High Voltage: A lithium rhapsody – will it do the contango?

Freddie Mercury. (Pic via Getty Images)

- More lithium bottom speculation? Go on then. Upward-curving contango spotted by expert

- New Aussie study confirms EVs are generally more fuel-efficient than petrol or diesel models

Lithium. For better or worse, or somewhere in between, it’s still the limelight-stealing battery metal – despite a rocky time of it over the past several months for spot prices and many a related stock amid supply overstocking/weaker-than-anticipated demand in the short-mid term.

And also despite salt-based plotlines for emerging battery techs which may or may not end up reducing lithium’s usage in an energy-transformed future.

Speaking of future, or futures, though – here, look at this, from renowned lithium analyst Juan Carlos Zuleta. Well it piqued our interest today anyway…

At market close today (15:00 China time), average futures #lithium carbonate prices increased by 0.71%, exceeding average spot LC prices by CNY 3,513, & maintaining the contango process that has been going on for 20 trading days now w/o interruption. pic.twitter.com/Z3q8SHy0xv

— Juan Carlos Zuleta (@jczuleta) February 5, 2024

Zuleta, by the way, has been a prominent lithium market analyst for many years, is regularly approached by leading global media outlets for his takes on lithium’s trajectory and in 2020 was appointed executive manager of Yacimientos de Litio Bolivianos (YLB), the state lithium company in Bolivia.

Bloke knows his stuff.

According to his analysis, lithium futures appear to be in the midst of “contango effect” trajectory. In fact, he’s been noticing the uptrend for a while – roughly 20 days.

Contango? Whatyoutalkin’boutWillis?

Contango refers to periods where futures contract prices rise above spot prices. The opposite of contango is known as “backwardation”. Guess contango just sounded cooler than forwardation.

In Investopedia’s words:

“Contango usually occurs when an asset’s price is expected to rise over time. That results in an upward-sloping forward curve.”

Chinese Li stock prices reacting positively to the spot #lithium price rebound right now. #BYD's stock price improvement is also contributing to this outcome. pic.twitter.com/KtOtucG8MG

— Juan Carlos Zuleta (@jczuleta) February 6, 2024

You heard it here second, then. The bottom is in sight. Okay, with the door left ajar for “backwardation” – no guarantees that won’t make a swift return.

While we’re on the bottom speculation, though, Josh Chiat’s Monsters of Rock has the latest from someone/something prominent – Wilsons Advisory. And it’s worth a read. Here’s a snippet:

Corporate advisory firm Wilsons Advisory suggests we’re reaching a nadir for lithium prices, with new research showing half or more of the hard rock projects under development would not get built at current spot prices.

Wilsons says further downside to pricing is ‘likely limited’.

“Despite all the recent ‘doom and gloom’, we believe the fundamental/structural outlook remains robust, and argue that much of the recent news flow is symptomatic of a cyclical bottom in a typical commodity price cycle (i.e. low prices seeing production cuts and development deferrals); and sowing the seeds of the next price cycle,” the firm’s analysis reads.

Read Josh’s full article for more. It delves, too, into some of Benchmark Mineral Intelligence’s latest battery metal assessments, noting “there is some evidence of further supply cuts across the cobalt and nickel industries even outside of the battered Australian nickel sulphide sector”.

