High Voltage: Carmakers are still betting big on China’s slowing EV market

Pic: Schroptschop / E+ via Getty Images

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

INDUSTRY FOCUS

China might be cutting subsidies for electric car buyers even further, another blow for the world’s most dominant — but noticeably flagging — EV market.

According to Bloomberg sources, Chinese regulators are discussing the idea “but are holding off on a decision until they weigh car sales data over the coming months”.

China has been subsidising EV purchases since 2009 to build the sector, but these are being rolled back to encourage automakers to stand on their own two feet.

The problem is that the last time the government cut subsidies, earlier this year, it sparked the country’s first drop in EV sales. This impacts the entire battery metals supply chain, as well as wider market sentiment.

#China #NEV market 2019 growth might be negative, CAAM estimates.

NEV sales trends are strongly related to policies. Before June and subsidy cuts, we witnessed peak in sales and then next four months downward trends. As for 2019, it might end in negative growth, CAAM explained. pic.twitter.com/3PKHbSinKH— Moneyball (@DKurac) November 11, 2019

And yet global automakers, playing the long game, are spending a lot of money to tap this massive market.Last week, VW celebrated pre-production at its first Chinese plant by rolling the very first China-specific all-electric Volkswagen ID off the production line in Shanghai.

The start of series production is scheduled for October 2020, VW says.

“The Volkswagen Group projects a total volume of 22 million all-electric cars worldwide by 2028, with more than 50 per cent of that from China,” Dr Herbert Diess, chairman of the board of management of Volkswagen AG, said.

“The country plays a crucial part in our electrification strategy, which will pave the way to Volkswagen’s goal of becoming net carbon-neutral by 2050.”

Even Toyota, an EV laggard, has just announced a 50-50 JV with Chinese electrification leader BYD — short for Build Your Dreams — to develop battery electric vehicles for the Chinese market.

Frontrunner Tesla has already constructed a $US2 billion ($2.9 billion) factory in Shanghai, its first manufacturing facility outside the US, where it hopes to start production by the end of the year.

In its Q3 report, Tesla said that Gigafactory Shanghai was built in 10 months and is ready for production. It was also “~65 per cent less expensive (capex per unit of capacity) to build than our Model 3 production system in the US”.

“China is by far the largest market for mid-sized premium sedans,” Tesla told investors.

“With Model 3 priced on par with gasoline powered mid-sized sedans (even before gas savings and other benefits), we believe China could become the biggest market for Model 3.”

SMALL CAP SPOTLIGHT

Of the companies on our list, 51 lost ground, 46 were ahead and 52 were steady this week.

Over the past year, we have 30 winners and 117 losers, which looks like this:

Kibaran Resources (ASX:KNL) +40%

Kibaran Resources wants to build a $US22.8m graphite processing plant in Kwinana, WA, for global lithium-ion battery customers.

Last week, crucial test work confirmed the effectiveness of its proprietary ‘EcoGraf’ purification process.

Kibaran — which is changing its name to EcoGraf — now has enough info to finalise the all-important process flow sheet design. It was enough to send the stock up about 40 per cent for the week.

The company says it remains on schedule to make a final investment decision on the development in the first half of 2020.

Panoramic Resources (ASX:PAN) +30%

One of the week’s biggest small cap news stories.

$3.8 billion market cap Independence Group (ASX:IGO) launched a takeover bid for nickel-cobalt play Panoramic on Monday last week.

The offer valued Panoramic at 47.6c per share – or $312m all up – which was a 51 per cent premium to the one-month volume weighted average price.

Still, that wasn’t enough for Panoramic’s ~35 per cent shareholder Zeta Resources (ASX:ZER), which said it “does not intend to accept Independence Group’s current offer”. Game on.

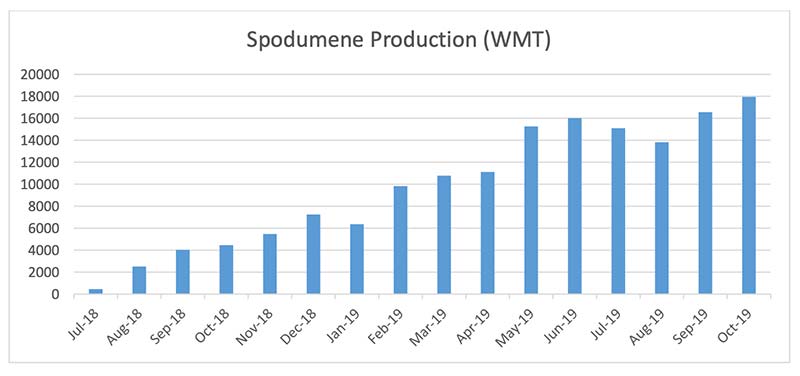

Altura Mining (ASX:AJM) +16%

Finally, some good news from WA’s cabal of struggling hard rock producers.

