High Voltage: US considers critical minerals price floors and CME launches spodumene futures

The US is sniffing out a lithium price floor. Pic via Getty Images

- US government considers setting price floors for critical minerals like lithium

- CME is launching a spodumene futures contract this month

- Liontown makes price public for Kathleen Valley lithium shipment

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

Pricing is the word of the week, off the back of a swathe of price-related news for critical minerals.

It’s no secret lithium is prone to wild price fluctuations, hindering prospects of raising capital as lenders lack an effective mechanism to manage price risk.

Following record highs in early 2023, lithium prices have seen the largest contraction amongst battery minerals, falling over 60% year-on-year due to a combination of slowing EV sales growth and surging Chinese-financed supply shifting the market into oversupply.

These falling prices and broader inflationary pressures have stressed project economics, already leading to closures and delays in numerous critical mineral operations in the west.

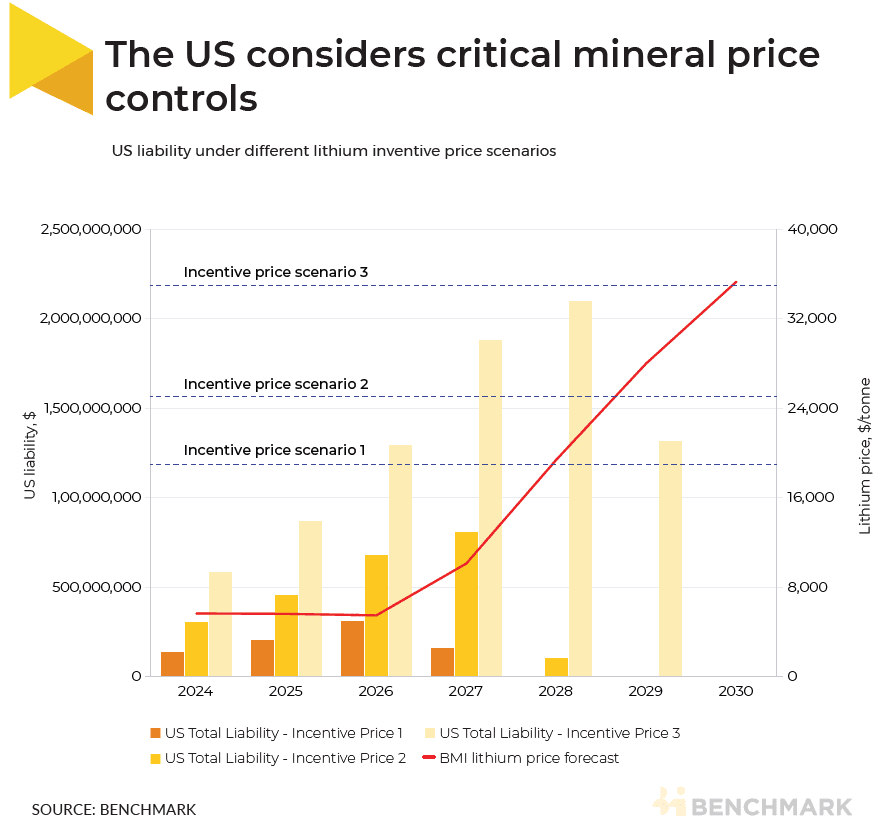

That’s one of the reasons why the US government is considering more robust measures – like setting price floors for critical minerals in a policy that would see them cover the difference once prices fall below a certain threshold.

However, if the measures were to be enacted, Benchmark Minerals Intelligence analysis indicates that the US could face up to $7.5 billion in potential liabilities for lithium alone between 2025 and 2030.

Spodumene futures launch pending

In this pricing environment, CME Group, the world’s leading derivatives marketplace, has announced plans to expand its battery metals suite and launch a Spodumene CIF China (Fastmarkets) Futures contract.

It looks to be a valuable tool for the industry to manage risk associated with the spodumene price, conversion margins, as well as take a view on the lithium conversion spread itself.

“Our suite of cobalt and lithium products serve an important role in the rapidly evolving battery metals space, with industry adoption accelerating,” CME Group global head of markets Jin Hennig said.

