Here’s how palladium – the hottest precious metal right now – can survive and thrive post-ICE

Picture: Getty Images

Here’s a quick run-down on palladium, how it has come to be the most valuable of the four major precious metals, and why it is trading above the price of gold and at a premium to the platinum price.

Part of the platinum group metals (PGMs) family, palladium’s predominant use is highly concentrated in the automotive industry in the form of catalytic converters, but experts say its unique hydrogen absorbing properties mean the critical mineral could play a key role in the envisioned hydrogen economy.

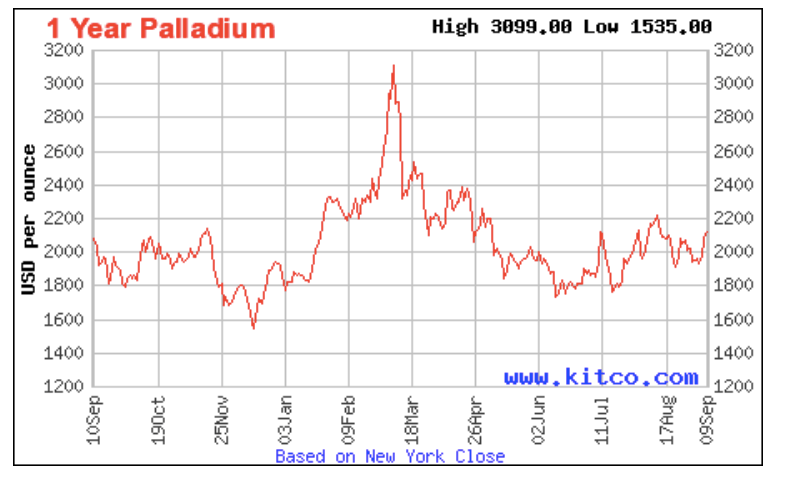

Over the last decade, the silvery white metal has attracted market attention for several different reasons, one being its massive price jump from an average of US$640/oz in 2012 to over US$3,100/oz in March after Russia’s invasion of Ukraine and the sanctions and boycotts that followed.

Historically, the palladium price traded at quite a significant discount to platinum, but the supply and demand dynamics have changed so much that the platinum price is now around US$900/oz while palladium prices have moved to a premium.

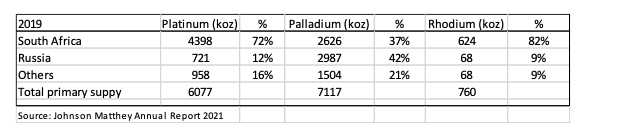

These price hikes have brought the importance of where a commodity is sourced to the fore, with Russia accounting for about 40% of the world’s mined palladium.

Together with South Africa, the two countries produce more than three quarters of global palladium supply.

In 2019, Russia produced about 42% of the world’s palladium, 12% of the world’s platinum and 9% of the world’s rhodium while South Africa produced 72% of the world’s platinum, 37% of palladium and 82% of the world’s rhodium.

Alison Britt, director of mineral resources for Geosciences Australia told Stockhead that while other countries such as the USA, Canada, Zimbabwe and even Australia produce palladium, it is in relatively small amounts and grouped with platinum production – meaning the exact quantity of palladium production is unknown.

“Interestingly, this may change in the future following the recent discovery of Chalice Mining’s Gonneville deposit at the Julimar Project, which is dominantly palladium along with platinum, nickel, and cobalt.

“Time will tell how much palladium this deposit will end up producing but it does serve to illustrate the ongoing need for new discoveries to ensure we have feedstock of the future.”

Bear case vs bull case

The bear case for PGMs is based on the acceleration of electric vehicles, which sees demand for their use in auto catalytic converters declining due to the replacement of internal combustion engines, but Bridge Street Capital analyst Chris Baker says this is likely to be a long-term, 50-year structural change.

“I would argue that the change is going to be a lot slower than most would like – we won’t be able to electrify the automotive industry as quickly as we hope… it’s just not possible.

“We can’t make enough batteries because we haven’t got enough raw materials which means in the shorter term – at least for the next 20 to 30 years – we will continue to see more intense scrutiny regarding internal combustion engines,” he says.

“Demand for ICEs will be around for decades, particularly in heavy vehicles and those that need to travel long distances – batteries are not yet up to that task.”

This means a lot more of palladium, platinum, and rhodium.

Sieberana Research presents a bullish outlook for demand against a backdrop of modest increases in PGM production with palladium supply set to grow by 31% into 2030 at a compound annual growth rate (CAGR) of 2.5%.

The research firm believes PGMs will be in deficit from 2023 onwards because of the global supply chain disruption for semi-conductor chips.

Green energy tech

Roughly 80% of global palladium consumption comes from the auto-catalyst industry, which work to alter and convert dangerous gases in vehicle exhaust pipes like unburnt hydrocarbons, nitrous oxides, and carbon monoxide into less harmful substances but other uses include things such as dentistry and jewellery.

One major growth area, however, is to do with green energy technologies for the production and storage of hydrogen in fuel cells.

