High Voltage: EVs are still selling but LFP growth cuts nickel and manganese deep

Nickel and manganese EV demand forecasts are copping a trim from BloombergNEF. Pic: Getty Images

- BloombergNEF says demand for EVs is still going strong in 2024

- New report flags more battery supply chain investment needed

- LFP batteries expected to cut demand for nickel and manganese

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

Automakers are softening previous electrification targets, often quoting their inability to manufacture EVs at as low a cost as internal-combustion cars.

But while sales are “only” forecast to grow this year by 21% this year (down from 62% in 2022 and 31% in 2023), demand for EVs is still going strong according to BloombergNEF’s Long-Term Electric Vehicle Outlook.

The report indicates that rapidly falling battery prices, advancements in next-generation battery technology and improving economics of electric vehicles continue to underpin long-term EV growth globally – good news for battery metals.

“Several next-generation battery technologies are reaching commercialisation in the next few years and prices have fallen by 90% over the past decade,” the report notes.

“This trend looks set to continue, with early indications that prices are dropping sharply in 2024 due to lower raw-material prices, manufacturing advances, and overcapacity.”

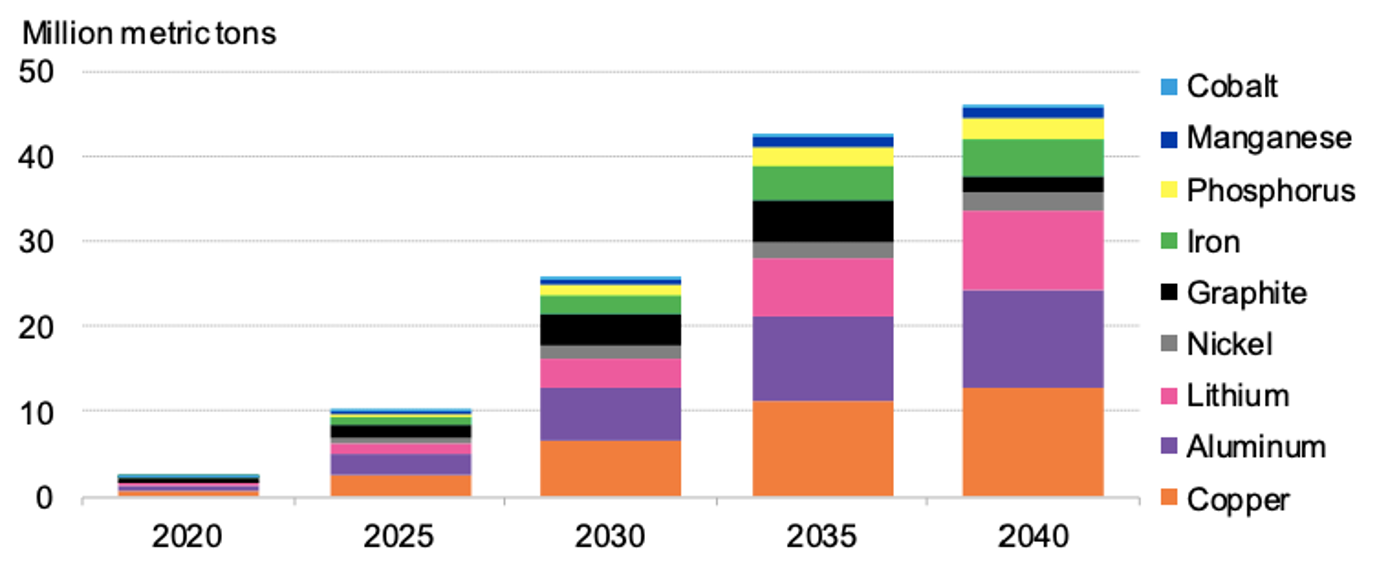

BloombergNEF points out what industry experts like Benchmark Minerals Intelligence Boss man Simon Moores has been saying for ages – large investments are needed in all areas of the battery supply chain.

“At least US$35 billion needs to be invested in battery-cell and component plants by the end of the decade, which is easily exceeded by the US$155 billion already planned by companies,” the report said.

LFP batteries bump off nickel and manganese demand

The report also notes that lithium-iron-phosphate batteries are taking over the EV market, expected to reach more than 50% of global passenger EV sales within the next two years. That will reduce demand growth for metals like nickel and manganese.

“Nickel and manganese are among the biggest losers from the advancements in LFP batteries,” BloombergNEF says.

“Nickel consumption in lithium-ion batteries reaches 517,000 metric tonnes in 2025, while manganese reaches 131,000 metric tonnes.

“These are 25% and 38% lower than our previous estimates in EVO 2023 for nickel and manganese, respectively, due to the shift toward lower-cost chemistries.”

