High Voltage: All the news driving battery metals stocks

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

Scroll down for a table showing the recent performance of 200 ASX battery metal stocks >>

INDUSTRY FOCUS

Carmakers are teaming up

Competing carmakers continue to collaborate on electric vehicle development during its painful transition from niche to mainstream.

These partnerships are just a more efficient way to keep costs down during this disruptive (and very pricey) shift.

The latest collab involves Germany’s Volkswagen Group – which owns Audi, Bentley, Bugatti, Lamborghini, Porsche, SEAT, Škoda and Volkswagen – and US-based Ford, which will develop commercial vans and medium-sized pickups for global markets from 2022.

Volkswagen and Ford may also collaborate on autonomous vehicles, mobility services and EVs and “have started to explore opportunities” already, Volkswagen told investors.

“Frenemies?”

In December, Bloomberg reported that German carmakers Daimler and BMW were also looking at collaborating on key car components, a move that reflected “the fundamental changes sweeping the industry”.

And Toyota could be launching a joint venture in 2020 with battery maker Panasonic, which could also provide batteries to Toyota’s EV technology partners Mazda and Subaru.

Now a collab of a different sort…

Ford also wants to prove to its customers that it only uses ethical cobalt in its EVs.

The American carmaker is partnering with Huayou Cobalt, IBM, LG Chem and RCS Global on the development of an open, industry-wide blockchain platform that will start with tracking cobalt but could eventually be used to trace and validate other minerals as well.

Basically, the partnership has each major stage of the supply chain covered, from mine to end-user, according to Ford.

Cobalt is in high demand for its use in lithium-ion batteries. The typical electric vehicle (EV) battery requires up to 9kg of cobalt and even a standard laptop requires around 30g of the mineral.

But the origin of cobalt has become a major consumer issue because of the use of child labour in some countries like the Congo, which supplies around 60 per cent of the world’s cobalt.

Nickel oversupply? Probably not

Analysts have reiterated that fears of bargain-basement battery grade nickel flooding the market starting in 2019 are unsubstantiated.

In September last year a Chinese consortium announced a new $700 million High-Pressure-Acid-Leaching (HPAL) plant in Indonesia, which would produce 50,000 tonnes a year of battery-grade nickel chemicals starting in 2019.

Two similar projects in Indonesia were announced around the same time, and collectively, helped send nickel prices to seven month lows.

Based on previous HPAL project development, this is both faster and cheaper than anyone thought possible.

But Andrew Mitchell, principal nickel analyst at Wood Mackenzie says the amount of nickel coming to the market from these projects will be smaller, slower and more costly “than so far alluded to”.

Mr Mitchell says the nickel market is still looking at another supply deficit for this year, and next year.

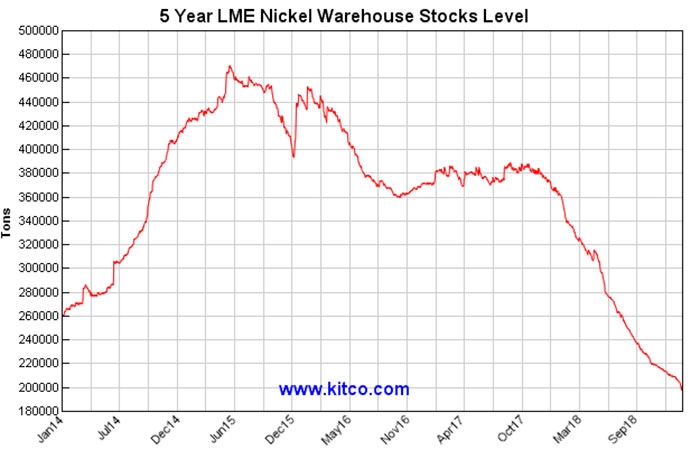

Check out this graph:

Reuters reports that official LME nickel inventories fell 44 per cent in 2018, and just recently fell through the 200,000-tonne mark for the first time since 2013.

This often means more nickel is being consumed than produced.

And if these 2019 HPAL construction milestones are not met, collective market relief could result in a nickel price recovery.