“With this launch of spodumene futures, we will expand hedging capabilities, making it easier for the market to manage the price differences across products in the lithium value chain.”

Albemarle’s global product pricing manager Peter Hannah said he welcomes the launch, which complements the lithium market’s evolving risk management needs.

“We recognise that trust in physical prices underpins confidence in futures trading, and are proud that our bidding event price discovery initiative has added valuable transparency to the spot market,” he said.

“The combination of liquid and robust physical and futures pricing mechanisms can help our industry grow.”

The move comes as lithium giant Liontown Resources (ASX:LTR) this week publicly disclosed its spodumene sales price of 6% equivalent or US$802/t for its first 10,000t shipment of 5.2% Li2O concentrate from the +500,000tpa Kathleen Valley project in WA to a Singapore-based trader.

“Developing a liquid and transparent lithium market is essential for all the players in the battery value chain and CME Group continues to work towards this goal,” Liontown chief commercial officer Grant Donald said.

“A forward curve for key materials across the entire supply chain will be essential to effectively manage price risk for the rapidly growing clean energy market.”

The spodumene futures will be launched on October 28, 2024, pending regulatory review.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Code Company Price % Week % Month % Six Month % Year Market Cap XTC XTC Lithium Limited 0.2 19900% 0% 19900% 0% $17,528,272 AR3 Austrare 0.17 127% 162% 70% -26% $27,643,655 ODE Odessa Minerals Ltd 0.004 100% 33% -33% -67% $4,173,130 IMI Infinitymining 0.035 94% 94% -49% -77% $5,836,998 RIL Redivium Limited 0.005 67% 25% 25% -38% $13,734,274 CTN Catalina Resources 0.004 60% 100% 0% 0% $4,953,948 RLC Reedy Lagoon Corp. 0.003 50% 0% -25% -57% $1,858,622 VML Vital Metals Limited 0.003 50% 50% -25% -70% $11,790,134 G88 Golden Mile Res Ltd 0.015 50% 67% 25% -48% $4,934,674 AS2 Askarimetalslimited 0.03 50% 50% -42% -84% $3,040,175 MHC Manhattan Corp Ltd 0.0015 50% 50% -40% -74% $4,638,800 LMG Latrobe Magnesium 0.044 47% 29% -12% 5% $100,987,107 LU7 Lithium Universe Ltd 0.014 33% 8% -26% -72% $7,126,963 REC Rechargemetals 0.032 33% 10% -36% -83% $4,470,079 BUR Burleyminerals 0.066 32% -37% -3% -57% $9,924,482 FRS Forrestaniaresources 0.017 31% 13% 6% -62% $2,750,358 PFE Panteraminerals 0.03 30% 7% -32% -47% $10,612,748 NVX Novonix Limited 0.7225 30% 21% -23% -11% $382,653,921 LLI Loyal Lithium Ltd 0.155 29% 19% -49% -77% $14,373,625 GRE Greentechmetals 0.125 29% 40% -48% -70% $10,384,997 KOB Kobaresourceslimited 0.135 29% 8% 17% 69% $21,405,818 BMM Balkanminingandmin 0.057 27% 6% -8% -72% $4,732,228 MIN Mineral Resources. 