High grade 64,000oz gold, 690,000oz silver resource puts Riedel on the fast track to development

Mining at Riedel Resources’ Tintic deposit could begin as early as 2025. Pic: via Getty Images.

- Riedel Resources defines maiden resource of 494,000t at 4g/t gold and 43.4g/t silver for the Tintic prospect

- Tintic to be fast-tracked via a low-cost, free-dig open pit and toll treatment to deliver early returns

- Metallurgical testing underway to feed into preliminary economic assessment that is due for completion in Q1 2024

- Mining could start as early as 2025

Special Report: Riedel Resources’ maiden resource of 64,000oz gold and 689,000oz silver at the Tintic prospect provides a near-term development opportunity and value for shareholders.

Tintic has been the primary focus of Riedel Resources’ (ASX:RIE) exploration efforts at the broader Kingman project in Arizona for two key reasons – the shallow depth of mineralisation and its free dig nature that makes it amendable for mining via open pit and the high grades present.

In the interests of delivering quick returns while saving costs, the company has also held to its preference for trucking ore to third-party mills for toll treatment.

Fast tracking potential start-up operation

With the release of the resource of 494,000t grading 4g/t gold and 43.4g/t silver, RIE is now positioned to push ahead with its goal to start mining in 2025.

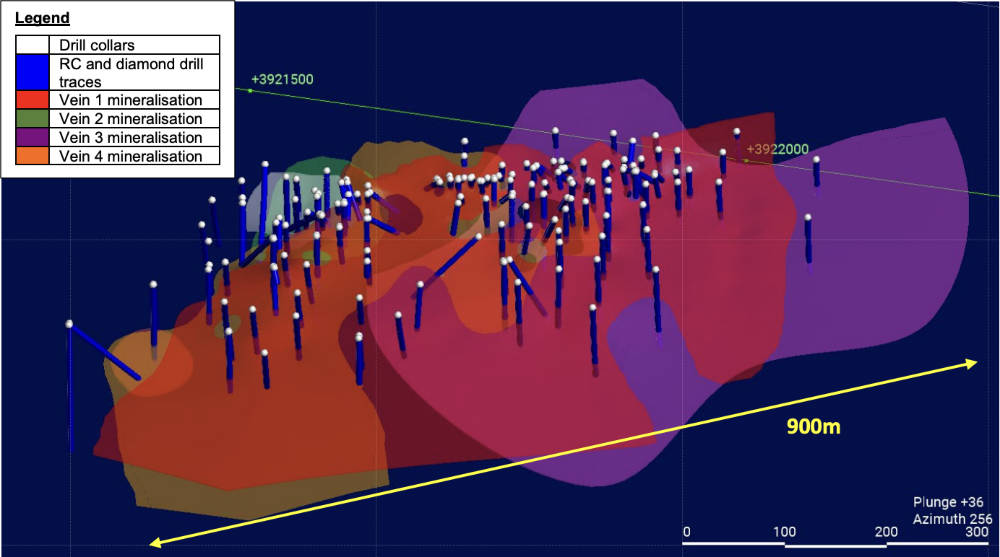

Tintic mineralisation wireframes with all drill holes included. Pic: Supplied (RIE).

This resource is contained within the top 40m of the deposit and remains open along strike, which presents the potential to further increase shallow resources through drilling.

A key takeaway is that given the company’s intention for its preliminary economic assessment to assess against several toll treating process plant scenarios with an approximate 180,000t throughput, the deposit currently has sufficient resources for more than two years of production.

This is more than enough time for RIE to explore for and add more ounces to its resources, which will in turn give it more production under toll treatment, perhaps enough for exploration over the broader Kingman project to justify and start a standalone project.

Metallurgical test work is currently underway with results expected early in Q1 2024.

Chief executive officer David Groombridge said the company aimed to “swiftly create short term value” for shareholders by “fast-tracking a potential start-up operation via a low-cost, free-dig open pit development scenario leveraging off local infrastructure”.

“Our immediate plan involves initiating a PEA in Q1 of 2024. This study will serve as the cornerstone for our permit application, scheduled for submission in Q2 of 2024, with a goal to commence mining in 2025 – a goal not too distant,” he added.

“Subsequently, we will be in a position to explore further opportunities within the Tintic area and the broader Kingman project, with the aim of transitioning from explorer to operator in a short timeframe.”

“While our primary attention remains focussed on activities to support short-term mine development, our 2024 fieldwork program aims to discover additional high-grade prospects located close to surface from the multiple unexplored targets in the project area.

“Further, we will begin initial investigations into the source of epithermal mineralisation, with the potential for a substantial copper porphyry system at greater depths.”

More activities

Besides the metallurgical test work, upcoming PEA and the lodging of permit application submissions for mining operations, the company plans to continue focusing on expanding the Tintic resource footprint through step-out drilling along strike along with identifying additional high-grade, shallow new discoveries within Kingman.

Future exploration will also concentrate on identifying additional shallow, high-grade mineralisation as well as the potential for additional copper-molybdenum porphyry mineralisation, analogous to the neighbouring Mineral Park mine.

This article was developed in collaboration with Riedel Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.