“But if it is shown that the Chinese can’t do it much better that it has been done before, then there will be a collective sigh of relief and perhaps the sentiment will change,” Mr Mitchell says.

SMALL CAP SPOTLIGHT

Of the companies on our list, about 63 lost ground, 66 were ahead and 60 were steady.

European Metals (ASX:EMH) got an unsolicited bid for its Cinovec lithium project near Prague, and even though important stuff – like price – wasn’t disclosed, its share price still jumped about 34 per cent.

Near-term battery metals hopeful Australian Mines (ASX:AUZ) had a strong week, up almost 30 per cent at one point to continue its strong start to 2019.

On Monday, the explorer told investors it had uncovered an “astounding” 3.4 per cent cobalt at its Sconi project.

In general, grades of over 1 per cent cobalt are considered high.

“We believe the deposits at Sconi have a lot more to give in terms of resources, which is clearly reflected in the almost three-and-a-half per cent record cobalt hit returned in these results,” managing director Benjamin Bell said.

Australian Mines, which is also trying to finalise project funding, expects to deliver the updated resource before April.

Other big winners this week included Six Sigma Metals (ASX:SI6) up 25 per cent to 1c, Black Rock Mining (ASX:BKT) up 25 per cent to 5c, and Technology Metals (ASX:TMT) up 16 per cent to 35c.

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, manganese and vanadium>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| Ticker | Name | One Week Price Change % | One Year Price Change % | Price [Mon 21 Intraday] | Market Cap |

