Hemi just keeps getting bigger as DFS approaches for De Grey’s world class 9.5Moz WA gold discovery

Pic via Getty Images

De Grey’s monstrous Hemi gold discovery has flexed its credentials as the world’s best Tier-1 gold undeveloped gold project with a resource update bringing it to the cusp of the 10Moz mark ahead the completion of a landmark Definitive Feasibility Study.

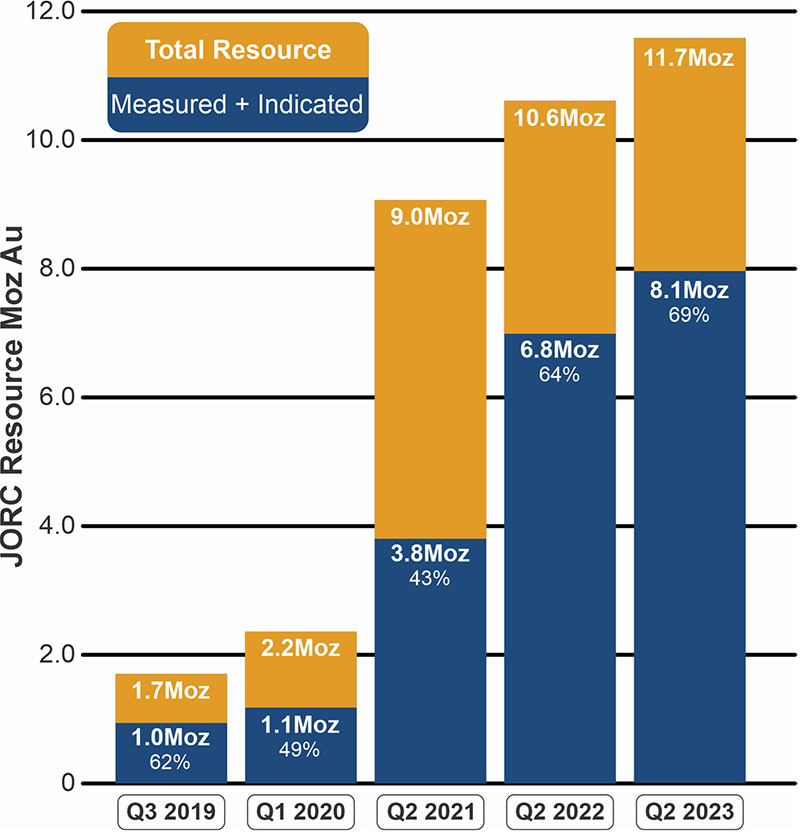

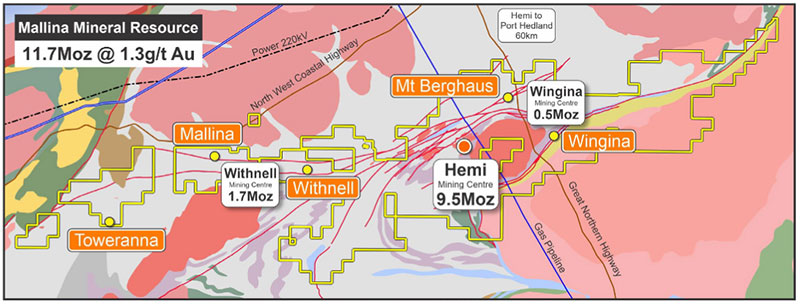

The Hemi resource now totals 9.5Moz, part of the expended 11.7Moz Mallina gold project, which has seen its resource increase by 1.1Moz since the 2022 estimate.

Since the last upgrade De Grey Mining’s (ASX:DEG) has been focused on infill drilling at Hemi to increase the JORC confidence of the resource to support the mining studies for the DFS.

On any measure that’s been a big success, with resources in the JORC indicated category at Hemi growing by 1.1Moz to 6.9Moz with the grade unchanged at an average of 1.3g/t. With the inclusion of the regional deposits around Hemi, the total measured and indicated resources have risen to 8.1Moz.

These figures will underpin an updated reserve estimate for the so close you can taste it Hemi DFS.

By way of comparison, the truly world class Hemi dwarfs the size of the last two major gold discoveries brought to market in WA.

In 2016, when Gold Road Resources brought Gold Fields on board to develop its Gruyere mine its resource base totaled 6.6Moz. AngloGold Ashanti’s Tropicana JV at the time with IGO was at 7.9Moz ahead of mining in 2012.

