Six Sigma adds $1.6M to the coffers as investors show strong interest

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Six Sigma Metals has raised $1.6 million via a placement that received strong interest from investors, including the company’s chairman.

Subject to shareholder approval, chairman Ed Bulseco will pick up a further 3.3 million shares, contributing $50,000 to the kitty.

The cash raised will be used to fund Six Sigma’s (ASX:SI6) exploration efforts in Botswana, as well as potential new ventures.

The company has ticked all the boxes in recent copper and silver drilling in Botswana, which is providing early indications the company may have a much deeper system.

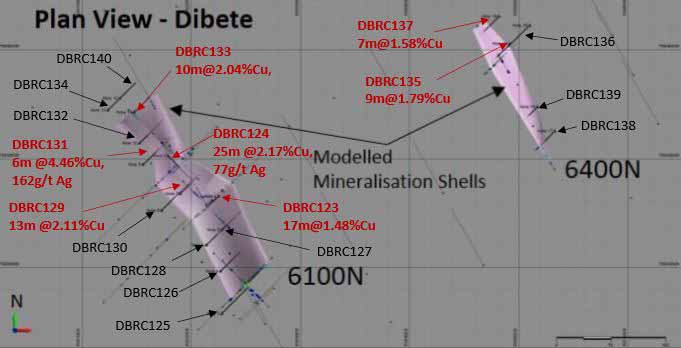

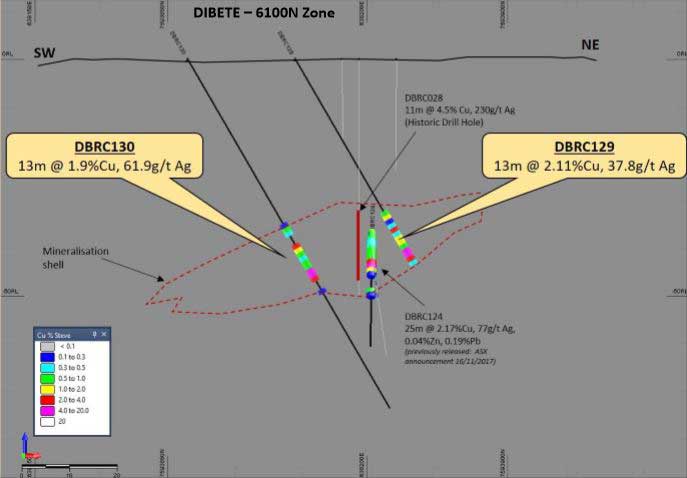

Drilling at the Dibete project has now defined a cumulative strike length of mineralisation from two lodes of over 400m with both zones remaining open and untested by drilling along strike and at depth.

The latest round of exploration drilling returned a substantial number of shallow intercepts of copper and silver grading well above the levels considered high grade.

Drilling has shown that Dibete is exhibiting similar geological characteristics to the historically-worked Messina Copper Mine in neighbouring South Africa that hosts large orebodies at depth.

“It’s the only thing that is analogous to this mineralisation and so we’re targeting a model based on that and drilling has just confirmed that this is a valid model,” director and geologist Steve Groves told Stockhead.

“The real prize for us is the deeper source. The deposit over the border has similar mineralisation at surface, but anywhere between 50m to over a kilometre depth there are large copper sulphide orebodies and obviously that would be the company maker.”

Near-surface, high-grades

Generally, anything over 1.5 per cent is considered high grade for copper, while above 50 grams per tonne (g/t) is high grade for silver.

Reverse circulation drilling delivered copper grades of up to 10.9 per cent copper and 445g/t of silver.

The shallowest intercept of 10m at 2.04 per cent copper and 15.6g/t of silver was made at just 7m from surface. The deepest intercept extended from 51m to 54m.

One notable intercept — 6m at 4.46% copper and 162g/t of silver from 38m — included a section of 2m at 10.9% copper and 445g/t of silver from 42m.

“If we can continue to extend these zones of mineralisation that are very shallow and very flat — and easy to mine and process by all accounts — then that in itself could form a resource, and there’s potential for multiple discoveries of that nature in the area,” Mr Groves said.

Ticking the boxes

Six Sigma (ASX:SI6) is highly encouraged by the thick, high-grade tenor of copper and silver returned from drilling.

The program was designed to test new mineralisation models at both the Dibete and Airstrip projects, with a total of 1,525m drilled across 22 holes.

“Drilling had a threefold focus,” Mr Groves said.

“One was to confirm historical drilling results, second was to confirm the new models to see that we’re on the right track and the third was to make sure it was open along strike. So in terms of that, it has achieved that very well.”

The second batch of 341 results from 13 holes recently received complete the analysis of the Dibete prospect.

The program at the 6100N zone successfully infilled gaps in the new mineralisation model as well as uncovered a strike extension of mineralisation to the North West that remains untested by drilling.

At 6400N, drilling has successfully defined a newly interpreted zone of mineralisation that strikes sub-parallel to 6100N and remains untested by drilling along strike to the North and South and at depth.

Future exploration programs will target the strike extensions of the shallow mineralised zones as well as the deeper source.

In addition to its copper exploration program, Six Sigma is also assessing the cobalt and tantalum potential of its Botswana tenure.

Successful capital raising

In total, Six Sigma (ASX:SI6) will issue around 106.7 million shares at 1.5c along with free attaching quoted options on the basis of two free options for every five shares subscribed for under the placement.

The first tranche is expected to be completed before the end of the December. The second tranche will be completed following the general meeting scheduled for February or March 2018.

This special report is brought to you by Six Sigma Metals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.