|---|---|---|---|---|---|

| CGM | COUGAR METALS | 50 | -72.73 | 0.003 | 2.9M |

| TKM | TREK METALS | 50 | -73.53 | 0.01 | 2.8M |

| EMH | EUROPEAN METALS | 33.87 | -37.12 | 0.42 | 60.9M |

| MLS | METALS AUSTRALIA | 33.33 | -50 | 0.004 | 9.4M |

| AUZ | AUSTRALIAN MINES | 29.41 | -66.15 | 0.05 | 124.2M |

| TON | TRITON MINERALS | 25.64 | -51 | 0.05 | 45.4M |

| BSM | BASS METALS | 25 | -11.76 | 0.02 | 41.4M |

| CZN | CORAZON MINING | 25 | -72.22 | 0.01 | 6.3M |

| PMY | PACIFICO MINERALS | 25 | -44.44 | 0.01 | 8.2M |

| SI6 | SIX SIGMA METALS | 25 | -66.67 | 0.01 | 2.3M |

| BKT | BLACK ROCK MINING | 24.32 | -36.11 | 0.05 | 24.8M |

| RLC | REEDY LAGOON | 20 | -90.48 | 0.01 | 2.4M |

| ORN | ORION MINERALS | 19.05 | -19.35 | 0.03 | 46.8M |

| TMT | TECHNOLOGY METALS AUSTRALIA | 16.67 | 16.67 | 0.35 | 24.5M |

| JRV | JERVOIS MINING | 16 | -50.43 | 0.28 | 64.7M |

| AMD | ARROW MINERALS | 14.29 | -60.98 | 0.02 | 5.0M |

| HMX | HAMMER METALS | 14.29 | -51.02 | 0.02 | 6.7M |

| KDR | KIDMAN RESOURCES | 13.95 | -39.36 | 1.18 | 495.9M |

| CLQ | CLEAN TEQ | 13.1 | -68.12 | 0.46 | 354.5M |

| ARE | ARGONAUT RESOURCES | 12.5 | -12.9 | 0.03 | 42.0M |

| CDT | CASTLE MINERALS | 12.5 | -66.67 | 0.01 | 2.0M |

| TNO | TANDO RESOURCES | 11.7 | 76.4 | 0.1 | 20.3M |

| ENT | ENTERPRISE METAL | 11.11 | -52.38 | 0.01 | 3.9M |

| CUL | CULLEN RESOURCES | 10.53 | -59.57 | 0.02 | 3.6M |

| MNS | MAGNIS ENERGY TECH | 10.34 | -22.89 | 0.34 | 195.6M |

| SYR | SYRAH RESOURCES | 10.06 | -55.73 | 1.94 | 676.9M |

| VRC | VOLT RESOURCES | 10 | -35.29 | 0.03 | 32.0M |

| VMS | VENTURE MINERALS | 9.52 | -48.89 | 0.02 | 12.0M |

| MRR | MINREX RESOURCES | 9.09 | -76 | 0.02 | 2.3M |

| AVL | AUSTRALIAN VANADIUM | 8.33 | -44.68 | 0.03 | 51.3M |

| MEI | METEORIC RESOURCES | 8.33 | -79.69 | 0.01 | 7.5M |

| THX | THUNDELARRA | 8.33 | -59.38 | 0.01 | 8.4M |

| LKE | LAKE RESOURCES | 7.94 | -71.67 | 0.07 | 24.9M |

| CXO | CORE LITHIUM | 7.69 | -27.27 | 0.06 | 38.9M |

| PGM | PLATINA RESOURCES | 7.69 | -53.33 | 0.08 | 18.5M |

| AOU | AUROCH MINERALS | 7.14 | -25 | 0.08 | 7.5M |

| ANW | AUS TIN MINING | 7.14 | 15.38 | 0.02 | 29.8M |

| MCT | METALICITY | 7.14 | -70.59 | 0.01 | 9.0M |

| INF | INFINITY LITHIUM | 6.78 | -60.62 | 0.06 | 12.0M |

| ESR | ESTRELLA RESOURCES | 6.67 | -33.33 | 0.02 | 7.9M |

| KSN | KINGSTON RESOURCES | 6.25 | -32 | 0.02 | 20.8M |

| LPD | LEPIDICO | 6.25 | -75 | 0.02 | 57.1M |

| VML | VITAL METALS | 6.25 | -22.73 | 0.01 | 14.8M |

| E25 | ELEMENT 25 | 6.06 | -22.22 | 0.19 | 14.7M |

| VXR | VENTUREX RESOURCES | 6.06 | -44.44 | 0.17 | 45.2M |

| ORE | OROCOBRE | 5.59 | -52.38 | 3.42 | 889.2M |

| AEE | AURA ENERGY | 5.56 | -34.48 | 0.02 | 20.7M |