EVs are fuel efficient – yep, thought so

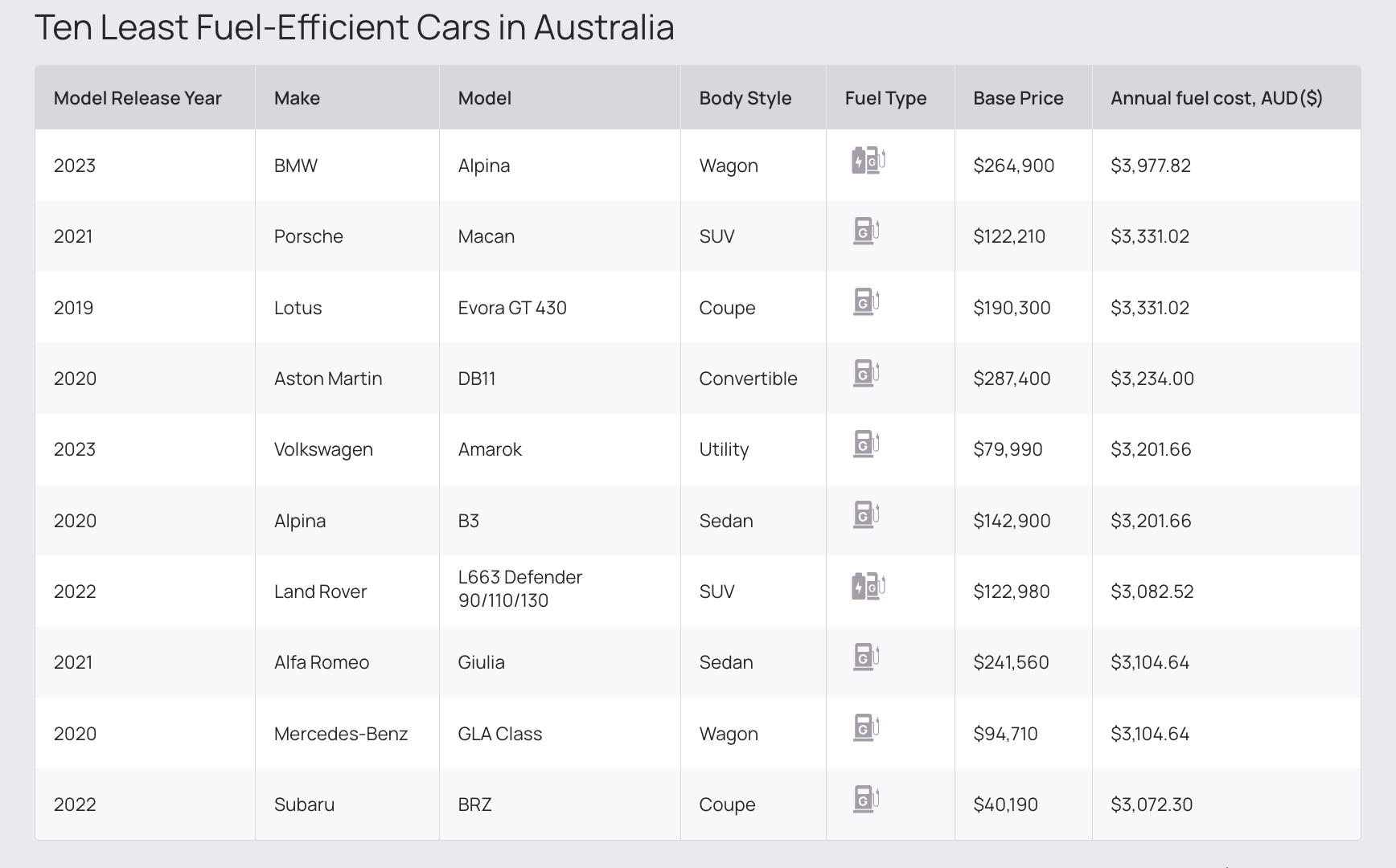

Meanwhile, in case you were in any doubt about the future of EVs, a new Aussie study backs up what most of us probably already knew – pound for pound, EVs are generally more fuel-efficient than petrol or diesel models.

A new study by financial services site MNY reveals insights on the most fuel-efficient cars in Australia, highlighting the importance of low running costs for consumers assessing the overall affordability of a car.

“Hands down, electric cars are the most fuel-efficient, even when taking into account electricity charging costs, which means those drivers will have the lowest annual power costs,” notes MNY in its report.

The 2019 Hyundai Ioniq EV sedan topped the chart with an annual fuel cost of just $491, while the 2023 Tesla Model 3 came in second, with an annual running cost of $554. The BMW i3 EV sedan was third, with $575 in annual power costs. Only one SUV made the top 10 list – the MG ZS EV, in ninth place.

“The top ten cars for fuel efficiency all have an annual fuel cost of around $500 to $700 per year, which is very low compared to the average vehicle. The savings primarily come from the fact that these cars are purely electric and do not use petrol in any form,” writes the MNY analysts.

The study does caveat the following, however:

“Most of these vehicles are also slightly more expensive than what the typical Australian consumer purchases. Therefore, accessing these fuel savings will often mean paying more money on the front end.

“These cars also trended towards smaller, lighter body styles which require less power to get going.”

“Overall, the worst performers for fuel efficiency are almost exclusively in the luxury category, wherein these vehicles are simply not built to save fuel but rather for more powerful driving experiences,” notes MNY.

Looking at fuel cost per engine type is perhaps the most relevant encompassing metric, which the study also covered, among several others:

Check out the full MNY research here.

ASX battery metals form guide:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop. (Note: figures accurate per ASX at 5pm Feb 6.)

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| PVW | PVW Res Ltd | 0.04 | -30% | -9% | -67% | $4,563,215 |