52.17 26% 32% -27% -23% $10,325,087,454 LPM Lithium Plus 0.12 26% 33% -20% -75% $15,940,800 RGL Riversgold 0.005 25% 25% -29% -62% $6,637,313 TAR Taruga Minerals 0.01 25% 43% 67% -9% $7,060,268 GL1 Globallith 0.24 23% -2% -51% -83% $65,146,972 JRV Jervois Global Ltd 0.0135 23% 35% -46% -65% $35,135,929 COB Cobalt Blue Ltd 0.087 23% 24% -40% -67% $35,065,404 CXO Core Lithium 0.1225 23% 33% -21% -72% $267,876,943 PLL Piedmont Lithium Inc 0.15 20% 15% -27% -77% $53,356,160 ADD Adavale Resource Ltd 0.003 20% -14% -50% -75% $3,671,296 AKN Auking Mining Ltd 0.006 20% -33% -73% -91% $1,410,281 WR1 Winsome Resources 0.6 19% 17% -32% -58% $134,127,200 HRE Heavy Rare Earths 0.038 19% 19% 3% -58% $2,457,905 SYA Sayona Mining Ltd 0.033 18% 27% -13% -69% $349,972,064 SYR Syrah Resources 0.3 18% 36% -41% -44% $346,688,742 SYR Syrah Resources 0.3 18% 36% -41% -44% $346,688,742 MOH Moho Resources 0.007 17% 56% 40% 0% $3,774,247 RR1 Reach Resources Ltd 0.014 17% 0% -7% -80% $12,242,039 RR1 Reach Resources Ltd 0.014 17% 0% -7% -80% $12,242,039 SRN Surefire Rescs NL 0.007 17% 8% -22% -50% $13,904,155 FIN FIN Resources Ltd 0.007 17% 17% -59% -42% $3,246,344 EMS Eastern Metals 0.022 16% 5% -24% -33% $2,273,525 1AE Auroraenergymetals 0.053 15% 0% -52% -66% $9,490,378 CNB Carnaby Resource Ltd 0.425 15% 1% -31% -51% $73,933,016 HAS Hastings Tech Met 0.315 15% 11% -18% -54% $55,151,971 CHN Chalice Mining Ltd 1.6 14% 55% 44% -30% $643,839,334 VRC Volt Resources Ltd 0.004 14% 0% -33% -50% $12,476,034 POS Poseidon Nick Ltd 0.004 14% 0% -27% -77% $16,815,502 AXE Archer Materials 0.21 14% -13% -62% -58% $54,792,108 AZL Arizona Lithium Ltd 0.017 13% 13% -35% 6% $71,581,032 DRE Dreadnought Resources Ltd 0.017 13% 0% -6% -65% $67,545,000 CTM Centaurus Metals Ltd 0.515 13% 39% 72% -24% $248,350,607 ASM Ausstratmaterials 0.57 13% 4% -61% -63% $106,978,585 MEK Meeka Metals Limited 0.062 13% 0% 77% 63% $91,424,098 A11 Atlantic Lithium 0.27 13% 15% -28% -42% $165,665,609 KNG Kingsland Minerals 0.225 13% 36% -15% -8% $14,133,454 LTR Liontown Resources 0.77 12% 8% -33% -74% $1,952,128,928 NC1 Nicoresourceslimited 0.11 12% -19% -21% -74% $10,945,058 BCA Black Canyon Limited 0.065 12% 3% -41% -46% $5,314,105 EVG Evion Group NL 0.028 12% 17% 33% -24% $9,714,969 WC8 Wildcat Resources 0.28 12% 6% -58% -43% $368,719,289 PMT Patriotbatterymetals 0.43 12% -2% -51% -65% $274,685,093 VMC Venus Metals Cor Ltd 0.067 12% -8% -28% -46% $11,963,850 BC8 Black Cat Syndicate 0.48 12% 35% 100% 129% $210,695,597 SMX Strata Minerals 0.029 12% 16% -3% -49% $5,533,640 WCN White Cliff Min Ltd 0.021 11% 40% 40% 75% $34,217,136 AQD Ausquest Limited 0.011 10% 0% 0% -15% $9,087,641 TON Triton Min Ltd 0.011 10% 22% -21% -52% $18,820,665 SRZ Stellar Resources 0.0165 10% -3% 27% 38% $34,315,334 STM Sunstone Metals Ltd 0.0055 10% -31% -66% -63% $21,629,518 FTL Firetail Resources 0.11 10% 67% 189% 16% $32,131,054 AXN Alliance Nickel Ltd 0.045 10% 32% 32% -31% $32,662,783 GW1 Greenwing Resources 0.046 