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium is performing>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| CODE | COMPANY | PRICE | WEEK RETURN % | MONTH RETURN % | 6 MONTH RETURN %% | YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| KOR | Korab Resources | 0.009 | 80% | 29% | -44% | -59% | $3,303,450 |

| RIL | Redivium Limited | 0.003 | 50% | 0% | -40% | -73% | $8,192,564 |

| ODE | Odessa Minerals Ltd | 0.004 | 33% | 0% | -43% | -71% | $4,173,130 |

| BUR | Burleyminerals | 0.145 | 32% | 7% | -6% | -28% | $21,803,787 |

| HRE | Heavy Rare Earths | 0.035 | 30% | 0% | -45% | -63% | $2,117,078 |

| CLA | Celsius Resource Ltd | 0.014 | 27% | 40% | 8% | -42% | $31,562,866 |

| KTA | Krakatoa Resources | 0.014 | 27% | -18% | -61% | -33% | $6,609,501 |

| KNI | Kunikolimited | 0.225 | 25% | 2% | -27% | -49% | $18,655,393 |

| VTM | Victory Metals Ltd | 0.34 | 24% | 15% | 58% | 55% | $31,539,519 |

| PTR | Petratherm Ltd | 0.019 | 19% | -27% | -44% | -76% | $4,495,023 |

| PNN | Power Minerals Ltd | 0.13 | 18% | 0% | -40% | -66% | $12,038,655 |

| NVX | Novonix Limited | 0.76 | 17% | -6% | 16% | -19% | $386,300,936 |

| BKT | Black Rock Mining | 0.0595 | 17% | -7% | -27% | -46% | $66,319,884 |

| MOH | Moho Resources | 0.004 | 14% | 0% | -64% | -60% | $2,156,713 |

| BOA | Boadicea Resources | 0.024 | 14% | -14% | -31% | -57% | $2,837,115 |

| PGM | Platina Resources | 0.025 | 14% | 0% | 19% | 4% | $14,333,148 |

| ARR | American Rare Earths | 0.255 | 13% | -6% | 82% | 104% | $120,888,708 |

| GSM | Golden State Mining | 0.01 | 11% | -9% | -33% | -79% | $2,793,706 |

| MTM | MTM Critical Metals | 0.04 | 11% | -17% | -17% | -62% | $11,525,381 |

| NWM | Norwest Minerals | 0.03 | 11% | -21% | 11% | -6% | $11,643,585 |

| SRZ | Stellar Resources | 0.02 | 11% | -5% | 150% | 100% | $38,835,036 |

| INR | Ioneer Ltd | 0.155 | 11% | -31% | 15% | -52% | $372,098,353 |

| DYM | Dynamicmetalslimited | 0.155 | 11% | -11% | 11% | -49% | $5,580,000 |

| ARN | Aldoro Resources | 0.073 | 11% | -4% | -11% | -34% | $9,827,533 |

| SYA | Sayona Mining Ltd | 0.0375 | 10% | -11% | -41% | -79% | $360,265,360 |

| PFE | Panteraminerals | 0.033 | 10% | -33% | -37% | -65% | $11,938,884 |

| EUR | European Lithium Ltd | 0.056 | 10% | 19% | -22% | -44% | $76,896,745 |

| LRV | Larvottoresources | 0.105 | 9% | 5% | 40% | -18% | $27,530,614 |

| G88 | Golden Mile Res Ltd | 0.012 | 9% | -8% | -29% | -75% | $4,934,674 |

| BC8 | Black Cat Syndicate | 0.3 | 9% | -6% | 18% | -15% | $113,361,066 |

| MMC | Mitremining | 0.8 | 8% | 2% | 214% | 167% | $92,949,323 |

| 1AE | Auroraenergymetals | 0.069 | 8% | -16% | -31% | 15% | $12,355,398 |

| NC1 | Nicoresourceslimited | 0.14 | 8% | -7% | -58% | -71% | $13,681,322 |

| IG6 | Internationalgraphit | 0.084 | 8% | -24% | -46% | -57% | $13,936,200 |

| LMG | Latrobe Magnesium | 0.045 | 7% | -19% | -22% | -15% | $100,823,855 |

| LU7 | Lithium Universe Ltd | 0.015 | 7% | -17% | -56% | -50% | $7,093,990 |

| JMS | Jupiter Mines. | 0.31 | 7% | -3% | 88% | 51% | $607,601,649 |

| TKM | Trek Metals Ltd | 0.033 | 6% | -21% | -18% | -55% | $16,944,604 |

| MLX | Metals X Limited | 0.42 | 6% | -9% | 50% | 62% | $376,079,668 |

| FGR | First Graphene Ltd | 0.054 | 6% | -7% | -23% | -19% | $35,599,593 |

