% 69% 699% 336% 721% $ 214,668,338.85 LSR Lodestar Minerals 0.001 0% 0% -38% -69% -69% $ 3,372,328.92 RAG Ragnar Metals Ltd 0.021 -5% 17% 17% -13% -13% $ 9,953,705.54 CTN Catalina Resources 0.004 0% 14% 33% 14% -11% $ 4,953,947.57 TMB Tambourahmetals 0.03 -12% -17% -57% -77% -73% $ 3,253,701.45 TEM Tempest Minerals 0.006 0% -45% -21% -21% -21% $ 3,763,618.73 EMC Everest Metals Corp 0.135 4% 4% 50% 47% 69% $ 24,216,804.17 WML Woomera Mining Ltd 0.002 0% -20% -50% -85% -93% $ 5,416,475.21 KZR Kalamazoo Resources 0.088 -4% 7% 1% -20% -27% $ 18,670,745.77 LMG Latrobe Magnesium 0.027 4% -33% -43% -40% -58% $ 58,713,434.38 KOR Korab Resources 0.008 0% 0% 14% -47% -50% $ 2,936,400.00 CMX Chemxmaterials 0.026 -33% -32% -48% -67% -68% $ 4,644,803.56 NC1 Nicoresourceslimited 0.105 -5% -13% -28% -67% -70% $ 12,039,563.25 GRE Greentechmetals 0.11 -8% 5% -44% -83% -76% $ 9,554,197.13 CMO Cosmometalslimited 0.018 0% -33% -55% -61% -68% $ 2,357,871.73 FRB Firebird Metals 0.11 5% -12% -42% -27% -24% $ 15,659,754.11 S32 South32 Limited 3.83 4% 4% 6% 17% 15% $ 17,002,832,521.76 OMH OM Holdings Limited 0.37 0% -4% -28% -20% -17% $ 287,346,300.38 JMS Jupiter Mines. 0.165 -6% 0% -42% -13% 0% $ 313,680,851.04 E25 Element 25 Ltd 0.275 -8% -19% 6% -28% -35% $ 60,475,910.28 EMN Euromanganese 0.06 2% 30% -25% -43% -40% $ 12,965,672.06 KGD Kula Gold Limited 0.007 -13% -13% -36% -42% -53% $ 4,502,483.45 LRS Latin Resources Ltd 0.2 5% -2% -15% -26% -30% $ 532,269,697.97 CRR Critical Resources 0.008 0% 0% -33% -69% -62% $ 15,709,468.90 ENT Enterprise Metals 0.004 0% 0% 0% 33% 0% $ 4,713,269.00 SCN Scorpion Minerals 0.013 -19% -24% -48% -75% -61% $ 6,141,842.88 GCM Green Critical Min 0.008 14% 300% 100% 0% -11% $ 12,208,341.11 ENV Enova Mining Limited 0.008 0% -20% -60% 33% -47% $ 7,879,434.79 RBX Resource B 0.036 0% 20% 3% -72% -52% $ 3,718,241.46 AKN Auking Mining Ltd 0.006 50% 0% -68% -85% -87% $ 1,956,751.34 RR1 Reach Resources Ltd 0.013 8% -10% -24% -76% -29% $ 10,493,176.19 EMT Emetals Limited 0.005 25% 25% 0% -29% -29% $ 4,250,000.00 PNT Panthermetalsltd 0.02 -29% 0% -27% -61% -52% $ 5,413,018.67 WIN WIN Metals 0.024 -4% -43% -33% -86% -73% $ 12,378,321.93 WMG Western Mines 0.19 -5% -21% -47% -33% -27% $ 17,030,215.40 AVW Avira Resources Ltd 0.001 0% 0% -33% 0% -50% $ 2,938,790.00 CAI Calidus Resources 0.115 0% 0% -4% -38% -47% $ 93,678,205.58 GT1 Greentechnology 0.075 -17% -17% -29% -82% -74% $ 31,100,167.76 KAI Kairos Minerals Ltd 0.016 0% 23% 33% -6% 14% $ 47,356,419.40 MTM MTM Critical Metals 0.068 -16% -1% 6% 196% 0% $ 26,096,445.60 NWM Norwest Minerals 0.017 -6% -23% -63% -44% -37% $ 8,732,151.18 PGD Peregrine Gold 0.17 13% -8% -23% -39% -29% $ 10,181,763.15 RAS Ragusa Minerals Ltd 0.014 -13% -18% -30% -67% -61% $ 1,996,383.00 RGL Riversgold 0.004 14% -20% -33% -56% -67% $ 5,696,119.08 SRZ Stellar Resources 0.018 0% 6% 0% 125% 157% $ 37,435,510.22 STM Sunstone Metals Ltd 0.007 -13% 40% -42% -61% -53% $ 36,042,325.45 ZNC Zenith Minerals Ltd 0.045 -22% -2% -45% -61% -70% $ 17,608,431.68 WC8 