10% -21% -31% -67% $10,861,758 IGO IGO Limited 5.845 9% 8% -18% -54% $4,430,016,706 QPM Queensland Pacific 0.035 9% 3% -13% -45% $90,762,439 CY5 Cygnus Metals Ltd 0.085 9% 21% 63% -50% $31,901,931 WMG Western Mines 0.25 9% -4% 52% -14% $18,733,237 AGY Argosy Minerals Ltd 0.039 8% -13% -70% -80% $53,869,075 HXG Hexagon Energy 0.026 8% 18% 4% 189% $12,822,898 ICL Iceni Gold 0.039 8% 8% 77% -50% $10,637,681 S32 South32 Limited 3.715 8% 20% 21% 6% $16,890,721,550 DYM Dynamicmetalslimited 0.2 8% 48% 5% -2% $7,200,000 IPX Iperionx Limited 3.42 8% 23% 51% 131% $896,198,644 ARU Arafura Rare Earths 0.1725 8% 8% -16% -35% $431,257,521 REE Rarex Limited 0.014 8% 17% -18% -59% $10,271,710 ARR American Rare Earths 0.295 7% 13% 31% 119% $143,382,757 DEV Devex Resources Ltd 0.155 7% -21% -48% -59% $68,462,054 NMT Neometals Ltd 0.1175 7% 40% -13% -66% $75,888,790 LTM Arcadium Lithium PLC 4.08 7% 5% -39% 0% $1,415,662,892 QEM QEM Limited 0.096 7% -30% -35% -48% $15,139,171 AVL Aust Vanadium Ltd 0.016 7% 14% 0% -43% $138,120,396 EMH European Metals Hldg 0.16 7% -16% -45% -76% $33,191,153 JLL Jindalee Lithium Ltd 0.245 7% 2% -66% -85% $17,306,182 BHP BHP Group Limited 45.45 6% 13% 1% 2% $228,629,987,531 DVP Develop Global Ltd 2.32 6% 8% -3% -30% $639,456,408 ARN Aldoro Resources 0.083 6% -6% 15% -5% $11,173,771 IXR Ionic Rare Earths 0.0085 6% 42% -53% -65% $43,827,864 MQR Marquee Resource Ltd 0.017 6% -6% -11% -41% $7,078,534 CHR Charger Metals 0.09 6% 7% -14% -33% $6,658,142 ITM Itech Minerals Ltd 0.073 6% -13% -6% -46% $12,463,683 PLS Pilbara Min Ltd 3.12 6% 10% -19% -26% $9,968,015,072 GT1 Greentechnology 0.095 6% 3% -32% -79% $33,511,449 NWC New World Resources 0.02 5% -5% -53% -33% $56,805,634 LEL Lithenergy 0.33 5% 2% -36% -41% $34,720,486 ZNC Zenith Minerals Ltd 0.045 5% 7% -52% -61% $15,857,140 NIC Nickel Industries 0.91 5% 12% 9% 21% $3,925,176,040 KM1 Kalimetalslimited 0.12 4% -25% -74% 0% $8,835,177 TLG Talga Group Ltd 0.38 4% -19% -50% -69% $162,933,301 LRS Latin Resources Ltd 0.2125 4% 9% 15% -25% $630,319,379 NVA Nova Minerals Ltd 0.145 4% -6% -42% -34% $39,430,848 OCN Oceanalithiumlimited 0.031 3% 3% -46% -86% $2,557,438 RVT Richmond Vanadium 0.31 3% 0% 11% -19% $26,724,420 CWX Carawine Resources 0.097 3% 7% -10% -34% $22,904,169 IG6 Internationalgraphit 0.073 3% 3% -57% -61% $14,129,758 ILU Iluka Resources 6.775 3% 12% -8% -13% $2,920,529,016 LKE Lake Resources 0.039 3% -5% -41% -78% $65,072,312 NTU Northern Min Ltd 0.0195 3% -22% -41% -30% $129,167,304 CMX Chemxmaterials 0.04 3% 8% -20% -56% $5,160,893 S2R S2 Resources 0.082 3% -25% -39% -53% $37,134,355 EG1 Evergreenlithium 0.042 2% -2% -60% -85% $2,361,660 LIT Lithium Australia 0.0215 2% 8% -26% -35% $27,326,469 CAE Cannindah Resources 0.044 2% -2% -27% -62% $25,435,518 VR8 Vanadium Resources 0.046 2% 21% 2% -21% $24,755,509 GLN Galan Lithium Ltd 0.1175 2% -7% -73% -81% $74,508,046 DLI Delta