| CXO | Core Lithium | 0.093 | 6% | -36% | -64% | -90% | $192,324,199 |

| SUM | Summitminerals | 0.465 | 6% | 116% | 323% | 288% | $27,876,978 |

| TLG | Talga Group Ltd | 0.59 | 5% | -18% | -24% | -58% | $224,054,961 |

| COB | Cobalt Blue Ltd | 0.083 | 5% | -11% | -63% | -65% | $31,630,621 |

| DTM | Dart Mining NL | 0.021 | 5% | -22% | 31% | -48% | $5,427,090 |

| VHM | Vhmlimited | 0.42 | 5% | -12% | -40% | -36% | $64,764,117 |

| LIN | Lindian Resources | 0.11 | 5% | -12% | -29% | -65% | $126,821,446 |

| PVW | PVW Res Ltd | 0.023 | 5% | -8% | -52% | -66% | $2,332,310 |

| DLI | Delta Lithium | 0.235 | 4% | -22% | -48% | -73% | $156,949,571 |

| EMC | Everest Metals Corp | 0.125 | 4% | -11% | 52% | -17% | $19,713,973 |

| ILU | Iluka Resources | 6.6 | 4% | -12% | -1% | -41% | $2,815,805,917 |

| QEM | QEM Limited | 0.145 | 4% | -3% | -26% | -28% | $21,951,798 |

| RNU | Renascor Res Ltd | 0.089 | 3% | -23% | -26% | -49% | $231,266,536 |

| JLL | Jindalee Lithium Ltd | 0.31 | 3% | -47% | -63% | -83% | $19,356,837 |

| EMS | Eastern Metals | 0.031 | 3% | -38% | -6% | -40% | $3,063,614 |

| MEK | Meeka Metals Limited | 0.032 | 3% | -14% | -20% | -6% | $40,745,395 |

| ARU | Arafura Rare Earths | 0.175 | 3% | -10% | 9% | -44% | $404,302,884 |

| CHN | Chalice Mining Ltd | 1.365 | 3% | -19% | -18% | -79% | $523,155,644 |

| AXN | Alliance Nickel Ltd | 0.039 | 3% | -9% | -11% | -59% | $29,033,585 |

| IDA | Indiana Resources | 0.08 | 3% | 3% | 25% | 67% | $50,749,702 |

| CMO | Cosmometalslimited | 0.048 | 2% | 14% | -16% | -44% | $6,151,512 |

| EMH | European Metals Hldg | 0.265 | 2% | -33% | -45% | -72% | $54,972,847 |

| LTM | Arcadium Lithium PLC | 5.155 | 2% | -25% | -49% | 0% | $1,889,078,472 |

| TVN | Tivan Limited | 0.073 | 1% | 43% | 16% | -1% | $125,092,126 |

| HAS | Hastings Tech Met | 0.2775 | 1% | 11% | -62% | -76% | $50,267,198 |

| BHP | BHP Group Limited | 43.12 | 1% | -3% | -13% | -3% | $219,800,145,609 |

| S32 | South32 Limited | 3.69 | 1% | -4% | 14% | -1% | $16,667,671,530 |

| PLS | Pilbara Min Ltd | 3.235 | 0% | -18% | -16% | -33% | $9,721,398,707 |

| IPX | Iperionx Limited | 1.9925 | 0% | -8% | 49% | 85% | $514,489,518 |

| PSC | Prospect Res Ltd | 0.16 | 0% | -20% | 80% | 14% | $76,588,782 |

| PAM | Pan Asia Metals | 0.16 | 0% | 0% | 28% | -27% | $29,436,781 |

| NWC | New World Resources | 0.031 | 0% | -23% | -18% | 3% | $85,068,452 |

| GSR | Greenstone Resources | 0.011 | 0% | -8% | 69% | -27% | $15,761,980 |

| LPD | Lepidico Ltd | 0.002 | 0% | -43% | -74% | -81% | $17,178,239 |

| MRD | Mount Ridley Mines | 0.001 | 0% | -33% | -50% | -60% | $7,784,883 |

| RLC | Reedy Lagoon Corp. | 0.003 | 0% | -25% | -40% | -38% | $1,858,622 |

| HXG | Hexagon Energy | 0.011 | 0% | -39% | -8% | 0% | $5,642,075 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | 0% | -69% | $50,378,922 |

| IXR | Ionic Rare Earths | 0.011 | 0% | -8% | -50% | -52% | $53,144,312 |

| EVG | Evion Group NL | 0.018 | 0% | -25% | -49% | -54% | $6,227,265 |

| TKL | Traka Resources | 0.0015 | 0% | -25% | -50% | -73% | $1,750,659 |

| PAN | Panoramic Resources | 0.035 | 0% | 0% | 0% | -65% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | 0% | 0% | $48,441,219 |