Altura Mining says that its Pilgangoora mine and process plant in the Pilbara region of WA is now effectively achieving nameplate annual production of ~220,000 tonnes of spodumene concentrate.

Managing director James Brown said increased output meant lower costs – “helping to make Altura one of the most efficient Australian producers of spodumene concentrate”.

“Importantly, not only are we achieving excellent production results, we are continuing to sell and ship our product to our diverse customer base,” he says.

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, manganese and vanadium>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| Code | Name | 1 Week Total Return % | 1 Year Total Return % | Price [intraday Monday] | Market Cap |

|---|---|---|---|---|---|

| AYR | ALLOY RESOURCES | 50 | -25 | 0.003 | $ 6,266,488.50 |

| KNL | KIBARAN RESOURCES | 40 | -37 | 0.1 | $ 30,047,058.00 |

| MZZ | MATADOR MINING | 32 | -24 | 0.225 | $ 19,781,762.00 |

| PAN | PANORAMIC RESOURCES | 30 | -6 | 0.435 | $ 281,321,344.00 |

| PNN | PEPINNINI LITHIUM | 25 | -48 | 0.002 | $ 3,142,818.50 |

| CZN | CORAZON MINING | 25 | -58 | 0.0025 | $ 4,076,721.25 |

| HXG | HEXAGON RESOURCES | 24 | -46 | 0.083 | $ 23,342,672.00 |

| SVM | SOVEREIGN METALS | 21 | 33 | 0.105 | $ 39,520,104.00 |

| LML | LINCOLN MINERALS | 20 | -25 | 0.006 | $ 2,874,918.50 |

| ARL | ARDEA RESOURCES | 19 | -13 | 0.62 | $ 70,966,760.00 |

| DHR | DARK HORSE RESOURCES | 17 | -36 | 0.0035 | $ 8,030,555.00 |

| NWC | NEW WORLD COBALT | 16 | -34 | 0.022 | $ 19,210,124.00 |

| AJM | ALTURA MINING | 16 | -73 | 0.066 | $ 158,310,336.00 |

| MLM | METALLICA MINERALS | 15 | -63 | 0.015 | $ 4,860,711.00 |

| AGY | ARGOSY MINERALS | 15 | -62 | 0.092 | $ 83,435,176.00 |

| ADV | ARDIDEN | 14 | -43 | 0.004 | $ 6,762,081.00 |

| LI3 | LITHIUM CONSOLIDATED | 13 | -61 | 0.034 | $ 4,341,966.50 |

| GXY | GALAXY RESOURCES | 12 | -59 | 1.09 | $ 413,574,144.00 |

| SYR | SYRAH RESOURCES | 12 | -76 | 0.49 | $ 179,817,856.00 |

| MQR | MARQUEE RESOURCES | 12 | 5 | 0.083 | $ 5,279,638.50 |

| PM1 | PURE MINERALS | 11 | 33 | 0.021 | $ 9,424,169.00 |

| WKT | WALKABOUT RESOURCES | 11 | 223 | 0.31 | $ 96,701,720.00 |

| CUL | CULLEN RESOURCES | 8 | -37 | 0.013 | $ 2,463,042.75 |

| RIE | RIEDEL RESOURCES | 8 | -57 | 0.013 | $ 5,434,906.00 |

| TNG | TNG | 8 | -25 | 0.095 | $ 102,333,608.00 |

| BSM | BASS METALS | 7 | -58 | 0.008 | $ 22,478,996.00 |

| OMH | OM HOLDINGS | 6 | -63 | 0.505 | $ 369,311,680.00 |

| SEI | SPECIALITY METALS INTERNATIONAL | 6 | 344 | 0.053 | $ 51,101,940.00 |

