High Voltage: Get out the long lens – lithium demand will quadruple by 2030, says Benchmark

Pic via Getty Images

- Big lithium demand is still in play, says Benchmark, if you’re patient

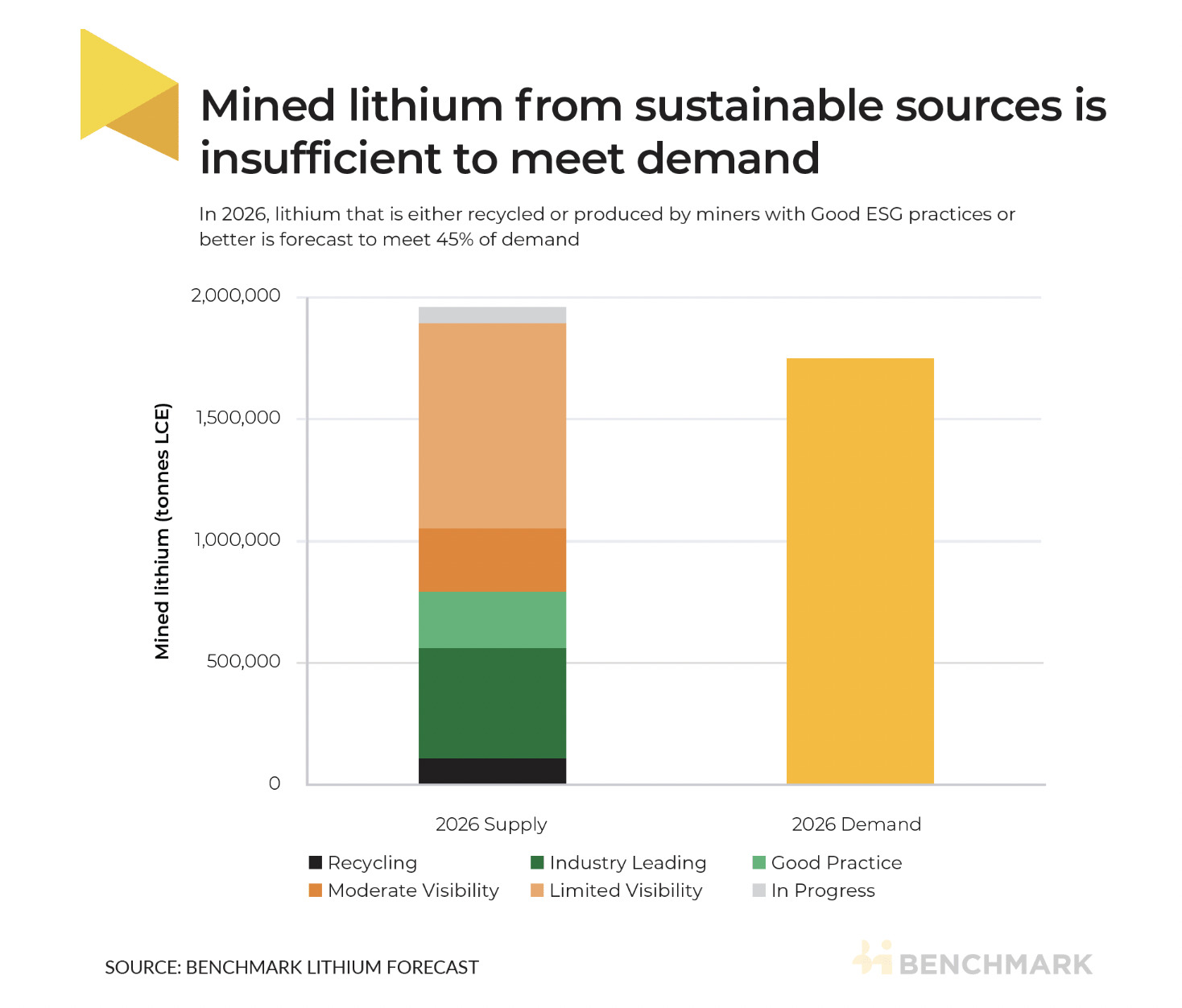

- And here’s another factor: lithium produced from sustainable sources is struggling to meet demand

- ASX battery metal stocks so far this week led by: AQD, NIC, NKL

As the negative lithium and nickel narratives continue into this year, it’s not so easy to get the rig into the right spot to drill for positivity.

But there is some there. In fact, we’ve made some visual confirmation and are just rounding up some results from the lab to back it up.

Essentially, what we’re saying, though, is – we’re sighting some good vibes amid downright bad news this week for crucial battery metals. Let’s start with the latter.