| LIT | Lithium Australia | 0.02 | 0% | -26% | -33% | -33% | $22,001,250 |

| ADD | Adavale Resource Ltd | 0.004 | 0% | -20% | -43% | -84% | $4,161,061 |

| AVL | Aust Vanadium Ltd | 0.015 | 0% | -12% | -25% | -53% | $129,157,547 |

| AUZ | Australian Mines Ltd | 0.008 | 0% | -20% | -20% | -43% | $9,789,585 |

| ATM | Aneka Tambang | 1.07 | 0% | -1% | -9% | 0% | $1,394,904 |

| RMX | Red Mount Min Ltd | 0.001 | 0% | 0% | -62% | -71% | $3,423,577 |

| GW1 | Greenwing Resources | 0.05 | 0% | -29% | -57% | -74% | $8,518,820 |

| MRC | Mineral Commodities | 0.021 | 0% | -5% | -34% | -58% | $20,673,925 |

| PUR | Pursuit Minerals | 0.003 | 0% | -33% | -60% | -78% | $10,906,200 |

| LEG | Legend Mining | 0.012 | 0% | -20% | -25% | -75% | $34,895,726 |

| AML | Aeon Metals Ltd. | 0.006 | 0% | -33% | -33% | -65% | $6,578,404 |

| WKT | Walkabout Resources | 0.115 | 0% | -8% | -12% | 17% | $77,195,067 |

| CNJ | Conico Ltd | 0.001 | 0% | 0% | -80% | -86% | $3,610,291 |

| LSR | Lodestar Minerals | 0.0015 | 0% | -6% | -53% | -58% | $3,035,096 |

| RAG | Ragnar Metals Ltd | 0.017 | 0% | 6% | -29% | -36% | $8,531,657 |

| CTN | Catalina Resources | 0.003 | 0% | -25% | -25% | 0% | $3,715,461 |

| TEM | Tempest Minerals | 0.008 | 0% | -7% | 5% | -53% | $4,152,995 |

| KGD | Kula Gold Limited | 0.01 | 0% | 11% | -33% | -47% | $6,182,119 |

| ENT | Enterprise Metals | 0.004 | 0% | -20% | 0% | 33% | $3,538,884 |

| GCM | Green Critical Min | 0.004 | 0% | 33% | -60% | -73% | $4,546,340 |

| PNT | Panthermetalsltd | 0.029 | 0% | -40% | -52% | -64% | $2,527,819 |

| WMG | Western Mines | 0.345 | 0% | 3% | 35% | -31% | $25,843,802 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | -50% | -50% | $2,663,790 |

| RAS | Ragusa Minerals Ltd | 0.016 | 0% | -20% | -52% | -76% | $2,424,179 |

| TAR | Taruga Minerals | 0.007 | 0% | -13% | -42% | -36% | $4,942,187 |

| AOA | Ausmon Resorces | 0.0025 | 0% | 0% | -17% | -38% | $2,647,498 |

| GRL | Godolphin Resources | 0.019 | 0% | -27% | -53% | -67% | $4,063,933 |

| PBL | Parabellumresources | 0.04 | 0% | -2% | -43% | -88% | $2,492,000 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | 0% | -65% | $4,550,568 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | 0% | -53% | $605,079,142 |