| LKE | LAKE RESOURCES | 6 | -62 | 0.037 | $ 18,947,324.00 |

| ORE | OROCOBRE | 6 | -36 | 2.81 | $ 688,213,312.00 |

| HWK | HAWKSTONE MINING | 6 | -60 | 0.009 | $ 8,153,180.00 |

| NVA | NOVA MINERALS | 5 | 63 | 0.039 | $ 35,417,296.00 |

| SYA | SAYONA MINING | 5 | -64 | 0.01 | $ 21,392,772.00 |

| JRV | JERVOIS MINING | 5 | 17 | 0.205 | $ 131,534,696.00 |

| BAR | BARRA RESOURCES | 5 | -45 | 0.021 | $ 12,526,831.00 |

| LPI | LITHIUM POWER INTERNATIONAL | 5 | -4 | 0.275 | $ 74,816,464.00 |

| MIN | MINERAL RESOURCES | 5 | 1 | 14.735 | $ 2,729,644,032.00 |

| SUH | SOUTHERN HEMISPHERE MINING | 5 | -57 | 0.023 | $ 2,117,597.75 |

| IDA | INDIANA RESOURCES | 4 | -52 | 0.025 | $ 4,403,872.50 |

| AML | AEON METALS | 4 | -56 | 0.125 | $ 80,888,368.00 |

| CRL | COMET RESOURCES | 4 | -19 | 0.026 | $ 6,937,500.00 |

| TLG | TALGA RESOURCES | 4 | 13 | 0.53 | $ 117,742,920.00 |

| BYH | BRYAH RESOURCES | 4 | -45 | 0.054 | $ 5,244,687.50 |

| HAV | HAVILAH RESOURCES | 4 | -47 | 0.1 | $ 28,647,064.00 |

| SRK | STRIKE RESOURCES | 3 | -33 | 0.04 | $ 6,518,236.50 |

| GME | GME RESOURCES | 2 | -24 | 0.057 | $ 29,362,090.00 |

| DEV | DEVEX RESOURCES | 0 | 140 | 0.105 | $ 15,300,856.00 |

| BOA | BOADICEA RESOURCES | 0 | 125 | 0.225 | $ 12,509,043.00 |

| CAZ | CAZALY RESOURCES | 0 | 100 | 0.048 | $ 16,267,324.00 |

| VML | VITAL METALS | 0 | 57 | 0.011 | $ 25,711,336.00 |

| CHN | CHALICE GOLD MINES | 0 | 54 | 0.17 | $ 53,443,288.00 |

| JRL | JINDALEE RESOURCES | 0 | 11 | 0.295 | $ 11,355,805.00 |

| E25 | ELEMENT 25 | 0 | 11 | 0.2 | $ 17,921,918.00 |

| AZI | ALTA ZINC | 0 | 10 | 0.005 | $ 13,032,892.00 |

| HIP | HIPO RESOURCES | 0 | 6 | 0.017 | $ 6,570,678.00 |

| INR | IONEER | 0 | 2 | 0.255 | $ 347,208,640.00 |

| LPD | LEPIDICO | 0 | 1 | 0.0175 | $ 74,777,360.00 |

| BDI | BLINA MINERALS | 0 | 0 | 0.001 | $ 5,454,882.50 |

| FEL | FE | 0 | -6 | 0.016 | $ 8,307,927.50 |

| INF | INFINITY LITHIUM | 0 | -7 | 0.066 | $ 13,965,579.00 |

| MTH | MITHRIL RESOURCES | 0 | -7 | 0.006 | $ 2,942,335.25 |

| HNR | HANNANS | 0 | -10 | 0.01 | $ 17,891,590.00 |

| SI6 | SIX SIGMA METALS | 0 | -11 | 0.004 | $ 2,580,012.50 |

| TON | TRITON MINERALS | 0 | -12 | 0.037 | $ 35,231,248.00 |

| NMT | NEOMETALS | 0 | -19 | 0.19 | $ 103,443,264.00 |

| RNU | RENASCOR RESOURCES | 0 | -22 | 0.014 | $ 14,994,516.00 |

| PIO | PIONEER RESOURCES | 0 | -24 | 0.013 | $ 19,613,864.00 |

| EMH | EUROPEAN METALS | 0 | -25 | 0.32 | $ 51,275,024.00 |

| SRN | SUREFIRE RESOURCES | 0 | -26 | 0.008 | $ 5,025,229.00 |