Perth-based IGO – the joint venture partner with China’s Tianqi in Australia’s biggest lithium mine (that’d be Greenbushes, of which Albermarle owns 49%) has announced it’s reducing lithium production, and halting one of its nickel operations – Cosmos.

Perth-based IGO has confirmed to the ASX this week that production cuts to its Greenbushes operations have come due to a weak global lithium market and apparent lowered demand for battery-grade lithium chemicals. The mine’s expected output now drops from 1.4 to 1.5 million tonnes, to 1.3 to 1.4 million tonnes, and the company said sales would be 20 per cent lower than production.

Meanwhile the Cosmos production halt has been made amid nickel prices, like global lithium prices, also taking a long walk off a short pier.

Read Josh Chiat’s latest Monsters of Rock for some deeper insight on this, in which he also examines growing concerns at Sayona Mining (ASX:SYA), Canada’s only active lithium producer, and Chinese lithium giant Ganfeng reporting a profit warning indicating its non-recurring profit would be down some 82.96-88.47% for 2023.

So how about that good news, then?

It’s better news, anyway, and as usual it requires a bit of a longer lens.

It’s being pushed by Benchmark Mineral Intelligence, which is one of the leading groups of analysts assessing prices, supply chain data and forecasting for the global lithium market. Grain of salt if you like.

The London-based price-reporting agency noted, according to its Lithium ion Battery Database that lithium ion battery demand is forecast to grow almost four-fold between 2023 and 2030 to 3.9 terawatt-hours.

This growth in battery demand, says Benchmark, will result in a corresponding surge in demand for critical raw materials as a whole.

And, according to the agency’s newly released Lithium Forecast for 2024:

“In 2015, batteries accounted for just 34% of lithium demand. In 2024, batteries are expected to account for 88% of the 1.2 million tonne demand.”

The sustainability supply-demand spin

Benchmark also throws an interesting metric into on the supply-demand sandwich – sustainability.

“Although a near-term surplus of lithium is forecast until 2029, there is a growing desire from automakers and consumers for lithium sourced sustainably,” notes the firm, adding:

“Benchmark’s Lithium Sustainability Index shows there is currently insufficient supply of lithium from companies with good environmental, social and governance (ESG) practices to meet demand now and in the future.”

“The question of provenance becomes the most important question of them all,” Cameron Perks, principal analyst for lithium at Benchmark, said during a Benchmark webinar last week.

Hmm, is this a reach?

Perhaps not when you consider the fact sustainability and ESG is a big, growing factor that’s driving many a commercial-based decision these days.

“The sourcing strategies, particularly for OEMs, is that they’re looking for industry leading, good practice companies to fulfil their lithium requirements in order to fulfil, say, decarbonisation goals, not just for the company, but for the country they’re operating in,” Perks said.

That’s all well and good, but Benchmark reckons the supply of such lithium is limited, noting that by 2026, lithium from recycled sources or mined by companies with industry leading or good ESG practices is set to meet 45% of demand but drop to 35% by 2030.

Lithium, EVs, clean energy, sustainability… guess it all ties in, doesn’t it, giving some validity to this angle.

ASX battery metals form guide:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop. (Note: figures accurate per ASX at 4pm Jan 31.)

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| PVW | PVW Res Ltd | 0.046 | -8% | -4% | -62% | $4,563,215 |

| A8G | Australasian Metals | 0.1 | -20% | -41% | -47% | $6,515,062 |

| INF | Infinity Lithium | 0.086 | -3% | -14% | -36% | $40,708,104 |

| LPI | Lithium Pwr Int Ltd | 0.56 | 1% | 2% | 29% | $355,493,683 |

| PSC | Prospect Res Ltd | 0.083 | 1% | -7% | -28% | $37,066,557 |

| PAM | Pan Asia Metals | 0.16 | 0% | 28% | -58% | $26,850,684 |

| CXO | Core Lithium | 0.195 | 0% | -22% | -83% | $416,702,431 |

| LOT | Lotus Resources Ltd | 0.365 | 16% | 28% | 46% | $614,338,468 |

| AGY | Argosy Minerals Ltd | 0.1 | 10% | -26% | -84% | $140,440,750 |

| AZS | Azure Minerals | 3.64 | -1% | -2% | 1038% | $1,669,593,653 |

| NWC | New World Resources | 0.04 | 3% | 3% | -30% | $83,934,206 |

| QXR | Qx Resources Limited | 0.017 | 0% | -26% | -65% | $18,871,324 |

| GSR | Greenstone Resources | 0.008 | 0% | 14% | -72% | $10,944,908 |

| CAE | Cannindah Resources | 0.078 | -9% | -22% | -68% | $45,090,236 |

| AZL | Arizona Lithium Ltd | 0.021 | -9% | -32% | -70% | $82,651,159 |

| RIL | Redivium Limited | 0.006 | 0% | -14% | -67% | $16,385,129 |

| COB | Cobalt Blue Ltd | 0.145 | -26% | -38% | -74% | $60,129,122 |

| ESS | Essential Metals Ltd | 0 | -100% | -100% | -100% | $135,278,382 |

| LPD | Lepidico Ltd | 0.006 | 0% | -25% | -60% | $45,829,848 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 0% | -60% | $15,569,766 |