| OMH | OM HLDGS | 5.1 | 29.91 | 1.35 | 989.8M |

| DGR | DGR GLOBAL | 4.35 | 14.29 | 0.12 | 73.6M |

| DEG | DE GREY MINING | 4.17 | -21.87 | 0.12 | 52.9M |

| K | KIBARAN RESOURCES | 3.85 | -15.62 | 0.13 | 37.2M |

| IDA | INDIANA RESOURCES | 3.7 | -19.03 | 0.06 | 5.4M |

| PAN | PANORAMIC RESOURCES | 3.41 | 17.03 | 0.47 | 225.0M |

| BGS | BIRIMIAN | 2.94 | -76.51 | 0.17 | 46.0M |

| AXE | ARCHER EXPLORATION | 2.78 | -43.08 | 0.08 | 14.2M |

| BAR | BARRA RESOURCES | 2.56 | -28.57 | 0.04 | 21.6M |

| SRK | STRIKE RESOURCES | 2.22 | -41.03 | 0.05 | 6.7M |

| JMS | JUPITER MINES | 2.04 | 255.41 | 0.25 | 489.7M |

| ARL | ARDEA RESOURCES | 1.82 | -65.85 | 0.55 | 58.8M |

| RIO | RIO TINTO | 1.57 | 10.03 | 80.38 | 119.8B |

| SVM | SOVEREIGN METALS | 1.45 | -51.72 | 0.07 | 19.4M |

| N27 | NORTHERN COBALT | 1.43 | -86.73 | 0.07 | 3.6M |

| MIN | MINERAL RESOURCES | 1.01 | -17.3 | 16.05 | 3.0B |

| PLS | PILBARA MINERALS | 0.71 | -29.35 | 0.71 | 1.2B |

| GXY | GALAXY RESOURCES | 0.45 | -40.79 | 2.24 | 916.9M |

| S32 | SOUTH32 | 0.29 | -6.01 | 3.4 | 17.2B |

| AML | AEON METALS | 0 | -7.02 | 0.27 | 155.7M |

| AYR | ALLOY RESOURCES | 0 | -50 | 0.003 | 4.7M |

| AZI | ALTA ZINC | 0 | -45.45 | 0.01 | 8.2M |

| AJM | ALTURA MINING | 0 | -62.07 | 0.17 | 300.4M |

| ADN | ANDROMEDA METALS | 0 | -12.5 | 0.01 | 7.6M |

| ADV | ARDIDEN | 0 | -87.5 | 0.004 | 6.7M |

| AGY | ARGOSY MINERALS | 0 | -67.05 | 0.14 | 133.9M |

| ACP | AUDALIA RESOURCES | 0 | -28.27 | 0.009 | 10.7M |

| ARM | AURORA MINERALS | 0 | -47.22 | 0.02 | 2.2M |

| BAU | BAUXITE RESOURCES | 0 | 3.52 | 0.05 | 11.8M |

| BDI | BLINA MINERALS | 0 | -50 | 0.001 | 4.4M |

| BPL | BROKEN HILL PROSPECTING | 0 | -65.17 | 0.03 | 4.6M |

| BYH | BRYAH RESOURCES | 0 | -55.56 | 0.08 | 4.9M |

| CAD | CAENEUS MINERALS | 0 | -66.67 | 0.001 | 14.1M |

| CFE | CAPE LAMBERT | 0 | -80 | 0.02 | 16.2M |

| CCZ | CASTILLO COPPER | 0 | -71.43 | 0.02 | 10.3M |

| CAZ | CAZALY RESOURCES | 0 | -59.18 | 0.02 | 4.7M |

| CHK | COHIBA MINERALS | 0 | 15.38 | 0.01 | 10.0M |

| CRL | COMET RESOURCES | 0 | -76.8 | 0.03 | 6.7M |

| DHR | DARK HORSE RESOURCES | 0 | -84.48 | 0.004 | 8.9M |

| DTM | DART MINING | 0 | -48.72 | 0.01 | 5.6M |

| DEV | DEVEX RESOURCES | 0 | -60.34 | 0.05 | 4.2M |

| EME | ENERGY METALS | 0 | 10 | 0.12 | 23.1M |

| FCC | FIRST COBALT | 0 | -86.67 | 0.17 | 61.1M |

| GBE | GLOBE METALS AND MINING | 0 | -22.22 | 0.01 | 6.5M |

| GME | GME RESOURCES | 0 | -38.34 | 0.09 | 45.8M |

| GED | GOLDEN DEEPS | 0 | -44.16 | 0.05 | 7.4M |

| HNR | HANNANS | 0 | -57.14 | 0.01 | 23.9M |

| HAV | HAVILAH RESOURCES | 0 | -26.67 | 0.17 | 36.0M |

| HWK | HAWKSTONE MINING | 0 | -40 | 0.02 | 10.3M |