| A8G | Australasian Metals | 0.105 | -16% | -30% | -43% | $5,212,049 |

| INF | Infinity Lithium | 0.07 | -21% | -28% | -50% | $36,082,183 |

| LPI | Lithium Pwr Int Ltd | 0.555 | 0% | -1% | 26% | $358,696,328 |

| PSC | Prospect Res Ltd | 0.079 | 0% | -13% | -37% | $36,834,891 |

| PAM | Pan Asia Metals | 0.16 | 0% | -9% | -56% | $26,850,684 |

| CXO | Core Lithium | 0.18 | -5% | -22% | -84% | $395,333,076 |

| LOT | Lotus Resources Ltd | 0.365 | 9% | 24% | 52% | $614,338,468 |

| AGY | Argosy Minerals Ltd | 0.095 | -5% | -30% | -87% | $147,462,787 |

| AZS | Azure Minerals | 3.63 | -1% | -2% | 1017% | $1,665,006,857 |

| NWC | New World Resources | 0.037 | 0% | -14% | -38% | $90,739,682 |

| QXR | Qx Resources Limited | 0.016 | -6% | -33% | -66% | $15,541,090 |

| GSR | Greenstone Resources | 0.006 | -25% | -33% | -79% | $8,208,681 |

| CAE | Cannindah Resources | 0.079 | -1% | -15% | -66% | $45,668,316 |

| AZL | Arizona Lithium Ltd | 0.02 | -9% | -35% | -73% | $79,515,346 |

| RIL | Redivium Limited | 0.005 | -17% | 0% | -71% | $13,654,274 |

| COB | Cobalt Blue Ltd | 0.165 | 0% | -31% | -70% | $60,129,122 |

| ESS | Essential Metals Ltd | 0 | -100% | -100% | -100% | $135,278,382 |

| LPD | Lepidico Ltd | 0.006 | 20% | -25% | -60% | $45,829,848 |

| MRD | Mount Ridley Mines | 0.0015 | 0% | -25% | -70% | $11,677,324 |

| CZN | Corazon Ltd | 0.01 | -23% | -41% | -58% | $7,387,175 |

| LKE | Lake Resources | 0.088 | -2% | -32% | -89% | $130,998,229 |

| DEV | Devex Resources Ltd | 0.26 | 4% | -9% | -9% | $116,915,528 |

| INR | Ioneer Ltd | 0.13 | 18% | -7% | -71% | $264,001,518 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203 |

| MAN | Mandrake Res Ltd | 0.039 | -5% | -5% | -24% | $24,014,637 |

| RLC | Reedy Lagoon Corp. | 0.004 | 0% | -20% | -54% | $2,478,163 |

| GBR | Greatbould Resources | 0.059 | 2% | -6% | -33% | $35,322,545 |

| FRS | Forrestaniaresources | 0.024 | -17% | -20% | -85% | $3,721,072 |

| STK | Strickland Metals | 0.095 | -5% | -24% | 164% | $151,087,554 |

| MLX | Metals X Limited | 0.28 | -2% | 4% | -25% | $263,107,159 |

| CLA | Celsius Resource Ltd | 0.011 | 0% | -15% | -39% | $26,952,620 |

| FGR | First Graphene Ltd | 0.063 | 13% | -3% | -36% | $40,855,007 |

| HXG | Hexagon Energy | 0.012 | 0% | 0% | -33% | $6,154,991 |

| TLG | Talga Group Ltd | 0.58 | -7% | -20% | -66% | $222,156,191 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | -90% | $50,378,922 |