Wildcat Resources 0.29 -8% 12% -41% -68% -58% $ 377,152,110.89 ASO Aston Minerals Ltd 0.01 0% -23% -9% -70% -58% $ 14,245,706.96 THR Thor Energy PLC 0.015 -6% 0% -12% -44% -50% $ 3,865,221.44 YAR Yari Minerals Ltd 0.004 0% 0% -20% -76% -65% $ 1,929,431.25 IG6 Internationalgraphit 0.059 -8% -19% -46% -67% -63% $ 12,387,733.12 LPM Lithium Plus 0.14 -13% 27% 33% -71% -61% $ 18,597,600.00 ODE Odessa Minerals Ltd 0.007 0% 75% 133% -22% -22% $ 7,609,695.22 KOB Kobaresourceslimited 0.087 -10% -33% -24% 30% 24% $ 13,319,175.58 AZI Altamin Limited 0.025 -9% -9% -35% -57% -50% $ 12,640,616.30 FTL Firetail Resources 0.1 -17% 0% 128% 0% 36% $ 29,812,317.75 LNR Lanthanein Resources 0.003 -14% 0% -40% -50% -74% $ 7,330,908.38 CLZ Classic Min Ltd 0.001 0% 0% -86% -98% -98% $ 1,544,025.56 NVX Novonix Limited 0.725 2% -4% -12% -8% -1% $ 355,504,892.40 OCN Oceanalithiumlimited 0.033 0% 10% -38% -69% -73% $ 2,722,434.00 SUM Summitminerals 0.175 13% -27% 17% 86% 77% $ 13,812,478.08 DVP Develop Global Ltd 2.33 -8% 1% -3% -29% -18% $ 637,848,961.50 XTC XTC Lithium Limited 0.2 19900% 19900% 19900% 0% 19900% $ 17,528,272.20 OD6 Od6Metalsltd 0.047 -8% 18% -33% -72% -66% $ 5,919,747.96 HRE Heavy Rare Earths 0.038 -14% 0% 3% -53% -41% $ 3,202,455.70 LIN Lindian Resources 0.087 -9% -12% -40% -53% -40% $ 107,221,767.95 PEK Peak Rare Earths Ltd 0.115 -43% -38% -49% -70% -67% $ 30,639,525.79 ILU Iluka Resources 5.84 -2% -11% -23% -21% -12% $ 2,518,043,473.68 ASM Ausstratmaterials 0.535 -1% -9% -47% -68% -58% $ 97,912,603.44 ETM Energy Transition 0.023 5% 5% -34% -30% -41% $ 32,400,299.59 CRI Criticalim 0.011 -8% -15% -48% 22% 57% $ 32,067,785.68 IDA Indiana Resources 0.11 10% 13% 38% 101% 38% $ 69,945,840.36 VTM Victory Metals Ltd 0.35 -4% -10% 52% 25% 67% $ 43,906,974.83 M2R Miramar 0.006 -25% -14% -36% -67% -70% $ 1,984,116.43 WCN White Cliff Min Ltd 0.018 0% -25% 13% 80% 100% $ 34,028,473.46 TAR Taruga Minerals 0.013 8% 44% 44% 30% 18% $ 9,178,348.21 ABX ABX Group Limited 0.043 0% 2% -31% -36% -40% $ 10,751,733.50 MEK Meeka Metals Limited 0.064 -26% 7% 88% 78% 60% $ 135,031,027.98 RR1 Reach Resources Ltd 0.013 8% -10% -24% -76% -29% $ 10,493,176.19 DRE Dreadnought Resources Ltd 0.017 13% 6% -6% -48% -43% $ 60,044,000.00 KFM Kingfisher Mining 0.06 -2% -14% -15% -60% -60% $ 3,384,045.06 AOA Ausmon Resorces 0.002 0% -20% 0% -33% -33% $ 2,117,998.69 WC1 Westcobarmetals 0.021 11% -12% -43% -64% -72% $ 3,202,506.95 GRL Godolphin Resources 0.016 -11% 23% -36% -56% -59% $ 5,375,590.76 DM1 Desert Metals 0.028 -15% 33% 22% -28% -45% $ 7,962,770.79 PTR Petratherm Ltd 0.047 -16% -2% 62% 2% 34% $ 14,870,632.90 ITM Itech Minerals Ltd 0.07 -3% -5% 3% -50% -36% $ 11,610,006.38 KTA Krakatoa Resources 0.01 -9% -9% -47% -63% -72% $ 4,721,072.20 M24 Mamba Exploration 0.011 -8% -15% -50% -62% -78% $ 2,256,987.31 LNR Lanthanein Resources 0.003 -14% 0% -40% -50% -74% $ 7,330,908.38 TKM Trek Metals Ltd 0.031 7% 3% -11% -38% -23% $ 15,416,185.86 BCA Black Canyon Limited 0.063 -2% -2% -52% -55% -55% $ 5,067,445.04 CDT Castle