Lithium 0.24 2% 17% -16% -68% $167,650,678 PAM Pan Asia Metals 0.055 2% -20% -66% -73% $10,804,533 HAW Hawthorn Resources 0.058 2% -6% -17% -37% $19,430,906 VUL Vulcan Energy 4.21 2% 10% 47% 45% $812,974,627 OMH OM Holdings Limited 0.385 1% 1% -9% -19% $295,008,868 LYC Lynas Rare Earths 7.635 1% 10% 32% 13% $7,290,801,843 A8G Australasian Metals 0.11 0% -19% 83% -42% $5,733,254 QXR Qx Resources Limited 0.006 0% 0% -65% -75% $6,660,467 MRD Mount Ridley Mines 0.001 0% 0% -50% -50% $7,784,883 CZN Corazon Ltd 0.005 0% 0% -50% -58% $3,339,528 GBR Greatbould Resources 0.057 0% 19% -5% 6% $34,736,462 MNS Magnis Energy Tech 0.042 0% 0% 0% -43% $50,378,922 PNN Power Minerals Ltd 0.11 0% 25% -24% -55% $13,212,605 ADV Ardiden Ltd 0.135 0% 4% -16% -37% $8,439,863 SRI Sipa Resources Ltd 0.015 0% 0% -12% -32% $3,422,372 PGM Platina Resources 0.021 0% 5% 11% -22% $13,086,787 PRL Province Resources 0.041 0% 0% 0% 0% $48,441,219 FBM Future Battery 0.02 0% -9% -65% -83% $13,307,119 AUZ Australian Mines Ltd 0.007 0% -7% -36% -50% $10,488,841 ALY Alchemy Resource Ltd 0.007 0% 17% 0% -36% $8,246,534 RMXDD Red Mount Min Ltd 0.01 0% 0% -24% -67% $3,486,220 LML Lincoln Minerals 0.006 0% 20% -14% 0% $12,337,557 MRC Mineral Commodities 0.026 0% 0% 13% -12% $25,596,288 PEK Peak Rare Earths Ltd 0.19 0% -8% -5% -46% $50,621,825 AML Aeon Metals Ltd. 0.005 0% 0% -29% -69% $5,482,003 PVT Pivotal Metals Ltd 0.011 0% -8% -42% -42% $8,741,479 SLZ Sultan Resources Ltd 0.006 0% 0% -50% -69% $1,185,519 MLS Metals Australia 0.026 0% 24% 18% -26% $18,907,708 EVR Ev Resources Ltd 0.005 0% 11% -38% -62% $6,981,357 EFE Eastern Resources 0.004 0% 0% -47% -56% $4,967,786 AM7 Arcadia Minerals 0.034 0% 10% -60% -66% $3,979,703 BYH Bryah Resources Ltd 0.004 0% -20% -60% -73% $2,013,147 GSM Golden State Mining 0.01 0% -17% -9% -74% $2,793,706 LSR Lodestar Minerals 0.001 0% 0% -17% -77% $3,372,329 TEM Tempest Minerals 0.01 0% 0% 16% 16% $6,272,698 EMC Everest Metals Corp 0.125 0% 9% 49% 14% $24,216,804 WML Woomera Mining Ltd 0.002 0% 0% -60% -80% $6,165,223 KOR Korab Resources 0.008 0% 0% -20% -58% $2,936,400 ENT Enterprise Metals 0.004 0% 0% 33% 0% $4,713,269 GCM Green Critical Min 0.002 0% -20% -50% -71% $2,937,085 EMT Emetals Limited 0.004 0% 0% -20% -50% $3,400,000 WIN WIN Metals 0.042 0% 24% -16% -81% $14,187,403 AVW Avira Resources Ltd 0.001 0% 0% 0% -50% $2,938,790 CAI Calidus Resources 0.115 0% 0% -8% -26% $93,678,206 PGD Peregrine Gold 0.19 0% 15% -16% -32% $12,896,900 RAS Ragusa Minerals Ltd 0.016 0% 0% -33% -57% $2,281,581 LNR Lanthanein Resources 0.003 0% 0% 20% -63% $7,330,908 CLZ Classic Min Ltd 0.001 0% 0% -92% -98% $1,544,026 OD6 Od6Metalsltd 0.04 0% -5% -47% -76% $5,147,607 PEK Peak Rare Earths Ltd 0.19 0% -8% -5% -46% $50,621,825 CRI Criticalim 0.012 0% -8% -48% 9% $34,720,409 IDA Indiana Resources 0.095 0% 1% 25% 54% $61,534,014 M2R Miramar 0.007 0% -50% -59% -80% $2,777,763 