| CZN | Corazon Ltd | 0.011 | -15% | -27% | -54% | $6,771,577 |

| LKE | Lake Resources | 0.092 | -2% | -29% | -89% | $138,117,698 |

| DEV | Devex Resources Ltd | 0.27 | 2% | 13% | -11% | $110,297,668 |

| INR | Ioneer Ltd | 0.12 | 9% | -20% | -72% | $263,926,518 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.04 | 0% | -7% | -23% | $25,246,157 |

| RLC | Reedy Lagoon Corp. | 0.005 | 0% | 0% | -48% | $3,097,704 |

| GBR | Greatbould Resources | 0.06 | 7% | -8% | -31% | $35,921,232 |

| FRS | Forrestaniaresources | 0.026 | -13% | -7% | -84% | $4,530,001 |

| STK | Strickland Metals | 0.097 | -8% | 2% | 162% | $161,049,371 |

| MLX | Metals X Limited | 0.295 | 4% | 2% | -28% | $267,643,490 |

| CLA | Celsius Resource Ltd | 0.011 | 0% | -8% | -35% | $24,706,568 |

| FGR | First Graphene Ltd | 0.061 | 3% | -14% | -39% | $39,537,103 |

| HXG | Hexagon Energy | 0.011 | 0% | -8% | -35% | $6,667,907 |

| TLG | Talga Group Ltd | 0.605 | 6% | -23% | -65% | $229,751,274 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | -90% | $50,378,922 |