| HGM | HIGH GRADE METALS | 0 | -83.33 | 0.01 | 5.0M |

| IEC | INTRA ENERGY | 0 | -9.09 | 0.01 | 3.9M |

| KLH | KALIA | 0 | -76.92 | 0.003 | 7.5M |

| KTA | KRAKATOA RESOURCES | 0 | -53.7 | 0.03 | 2.9M |

| LRS | LATIN RESOURCES | 0 | -82.14 | 0.002 | 7.1M |

| LCD | LATITUDE CONSOLIDATED | 0 | -25 | 0.02 | 5.0M |

| MQR | MARQUEE RESOURCES | 0 | -88.24 | 0.06 | 2.6M |

| MZZ | MATADOR MINING | 0 | -55.41 | 0.17 | 8.9M |

| MLM | METALLICA MINERALS | 0 | -50.98 | 0.03 | 8.1M |

| MTC | METALSTECH | 0 | -87.27 | 0.04 | 4.1M |

| MTH | MITHRIL RESOURCES | 0 | -89.98 | 0.01 | 2.1M |

| MTB | MOUNT BURGESS | 0 | -60 | 0.004 | 1.8M |

| NVA | NOVA MINERALS | 0 | -57.89 | 0.02 | 18.6M |

| OAR | OAKDALE RESOURCES | 0 | -48.78 | 0.02 | 1.4M |

| PLL | PIEDMONT LITHIUM | 0 | -49.74 | 0.1 | 65.3M |

| PIO | PIONEER RESOURCES | 0 | -43.33 | 0.02 | 25.6M |

| POS | POSEIDON NICKEL | 0 | 0 | 0.04 | 113.6M |

| PSC | PROSPECT RESOURCES | 0 | -63.33 | 0.02 | 45.0M |

| PM1 | PURE MINERALS | 0 | -23.81 | 0.02 | 5.0M |

| RMX | RED MOUNTAIN MINING | 0 | -77.42 | 0.01 | 5.4M |

| RNU | RENASCOR RESOURCES | 0 | -57.14 | 0.02 | 20.8M |

| RTR | RUMBLE RESOURCES | 0 | -28.79 | 0.05 | 16.8M |

| SYA | SAYONA MINING | 0 | -79.8 | 0.02 | 34.3M |

| SCI | SILVER CITY MINERALS | 0 | -58.33 | 0.02 | 4.4M |

| SXX | SOUTHERN CROSS EXPLORATION | 0 | -33.33 | 0.01 | 6.5M |

| SUH | SOUTHERN HEMISPHERE MINING | 0 | -76.15 | 0.03 | 2.7M |

| SEI | SPECIALITY METALS INTERNATIONAL | 0 | -29.41 | 0.02 | 13.3M |

| SRN | SUREFIRE RESOURCES | 0 | -59.17 | 0.01 | 3.1M |

| TNG | TNG | 0 | -30 | 0.11 | 101.2M |

| WKT | WALKABOUT RESOURES | 0 | -31.03 | 0.11 | 30.4M |

| LIT | LITHIUM AUSTRALIA | -1.1 | -52.63 | 0.09 | 41.8M |

| CZI | CASSINI RESOURCES | -1.16 | 14.86 | 0.09 | 29.4M |

| NMT | NEOMETALS | -2.17 | -46.71 | 0.22 | 122.4M |

| ASN | ANSON RESOURCES | -2.67 | -70.2 | 0.07 | 36.2M |

| FGR | FIRST GRAPHENE | -2.94 | -5.71 | 0.16 | 68.3M |

| GLN | GALAN LITHIUM | -3.12 | 226.32 | 0.31 | 34.6M |

| HXG | HEXAGON RESOURCES | -3.45 | -12.5 | 0.14 | 40.8M |

| SGQ | ST GEORGE MINING | -3.57 | -40 | 0.13 | 40.2M |

| CHN | CHALICE GOLD | -3.85 | -14.53 | 0.13 | 33.3M |

| ARU | ARAFURA RESOURCES | -4 | -61.74 | 0.05 | 34.6M |

| LTR | LIONTOWN RESOURCES | -4 | -52.94 | 0.02 | 27.2M |

| LPI | LITHIUM POWER | -4.08 | -58.04 | 0.23 | 61.7M |

| KAI | KAIROS MINERALS | -4.17 | -51.06 | 0.02 | 19.6M |

| THR | THOR MINING | -4.17 | -50 | 0.02 | 16.5M |

| NZC | NZURI COPPER | -4.26 | -46.43 | 0.23 | 66.6M |

| SO4 | SALT LAKE POTASH | -4.44 | -14 | 0.43 | 88.7M |

| BSX | BLACKSTONE MINERALS | -4.76 | -81.98 | 0.1 | 10.8M |