| OZL | OZ Minerals | 0 | -100% | -100% | -100% | $8,918,404,433 |

| PLL | Piedmont Lithium Inc | 0.185 | -29% | -52% | -81% | $77,181,700 |

| EUR | European Lithium Ltd | 0.086 | 2% | -4% | 5% | $119,904,569 |

| BKT | Black Rock Mining | 0.065 | 3% | -21% | -61% | $70,238,234 |

| QEM | QEM Limited | 0.18 | -5% | -10% | -14% | $27,250,508 |

| LYC | Lynas Rare Earths | 5.84 | -2% | -13% | -38% | $5,309,063,828 |

| ESR | Estrella Res Ltd | 0.005 | 0% | 0% | -67% | $7,037,487 |

| ARL | Ardea Resources Ltd | 0.395 | 8% | -16% | -46% | $80,776,935 |

| GLN | Galan Lithium Ltd | 0.295 | -45% | -56% | -74% | $116,645,852 |

| JLL | Jindalee Lithium Ltd | 0.955 | -5% | -1% | -59% | $55,046,006 |

| VUL | Vulcan Energy | 2.01 | -7% | -19% | -72% | $345,866,746 |

| SBR | Sabre Resources | 0.02 | -26% | -31% | -55% | $7,859,501 |

| CHN | Chalice Mining Ltd | 0.88 | -13% | -38% | -86% | $344,232,524 |

| VRC | Volt Resources Ltd | 0.005 | -17% | -17% | -58% | $20,650,533 |

| NMT | Neometals Ltd | 0.125 | -17% | -32% | -84% | $84,063,193 |

| AXN | Alliance Nickel Ltd | 0.03 | 0% | -29% | -71% | $23,952,707 |

| PNN | Power Minerals Ltd | 0.15 | -3% | -27% | -71% | $13,980,176 |

| IGO | IGO Limited | 6.78 | -11% | -21% | -54% | $5,217,575,232 |

| GED | Golden Deeps | 0.037 | 0% | -18% | -69% | $4,274,327 |

| ADV | Ardiden Ltd | 0.18 | 13% | -3% | -40% | $11,253,151 |

| SRI | Sipa Resources Ltd | 0.022 | 10% | -15% | -29% | $4,791,321 |

| NTU | Northern Min Ltd | 0.027 | 4% | -10% | -34% | $153,685,460 |

| AXE | Archer Materials | 0.335 | 5% | -15% | -46% | $87,922,219 |

| PGM | Platina Resources | 0.02 | 5% | 0% | -13% | $11,217,246 |

| AAJ | Aruma Resources Ltd | 0.021 | 0% | -22% | -73% | $3,937,830 |

| IXR | Ionic Rare Earths | 0.019 | -5% | -17% | -46% | $86,165,747 |

| NIC | Nickel Industries | 0.68 | 13% | 3% | -39% | $3,021,495,965 |

| EVG | Evion Group NL | 0.03 | -6% | -14% | -56% | $10,724,735 |

| CWX | Carawine Resources | 0.115 | 10% | 5% | 6% | $27,154,427 |

| PLS | Pilbara Min Ltd | 3.38 | -6% | -14% | -31% | $10,322,475,051 |

| HAS | Hastings Tech Met | 0.565 | -5% | -21% | -83% | $72,445,325 |

| BUX | Buxton Resources Ltd | 0.125 | -14% | -26% | -14% | $22,522,096 |

| ARR | American Rare Earths | 0.13 | 0% | -16% | -55% | $58,035,029 |

| SGQ | St George Min Ltd | 0.022 | -21% | -37% | -72% | $23,724,970 |

| TKL | Traka Resources | 0.002 | 0% | -33% | -64% | $3,501,317 |

| PAN | Panoramic Resources | 0.035 | 0% | 0% | -80% | $103,937,992 |

| PRL | Province Resources | 0.041 | 0% | 0% | -31% | $48,441,219 |

| IPT | Impact Minerals | 0.012 | -8% | 0% | 20% | $34,376,447 |

| LIT | Lithium Australia | 0.029 | 7% | -3% | -38% | $34,221,367 |

| AKE | Allkem Limited | 0 | -100% | -100% | -100% | $6,304,350,967 |

| ARN | Aldoro Resources | 0.093 | -11% | -19% | -60% | $12,116,137 |

| JRV | Jervois Global Ltd | 0.028 | -3% | -33% | -89% | $75,670,579 |

| MCR | Mincor Resources NL | 0 | -100% | -100% | -100% | $751,215,521 |

| SYR | Syrah Resources | 0.45 | 0% | -24% | -78% | $280,497,558 |

| FBM | Future Battery | 0.052 | -9% | -30% | -16% | $27,755,311 |

| ADD | Adavale Resource Ltd | 0.0065 | -19% | -7% | -70% | $4,867,033 |

| LTR | Liontown Resources | 0.9 | -6% | -43% | -42% | $2,168,769,345 |

| CTM | Centaurus Metals Ltd | 0.29 | -3% | -44% | -74% | $143,508,714 |

| VML | Vital Metals Limited | 0.004 | -20% | -33% | -83% | $29,475,335 |

| BSX | Blackstone Ltd | 0.051 | -19% | -25% | -69% | $28,635,957 |

| POS | Poseidon Nick Ltd | 0.007 | -13% | -42% | -82% | $25,994,743 |

| CHR | Charger Metals | 0.13 | 4% | -24% | -70% | $9,677,531 |

| AVL | Aust Vanadium Ltd | 0.018 | -8% | -22% | -50% | $154,703,007 |

| AUZ | Australian Mines Ltd | 0.009 | -10% | -10% | -84% | $9,591,784 |

| TMT | Technology Metals | 0.26 | 0% | 11% | -17% | $67,134,856 |

| RXL | Rox Resources | 0.175 | 9% | -5% | -5% | $64,636,996 |

| RNU | Renascor Res Ltd | 0.077 | -5% | -36% | -70% | $200,613,192 |

| GL1 | Globallith | 0.45 | -15% | -60% | -79% | $113,215,405 |

| BRB | Breaker Res NL | 0 | -100% | -100% | -100% | $158,126,031 |

| ASN | Anson Resources Ltd | 0.077 | -19% | -41% | -72% | $102,859,134 |

| SYA | Sayona Mining Ltd | 0.04 | 3% | -34% | -85% | $401,438,545 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| EGR | Ecograf Limited | 0.145 | 7% | -3% | -41% | $63,564,455 |