| OZL | OZ Minerals | 0 | -100% | -100% | -100% | $8,918,404,433 |

| PLL | Piedmont Lithium Inc | 0.24 | -13% | -44% | -74% | $102,265,753 |

| EUR | European Lithium Ltd | 0.085 | -1% | -19% | 6% | $117,116,091 |

| BKT | Black Rock Mining | 0.062 | -9% | -26% | -60% | $70,228,457 |

| QEM | QEM Limited | 0.185 | -3% | 3% | -8% | $28,007,467 |

| LYC | Lynas Rare Earths | 5.88 | -3% | -18% | -37% | $5,477,308,809 |

| ESR | Estrella Res Ltd | 0.005 | 0% | 0% | -69% | $8,796,859 |

| ARL | Ardea Resources Ltd | 0.42 | 8% | -12% | -44% | $75,851,512 |

| GLN | Galan Lithium Ltd | 0.435 | -18% | -37% | -63% | $190,875,031 |

| JLL | Jindalee Lithium Ltd | 1 | 0% | -4% | -52% | $61,699,919 |

| VUL | Vulcan Energy | 2.14 | 1% | -25% | -70% | $378,560,618 |

| SBR | Sabre Resources | 0.026 | 0% | -21% | -42% | $9,356,548 |

| CHN | Chalice Mining Ltd | 1.115 | 3% | -34% | -83% | $429,804,451 |

| VRC | Volt Resources Ltd | 0.005 | -17% | -23% | -58% | $24,780,640 |

| NMT | Neometals Ltd | 0.145 | -6% | -31% | -82% | $93,403,547 |

| AXN | Alliance Nickel Ltd | 0.039 | 8% | -9% | -63% | $28,307,745 |

| PNN | Power Minerals Ltd | 0.15 | -12% | -29% | -71% | $14,417,057 |

| IGO | IGO Limited | 7.56 | 1% | -16% | -48% | $5,853,680,194 |

| GED | Golden Deeps | 0.037 | -5% | -20% | -63% | $4,274,327 |

| ADV | Ardiden Ltd | 0.175 | 9% | 0% | -49% | $10,940,564 |

| SRI | Sipa Resources Ltd | 0.02 | -9% | -20% | -38% | $4,563,163 |

| NTU | Northern Min Ltd | 0.027 | 0% | -10% | -34% | $153,685,460 |

| AXE | Archer Materials | 0.31 | -3% | -18% | -50% | $79,002,574 |

| PGM | Platina Resources | 0.02 | 5% | -5% | -13% | $12,463,607 |

| AAJ | Aruma Resources Ltd | 0.021 | 5% | -22% | -74% | $4,134,722 |

| IXR | Ionic Rare Earths | 0.02 | 5% | -23% | -39% | $81,329,682 |

| NIC | Nickel Industries | 0.795 | 36% | 14% | -27% | $3,107,212,163 |

| EVG | Evion Group NL | 0.03 | 25% | -12% | -53% | $11,070,694 |

| CWX | Carawine Resources | 0.105 | 0% | -5% | -11% | $24,793,172 |

| PLS | Pilbara Min Ltd | 3.55 | 3% | -10% | -25% | $10,834,084,602 |

| HAS | Hastings Tech Met | 0.59 | -6% | -20% | -83% | $76,973,158 |

| BUX | Buxton Resources Ltd | 0.145 | -3% | -15% | 26% | $24,254,565 |

| ARR | American Rare Earths | 0.13 | -7% | -21% | -47% | $62,499,262 |

| SGQ | St George Min Ltd | 0.024 | -17% | -29% | -68% | $25,702,051 |

| TKL | Traka Resources | 0.002 | 0% | -33% | -68% | $3,501,317 |

| PAN | Panoramic Resources | 0.035 | 0% | 0% | -81% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | -34% | $48,441,219 |

| IPT | Impact Minerals | 0.012 | -8% | 9% | 20% | $34,376,447 |

| LIT | Lithium Australia | 0.027 | -7% | -10% | -44% | $34,221,367 |

| AKE | Allkem Limited | 0 | -100% | -100% | -100% | $6,304,350,967 |

| ARN | Aldoro Resources | 0.11 | 20% | -12% | -56% | $12,923,879 |

| JRV | Jervois Global Ltd | 0.027 | -10% | -39% | -89% | $78,373,100 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | $751,215,521 |

| SYR | Syrah Resources | 0.42 | -3% | -35% | -81% | $310,912,956 |

| FBM | Future Battery | 0.052 | -13% | -29% | -17% | $24,019,019 |

| ADD | Adavale Resource Ltd | 0.006 | -25% | -14% | -70% | $5,272,619 |

| LTR | Liontown Resources | 1.03 | 10% | -38% | -34% | $2,482,534,374 |

| CTM | Centaurus Metals Ltd | 0.29 | 0% | -46% | -74% | $148,457,290 |

| VML | Vital Metals Limited | 0.005 | 0% | -23% | -81% | $29,475,335 |

| BSX | Blackstone Ltd | 0.0605 | -2% | -14% | -62% | $31,994,376 |

| POS | Poseidon Nick Ltd | 0.008 | 14% | -33% | -80% | $25,994,743 |

| CHR | Charger Metals | 0.12 | -14% | -27% | -66% | $9,290,430 |

| AVL | Aust Vanadium Ltd | 0.021 | 5% | 0% | -25% | $99,372,136 |

| AUZ | Australian Mines Ltd | 0.009 | -25% | -10% | -83% | $9,591,784 |

| TMT | Technology Metals | 0.26 | 0% | 8% | -19% | $67,134,856 |

| RXL | Rox Resources | 0.18 | 14% | -3% | -3% | $66,483,767 |

| RNU | Renascor Res Ltd | 0.081 | -10% | -38% | -68% | $215,849,637 |

| GL1 | Globallith | 0.505 | -11% | -58% | -78% | $144,447,241 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | $158,126,031 |

| ASN | Anson Resources Ltd | 0.084 | -12% | -40% | -72% | $120,859,482 |

| SYA | Sayona Mining Ltd | 0.04 | -9% | -44% | -85% | $432,318,433 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.13 | -4% | -7% | -40% | $61,294,296 |