“When it comes to the hydrogen sector palladium is used in the electrolysers that produce the hydrogen and it’s also used in fuel cells of hydrogen cars to transform the hydrogen into electricity,” Britt says.

“It is being used both ways – to make hydrogen and use hydrogen while also being used for purifying hydrogen, hydrogenation, and dehydrogenation reactions.

“Palladium is in lockstep with hydrogen and demand is going to remain strong, even as the use in internal combustion engines eventually declines.”

“We will be using palladium well into the future.”

ASX companies with exposure to palladium

There is enormous potential here in Australia to be a supplier of choice for critical minerals, such as palladium, as countries increasingly begin to look for material with ESG credentials in a tier-1 jurisdiction.

SOUTHERN PALLADIUM (ASX:SPD)

Southern Palladium listed on the ASX back in June after a $19m IPO at $0.50 a share.

It holds 70% of the palladium-rhodium rich Bengwenyama project, one of the last outcropping deposits along the Eastern Limb of South Africa’s prolific Bushveld complex.

It is also the largest source of platinum and palladium ore in the world with the UG2 Reef hosting over 80% of the metal content.

Speaking with Stockhead in the past, SPD CEO Johan Odendaal says the project’s location and shallow orebody sets the company apart from other PGM players, with the potential for at least the first 20 years of production to be mined within 500m from surface.

The deposit is nestled among some of the world’s top PGM deposits close to smelters owned by the industry’s two majors – Impala Platinum (Implats) and Anglo American Platinum with infrastructure in place to develop the project.

CHALICE MINING (ASX:CHN)

Work conducted by Geoscience Australia helped in the discovery of the Gonneville deposit, regarded as the most significant PGE find in Australia’s history.

The original resource posted at Gonneville back in December 2021 contained a total 10Moz of Pd-Pt-Au, 530,000t of nickel, 330,000t of copper and 53,000t of cobalt, the equivalent of 1.9Mt of nickel or 17Moz of palladium.

The new one is slightly bigger. At 350Mt at 0.96g/t 3E, 0.16% nickel, 0.1% copper and 0.015% cobalt (0.58% NiEq or ~1.8g/t PdEq) it boasts 11Moz of 3E, 560,000t nickel, 360,000t copper, 54,000t of cobalt for 2Mt NiEq and 20Moz PdEq.

Additional drilling has largely been infill designed to improve Chalice’s confidence in the resource, which is now 70% indicated, meaning the vast bulk of the resources could be converted into reserves for future feasibility studies.

A scoping study is still on track for this quarter, the first look at the potential economics of the proposed mine, while new drilling intersections at the Dampier target around 10km have Chalice hopeful of making a similar discovery beneath the Julimar State Forest.

PODIUM MINERALS (ASX:POD)

In early August, Podium revealed Australia’s first five element (5E) PGM resource for its Park Reef Project in Western Australia, home to an inferred resource of 52.2Mt at 1.64g/t for 3Moz 5E PGM.

The resource has expanded to include additional PGM metals such as rhodium and iridium as well as the addition of cobalt.

The upper PGM horizon hosts higher-grade PGM zones totalling 12.3 million tonnes at 2.05g/t 5E PGM, allowing the study team to assess multiple mining options for the project.

Podium is focused on adding value to the Parks Reef project with drilling, assays and metallurgical test work delivering strong results that will feed into a scoping study.

Future Metals (ASX:FME)

Future Metals’ Panton PGM-Nickel Project north of Halls Creek in the Eastern Kimberley is home to a resource estimate of 5Moz of PGM and 239,000t of nickel, demonstrating its potential to be a PGM nickel project of global scale.

According to managing director and CEO Jardee Kininmonth, there is significant exploration upside at Panton with potential to add both tonnes and grade across numerous targets.

“We intend to follow up the success of the new MRE with a drill program which will test a number of exploration targets including the impressive Northern Anomaly – which is highly prospective for concentrated sulphide zones,” he says.

The company is moving towards a scoping study to make a preliminary assessment on the best path forward for Panton.

Galileo (ASX:GAL)

Galileo made a company-changing discovery in May after returning 33m at 2g/t 3E (1.64g/t palladium, 0.28g/t platinum, 0.09g/t gold), 0.32% copper & 0.30% nickel from 144m at the Callisto discovery within the wider Norseman Gold Project in WA.

The Mark Creasy-backed venture saw Creasy himself up his stake after the big discovery, which sent shares in the company soaring 200% in one day.

GAL is continuing to intersect more massive sulphides at the shallow depth of 190m, confirming there is much to learn about the larger mineralised system and the opportunities that may present themselves as it continues to carry out extensive drill campaigns.

“As there is no known mineralised outcrop, and over five kilometres of prospective strike, we consider that significant potential exists for additional discoveries at shallow depths,” managing director Brad Underwood says.

“With an ongoing RC drill campaign of 10,000m, and an ongoing 2,000m of diamond core drilling, we are very excited to be rapidly progressing this new West Australian mineral discovery.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.