High grade vanadium has Pursuit well placed for rapid, low cost production

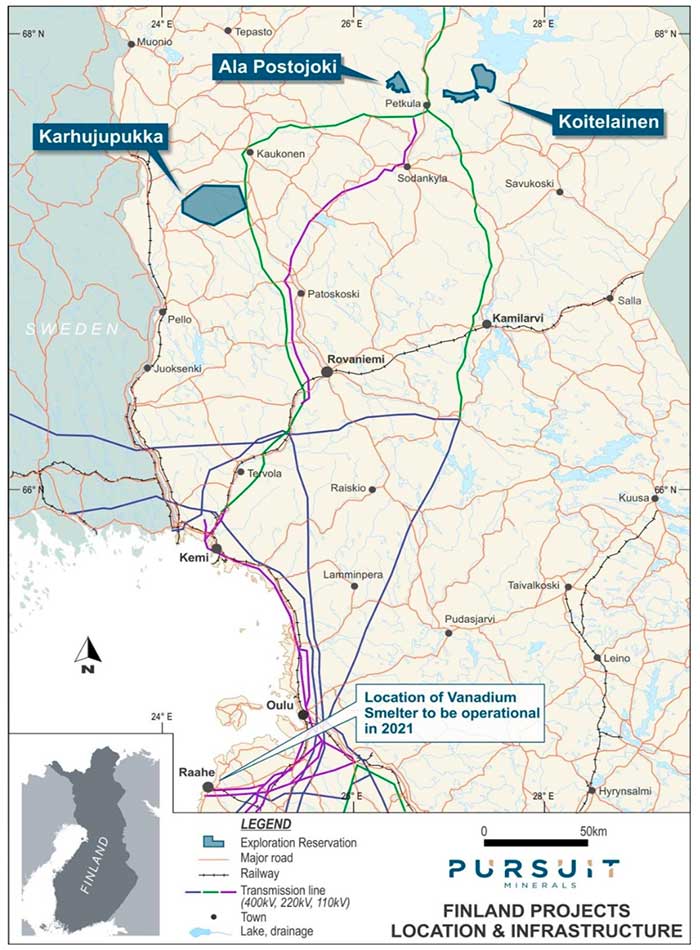

Special Report: Pursuit Minerals is now progressing rapid, low cost “dig and deliver” development plans for its high grade Koitelainen and Airijoki vanadium projects in Finland and Sweden.

“Dig and deliver” refers to simple, low cost processing and export of high-grade vanadium in magnetite concentrate to vanadium smelters overseas.

Pursuit (ASX:PUR) is able to consider this rapid project development concept because of the high-grade vanadium magnetite concentrates produced at Koitelainen and Airijoki.

At over 2 per cent vanadium pentoxide (V2O5) in magnetite concentrate, these grades compete with the very best projects around the world.

This process means Pursuit can start making money without funding the expensive processing equipment required to convert this into V2O5 flake.

By exporting high-grade vanadium in magnetite concentrates the timeline to production is significantly shortened, feasibility studies and government approval processes simplified, and capital expenditure requirements substantially reduced.

Scoping Studies on both projects are due to start as soon as JORC-compliant mineral resources are defined in December 2018 (at Koitelainen) and January or February 2019 (at Airijoki), Pursuit Minerals Managing Director Jeremy Read said.

Miners usually undertake four different types of studies to determine whether or not a resource can be mined economically.

These are – in order of importance — scoping, preliminary feasibility (PFS), definitive feasibility (DFS) and bankable feasibility (BFS).

JORC refers to the mining industry’s official code for reporting exploration results, mineral resources and ore reserves, managed by the Australasian Joint Ore Reserves Committee.

“We know that both the Koitelainen and Airijoki Projects produce vanadium magnetite concentrates that are right in the upper echelon of projects globally, so via Scoping Studies we want to examine the economics of dig and deliver type projects where the vanadium,” Mr Read said.

“Enriched magnetite would be mined, concentrated via a simple magnetite concentration process and then sold as a premium quality vanadium magnetite concentrate to markets in China or Europe.”

Pursuit’s wants to complete both Scoping Studies prior to March or April 2019 to determine the economics of the Airijoki and Koitelainen projects and to establish a potential pathway to production.

If successful, this could help Pursuit invest in Step 2, which involves building a processing plant that could produce V2O5 flake – which attracts a higher price from buyers.

Vanadium, on the up and up

Spot vanadium prices recently reached all time recent highs of US$37/per pound – a huge leap from about US$5/lb in 2017.

This has been driven predominantly by rising demand from the steel industry, which uses vanadium as a strengthening agent.

But vanadium is not a one-trick pony. Amongst other things, it’s also key component in Redox Flow Batteries, a key player in the budding battery storage market.

Overall, current vanadium demand is about 100,000 tonnes per annum, but that is tipped to triple over the next five to six years.

As customers cry out for additional vanadium supply, it will be the miners that can get high quality projects in production quickly and efficiently that will be able to take advantage.

Pursuit Minerals is a Stockhead advertiser.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.