Havilah Resources builds cobalt war chest; shares jump 9pc

Pic: Schroptschop / E+ via Getty Images

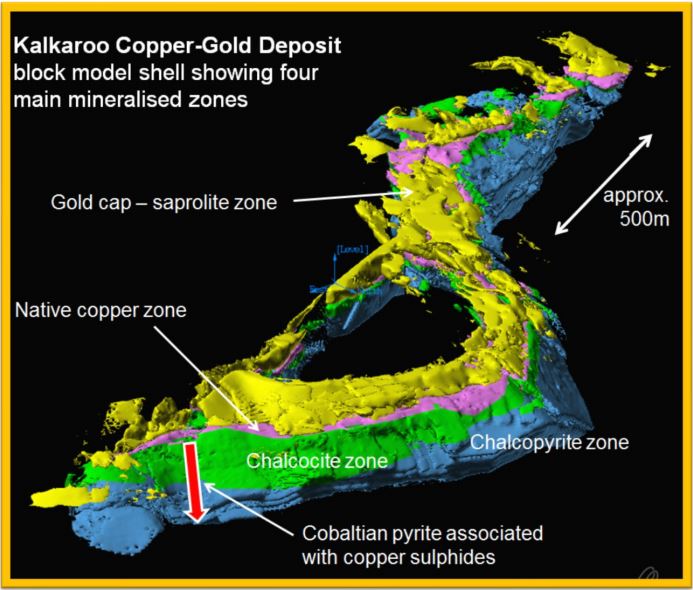

Havilah Resources has added more cobalt to its inventory with a new resource at its Kalkaroo copper, cobalt and gold project near Broken Hill, NSW.

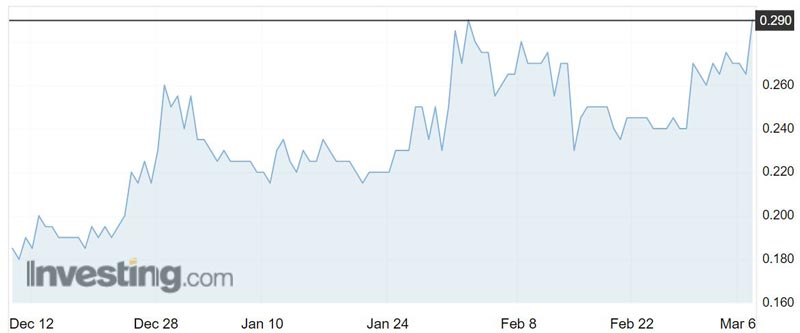

Investors liked the news, pushing shares up 9.4 per cent to 29c on Wednesday morning.

Cobalt players in particular have found favour with investors in the past few years thanks to rising demand for electric vehicles and constrained supply.

Havilah (ASX:HAV) has defined an inferred resource of 193.3 million tonnes at 120 parts per million, or 0.012 per cent, containing 23,200 tonnes of cobalt metal.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

Around 0.15 per cent cobalt is considered an acceptable grade to start looking at a deposit, according to those in the industry, but with the price moving as much as it has it is bringing lower grade deposits into the economic fold.

Havilah says there is the potential to increase the grade at Kalkaroo to 0.4 per cent by producing a concentrate during the copper flotation process.

“As this cobalt is all contained in cobaltian pyrite, which is a by-product of the copper flotation process, we believe it will be possible to recover the cobalt along with the associated gold in the pyrite,” chief Walter Richards said.

This new resource expands Havilah’s cobalt war chest to 31,390 tonnes, which the company says has “appreciable upside potential”.

Havilah controls more than 14,000 sq km of tenements in the Curnamona Craton in north-eastern South Australia.

“There is great potential for cobalt-derived revenue to substantially increase the return from the Kalkaroo project,” Mr Richards said.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.