| SRN | Surefire Rescs NL | 0.008 | 0% | -16% | -11% | -43% | $15,890,463 |

| WSR | Westar Resources | 0.01 | 0% | 0% | -41% | -82% | $2,600,642 |

| TMX | Terrain Minerals | 0.003 | 0% | -14% | -40% | -50% | $4,295,012 |

| MHC | Manhattan Corp Ltd | 0.002 | 0% | 0% | -50% | -71% | $4,405,470 |

| ASR | Asra Minerals Ltd | 0.004 | 0% | -43% | -50% | -50% | $8,144,317 |

| IGO | IGO Limited | 5.945 | -1% | -19% | -34% | -59% | $4,475,452,775 |

| GT1 | Greentechnology | 0.077 | -1% | -23% | -69% | -89% | $24,453,159 |

| L1M | Lightning Minerals | 0.07 | -1% | -13% | -50% | -55% | $6,601,633 |

| EMN | Euromanganese | 0.068 | -1% | -12% | -32% | -59% | $14,889,717 |

| WC8 | Wildcat Resources | 0.34 | -1% | -32% | -51% | 183% | $416,264,683 |

| LYC | Lynas Rare Earths | 5.97 | -1% | -10% | -15% | -14% | $5,589,614,746 |

| KOB | Kobaresourceslimited | 0.1425 | -2% | -5% | 78% | -5% | $23,784,242 |

| EG1 | Evergreenlithium | 0.054 | -2% | -43% | -72% | -85% | $3,317,570 |

| ASN | Anson Resources Ltd | 0.1025 | -2% | -27% | -24% | -32% | $129,052,821 |

| GAL | Galileo Mining Ltd | 0.2 | -2% | -26% | -20% | -64% | $40,513,110 |

| BNR | Bulletin Res Ltd | 0.04 | -2% | -20% | -67% | -31% | $12,625,373 |

| LEL | Lithenergy | 0.38 | -3% | -10% | -30% | -55% | $42,000,588 |

| RBX | Resource B | 0.034 | -3% | 13% | -56% | -82% | $2,811,272 |

| QPM | Queensland Pacific | 0.033 | -3% | -15% | -35% | -67% | $83,187,998 |

| BSX | Blackstone Ltd | 0.046 | -3% | -23% | -32% | -58% | $23,639,450 |

| MAN | Mandrake Res Ltd | 0.03 | -3% | -12% | -32% | -23% | $18,502,798 |

| WCN | White Cliff Min Ltd | 0.015 | -3% | -6% | 67% | 114% | $24,365,811 |

| KFM | Kingfisher Mining | 0.06 | -3% | -10% | -63% | -80% | $3,222,900 |

| OMH | OM Holdings Limited | 0.445 | -3% | -7% | -1% | -11% | $340,984,276 |

| PLL | Piedmont Lithium Inc | 0.145 | -3% | -34% | -66% | -83% | $58,384,872 |

| GRE | Greentechmetals | 0.14 | -3% | -35% | -70% | -73% | $10,800,397 |

| DVP | Develop Global Ltd | 2.12 | -4% | -7% | -26% | -35% | $524,715,199 |

| INF | Infinity Lithium | 0.051 | -4% | -9% | -46% | -48% | $23,592,197 |

| A8G | Australasian Metals | 0.075 | -4% | -1% | -56% | -46% | $3,909,037 |

| ADV | Ardiden Ltd | 0.125 | -4% | -17% | -31% | -58% | $8,127,276 |

| BMM | Balkanminingandmin | 0.05 | -4% | -11% | -62% | -73% | $3,694,107 |

| FTL | Firetail Resources | 0.075 | -4% | 68% | 5% | -34% | $13,943,067 |

| CNB | Carnaby Resource Ltd | 0.49 | -4% | -38% | -36% | -49% | $89,407,368 |

| SGQ | St George Min Ltd | 0.024 | -4% | 41% | -25% | -38% | $24,713,511 |

| ASM | Ausstratmaterials | 0.79 | -4% | -22% | -33% | -29% | $135,850,169 |

| OD6 | Od6Metalsltd | 0.045 | -4% | -29% | -69% | -80% | $5,791,058 |

| NKL | Nickelxltd | 0.022 | -4% | 5% | -44% | -66% | $2,019,749 |

| ICL | Iceni Gold | 0.065 | -4% | 5% | 23% | -25% | $17,729,468 |

| STK | Strickland Metals | 0.105 | -5% | -5% | 22% | 123% | $187,922,113 |

| PGD | Peregrine Gold | 0.21 | -5% | -28% | -13% | -25% | $13,236,292 |

| KZR | Kalamazoo Resources | 0.081 | -5% | -26% | -23% | -35% | $14,389,346 |

| NIC | Nickel Industries | 0.805 | -5% | -19% | 20% | -9% | $3,514,364,102 |

| KAI | Kairos Minerals Ltd | 0.01 | -5% | -13% | -33% | -35% | $23,588,210 |

| DM1 | Desert Metals | 0.02 | -5% | -5% | -61% | -66% | $5,308,514 |

| LRS | Latin Resources Ltd | 0.185 | -5% | -29% | -26% | -27% | $517,892,601 |

| AZI | Altamin Limited | 0.036 | -5% | -8% | -31% | -52% | $16,676,263 |

| FBM | Future Battery | 0.034 | -6% | -19% | -53% | -72% | $19,868,278 |

| GLN | Galan Lithium Ltd | 0.165 | -6% | -28% | -70% | -81% | $80,570,479 |

| NTU | Northern Min Ltd | 0.033 | -6% | -13% | -3% | 0% | $200,973,294 |

| EV1 | Evolutionenergy | 0.033 | -6% | -51% | -76% | -82% | $10,044,632 |

| BUX | Buxton Resources Ltd | 0.065 | -6% | -38% | -63% | -61% | $13,261,048 |

| SBR | Sabre Resources | 0.016 | -6% | -16% | -45% | -43% | $5,988,191 |

| ABX | ABX Group Limited | 0.047 | -6% | -10% | -35% | -55% | $10,251,653 |

| IPT | Impact Minerals | 0.015 | -6% | -21% | 50% | 7% | $45,891,506 |

| SCN | Scorpion Minerals | 0.015 | -6% | -29% | -56% | -82% | $6,141,843 |

| THR | Thor Energy PLC | 0.015 | -6% | -12% | -48% | -63% | $3,008,376 |

| DEV | Devex Resources Ltd | 0.295 | -6% | -21% | 23% | -2% | $132,357,201 |

| PMT | Patriotbatterymetals | 0.58 | -6% | -34% | -46% | -69% | $358,581,362 |

| CAI | Calidus Resources | 0.1025 | -7% | -21% | -49% | -40% | $85,532,275 |

| PAT | Patriot Lithium | 0.054 | -7% | -34% | -70% | -78% | $5,565,347 |

| AXE | Archer Materials | 0.33 | -7% | -26% | -8% | -49% | $84,099,514 |

| QXR | Qx Resources Limited | 0.0065 | -7% | -41% | -74% | -79% | $7,770,545 |

| LCY | Legacy Iron Ore | 0.013 | -7% | -13% | -19% | -38% | $100,276,127 |

| CHR | Charger Metals | 0.064 | -7% | -36% | -62% | -85% | $4,722,635 |

| FG1 | Flynngold | 0.025 | -7% | -26% | -44% | -52% | $6,363,617 |

| MIN | Mineral Resources. | 56.07 | -7% | -26% | -18% | -19% | $11,084,815,413 |