| ATM | Aneka Tambang | 1.1 | -6% | -7% | 0% | $1,434,014 |

| TVN | Tivan Limited | 0.056 | -2% | -11% | -33% | $89,620,121 |

| ALY | Alchemy Resource Ltd | 0.009 | 13% | -10% | -50% | $9,424,610 |

| GAL | Galileo Mining Ltd | 0.21 | 0% | -24% | -76% | $41,501,235 |

| BHP | BHP Group Limited | 45.96 | -2% | -6% | -4% | $235,442,963,106 |

| LEL | Lithenergy | 0.3375 | -22% | -40% | -63% | $36,053,500 |

| MMC | Mitremining | 0.225 | 2% | -6% | -30% | $13,605,030 |

| RMX | Red Mount Min Ltd | 0.002 | -33% | -33% | -67% | $6,683,940 |

| GW1 | Greenwing Resources | 0.085 | -11% | -35% | -73% | $15,159,879 |

| AQD | Ausquest Limited | 0.011 | -8% | 10% | -35% | $9,076,641 |

| LML | Lincoln Minerals | 0.005 | -17% | -17% | -89% | $8,520,226 |

| 1MC | Morella Corporation | 0.004 | -20% | -27% | -71% | $24,715,198 |

| REE | Rarex Limited | 0.016 | -24% | -41% | -75% | $12,984,345 |

| MRC | Mineral Commodities | 0.026 | 0% | -21% | -56% | $24,611,815 |

| PUR | Pursuit Minerals | 0.0045 | -25% | -44% | -80% | $13,247,871 |

| QPM | Queensland Pacific | 0.036 | -10% | -31% | -67% | $78,489,072 |

| EMH | European Metals Hldg | 0.305 | 2% | -24% | -55% | $38,501,832 |

| BMM | Balkanminingandmin | 0.072 | -20% | -35% | -84% | $5,114,917 |

| PEK | Peak Rare Earths Ltd | 0.205 | -15% | -44% | -53% | $57,177,478 |

| LEG | Legend Mining | 0.016 | 14% | 14% | -69% | $49,376,112 |

| MOH | Moho Resources | 0.008 | -11% | -20% | -62% | $4,287,529 |

| AML | Aeon Metals Ltd. | 0.009 | 0% | -10% | -68% | $10,964,006 |

| G88 | Golden Mile Res Ltd | 0.012 | -20% | -33% | -41% | $3,623,285 |

| WKT | Walkabout Resources | 0.12 | 0% | -14% | 20% | $83,907,681 |

| TON | Triton Min Ltd | 0.017 | -11% | -23% | -58% | $26,543,675 |

| AR3 | Austrare | 0.125 | 0% | -14% | -60% | $16,958,256 |

| ARU | Arafura Rare Earths | 0.125 | 4% | -22% | -80% | $288,787,774 |

| MIN | Mineral Resources. | 55.21 | -8% | -19% | -38% | $10,967,525,389 |

| VMC | Venus Metals Cor Ltd | 0.1 | 4% | 0% | 19% | $20,870,155 |

| S2R | S2 Resources | 0.145 | 7% | -6% | -9% | $65,664,409 |

| CNJ | Conico Ltd | 0.003 | -25% | -33% | -77% | $4,710,285 |

| VR8 | Vanadium Resources | 0.035 | -17% | -36% | -61% | $19,050,207 |

| PVT | Pivotal Metals Ltd | 0.017 | -11% | -19% | -53% | $12,674,129 |

| BOA | Boadicea Resources | 0.028 | -3% | -18% | -72% | $3,569,619 |

| IPX | Iperionx Limited | 1.84 | 6% | 23% | 122% | $407,702,416 |

| SLZ | Sultan Resources Ltd | 0.015 | 0% | -21% | -76% | $2,371,041 |

| NKL | Nickelxltd | 0.039 | -5% | -15% | -47% | $3,424,792 |

| NVA | Nova Minerals Ltd | 0.295 | -19% | -18% | -55% | $66,430,338 |

| MLS | Metals Australia | 0.03 | -9% | -17% | -43% | $19,345,122 |

| MQR | Marquee Resource Ltd | 0.019 | -7% | -32% | -42% | $8,267,688 |

| MRR | Minrex Resources Ltd | 0.011 | -21% | -31% | -70% | $13,560,844 |

| EVR | Ev Resources Ltd | 0.0115 | 15% | -4% | -23% | $10,995,883 |

| EFE | Eastern Resources | 0.008 | 14% | -11% | -53% | $8,693,625 |

| CNB | Carnaby Resource Ltd | 0.64 | -2% | -16% | -46% | $104,221,656 |

| BNR | Bulletin Res Ltd | 0.085 | 2% | -41% | -32% | $23,782,679 |

| AX8 | Accelerate Resources | 0.022 | -15% | -44% | -24% | $12,630,239 |

| AM7 | Arcadia Minerals | 0.067 | -4% | -3% | -68% | $7,306,357 |

| AS2 | Askarimetalslimited | 0.097 | -22% | -45% | -84% | $7,405,270 |

| BYH | Bryah Resources Ltd | 0.01 | 0% | -29% | -54% | $4,336,073 |

| DTM | Dart Mining NL | 0.012 | -14% | -25% | -76% | $2,958,535 |

| EMS | Eastern Metals | 0.033 | -8% | -8% | -57% | $2,720,066 |

| FG1 | Flynngold | 0.055 | -5% | 10% | -42% | $9,027,750 |

| GSM | Golden State Mining | 0.011 | -15% | -27% | -77% | $3,073,077 |

| IMI | Infinitymining | 0.1 | -9% | -23% | -57% | $13,062,873 |

| LRV | Larvottoresources | 0.066 | -6% | -6% | -58% | $14,758,369 |

| LSR | Lodestar Minerals | 0.002 | -33% | -50% | -60% | $4,046,795 |

| RAG | Ragnar Metals Ltd | 0.021 | -5% | -9% | 22% | $10,427,581 |

