Here’s why Prospect favours a single stage development for Arcadia

Pic: John W Banagan / Stone via Getty Images

Prospect has unveiled the direct optimised feasibility study which clearly highlights why it prefers a single stage development for bringing its Arcadia lithium project into production.

The capital efficiencies and improved economic returns from constructing the proposed 2.4 million tonne per annum capacity plant in a single stage – instead of the two stage approach presented in October – are pretty undeniable according to the study’s baseline figures.

These include post-tax net present value (NPV) and internal rate of return (IRR) – measures of a project’s profitability – of US$929m and 60% respectively, an easy beat on the US$408m and 34% calculated in the Staged OFS.

Other improvements that Prospect Resources (ASX:PSC) could benefit from if it chooses the direct route include:

- lower pre-production capital of $192m vs. a combined $212m

- a 5.7% reduction in all-in-sustaining-cost to US$364/t of concentrate

- a significantly reduced payback period of 3.3 years from 5.4 years

- a 77% increase in net cashflow to US$2.6bn

Arcadia: long life and large scale

The company added that both options highlight Arcadia’s future as a compelling long life, large scale, hard rock open pit lithium mine in Zimbabwe with the single stage development really underscoring its position as one of the best lithium projects globally in terms of scale and cost of production.

It’s also worth noting the life-of-mine average reference price of US$892m for each tonne of 6% lithium oxide spodumene (SC6) is decidedly conservative given that S&P Global Platts December assessment of the weekly SC6 price out of Australia of US$2,650/t.

With the International Energy Agency (IEA) forecasting lithium demand to grow between 13 times to 42 times by 2040, it’s likely higher lithium pricing will prevail, which can only benefit Prospect and its Arcadia project.

“While the Staged OFS presented a strong development case for Arcadia with a lower upfront capital requirement, the single-stage build to 2.4 Mtpa was always expected to be more compelling in terms of capital and economic efficiencies. This expectation has been resoundingly validated by the outcomes of the Direct OFS,” managing director Sam Hosack said.

“The Direct OFS further enhances Arcadia’s positioning as one of the world’s premier hard rock lithium assets, with outstanding projected returns under a range of lithium price scenarios.

“It builds on the detailed technical assessments undertaken as part of the DFS (2019) and Staged OFS (October 2021) in outlining a robust and highly attractive mine development case for Arcadia.”

Hosack added that with the strong economics and its position as one of the only independent, shovel-ready projects globally without offtake totally locked up, it was unsurprising that the company had received strong interest in its strategic partnership process.

Seven scenarios and counting

By late November Prospect had received seven non-binding proposals for the advancement of Arcadia from a range of international parties, encompassing structures including development joint venture, offtake prepayment debt funding and outright acquisition of Prospect’s 87% interest in Arcadia.

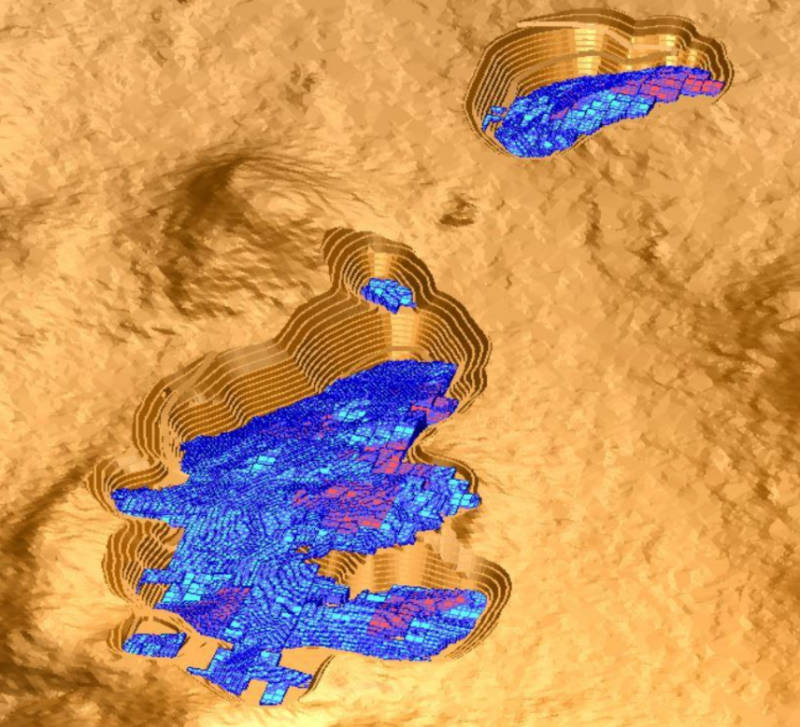

Meet the Arcadia Lithium project

The Arcadia project in Zimbabwe contains an overall mineral resource well over 72 million tonnes at 1.06% lithium oxide (Li2O) and 119 parts per million tantalum pentoxide (Ta2O5) for 770,200 of Li2O and 19.4Mlbs of Ta2O5 at a 0.2%Li20 cut-off grade.

Ore reserves, which both feasibility studies are based entirely on, stands at 42.3Mt at 1.19% Li2O and 121ppm Ta2O5 for 504,000t of contained Li2O and 11.3Mlb of Ta2O5.

Arcadia’s location within an established mining jurisdiction where mining and export of lithium products has been ongoing for over 60 years, places the project in close proximity to major highways and railheads accessing the Port of Beira, along with the major transmission line between the region’s largest hydro-electric facilities.

The project is currently envisioned as a conventional truck and shovel open pit with waste dumps located as close as possible to pit exit points to minimise haulage profiles without disrupting the access to the minable resource or crushing plant.

This article was developed in collaboration with [Client Name], a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.