| NVA | Nova Minerals Ltd | 0.185 | -8% | -21% | -46% | -27% | $40,860,807 |

| HAW | Hawthorn Resources | 0.059 | -8% | -13% | -40% | -59% | $19,765,921 |

| ARL | Ardea Resources Ltd | 0.47 | -8% | -24% | 0% | 49% | $94,849,385 |

| CMX | Chemxmaterials | 0.047 | -8% | 4% | -33% | -50% | $6,224,094 |

| VMC | Venus Metals Cor Ltd | 0.07 | -8% | -22% | -33% | -37% | $13,281,008 |

| LTR | Liontown Resources | 0.92 | -8% | -33% | -39% | -68% | $2,254,783,626 |

| RON | Roninresourcesltd | 0.115 | -8% | -4% | -34% | -26% | $4,234,876 |

| GBR | Greatbould Resources | 0.057 | -8% | -3% | -14% | -22% | $35,162,856 |

| S2R | S2 Resources | 0.091 | -8% | -27% | -49% | -21% | $41,210,077 |

| AQD | Ausquest Limited | 0.011 | -8% | -21% | 0% | -27% | $9,076,641 |

| TON | Triton Min Ltd | 0.011 | -8% | -8% | -50% | -67% | $17,252,276 |

| MQR | Marquee Resource Ltd | 0.011 | -8% | -15% | -56% | -76% | $4,547,228 |

| BCA | Black Canyon Limited | 0.0825 | -8% | -31% | -41% | -57% | $5,681,458 |

| SYR | Syrah Resources | 0.3525 | -8% | -27% | -41% | -55% | $351,863,200 |

| SYR | Syrah Resources | 0.3525 | -8% | -27% | -41% | -55% | $351,863,200 |

| A11 | Atlantic Lithium | 0.365 | -9% | -14% | -9% | -39% | $237,129,204 |

| MEI | Meteoric Resources | 0.155 | -9% | -14% | -37% | -24% | $308,468,576 |

| RXL | Rox Resources | 0.1275 | -9% | -25% | -31% | -62% | $52,918,741 |

| MLS | Metals Australia | 0.019 | -10% | -14% | -46% | -44% | $13,440,021 |

| AKN | Auking Mining Ltd | 0.019 | -10% | -10% | -56% | -59% | $5,041,720 |

| CTM | Centaurus Metals Ltd | 0.42 | -10% | -11% | -10% | -52% | $210,876,785 |

| LOT | Lotus Resources Ltd | 0.325 | -10% | -29% | 5% | 86% | $604,301,315 |

| AZL | Arizona Lithium Ltd | 0.018 | -10% | -25% | -44% | -45% | $80,528,662 |

| CWX | Carawine Resources | 0.09 | -10% | -10% | -18% | -13% | $21,251,290 |

| POS | Poseidon Nick Ltd | 0.0045 | -10% | -36% | -63% | -88% | $18,567,674 |

| GL1 | Globallith | 0.27 | -10% | -28% | -77% | -82% | $71,572,957 |

| SLZ | Sultan Resources Ltd | 0.009 | -10% | -25% | -60% | -80% | $1,778,278 |

| ASO | Aston Minerals Ltd | 0.009 | -10% | -53% | -65% | -89% | $12,950,643 |

| MHK | Metalhawk. | 0.045 | -10% | -24% | -65% | -76% | $4,530,150 |

| NMT | Neometals Ltd | 0.089 | -10% | -23% | -54% | -82% | $54,807,308 |

| WR1 | Winsome Resources | 0.75 | -10% | -39% | -27% | -56% | $166,651,500 |

| E25 | Element 25 Ltd | 0.22 | -10% | -17% | -41% | -65% | $46,769,022 |

| CAE | Cannindah Resources | 0.052 | -10% | 0% | -48% | -66% | $30,060,158 |

| WIN | Widgienickellimited | 0.026 | -10% | -28% | -72% | -88% | $7,978,853 |

| LKE | Lake Resources | 0.043 | -10% | -33% | -66% | -85% | $73,177,506 |

| BM8 | Battery Age Minerals | 0.125 | -11% | -26% | -32% | -73% | $12,093,138 |

| ESR | Estrella Res Ltd | 0.004 | -11% | -11% | -20% | -56% | $7,037,487 |

| JRV | Jervois Global Ltd | 0.016 | -11% | 0% | -62% | -75% | $43,244,221 |

| MRR | Minrex Resources Ltd | 0.008 | -11% | -27% | -53% | -47% | $9,763,808 |

| VUL | Vulcan Energy | 3.76 | -11% | -29% | 46% | -1% | $733,935,427 |

| CY5 | Cygnus Metals Ltd | 0.046 | -12% | -39% | -63% | -81% | $12,614,443 |

| CRR | Critical Resources | 0.0075 | -12% | -38% | -61% | -80% | $12,462,452 |

| ETM | Energy Transition | 0.022 | -12% | -33% | -42% | -42% | $30,897,396 |

| TOR | Torque Met | 0.1275 | -12% | -35% | -43% | -2% | $26,568,176 |