| CTN | Catalina Resources | 0.005 | 67% | 25% | -57% | $6,192,434 |

| TMB | Tambourahmetals | 0.086 | 0% | -25% | -25% | $7,215,811 |

| TEM | Tempest Minerals | 0.007 | -13% | -13% | -73% | $3,633,871 |

| EMC | Everest Metals Corp | 0.08 | 5% | 1% | -12% | $12,321,233 |

| WML | Woomera Mining Ltd | 0.006 | 20% | -76% | -63% | $6,090,695 |

| KZR | Kalamazoo Resources | 0.1 | 5% | -35% | -52% | $16,090,658 |

| LMG | Latrobe Magnesium | 0.057 | 0% | -7% | -27% | $107,196,900 |

| KOR | Korab Resources | 0.008 | -47% | -56% | -65% | $2,936,400 |

| CMX | Chemxmaterials | 0.078 | 3% | -5% | -48% | $7,280,767 |

| NC1 | Nicoresourceslimited | 0.205 | -15% | -40% | -66% | $25,116,132 |

| GRE | Greentechmetals | 0.205 | -16% | -51% | 78% | $18,917,994 |

| CMO | Cosmometalslimited | 0.05 | -19% | -23% | -63% | $3,284,833 |

| FRB | Firebird Metals | 0.12 | 4% | -11% | -29% | $16,371,561 |

| S32 | South32 Limited | 3.14 | -7% | -4% | -33% | $14,629,505,175 |

| OMH | OM Holdings Limited | 0.47 | -2% | -4% | -43% | $363,971,980 |

| JMS | Jupiter Mines. | 0.18 | 3% | 3% | -22% | $352,710,957 |

| E25 | Element 25 Ltd | 0.245 | -22% | -40% | -71% | $59,820,842 |

| EMN | Euromanganese | 0.083 | -9% | -14% | -73% | $18,997,908 |

| KGD | Kula Gold Limited | 0.0065 | -19% | -62% | -76% | $2,750,877 |

| LRS | Latin Resources Ltd | 0.14 | -13% | -40% | 22% | $377,494,587 |

| CRR | Critical Resources | 0.015 | 7% | -25% | -74% | $23,112,054 |

| ENT | Enterprise Metals | 0.004 | 0% | 0% | -60% | $3,207,884 |

| SCN | Scorpion Minerals | 0.02 | -29% | -39% | -75% | $10,236,405 |

| GCM | Green Critical Min | 0.005 | -29% | -44% | -75% | $6,819,510 |

| ENV | Enova Mining Limited | 0.027 | 29% | 29% | 125% | $14,100,445 |

| RBX | Resource B | 0.056 | -25% | -23% | -53% | $4,630,331 |

| AKN | Auking Mining Ltd | 0.029 | -17% | -34% | -74% | $6,449,904 |

| RR1 | Reach Resources Ltd | 0.003 | 0% | -33% | -25% | $8,025,743 |

| EMT | Emetals Limited | 0.006 | 0% | -14% | -45% | $5,100,000 |

| PNT | Panthermetalsltd | 0.04 | -20% | -33% | -78% | $3,486,646 |

| WIN | Widgienickellimited | 0.048 | -44% | -46% | -85% | $16,982,868 |

| WMG | Western Mines | 0.18 | -5% | -27% | 9% | $12,161,978 |

| AVW | Avira Resources Ltd | 0.002 | 0% | 33% | -33% | $4,267,580 |

| CAI | Calidus Resources | 0.175 | 0% | -15% | -35% | $107,187,975 |

| GT1 | Greentechnology | 0.12 | -23% | -56% | -86% | $42,829,033 |

| KAI | Kairos Minerals Ltd | 0.013 | -13% | -7% | -35% | $35,382,315 |

| MTM | MTM Critical Metals | 0.068 | -9% | -43% | -12% | $8,079,263 |

| NWM | Norwest Minerals | 0.026 | 8% | -19% | -61% | $7,476,807 |

| PGD | Peregrine Gold | 0.29 | 0% | -3% | -41% | $19,428,979 |

| RAS | Ragusa Minerals Ltd | 0.027 | -13% | -33% | -75% | $4,135,365 |

| RGL | Riversgold | 0.009 | -5% | -31% | -67% | $9,676,615 |

| SRZ | Stellar Resources | 0.007 | 0% | -13% | -46% | $8,043,185 |

| STM | Sunstone Metals Ltd | 0.01 | -17% | -29% | -69% | $34,877,349 |

| ZNC | Zenith Minerals Ltd | 0.12 | -17% | -11% | -50% | $44,047,610 |

| WC8 | Wildcat Resources | 0.435 | 10% | -37% | 1454% | $502,252,012 |

| ASO | Aston Minerals Ltd | 0.019 | 12% | -14% | -80% | $23,311,157 |

| THR | Thor Energy PLC | 0.032 | -16% | 7% | -47% | $6,139,199 |

| YAR | Yari Minerals Ltd | 0.008 | -20% | -27% | -56% | $4,341,220 |

| IG6 | Internationalgraphit | 0.135 | 4% | -7% | -46% | $12,903,276 |

| LPM | Lithium Plus | 0.165 | -28% | -49% | -61% | $17,197,640 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | -25% | -54% | $6,259,695 |

| KOB | Kobaresourceslimited | 0.15 | 7% | 111% | -14% | $22,170,833 |

| AZI | Altamin Limited | 0.05 | -2% | -7% | -36% | $21,834,219 |

| FTL | Firetail Resources | 0.05 | -17% | -33% | -64% | $8,636,522 |

| LNR | Lanthanein Resources | 0.005 | -23% | -55% | -76% | $6,449,060 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -88% | $12,357,085 |