| ATM | Aneka Tambang | 1.15 | -2% | -3% | 5% | $1,531,788 |

| TVN | Tivan Limited | 0.055 | -7% | -8% | -29% | $88,018,517 |

| ALY | Alchemy Resource Ltd | 0.008 | -11% | -20% | -53% | $9,424,610 |

| GAL | Galileo Mining Ltd | 0.21 | -5% | -26% | -75% | $42,489,359 |

| BHP | BHP Group Limited | 47.27 | 1% | -6% | -4% | $238,484,206,978 |

| LEL | Lithenergy | 0.37 | -19% | -36% | -56% | $35,538,450 |

| MMC | Mitremining | 0.22 | 10% | -19% | -21% | $12,471,278 |

| RMX | Red Mount Min Ltd | 0.003 | 0% | 0% | -50% | $8,020,728 |

| GW1 | Greenwing Resources | 0.09 | -8% | -33% | -70% | $15,682,633 |

| AQD | Ausquest Limited | 0.014 | 40% | 27% | -13% | $11,552,089 |

| LML | Lincoln Minerals | 0.006 | 20% | 0% | -87% | $8,520,226 |

| 1MC | Morella Corporation | 0.005 | 25% | -9% | -64% | $24,715,198 |

| REE | Rarex Limited | 0.021 | -5% | -25% | -67% | $13,667,731 |

| MRC | Mineral Commodities | 0.015 | -50% | -53% | -73% | $25,596,288 |

| PUR | Pursuit Minerals | 0.005 | -17% | -38% | -75% | $17,663,828 |

| QPM | Queensland Pacific | 0.037 | -3% | -33% | -66% | $80,501,612 |

| EMH | European Metals Hldg | 0.29 | 4% | -32% | -59% | $37,870,655 |

| BMM | Balkanminingandmin | 0.083 | -8% | -25% | -78% | $6,393,646 |

| PEK | Peak Rare Earths Ltd | 0.245 | -9% | -30% | -44% | $69,144,858 |

| LEG | Legend Mining | 0.017 | 31% | 21% | -61% | $46,471,635 |

| MOH | Moho Resources | 0.009 | -10% | -10% | -59% | $4,823,470 |

| AML | Aeon Metals Ltd. | 0.009 | 0% | -18% | -70% | $9,867,606 |

| G88 | Golden Mile Res Ltd | 0.015 | -6% | -21% | -33% | $4,940,843 |

| WKT | Walkabout Resources | 0.13 | 13% | -7% | 37% | $83,907,681 |

| TON | Triton Min Ltd | 0.0175 | -3% | -24% | -54% | $29,666,461 |

| AR3 | Austrare | 0.125 | -14% | -17% | -59% | $20,041,575 |

| ARU | Arafura Rare Earths | 0.13 | 4% | -21% | -76% | $311,890,796 |

| MIN | Mineral Resources. | 59.95 | 8% | -14% | -33% | $11,875,142,280 |

| VMC | Venus Metals Cor Ltd | 0.1 | 2% | 0% | 11% | $18,972,868 |

| S2R | S2 Resources | 0.15 | 7% | -9% | -9% | $65,664,409 |

| CNJ | Conico Ltd | 0.004 | 0% | -20% | -67% | $6,280,380 |

| VR8 | Vanadium Resources | 0.038 | -14% | -30% | -49% | $21,291,408 |

| PVT | Pivotal Metals Ltd | 0.019 | 6% | -24% | -53% | $13,378,247 |

| BOA | Boadicea Resources | 0.03 | -3% | -17% | -70% | $3,692,709 |

| IPX | Iperionx Limited | 1.82 | 10% | 31% | 102% | $418,314,931 |

| SLZ | Sultan Resources Ltd | 0.016 | 7% | -30% | -79% | $2,371,041 |

| NKL | Nickelxltd | 0.043 | 34% | 16% | -43% | $3,776,052 |

| NVA | Nova Minerals Ltd | 0.335 | -3% | -7% | -51% | $73,811,486 |

| MLS | Metals Australia | 0.032 | 0% | -14% | -37% | $19,345,122 |

| MQR | Marquee Resource Ltd | 0.022 | 10% | -15% | -37% | $8,681,072 |

| MRR | Minrex Resources Ltd | 0.013 | 0% | -24% | -65% | $14,103,278 |

| EVR | Ev Resources Ltd | 0.009 | -10% | -18% | -40% | $10,995,883 |

| EFE | Eastern Resources | 0.008 | 0% | 0% | -53% | $8,693,625 |

| CNB | Carnaby Resource Ltd | 0.635 | -6% | -20% | -40% | $103,407,424 |

| BNR | Bulletin Res Ltd | 0.083 | -7% | -41% | -17% | $25,250,746 |

| AX8 | Accelerate Resources | 0.027 | 0% | -36% | -4% | $16,074,849 |

| AM7 | Arcadia Minerals | 0.065 | -7% | -11% | -72% | $7,524,457 |

| AS2 | Askarimetalslimited | 0.12 | -11% | -31% | -80% | $10,133,528 |

| BYH | Bryah Resources Ltd | 0.012 | 0% | -8% | -49% | $4,769,680 |

| DTM | Dart Mining NL | 0.014 | 0% | -18% | -74% | $3,186,115 |

| EMS | Eastern Metals | 0.033 | -8% | -6% | -61% | $2,390,361 |

| FG1 | Flynngold | 0.06 | -2% | 15% | -39% | $8,743,455 |

| GSM | Golden State Mining | 0.011 | -8% | -27% | -74% | $3,352,448 |

| IMI | Infinitymining | 0.12 | 14% | -14% | -53% | $13,062,873 |