| VR8 | Vanadium Resources | 0.057 | -12% | -2% | 2% | -24% | $32,497,412 |

| AGY | Argosy Minerals Ltd | 0.077 | -13% | -43% | -41% | -80% | $109,194,070 |

| WC1 | Westcobarmetals | 0.035 | -13% | -36% | -54% | -68% | $4,402,812 |

| FIN | FIN Resources Ltd | 0.007 | -13% | -42% | -61% | -46% | $4,544,881 |

| WA1 | Wa1Resourcesltd | 17.95 | -13% | -13% | 45% | 221% | $1,097,307,552 |

| SRI | Sipa Resources Ltd | 0.013 | -13% | -19% | -48% | -24% | $2,966,056 |

| REE | Rarex Limited | 0.013 | -13% | -35% | -50% | -65% | $11,061,842 |

| SLM | Solismineralsltd | 0.08 | -14% | -27% | -50% | -92% | $5,945,222 |

| AR3 | Austrare | 0.075 | -14% | -35% | -50% | -74% | $11,070,454 |

| LM1 | Leeuwin Metals Ltd | 0.05 | -14% | -29% | -67% | -86% | $2,155,177 |

| FRB | Firebird Metals | 0.155 | -14% | -21% | 3% | 70% | $23,489,631 |

| LML | Lincoln Minerals | 0.006 | -14% | -20% | 0% | -60% | $12,337,129 |

| EVR | Ev Resources Ltd | 0.006 | -14% | -33% | -33% | -54% | $7,927,629 |

| WML | Woomera Mining Ltd | 0.003 | -14% | -25% | -88% | -75% | $3,654,417 |

| LNR | Lanthanein Resources | 0.003 | -14% | -40% | -73% | -80% | $8,552,726 |

| LNR | Lanthanein Resources | 0.003 | -14% | -40% | -73% | -80% | $8,552,726 |

| REC | Rechargemetals | 0.03 | -14% | -25% | -67% | -91% | $4,190,699 |

| GED | Golden Deeps | 0.034 | -15% | -21% | -28% | -43% | $3,812,238 |

| M2R | Miramar | 0.008 | -15% | -15% | -60% | -79% | $1,579,118 |

| RR1 | Reach Resources Ltd | 0.016 | -16% | 7% | -13% | -73% | $13,990,902 |

| RR1 | Reach Resources Ltd | 0.016 | -16% | 7% | -13% | -73% | $13,990,902 |

| 1MC | Morella Corporation | 0.0025 | -17% | -17% | -58% | -64% | $18,536,398 |

| EFE | Eastern Resources | 0.005 | -17% | -29% | -38% | -50% | $6,830,706 |

| RGL | Riversgold | 0.005 | -17% | -33% | -58% | -62% | $6,047,884 |

| M24 | Mamba Exploration | 0.015 | -17% | -25% | -63% | -79% | $2,761,234 |

| ITM | Itech Minerals Ltd | 0.052 | -17% | -32% | -57% | -76% | $6,603,312 |

| KM1 | Kalimetalslimited | 0.255 | -18% | -37% | 0% | 0% | $19,848,945 |

| LLI | Loyal Lithium Ltd | 0.16 | -18% | -36% | -47% | -50% | $14,517,290 |

| STM | Sunstone Metals Ltd | 0.009 | -18% | -31% | -36% | -55% | $38,382,673 |

| EGR | Ecograf Limited | 0.11 | -19% | -31% | -19% | -19% | $49,943,500 |

| VMS | Venture Minerals | 0.022 | -19% | -8% | 214% | 57% | $49,866,953 |

| PEK | Peak Rare Earths Ltd | 0.175 | -19% | -27% | -51% | -61% | $50,528,934 |

| OCN | Oceanalithiumlimited | 0.035 | -19% | -22% | -71% | -89% | $1,676,372 |

| PEK | Peak Rare Earths Ltd | 0.175 | -19% | -27% | -51% | -61% | $50,528,934 |

| SRL | Sunrise | 0.345 | -19% | -42% | -23% | -66% | $31,128,487 |

| AS2 | Askarimetalslimited | 0.043 | -19% | -33% | -75% | -85% | $4,200,708 |

| AAJ | Aruma Resources Ltd | 0.012 | -20% | -37% | -54% | -72% | $2,362,698 |

| EMT | Emetals Limited | 0.004 | -20% | -20% | -43% | -56% | $3,400,000 |

| CDT | Castle Minerals | 0.004 | -20% | -20% | -53% | -62% | $4,647,392 |

| ANX | Anax Metals Ltd | 0.024 | -20% | -47% | -20% | -63% | $17,282,927 |

| DRE | Dreadnought Resources Ltd | 0.021 | -22% | 24% | -32% | -60% | $70,261,459 |

| ENV | Enova Mining Limited | 0.0115 | -23% | -43% | -32% | 92% | $11,495,152 |

| TMB | Tambourahmetals | 0.052 | -24% | -28% | -55% | -45% | $4,312,898 |

| AX8 | Accelerate Resources | 0.034 | -24% | -26% | -21% | 89% | $21,105,634 |