| NVX | Novonix Limited | 0.58 | -5% | -15% | -69% | $271,316,557 |

| OCN | Oceanalithiumlimited | 0.062 | -11% | -44% | -83% | $3,352,743 |

| SUM | Summitminerals | 0.076 | 7% | -22% | -48% | $3,335,999 |

| DVP | Develop Global Ltd | 2.21 | -9% | -17% | -37% | $536,264,414 |

| OD6 | Od6Metalsltd | 0.11 | -27% | -21% | -67% | $7,427,092 |

| HRE | Heavy Rare Earths | 0.05 | -2% | -22% | -67% | $3,024,397 |

| LIN | Lindian Resources | 0.125 | -14% | -19% | -47% | $155,509,502 |

| PEK | Peak Rare Earths Ltd | 0.205 | -15% | -44% | -53% | $57,177,478 |

| ILU | Iluka Resources | 6.88 | -5% | 9% | -39% | $2,935,362,561 |

| ASM | Ausstratmaterials | 1.01 | 1% | -18% | -57% | $169,293,862 |

| ETM | Energy Transition | 0.035 | -8% | -19% | -31% | $49,002,093 |

| VMS | Venture Minerals | 0.009 | 13% | 29% | -65% | $17,680,104 |

| IDA | Indiana Resources | 0.082 | 0% | -4% | 39% | $50,449,439 |

| VTM | Victory Metals Ltd | 0.2 | -13% | 3% | 3% | $16,686,929 |

| M2R | Miramar | 0.02 | -17% | -13% | -74% | $3,275,130 |

| WCN | White Cliff Min Ltd | 0.016 | 0% | 78% | 45% | $21,373,749 |

| TAR | Taruga Minerals | 0.008 | 0% | -33% | -56% | $6,354,241 |

| ABX | ABX Group Limited | 0.07 | -3% | -1% | -48% | $17,502,822 |

| MEK | Meeka Metals Limited | 0.037 | 3% | 0% | -36% | $46,918,939 |

| RR1 | Reach Resources Ltd | 0.003 | 0% | -33% | -25% | $8,025,743 |

| DRE | Dreadnought Resources Ltd | 0.017 | -23% | -41% | -85% | $62,623,313 |

| KFM | Kingfisher Mining | 0.099 | -14% | -34% | -81% | $5,640,075 |

| AOA | Ausmon Resorces | 0.002 | -33% | -33% | -67% | $2,647,498 |

| WC1 | Westcobarmetals | 0.042 | -24% | -43% | -74% | $6,644,018 |

| GRL | Godolphin Resources | 0.039 | -9% | -3% | -56% | $6,600,439 |

| DM1 | Desert Metals | 0.031 | 3% | -35% | -85% | $8,228,196 |

| PTR | Petratherm Ltd | 0.027 | 8% | -21% | -63% | $5,843,530 |

| ITM | Itech Minerals Ltd | 0.086 | 4% | -25% | -75% | $9,774,685 |

| KTA | Krakatoa Resources | 0.018 | -5% | -54% | -57% | $8,970,037 |

| M24 | Mamba Exploration | 0.052 | -5% | -20% | -74% | $3,396,361 |

| LNR | Lanthanein Resources | 0.005 | -23% | -55% | -76% | $6,449,060 |

| TKM | Trek Metals Ltd | 0.031 | -23% | -21% | -58% | $18,470,767 |

| BCA | Black Canyon Limited | 0.12 | 14% | -14% | -51% | $7,364,854 |

| CDT | Castle Minerals | 0.007 | 0% | -22% | -68% | $9,795,944 |

| DLI | Delta Lithium | 0.27 | -4% | -36% | -46% | $199,309,500 |

| A11 | Atlantic Lithium | 0.37 | -1% | -13% | -50% | $243,625,895 |

| KNI | Kunikolimited | 0.21 | -7% | -28% | -57% | $18,153,296 |

| CY5 | Cygnus Metals Ltd | 0.066 | -3% | -47% | -87% | $19,534,462 |

| WR1 | Winsome Resources | 0.55 | -4% | -43% | -75% | $102,070,002 |

| LLI | Loyal Lithium Ltd | 0.215 | 0% | -52% | -56% | $18,323,210 |