| LRV | Larvottoresources | 0.071 | 9% | 1% | -57% | $16,547,262 |

| LSR | Lodestar Minerals | 0.0025 | -17% | -38% | -38% | $5,058,493 |

| RAG | Ragnar Metals Ltd | 0.022 | -4% | -8% | 65% | $10,427,581 |

| CTN | Catalina Resources | 0.004 | 33% | -11% | -60% | $3,715,461 |

| TMB | Tambourahmetals | 0.085 | -3% | -26% | -19% | $7,298,751 |

| TEM | Tempest Minerals | 0.0075 | 0% | -6% | -71% | $3,893,433 |

| EMC | Everest Metals Corp | 0.076 | -1% | -5% | -21% | $12,978,366 |

| WML | Woomera Mining Ltd | 0.005 | -17% | -83% | -71% | $6,090,695 |

| KZR | Kalamazoo Resources | 0.094 | -4% | -22% | -56% | $16,263,675 |

| LMG | Latrobe Magnesium | 0.058 | 7% | -9% | -21% | $110,958,195 |

| KOR | Korab Resources | 0.011 | -31% | -31% | -54% | $4,037,550 |

| CMX | Chemxmaterials | 0.067 | -12% | -18% | -57% | $6,253,993 |

| NC1 | Nicoresourceslimited | 0.235 | -2% | -32% | -63% | $26,754,141 |

| GRE | Greentechmetals | 0.245 | 0% | -47% | 104% | $19,789,276 |

| CMO | Cosmometalslimited | 0.062 | 0% | 0% | -60% | $2,523,193 |

| FRB | Firebird Metals | 0.12 | 20% | -17% | -40% | $17,083,368 |

| S32 | South32 Limited | 3.35 | 0% | 1% | -26% | $15,127,723,617 |

| OMH | OM Holdings Limited | 0.46 | -5% | 3% | -42% | $367,803,264 |

| JMS | Jupiter Mines. | 0.185 | 6% | 12% | -20% | $352,710,957 |

| E25 | Element 25 Ltd | 0.275 | -8% | -35% | -72% | $60,908,494 |

| EMN | Euromanganese | 0.084 | -2% | -16% | -74% | $20,593,297 |

| KGD | Kula Gold Limited | 0.009 | -25% | -40% | -68% | $3,385,695 |

| LRS | Latin Resources Ltd | 0.17 | -3% | -40% | 55% | $475,363,554 |

| CRR | Critical Resources | 0.014 | 0% | -33% | -74% | $23,112,054 |

| ENT | Enterprise Metals | 0.004 | 0% | 0% | -60% | $3,207,884 |

| SCN | Scorpion Minerals | 0.025 | -11% | -24% | -71% | $11,464,773 |

| GCM | Green Critical Min | 0.006 | -14% | -33% | -69% | $6,819,510 |

| ENV | Enova Mining Limited | 0.017 | -15% | 13% | 42% | $13,459,516 |

| RBX | Resource B | 0.075 | 0% | 0% | -17% | $6,201,336 |

| AKN | Auking Mining Ltd | 0.036 | 3% | -23% | -69% | $7,601,672 |

| RR1 | Reach Resources Ltd | 0.003 | 0% | -25% | -14% | $9,630,891 |

| EMT | Emetals Limited | 0.007 | 0% | 0% | -36% | $5,950,000 |

| PNT | Panthermetalsltd | 0.05 | 0% | -17% | -73% | $4,358,308 |

| WIN | Widgienickellimited | 0.075 | -6% | -19% | -80% | $25,623,275 |

| WMG | Western Mines | 0.19 | 6% | -27% | 12% | $12,837,644 |

| AVW | Avira Resources Ltd | 0.002 | 0% | 0% | -20% | $4,267,580 |

| CAI | Calidus Resources | 0.195 | 0% | -9% | -29% | $116,375,516 |

| GT1 | Greentechnology | 0.155 | -3% | -46% | -83% | $46,001,554 |

| KAI | Kairos Minerals Ltd | 0.013 | 8% | -7% | -32% | $41,934,595 |

| MTM | MTM Critical Metals | 0.075 | -6% | 10% | -6% | $8,700,745 |

| NWM | Norwest Minerals | 0.024 | -4% | -11% | -62% | $6,901,668 |

| PGD | Peregrine Gold | 0.3 | -6% | 25% | -42% | $20,098,944 |

| RAS | Ragusa Minerals Ltd | 0.031 | 3% | -14% | -70% | $4,563,161 |

| RGL | Riversgold | 0.01 | 0% | -17% | -68% | $9,676,615 |

| SRZ | Stellar Resources | 0.007 | 0% | 0% | -50% | $8,043,185 |

| STM | Sunstone Metals Ltd | 0.01 | -17% | -33% | -74% | $31,389,614 |

| ZNC | Zenith Minerals Ltd | 0.135 | -18% | -10% | -45% | $47,571,419 |

| WC8 | Wildcat Resources | 0.4 | -2% | -42% | 1233% | $520,189,584 |

| ASO | Aston Minerals Ltd | 0.018 | -10% | -25% | -81% | $22,016,093 |

| THR | Thor Energy PLC | 0.033 | -3% | 10% | -45% | $6,511,271 |

| YAR | Yari Minerals Ltd | 0.01 | 0% | -13% | -44% | $5,305,936 |

| IG6 | Internationalgraphit | 0.135 | -4% | -16% | -46% | $11,568,454 |

| LPM | Lithium Plus | 0.24 | 0% | -32% | -31% | $20,637,168 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | -33% | -57% | $7,302,978 |