| CZN | Corazon Ltd | 0.0045 | -25% | -50% | -70% | -72% | $2,671,622 |

| ALY | Alchemy Resource Ltd | 0.006 | -25% | -14% | -40% | -60% | $7,068,458 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | -40% | -67% | -77% | $1,447,073 |

| CLZ | Classic Min Ltd | 0.0015 | -25% | -70% | -97% | -97% | $826,543 |

| RVT | Richmond Vanadium | 0.22 | -27% | -20% | -24% | -45% | $18,965,717 |

| BYH | Bryah Resources Ltd | 0.005 | -29% | -50% | -64% | -67% | $2,612,721 |

| PVT | Pivotal Metals Ltd | 0.014 | -30% | -36% | -36% | -36% | $10,561,774 |

| ZNC | Zenith Minerals Ltd | 0.048 | -30% | -33% | -72% | -51% | $17,619,044 |

| VRC | Volt Resources Ltd | 0.004 | -33% | -20% | -33% | -60% | $18,714,052 |

| VML | Vital Metals Limited | 0.002 | -33% | -43% | -67% | -75% | $11,790,134 |

| LPM | Lithium Plus | 0.165 | -35% | 65% | -48% | -37% | $21,174,400 |

| FRS | Forrestaniaresources | 0.033 | -37% | 74% | 18% | -57% | $5,015,358 |

| AM7 | Arcadia Minerals | 0.034 | -37% | -53% | -56% | -73% | $4,330,854 |

| IMI | Infinitymining | 0.012 | -40% | -73% | -92% | -90% | $1,781,301 |

Weekly Small Cap Standouts

KORAB RESOURCES (ASX:KOR)

Korab is gearing up for a helicopter assisted infill ground gravity survey at its Rum Jungle project in the NT, targeting several silver, gold, zinc, lead, nickel, magnesium, and copper prospects and targets defined by the company using data collected and evaluated over the past seven years.

Rum Jungle covers approximately 243 square kilometres within the Rum Jungle Mineral Field, which forms part of the Pine Creek Orogen.

Handily, the survey will undertaken in conjunction with the low-resolution ground gravity survey to be undertaken by the Northern Territory Geological Survey (NTGS) over the coming months, saving Korab the contractor mobilisation costs.

KUNIKO (ASX:KNI)

Kuniko has completed an 8-hole, 3,794 metre diamond drilling program at its Ertelien nickel-copper-cobalt project in Norway with promising assay results from the first hole of 0.83% NiEq over 15.2m from 404.5 m and 1.04% NiEq over 2.4m from 473.2 m downhole.

Assays also highlighted notable copper and gold grades up to 3.95% Cu and 2.33 g/t Au.

“The high-grade intersections and extensive disseminated sulphide zones highlight the significant potential of the Ertelien project. These results align with our strategy to expand the known resources in a near term update to the 23Mt mineral resource estimate,” CEO Antony Beckmand said.

BLACK ROCK MINING (ASX:BKT)

Black Rock has completed full form offtake agreements for large flake graphite concentrate production from the Mahenge project in Tanzania.

The company’s 84%-owned subsidiary, Faru Graphite Corporation signed the three-year deals with Muhui International Trade (Dalian) Co. Ltd (Muhui) and Qingdao Yujinxi New Material Co. Ltd (Qinqdao) for the supply of 15,000tpa of large flake concentrate (>+100 mesh) under each offtake contract (for a total of 30,000tpa).

Plus, the buyers have an option to purchase an additional 10,000tpa of any uncontracted volume under each offtake contract (for a total additional volume of 20,000tpa).

“Signing these offtake agreements represents completion of another key milestone and clearly illustrates our growing confidence that all elements required to finance and develop the Mahenge graphite project are coming together,” Black Rock CEO John de Vries said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.