Minerals 0.003 0% 0% -45% -70% -68% $ 4,118,442.32 DLI Delta Lithium 0.225 -10% -6% -25% -60% -52% $ 167,650,678.37 A11 Atlantic Lithium 0.23 -15% -10% -41% -41% -42% $ 151,595,629.13 KNI Kunikolimited 0.22 22% 26% -6% -31% -27% $ 19,523,085.30 CY5 Cygnus Metals Ltd 0.14 0% 65% 79% -20% 4% $ 64,077,706.13 WR1 Winsome Resources 0.525 1% -9% -59% -62% -50% $ 112,964,588.43 LLI Loyal Lithium Ltd 0.115 -8% -23% -54% -76% -63% $ 9,273,306.30 BC8 Black Cat Syndicate 0.52 -12% 1% 104% 142% 108% $ 297,524,993.90 BUR Burleyminerals 0.074 -20% 12% 42% -66% -55% $ 11,127,449.86 PBL Parabellumresources 0.06 22% 9% 40% -83% -14% $ 3,738,000.06 L1M Lightning Minerals 0.074 14% 14% -21% -38% -47% $ 6,698,254.43 WA1 Wa1Resourcesltd 13.02 -3% -10% -27% 36% 5% $ 924,320,342.40 EV1 Evolutionenergy 0.037 0% 9% -49% -74% -74% $ 13,701,551.43 1AE Auroraenergymetals 0.047 2% -11% -45% -50% -59% $ 8,236,931.90 RVT Richmond Vanadium 0.32 8% -2% 10% -16% 14% $ 27,586,497.92 PMT Patriotbatterymetals 0.36 -8% -17% -54% -69% -68% $ 218,318,007.90 PAT Patriot Lithium 0.045 7% 22% -45% -79% -75% $ 4,656,620.93 BM8 Battery Age Minerals 0.095 -1% -21% -5% -55% -50% $ 9,668,543.30 OM1 Omnia Metals Group 0.078 0% 0% 0% 0% 0% $ 4,550,567.66 VHM Vhmlimited 0.395 -5% -14% -20% -16% -44% $ 64,313,985.45 LLL Leolithiumlimited 0.505 0% 0% 0% 0% 0% $ 605,458,341.55 SRN Surefire Rescs NL 0.004 -20% -33% -60% -67% -53% $ 7,945,231.25 SRL Sunrise 0.32 -9% -20% -44% -55% -30% $ 30,677,349.32 SYR Syrah Resources 0.275 -2% -7% -44% -64% -57% $ 310,467,529.80 EG1 Evergreenlithium 0.082 0% 95% -11% -53% -57% $ 4,610,860.00 WSR Westar Resources 0.009 0% 13% -18% -44% -50% $ 3,588,523.32 LU7 Lithium Universe Ltd 0.01 -28% -28% -60% -76% -70% $ 5,939,135.64 MEI Meteoric Resources 0.105 -9% 5% -52% -55% -60% $ 241,364,677.37 REC Rechargemetals 0.028 -7% -18% -18% -78% -71% $ 3,911,319.08 SLM Solismineralsltd 0.09 -6% -3% -10% -63% -38% $ 6,807,049.39 DYM Dynamicmetalslimited 0.215 -2% 10% 26% 5% 54% $ 7,740,000.00 TOR Torque Met 0.068 -8% -7% -48% -65% -69% $ 15,210,905.19 ICL Iceni Gold 0.0495 3% 34% 115% -15% -5% $ 13,315,431.22 TMX Terrain Minerals 0.0035 17% -13% -13% -30% -30% $ 5,400,086.41 MHC Manhattan Corp Ltd 0.001 -50% -50% -40% -76% -70% $ 8,995,939.72 MHK Metalhawk. 0.195 11% 22% 225% 39% 44% $ 18,623,950.37 ANX Anax Metals Ltd 0.011 -8% -42% -73% -63% -63% $ 9,585,784.36 FIN FIN Resources Ltd 0.007 0% 0% -50% -76% -68% $ 4,544,880.90 LM1 Leeuwin Metals Ltd 0.073 0% -13% 14% -73% -48% $ 3,420,171.98 HAW Hawthorn Resources 0.059 0% 2% -17% -41% -37% $ 19,765,921.17 LCY Legacy Iron Ore 0.012555 0% 0% -24% -24% -24% $ 96,846,683.85 RON Roninresourcesltd 0.14 0% 17% 22% 8% -24% $ 5,155,501.40 ASR Asra Minerals Ltd 0.0035 -13% -22% -50% -50% -50% $ 6,694,673.99 PFE Panteraminerals 0.022 -8% -15% -39% -61% -56% $ 9,549,344.24 KM1 Kalimetalslimited 0.145 4% 26% -64% 0% 0% $ 12,676,557.96 LTM Arcadium Lithium PLC 8.22 0% 97% 17% 0% -27% $ 2,428,452,165.15 KNG Kingsland Minerals 0.205 14% -7% -16% -21% -28% $ 15,237,791.31