| BC8 | Black Cat Syndicate | 0.21 | -13% | -13% | -48% | $70,375,775 |

| BUR | Burleyminerals | 0.088 | -12% | -47% | -71% | $9,296,708 |

| PBL | Parabellumresources | 0.066 | 2% | 10% | -87% | $4,111,800 |

| L1M | Lightning Minerals | 0.074 | -22% | -41% | -62% | $3,124,655 |

| WA1 | Wa1Resourcesltd | 9.88 | -7% | -26% | 485% | $442,449,897 |

| EV1 | Evolutionenergy | 0.105 | -22% | -22% | -67% | $24,712,500 |

| 1AE | Auroraenergymetals | 0.155 | 15% | 24% | 0% | $22,288,970 |

| RVT | Richmond Vanadium | 0.38 | 15% | 31% | -5% | $32,758,966 |

| PMT | Patriotbatterymetals | 0.66 | -18% | -37% | -60% | $335,160,106 |

| PAT | Patriot Lithium | 0.13 | 0% | -28% | -70% | $9,398,313 |

| BM8 | Battery Age Minerals | 0.14 | -15% | -36% | -72% | $13,305,246 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | -54% | $3,786,192 |

| VHM | Vhmlimited | 0.6 | 2% | -12% | -39% | $92,349,675 |

| LLL | Leolithiumlimited | 0.505 | 0% | 0% | -18% | $498,553,663 |

| SRN | Surefire Rescs NL | 0.012 | 20% | 33% | -14% | $21,594,736 |

| SRL | Sunrise | 0.335 | -16% | -27% | -81% | $31,579,624 |

| SYR | Syrah Resources | 0.45 | 0% | -24% | -78% | $280,497,558 |

| EG1 | Evergreenlithium | 0.099 | -10% | -42% | 0% | $7,028,750 |

| WSR | Westar Resources | 0.019 | 6% | -5% | -60% | $3,521,793 |

| LU7 | Lithium Universe Ltd | 0.023 | 5% | -26% | -23% | $8,936,004 |

| MEI | Meteoric Resources | 0.16 | -24% | -45% | 23% | $318,419,175 |

| REC | Rechargemetals | 0.066 | -13% | -37% | -49% | $7,015,174 |

| SLM | Solismineralsltd | 0.12 | 0% | -17% | 9% | $9,418,650 |

| DYM | Dynamicmetalslimited | 0.16 | 7% | -16% | -18% | $5,760,000 |

| TOR | Torque Met | 0.205 | 5% | -9% | 14% | $31,375,972 |

| ICL | Iceni Gold | 0.039 | -6% | -40% | -65% | $9,862,442 |

| TMX | Terrain Minerals | 0.004 | -20% | -20% | -38% | $6,442,518 |

| MHC | Manhattan Corp Ltd | 0.0035 | 17% | 17% | -61% | $8,810,939 |

| MHK | Metalhawk. | 0.081 | -23% | -38% | -44% | $8,450,228 |

| ANX | Anax Metals Ltd | 0.021 | 0% | -30% | -71% | $11,120,906 |

| FIN | FIN Resources Ltd | 0.017 | 6% | -26% | 21% | $11,037,568 |

| LM1 | Leeuwin Metals Ltd | 0.092 | -12% | -34% | 0% | $4,450,909 |

| HAW | Hawthorn Resources | 0.091 | 1% | -13% | -13% | $27,806,296 |

| LCY | Legacy Iron Ore | 0.015 | -12% | -12% | -12% | $105,712,632 |

| RON | Roninresourcesltd | 0.12 | -14% | -33% | -31% | $4,419,001 |

| ASR | Asra Minerals Ltd | 0.006 | 0% | 0% | -60% | $9,818,974 |

| PFE | Panteraminerals | 0.055 | -4% | 10% | -59% | $7,294,240 |

| IR1 | Iris Metals | 0.70 | +27% | -22% | -39% | $90,640,000 |

| KM1 | Kalimetalslimited | 0.39 | -25% | 56% | 0% | $32,445,390 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.