| COB | COBALT BLUE | 0 | -38 | 0.14 | $ 19,487,328.00 |

| CZR | COZIRON RESOURCES | 0 | -38 | 0.008 | $ 16,664,410.00 |

| KOR | KORAB RESOURCES | 0 | -38 | 0.016 | $ 5,075,191.50 |

| MTB | MOUNT BURGESS MINING | 0 | -40 | 0.003 | $ 1,560,388.13 |

| RLC | REEDY LAGOON | 0 | -43 | 0.004 | $ 1,609,086.88 |

| BEM | BLACKEARTH MINERALS | 0 | -44 | 0.055 | $ 5,796,431.50 |

| WCN | WHITE CLIFF MINERALS | 0 | -47 | 0.006 | $ 3,292,449.25 |

| VRC | VOLT RESOURCES | 0 | -50 | 0.012 | $ 19,264,888.00 |

| IEC | INTRA ENERGY | 0 | -50 | 0.006 | $ 2,326,344.25 |

| CLQ | CLEAN TEQ | 0 | -53 | 0.245 | $ 182,882,752.00 |

| SBR | SABRE RESOURCES | 0 | -56 | 0.004 | $ 1,901,534.75 |

| BUX | BUXTON RESOURCES | 0 | -57 | 0.067 | $ 8,843,603.00 |

| MLS | METALS AUSTRALIA | 0 | -57 | 0.002 | $ 2,957,197.75 |

| MLL | MALI LITHIUM | 0 | -60 | 0.079 | $ 25,070,500.00 |

| KAI | KAIROS MINERALS | 0 | -60 | 0.011 | $ 9,844,002.00 |

| VR8 | VANADIUM RESOURCES | 0 | -62 | 0.044 | $ 15,493,607.00 |

| MRR | MINREX RESOURCES | 0 | -63 | 0.009 | $ 862,899.56 |

| CGM | COUGAR METALS | 0 | -67 | $ 1,176,583.25 | |

| SVD | SCANDIVANADIUM | 0 | -68 | 0.008 | $ 2,814,928.75 |

| MCT | METALICITY | 0 | -71 | 0.005 | $ 3,616,049.75 |

| ARE | ARGONAUT RESOURCES | 0 | -72 | 0.005 | $ 7,771,903.00 |

| BAT | BATTERY MINERALS | 0 | -72 | 0.008 | $ 10,544,732.00 |

| TMT | TECHNOLOGY METALS AUSTRALIA | 0 | -74 | 0.145 | $ 12,257,583.00 |

| AEE | AURA ENERGY | 0 | -74 | 0.0055 | $ 6,575,953.00 |

| THR | THOR MINING | 0 | -77 | 0.006 | $ 5,609,881.00 |

| CLA | CELSIUS RESOURCES | 0 | -78 | 0.013 | $ 9,843,835.00 |

| WML | WOOMERA MINING | 0 | -79 | 0.016 | $ 2,148,671.50 |

| CFE | CAPE LAMBERT RESOURCES | 0 | -83 | 0.004 | $ 4,417,896.00 |

| ANW | AUS TIN MINING | 0 | -89 | 0.002 | $ 4,978,992.50 |

| POS | POSEIDON NICKEL | -2 | 0 | 0.049 | $ 129,492,392.00 |

| LIT | LITHIUM AUSTRALIA | -3 | -62 | 0.038 | $ 18,165,242.00 |

| GLN | GALAN LITHIUM | -3 | -32 | 0.18 | $ 25,317,254.00 |

| PLS | PILBARA MINERALS | -3 | -60 | 0.3275 | $ 744,940,928.00 |

| NZC | NZURI COPPER | -3 | 31 | 0.32 | $ 94,689,760.00 |

| ASN | ANSON RESOURCES | -3 | -64 | 0.032 | $ 19,198,776.00 |

| AXE | ARCHER MATERIALS | -4 | 69 | 0.13 | $ 25,621,932.00 |

| BPL | BROKEN HILL PROSPECTING | -4 | -36 | 0.025 | $ 3,697,085.00 |

| PSC | PROSPECT RESOURCES | -4 | -56 | 0.13 | $ 27,134,452.00 |

| CXO | CORE LITHIUM | -5 | -26 | 0.039 | $ 30,820,318.00 |

| SO4 | SALT LAKE POTASH | -5 | 70 | 0.78 | $ 215,029,056.00 |

| MZN | MARINDI METALS | -5 | -76 | 0.073 | $ 5,835,974.50 |