KFM Kingfisher Mining 0.075 0% 23% -12% -58% $4,028,625 AOA Ausmon Resorces 0.003 0% 50% 50% 0% $3,176,998 KTA Krakatoa Resources 0.012 0% 9% 33% -50% $5,665,287 M24 Mamba Exploration 0.012 0% -20% -52% -77% $2,256,987 LNR Lanthanein Resources 0.003 0% 0% 20% -63% $7,330,908 TKM Trek Metals Ltd 0.031 0% -23% -16% -47% $15,930,059 CDT Castle Minerals 0.003 0% -14% -50% -70% $4,118,442 PBL Parabellumresources 0.055 0% 45% -8% -84% $3,426,500 L1M Lightning Minerals 0.07 0% -5% -3% -42% $6,985,322 BM8 Battery Age Minerals 0.12 0% 9% 20% -57% $11,162,897 OM1 Omnia Metals Group 0.078 0% 0% 0% -8% $4,550,568 LLL Leolithiumlimited 0.505 0% 0% 0% 0% $605,458,342 TMX Terrain Minerals 0.004 0% 14% 0% -20% $7,200,115 LCY Legacy Iron Ore 0.013 0% 0% -13% -19% $100,276,127 RON Roninresourcesltd 0.105 0% -16% -16% -25% $3,866,626 ASR Asra Minerals Ltd 0.005 0% -29% -17% -41% $11,157,790 ATM Aneka Tambang 1.025 0% 0% -7% -14% $1,336,240 WA1 Wa1Resourcesltd 14.8 -1% -13% 22% 190% $982,067,849 PSC Prospect Res Ltd 0.097 -1% -2% 20% 28% $53,007,416 STK Strickland Metals 0.09 -1% -8% -10% 29% $205,289,571 LM1 Leeuwin Metals Ltd 0.084 -1% 4% 22% -73% $3,935,540 ARL Ardea Resources Ltd 0.405 -1% -8% -40% -31% $80,871,581 LRV Larvottoresources 0.365 -1% -9% 400% 219% $122,448,504 ASL Andean Silver 1.145 -2% 21% 116% 332% $161,544,818 BKT Black Rock Mining 0.052 -2% -5% -21% -39% $65,106,526 FGR First Graphene Ltd 0.046 -2% -4% -16% -13% $31,219,831 MLX Metals X Limited 0.435 -2% 9% 21% 50% $390,036,578 MEI Meteoric Resources 0.1025 -2% 4% -56% -52% $241,049,677 KZR Kalamazoo Resources 0.077 -3% -20% -13% -27% $14,400,028 PAT Patriot Lithium 0.035 -3% -15% -59% -81% $3,621,816 LOT Lotus Resources Ltd 0.2575 -3% 12% -36% -5% $476,727,540 EV1 Evolutionenergy 0.034 -3% 26% -66% -79% $12,259,283 JMS Jupiter Mines. 0.165 -3% -8% -23% -15% $333,285,904 INF Infinity Lithium 0.032 -3% -20% -52% -62% $16,190,723 MHK Metalhawk. 0.16 -3% 80% 132% 76% $15,603,850 1MC Morella Corporation 0.029 -3% -12% -61% -83% $8,394,003 INR Ioneer Ltd 0.2075 -3% 30% 30% -10% $479,320,457 CMO Cosmometalslimited 0.027 -4% -7% -29% -45% $3,536,808 KAI Kairos Minerals Ltd 0.0125 -4% 25% -4% -40% $32,886,402 EMN Euromanganese 0.047 -4% -8% -46% -66% $10,195,104 TVN Tivan Limited 0.046 -4% -2% -13% -43% $82,876,648 BNR Bulletin Res Ltd 0.045 -4% -6% -29% -43% $13,212,600 NWM Norwest Minerals 0.021 -5% -5% -28% -30% $9,702,390 LIN Lindian Resources 0.1 -5% -9% -13% -50% $115,292,224 ANX Anax Metals Ltd 0.02 -5% 0% -20% -41% $13,892,057 RNU Renascor Res Ltd 0.078 -5% -20% -4% -35% $203,346,374 FG1 Flynngold 0.0285 -5% 14% -35% -44% $7,265,119 ENV Enova Mining Limited 0.0095 -5% 19% -59% 36% $8,864,364 EUR European Lithium Ltd 0.037 -5% 0% -45% -50% $51,730,538 ASN Anson Resources Ltd 0.074 -5% -24% -26% -51% $101,559,615 EGR Ecograf Limited 0.091 -5% -8% -48% -24% $41,316,896 RAG Ragnar Metals