| KOB | Kobaresourceslimited | 0.155 | 11% | 121% | -9% | $15,812,500 |

| AZI | Altamin Limited | 0.05 | -9% | -9% | -34% | $21,834,219 |

| FTL | Firetail Resources | 0.059 | -2% | -23% | -59% | $8,785,428 |

| LNR | Lanthanein Resources | 0.006 | -14% | -48% | -71% | $8,383,777 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -88% | $12,357,082 |

| NVX | Novonix Limited | 0.565 | 1% | -23% | -69% | $283,538,023 |

| OCN | Oceanalithiumlimited | 0.063 | -18% | -48% | -83% | $3,406,820 |

| SUM | Summitminerals | 0.071 | -23% | -28% | -47% | $3,288,342 |

| DVP | Develop Global Ltd | 2.41 | 21% | -15% | -38% | $579,942,059 |

| OD6 | Od6Metalsltd | 0.13 | 0% | -7% | -61% | $6,876,937 |

| HRE | Heavy Rare Earths | 0.049 | -11% | -23% | -65% | $3,084,884 |

| LIN | Lindian Resources | 0.135 | -10% | -7% | -40% | $155,509,502 |

| PEK | Peak Rare Earths Ltd | 0.245 | -9% | -30% | -44% | $69,144,858 |

| ILU | Iluka Resources | 7.25 | 1% | 10% | -33% | $3,097,254,836 |

| ASM | Ausstratmaterials | 1.045 | 2% | -18% | -42% | $183,471,180 |

| ETM | Energy Transition | 0.037 | -3% | -5% | -27% | $54,602,332 |

| VMS | Venture Minerals | 0.01 | 25% | 43% | -63% | $19,890,117 |

| IDA | Indiana Resources | 0.083 | 1% | 4% | 38% | $49,834,202 |

| VTM | Victory Metals Ltd | 0.215 | -7% | 2% | 8% | $17,907,924 |

| M2R | Miramar | 0.024 | 0% | 14% | -70% | $3,572,869 |

| WCN | White Cliff Min Ltd | 0.016 | 7% | 78% | 23% | $20,037,890 |

| TAR | Taruga Minerals | 0.008 | 0% | -27% | -65% | $5,648,214 |

| ABX | ABX Group Limited | 0.071 | -1% | -1% | -43% | $17,502,822 |

| MEK | Meeka Metals Limited | 0.037 | -8% | -8% | -38% | $44,449,522 |

| RR1 | Reach Resources Ltd | 0.003 | 0% | -25% | -14% | $9,630,891 |

| DRE | Dreadnought Resources Ltd | 0.021 | -13% | -30% | -81% | $73,060,532 |

| KFM | Kingfisher Mining | 0.115 | -18% | -23% | -79% | $6,177,225 |

| AOA | Ausmon Resorces | 0.0025 | -17% | -17% | -64% | $2,117,999 |

| WC1 | Westcobarmetals | 0.056 | 2% | -26% | -66% | $6,764,819 |

| GRL | Godolphin Resources | 0.043 | 10% | 10% | -55% | $7,277,407 |

| DM1 | Desert Metals | 0.032 | -14% | -37% | -84% | $7,962,771 |

| PTR | Petratherm Ltd | 0.024 | -20% | -31% | -69% | $5,618,778 |

| ITM | Itech Minerals Ltd | 0.08 | -11% | -27% | -75% | $9,774,685 |

| KTA | Krakatoa Resources | 0.02 | 5% | -44% | -53% | $9,442,144 |

| M24 | Mamba Exploration | 0.059 | 7% | 18% | -74% | $3,844,937 |

| LNR | Lanthanein Resources | 0.006 | -14% | -48% | -71% | $8,383,777 |

| TKM | Trek Metals Ltd | 0.037 | -8% | -8% | -53% | $19,496,921 |

| BCA | Black Canyon Limited | 0.105 | -5% | -25% | -59% | $7,364,854 |

| CDT | Castle Minerals | 0.007 | 0% | -26% | -68% | $8,571,451 |

| DLI | Delta Lithium | 0.275 | -2% | -41% | -41% | $206,427,696 |

| A11 | Atlantic Lithium | 0.3775 | -2% | -4% | -45% | $253,370,931 |

| KNI | Kunikolimited | 0.25 | 9% | -17% | -50% | $20,314,403 |

| CY5 | Cygnus Metals Ltd | 0.069 | -12% | -49% | -86% | $19,242,903 |