All indicated resources at Hemi also fall within the planned open pit shells, to 390m depth, with inferred ounces coming at a low discovery cost of $10/oz converted to indicated at a price of just $6/oz.

Mallina has grown an extraordinary 432% since Hemi’s discovery in early 2020, taking De Grey from a junior gold explorer to one of the ASX 200’s most exciting growth stocks in just three years.

The upcoming DFS will further cement De Grey’s status as the next major gold miner in Australia, building off a PFS last year that estimated the company would deliver 540,000oz of gold each year for a decade, with an initial project life of 13.6 years.

That would firmly ensconce Hemi as one of Australia’s five biggest gold mines.

“Hemi is Australia’s largest undeveloped gold deposit and continues to grow. Work during the last 12 months has upgraded the resource to a high confidence level to support delivery of the DFS,” De Grey GM exploration Phil Tornatora said.

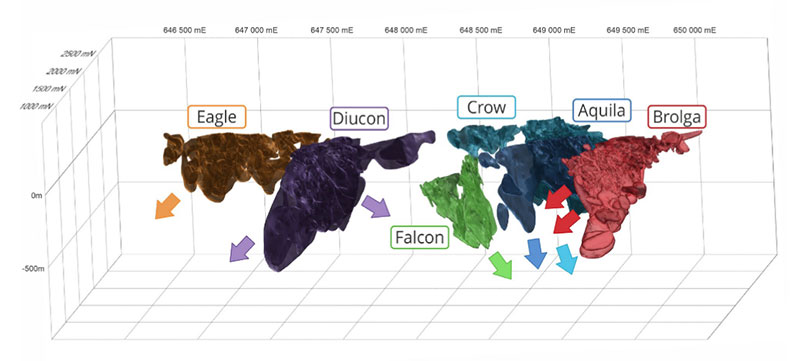

“Drilling has provided a significant lift in Indicated resources, expanded open pit resources (particularly at Diucon and Eagle) and provided geotechnical and metallurgical data to support the DFS.

Still more to find

Incredibly there remains more to find both beneath the planned open pits, which boast a combined gold endowment of 23,500oz per vertical metre, and along strike from major deposits like Diucon/Eagle, south of Brolga and Falcon and at Antwerp.

Around 1Moz of resources sit below the 390m pit shells, lifting the prospect of further open pit and underground plans beyond the completion in the September quarter of the Hemi DFS.

“The Hemi resource below 390m has now reached 1Moz and conceptual studies are planned to determine the potential of an underground mining operation to add to the Project mine life and the current PFS production rate of 540,000ozpa through the potential delivery of higher grade material to the plant,” Tornatora said.

“Drilling beneath the open pits at Hemi has demonstrated that the large mineralised system remains open.

“Our ongoing exploration is targeting strike and depth extensions to the Hemi deposits, new shallow potential resources adjacent to Hemi, as well as new large-scale discoveries at Regional prospects. Work is also ongoing to expand and upgrade the Regional deposits.”

De Grey managing director Glenn Jardine said the higher indicated ounces would support an improved ore reserve and the proportion of the long-term production profile sourced from those high confidence reserves.

“Resource definition drilling completed for the 2023 MRE update at Mallina has succeeded in increasing Measured and Indicated resources from 6.8Moz to 8.1Moz with Hemi Indicated resources increasing from 5.8Moz to 6.9Moz,” he said.

“The increase in Indicated resources has been aimed at improving the overall Ore Reserve and percentage of Ore Reserves within the DFS production profile. Increased Ore Reserves will further de-risk the project and maximise its debt carrying capacity.

“The DFS is advancing to plan and due for completion in the September quarter 2023.”

Gold in strong form

The updated resource, 69% of which is measured or indicated, up from 64% previously, has been posted at a time of strong gold prices.

Bullion was fetching US$1941.41/oz overnight, equivalent to $2856/oz, having traded at over $3000/oz not long ago.

Recent pit optimisation was undertaken at a $3000/oz price. But Hemi remains monstrous at far lower gold prices as well.

At a 0.3g/t cut off grade and gold price of $2500/oz Hemi would contain 6.6Moz of indicated and 480,000oz of inferred resources just in open pit resources, excluding any regional resources from the broader Mallina project.

Outside of Hemi, De Grey has also boosted the Toweranna resource by 14% to 600,000oz.

This article was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.