Here comes the iron ore slide

Pic: Tyler Stableford / Stone via Getty Images

Iron ore prices fell heavily for a second consecutive session on Friday, adding to losses seen earlier in the week.

With recent gains in Chinese futures continuing to unwind on Friday evening, there may well be further weakness to come on Monday.

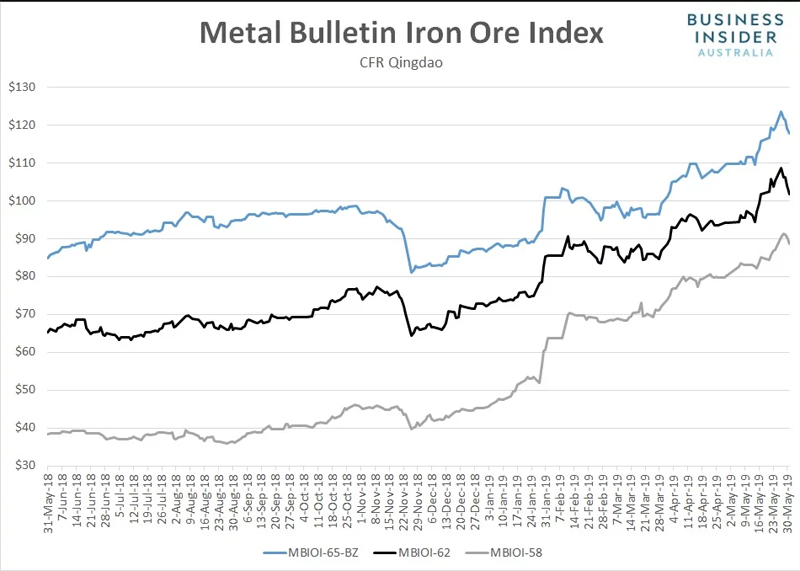

According to Metal Bulletin, the spot price for benchmark 62% iron ore fines slumped 2.2% to $101.60 a tonne, extending its drop from the five-year high of $108.62 a tonne set earlier in the week to 6.5%.

Higher and lower grades also softened on Friday. 65% fines slipped 1.1% to $117.70 a tonne while 58% fines skidded by a larger 2.0% to $88.55 a tonne.

Despite the recent weakness across all three grades, the price for the benchmark, 65% and 58% fines still surged 7.9%, 7.2% and 10.5% respectively in over the course of May.

Mirroring the performance in physical markets, Dalian iron ore futures continued to unwind on Friday, finishing the day session at 727 yuan, down from 735 yuan on Thursday evening.

The weakness in physical and futures markets followed the release of the official China steel industry PMI for May that revealed a sudden drop in new orders from both home and abroad compared to the levels seen in April.

Despite the drop in new work, inventories of finished steel products at Chinese mills continued to draw at a rapid pace despite output levels increasing at a faster pace than a month earlier. With output lifting, stockpiles of raw materials all fell sharply.

Fitting with the detail in China’s steel PMI, separate data from Mysteel Consultancy showed capacity utilisation at Chinese steel mills rose to 71.69% last week, the highest level in over a year.

Contributing to the weakness in iron ore futures, rebar and hot-rolled coil futures in Shanghai continued to soften with the most actively traded October 2019 contracts finishing Friday’s day session at 3,750 and 3,625 yuan respectively, down from 3,780 and 3,645 yuan on Thursday evening.

Coke and coking coal futures also fell, closing the day session at 1,386 and 2,140.5 yuan respectively.

While steel futures in Shanghai managed to crawl higher on Friday evening, that did little to support bulk commodity futures, especially iron ore which continued to tumble from the record high of 774.5 yuan set earlier in the week.

SHFE Hot Rolled Coil ¥3,644 , 0.30%

SHFE Rebar ¥3,754 , -0.40%

DCE Iron Ore ¥716.00 , -2.52%

DCE Coking Coal ¥1,386.50 , -0.82%

DCE Coke ¥2,133.00 , -2.29%

If sustained, the weakness in Dalian futures points to the likelihood of continued declines in physical markets on Monday. Trade in Chinese commodity futures will resume at 11am AEST.

Following the release of official manufacturing PMI from the Chinese government on Friday, the separate Caixin-IHS Markit China manufacturing PMI for May will be released at 11.45am AEST on Monday.

After a larger-than-expected decline in the government measure, markets are looking for a reading of 50.0, down marginally from 50.2 in April. A figure of 50 indicates no change in activity level from a month earlier.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.