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Weekly Small Cap Standouts

Parabellum Resources (ASX:PBL)

A company in search of a purpose, Parabellum has flagged further returns having banked a $324,828 payment to boost its treasury after a company which had an 80% option over the Khotgor project in Mongolia let that option lapse.

The payment came from unspent cash on the $3.9m program funded by PBL at what it said on the acquisition in 2022 was a large rare earth project.

PBL is planning to sell its 30% ownership stake in Temarise, but keep a pilot plant, drill data, resource and IP acquired and developed since the company invested in 2022.

Mark Hohnen and Peter Secker have stepped down from the company’s board with Peter Ruse to become chairman, Shaun Menezes to remain as a non-exec director, CFO and company secretary and Fabio Vergara to join as an NED.

Vergara is a Perth geologist who has worked across a range of projects in emerging regions and with Charlie Bass’ family office including copper explorer Eagle Mountain Mining (ASX:EM2). Project acquisitions are on the cards.

“Parabellum sits in an enviable position with a healthy cash balance following the capital return from the Temarise Investment and the flexibility to actively pursue value accretive acquisitions in line with our strategy,” Ruse said.

“With a reduced board, low corporate overheads, and added technical expertise “in-house” we are excited about the pathway ahead.”

Shares in the semiconductor stocks surged yesterday by over 17% as it announced its commercial foundry partner in the Netherlands had fabricated a miniaturised version of its biochip graphene field effect transistor.

The Applied Nanolayers foundry was able to produce a chip that had been trimmed in size by 97% from 10 by 10 millimetres to just 1.5mm x 1.5mm.

“Archer is proactively reducing device fabrication costs and paving the way for a wafer-scale run of over a thousand miniaturised gFET chips. The team has been able to achieve this significant step by applying its know-how in gFET chip design,” AXE chair Greg English said.

“By working with Applied Nanolayers and AOI Electronics on the miniaturised gFET chips, we have successfully proved the fabless commercial model to support development of the Biochip and strengthen our relationships with semiconductor supply-chain partners.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.