| HIG | HIGHLANDS PAC | -4.76 | 3.09 | 0.1 | 109.3M |

| ZNC | ZENITH MINERALS | -4.76 | -60 | 0.08 | 17.0M |

| POW | PROTEAN ENERGY | -5 | -44.12 | 0.02 | 5.8M |

| BEM | BLACKEARTH MINERALS | -5.06 | -- | 0.08 | 4.6M |

| FEL | FE | -5.26 | -75 | 0.02 | 6.7M |

| GPX | GRAPHEX MINING | -5.26 | -40 | 0.19 | 14.5M |

| COB | COBALT BLUE | -5.41 | -78.13 | 0.17 | 21.8M |

| BMT | BERKUT MINERALS | -5.56 | -66 | 0.07 | 3.7M |

| NWC | NEW WORLD COBALT | -5.56 | -83 | 0.02 | 9.0M |

| RDS | REDSTONE RESOURCES | -5.56 | 47.19 | 0.02 | 8.0M |

| AVZ | AVZ MINERALS | -5.63 | -79.7 | 0.07 | 126.5M |

| PUR | PURSUIT MINERALS | -5.77 | -55.45 | 0.05 | 7.0M |

| VMC | VENUS METALS | -5.88 | 10.34 | 0.15 | 13.9M |

| CLA | CELSIUS RESOURCES | -5.97 | -51.54 | 0.06 | 47.7M |

| RIE | RIEDEL RESOURCES | -6.25 | -82.56 | 0.02 | 6.3M |

| SVD | SCANDIVANADIUM | -6.25 | -40.79 | 0.02 | 5.3M |

| OKR | OKAPI RESOURCES | -6.38 | -74.12 | 0.25 | 7.6M |

| TRT | TODD RIVER RESOURCES | -6.58 | -57.4 | 0.07 | 10.8M |

| KOR | KORAB RESOURCES | -6.9 | -6.9 | 0.03 | 8.3M |

| CZR | COZIRON RESOURCES | -7.14 | -45.83 | 0.01 | 23.2M |

| CGN | CRATER GOLD MINING | -7.14 | -13.33 | 0.01 | 3.6M |

| MZN | MARINDI METALS | -7.69 | -64.71 | 0.01 | 11.9M |

| TAR | TARUGA MINERALS | -7.69 | -45.45 | 0.06 | 8.5M |

| AUR | AURIS MINERALS | -7.89 | -35.19 | 0.04 | 14.3M |

| BAT | BATTERY MINERALS | -8.33 | -68.12 | 0.02 | 24.5M |

| GWR | GWR GROUP | -9.09 | 40.85 | 0.1 | 25.4M |

| WML | WOOMERA MINING | -9.46 | -93.3 | 0.07 | 7.6M |

| CNJ | CONICO | -10 | -60 | 0.02 | 6.3M |

| EUR | EUROPEAN LITHIUM | -10 | -64 | 0.09 | 49.5M |

| IRC | INTERMIN RES OURCES | -10 | -18.18 | 0.13 | 31.8M |

| LI3 | LITHIUM CONSOLIDATED | -10 | -50.34 | 0.07 | 6.5M |

| TLG | TALGA RESOURCES | -10.53 | -46.03 | 0.34 | 74.2M |

| BOA | BOADICEA RESOURCES | -11.11 | -20 | 0.16 | 8.5M |

| SBR | SABRE RES OURCES | -11.11 | -60 | 0.01 | 3.3M |

| WCN | WHITE CLIFF MINERALS | -11.11 | -87.13 | 0.02 | 3.7M |

| INR | IONEER | -12.5 | -53.33 | 0.19 | 257.2M |

| CMC | CHINA MAGNESIUM | -14.29 | -14.29 | 0.02 | 6.3M |

| LML | LINCOLN MINERALS | -14.29 | -82.86 | 0.01 | 3.4M |

| TKL | TRAKA RESOURCES | -15 | -77.63 | 0.02 | 5.6M |

| MXR | MAXIMUS RESOURCES | -15.49 | -65.22 | 0.06 | 1.8M |

| 4CE | FORCE COMMODITIES | -16.67 | -89.29 | 0.02 | 6.4M |

| PNN | PEPINNINI LITHIUM | -16.67 | -91.53 | 0.01 | 3.6M |

| EUC | EUROPEAN COBALT | -18.18 | -80.71 | 0.03 | 20.6M |

| PSM | PENINSULA MINES | -18.18 | -67.86 | 0.004 | 3.9M |

| BUX | BUXTON RESOURCES | -18.52 | -24.14 | 0.11 | 15.0M |

| GPP | GREENPOWER ENERGY | -25 | -84.21 | 0.003 | 4.7M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.