| N27 | NORTHERN COBALT | -6 | -37 | 0.065 | $ 4,934,233.00 |

| MTC | METALSTECH | -6 | -66 | 0.015 | $ 1,754,308.25 |

| BKT | BLACK ROCK MINING | -6 | 10 | 0.044 | $ 27,392,238.00 |

| AVZ | AVZ MINERALS | -7 | -48 | 0.049 | $ 99,078,384.00 |

| DGR | DGR GLOBAL | -7 | -39 | 0.083 | $ 50,894,096.00 |

| KTA | KRAKATOA RESOURCES | -7 | 52 | 0.041 | $ 7,095,000.00 |

| LTR | LIONTOWN RESOURCES | -8 | 344 | 0.096 | $ 167,259,040.00 |

| CHK | COHIBA MINERALS | -8 | 71 | 0.012 | $ 7,975,371.00 |

| RMX | RED MOUNTAIN MINING | -8 | -14 | 0.006 | $ 5,082,220.50 |

| HRZ | HORIZON MINERALS | -8 | -25 | 0.12 | $ 51,357,024.00 |

| GPX | GRAPHEX MINING | -8 | -24 | 0.185 | $ 18,116,138.00 |

| PGM | PLATINA RESOURCES | -8 | -65 | 0.022 | $ 7,504,348.50 |

| AVL | AUSTRALIAN VANADIUM | -8 | -73 | 0.012 | $ 28,080,822.00 |

| PLL | PIEDMONT LITHIUM | -9 | -16 | 0.105 | $ 85,614,936.00 |

| EUR | EUROPEAN LITHIUM | -9 | -27 | 0.084 | $ 50,653,084.00 |

| TKL | TRAKA RESOURCES | -10 | -73 | 0.009 | $ 3,604,166.75 |

| PUR | PURSUIT MINERALS | -10 | -75 | 0.009 | $ 2,971,978.00 |

| LRS | LATIN RESOURCES | -10 | -92 | 0.009 | $ 1,401,292.13 |

| VMC | VENUS METALS | -11 | 15 | 0.17 | $ 20,269,330.00 |

| FGR | FIRST GRAPHENE | -11 | -3 | 0.15 | $ 78,328,816.00 |

| KSN | KINGSTON RESOURCES | -11 | -33 | 0.16 | $ 30,020,650.00 |

| AMD | ARROW MINERALS | -11 | -50 | 0.008 | $ 6,701,705.50 |

| CNJ | CONICO | -11 | -65 | 0.008 | $ 3,075,185.75 |

| NXE | NEW ENERGY MINERALS | -11 | -72 | 0.016 | $ 2,446,327.00 |

| GPP | GREENPOWER ENERGY | -11 | -80 | 0.008 | $ 2,612,018.75 |

| JMS | JUPITER MINES | -12 | -6 | 0.255 | $ 519,132,608.00 |

| GBE | GLOBE METALS AND MINING | -13 | 43 | 0.022 | $ 9,318,447.00 |

| GED | GOLDEN DEEPS | -15 | -55 | 0.022 | $ 6,943,098.50 |

| MNS | MAGNIS ENERGY TECHNOLOGIES | -15 | -66 | 0.115 | $ 70,822,120.00 |

| MEI | METEORIC RESOURCES | -16 | 286 | 0.059 | $ 55,254,072.00 |

| BSX | BLACKSTONE MINERALS | -16 | -25 | 0.11 | $ 21,090,462.00 |

| TAR | TARUGA MINERALS | -16 | -68 | 0.021 | $ 1,835,174.13 |

| DTM | DART MINING | -17 | -29 | 0.006 | $ 6,422,257.00 |

| 4CE | FORCE COMMODITIES | -17 | -40 | 0.015 | $ 7,614,821.50 |

| LCD | LATITUDE CONSOLIDATED | -18 | -18 | 0.014 | $ 3,852,506.00 |

| POW | PROTEAN ENERGY | -20 | -83 | 0.004 | $ 1,245,749.00 |

| ZNC | ZENITH MINERALS | -22 | -29 | 0.054 | $ 11,508,194.00 |

| AUZ | AUSTRALIAN MINES | -25 | -75 | 0.014 | $ 55,115,880.00 |

| PSM | PENINSULA MINES | -33 | -67 | 0.002 | $ 3,050,616.25 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.