| WR1 | Winsome Resources | 0.555 | -7% | -47% | -76% | $112,563,180 |

| LLI | Loyal Lithium Ltd | 0.24 | -8% | -23% | -52% | $19,988,957 |

| BC8 | Black Cat Syndicate | 0.25 | 6% | 0% | -33% | $74,475,500 |

| BUR | Burleyminerals | 0.105 | -22% | -36% | -61% | $10,846,159 |

| PBL | Parabellumresources | 0.066 | 10% | -6% | -87% | $4,111,800 |

| L1M | Lightning Minerals | 0.09 | -5% | -36% | -55% | $3,800,256 |

| WA1 | Wa1Resourcesltd | 10.16 | 2% | -18% | 498% | $484,322,127 |

| EV1 | Evolutionenergy | 0.125 | -7% | -11% | -60% | $31,773,214 |

| 1AE | Auroraenergymetals | 0.135 | -7% | 17% | -13% | $22,288,970 |

| RVT | Richmond Vanadium | 0.335 | 5% | 20% | -12% | $28,879,615 |

| PMT | Patriotbatterymetals | 0.8 | 8% | -29% | -50% | $405,720,129 |

| PAT | Patriot Lithium | 0.125 | -11% | -31% | -66% | $8,354,056 |

| BM8 | Battery Age Minerals | 0.155 | -9% | -18% | -69% | $14,681,651 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | -54% | $3,786,192 |

| VHM | Vhmlimited | 0.675 | 13% | -4% | -30% | $93,888,836 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | -17% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.0095 | -14% | 12% | -32% | $19,631,578 |

| SRL | Sunrise | 0.375 | 0% | -18% | -79% | $32,481,899 |

| SYR | Syrah Resources | 0.42 | -3% | -35% | -81% | $310,912,956 |

| EG1 | Evergreenlithium | 0.12 | 4% | -37% | 0% | $6,185,300 |

| WSR | Westar Resources | 0.018 | -10% | -5% | -62% | $3,336,435 |

| LU7 | Lithium Universe Ltd | 0.023 | -4% | -32% | 15% | $8,936,004 |

| MEI | Meteoric Resources | 0.19 | -7% | -27% | 58% | $388,073,370 |

| REC | Rechargemetals | 0.075 | -7% | -21% | -42% | $8,017,342 |

| SLM | Solismineralsltd | 0.12 | -8% | -17% | 41% | $10,192,092 |

| DYM | Dynamicmetalslimited | 0.15 | 7% | 7% | -23% | $5,400,000 |

| TOR | Torque Met | 0.205 | 8% | -7% | 17% | $31,375,972 |

| ICL | Iceni Gold | 0.047 | 0% | -10% | -57% | $11,588,369 |

| TMX | Terrain Minerals | 0.005 | 25% | 0% | -17% | $7,158,353 |

| MHC | Manhattan Corp Ltd | 0.0035 | -13% | -13% | -50% | $8,810,939 |

| MHK | Metalhawk. | 0.1 | 5% | -26% | -38% | $10,438,517 |

| ANX | Anax Metals Ltd | 0.021 | 5% | -30% | -71% | $11,120,906 |

| FIN | FIN Resources Ltd | 0.018 | 0% | -18% | 13% | $11,037,568 |

| LM1 | Leeuwin Metals Ltd | 0.1 | -20% | -29% | 0% | $4,685,167 |

| HAW | Hawthorn Resources | 0.095 | -3% | 2% | -5% | $31,826,483 |

| LCY | Legacy Iron Ore | 0.017 | 0% | 0% | 0% | $108,916,045 |

| RON | Roninresourcesltd | 0.14 | -10% | -24% | -13% | $5,155,501 |

| ASR | Asra Minerals Ltd | 0.005 | -17% | -29% | -64% | $9,818,974 |

| PFE | Panteraminerals | 0.058 | 18% | 12% | -57% | $7,692,108 |

| KM1 | Kalimetalslimited | 0.46 | -12% | 0% | 0% | $38,934,468 |

What’s hot and not over the past week?

CHARGED UP

AusQuest (ASX:AQD) +40%

Nickel Industries (ASX:NIC) +36%

NickelX (ASX:NKL) +34%

LOW ON JUICE

Mineral Commodities (ASX:MRC) -50%

Korab Resources (ASX:KOR) -31%

Cobalt Blue Holdings (ASX:COB) -26%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.