Ltd 0.018 -5% -5% -10% -22% $8,531,748 WSR Westar Resources 0.0085 -6% 6% -18% -58% $3,389,161 AAJ Aruma Resources Ltd 0.016 -6% -16% -16% -56% $3,552,931 MRR Minrex Resources Ltd 0.008 -6% -6% -38% -43% $7,594,073 THR Thor Energy PLC 0.016 -6% 7% -30% -58% $3,700,372 PTR Petratherm Ltd 0.048 -6% 140% 100% -11% $13,582,313 KNI Kunikolimited 0.16 -6% -6% -38% -48% $14,316,929 DTM Dart Mining NL 0.015 -6% -18% -49% -17% $5,573,320 AZI Altamin Limited 0.03 -6% 3% -40% -53% $13,165,471 SBR Sabre Resources 0.014 -7% -7% -26% -63% $5,894,429 ABX ABX Group Limited 0.04 -7% -5% -26% -49% $9,751,572 MTM MTM Critical Metals 0.066 -7% 16% 2% 83% $18,271,945 IPT Impact Minerals 0.013 -7% 0% -13% 4% $39,772,638 FRB Firebird Metals 0.13 -7% 24% 4% -7% $16,371,561 SLM Solismineralsltd 0.087 -7% -5% -13% -64% $6,422,731 TOR Torque Met 0.074 -8% -33% -41% -77% $16,947,031 CLA Celsius Resource Ltd 0.012 -8% -20% -8% 9% $30,852,294 RXL Rox Resources 0.12 -8% -8% -36% -46% $52,350,899 LEG Legend Mining 0.012 -8% -8% -8% -50% $34,913,726 ASO Aston Minerals Ltd 0.012 -8% 20% 0% -56% $15,540,771 GED Golden Deeps 0.035 -8% 25% -29% -38% $5,303,282 PVW PVW Res Ltd 0.022 -8% 0% -19% -67% $3,495,905 SGQ St George Min Ltd 0.033 -8% 10% 74% -13% $34,833,294 DM1 Desert Metals 0.022 -8% 0% -31% -51% $5,839,365 BOA Boadicea Resources 0.021 -9% 5% -9% -48% $2,590,410 PNT Panthermetalsltd 0.021 -9% -9% 0% -63% $4,942,321 WKT Walkabout Resources 0.1 -9% 1% -20% -13% $70,482,452 MAN Mandrake Res Ltd 0.029 -9% 12% -22% -28% $17,269,278 KGD Kula Gold Limited 0.009 -10% 13% 29% -31% $5,788,907 TMB Tambourahmetals 0.034 -11% -23% -54% -81% $3,140,543 SCN Scorpion Minerals 0.017 -11% 6% -41% -71% $6,960,755 BUX Buxton Resources Ltd 0.057 -11% -10% -46% -72% $12,230,885 RBX Resource B 0.03 -12% -19% -30% -81% $2,480,535 GRL Godolphin Resources 0.014 -13% 0% -61% -66% $3,208,368 E25 Element 25 Ltd 0.315 -14% 58% 40% -26% $70,371,968 ESR Estrella Res Ltd 0.012 -14% 100% 140% 71% $23,630,168 YAR Yari Minerals Ltd 0.003 -14% -25% -40% -83% $1,447,073 VTM Victory Metals Ltd 0.385 -14% 6% 54% 93% $40,665,997 LPD Lepidico Ltd 0.0025 -17% 25% -34% -78% $25,767,375 BSX Blackstone Ltd 0.035 -17% -24% -42% -71% $18,477,792 PUR Pursuit Minerals 0.0025 -17% -17% -38% -72% $9,088,500 SRL Sunrise 0.39 -17% -26% -42% -49% $35,639,862 WC1 Westcobarmetals 0.024 -17% -31% -54% -72% $3,660,008 GAL Galileo Mining Ltd 0.14 -18% -24% -47% -66% $27,667,490 CRR Critical Resources 0.009 -18% -18% -31% -76% $14,242,802 ETM Energy Transition 0.022 -19% 10% -44% -45% $35,217,717 VHM Vhmlimited 0.45 -20% -22% -13% -9% $76,303,860 SUM Summitminerals 0.215 -23% 2% 207% 87% $19,395,437 AX8 Accelerate Resources 0.008 -27% -11% -80% -67% $4,974,031 TKL Traka Resources 0.001 -33% 0% -50% -75% $1,945,659 CNJ Conico Ltd 0.001 -50% -50% -50% -83% $2,201,528 Code Company Price % Week % Month % Six Month % Year Market Cap

Weekly Small Cap Standouts

Australian Rare Earths (ASX:AR3)

A resource expansion at Koppamurra has expanded the resource by 27% up to 236Mt, which includes a 70% upgrade of its higher-grade core, now 68Mt at >1000ppm.

That’s some very decent grades and puts South Australia and Victoria (it cuts through the border) on the radar to contain its very own world-class ionic clay-hosted REE deposit, which AR3 has been proving up for the past few years.

The results further back up the company’s bold theory that Koppamurra is a discovery of “multi-generational significance”.

It’s gearing towards an accelerated timeline for developing the resource and now has a large swathe of tonnes in the higher confidence indicated category that makes up just 2% of its massive 7700km2 landholding in the region.

Lithium Universe has outlined robust economics in its pre-feasibility study for its planned Bécancour lithium refinery in Quebec, despite the challenging lithium price environment.

The refinery is expected to deliver pre-tax net present value and internal rate of return – both measures of profitability – of US$779m and 23.5% respectively.

This is based on a price forecast of US$1,170/t for 6% Li2O spodumene and US$20,970/t for battery grade lithium carbonate.

Operating costs are estimated at US$3,976/t while payback on the Capex of US$494m is expected to be ~3.5 years.

Annual revenue and EBITDA are expected to be US$383m and US$147m from the refinery, which is designed to produce 18,270t of green, battery-grade lithium carbonate per annum.

The company has completed the 3D Static Geological Model, delivered by SLB, that details the subsurface geology and reservoir characteristics of the Smackover lithium brine project in Arkansas, USA.

The development of a 3D Static Geological Model is seen as a critical step in de-risking and optimising the exploration planning, workflow and project development.

PFE says the subsurface model confirms that the project has the potential to host a large and world-class lithium brine resource, analogous to neighbouring Arkansas super majors Exxon Mobil and Equinor/Standard Lithium, both with advanced lithium brine projects.

The plan is now re-enter the first well to test lithium brine grade through independent labs.

At Stockhead, we tell it like it is. While Lithium Universe is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.