Guy on Rocks: True wealth in 2022 – happy days ahead, or heading down the toilet?

Buckle up WA, it's coming for you next. Picture: Getty Images

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Commodities 2022 – buckle up!

An unusual start to the year here in the West where wealth is no longer measured in your stores of gold bullion, property or cash but how many rolls of toilet paper and Panadol you have stashed away as the countdown to the border opening looms in early February 2022.

There is more discussion on the street about various types of face masks and their efficacy rather than the splendid performance of the Australian cricket team in the recent Ashes series. The one thing that is certain is that WA is about as well prepared for the border opening as England’s middle order batters were for the Ashes…

2021 set the scene for high levels of price volatility with inventories of all base metals falling over last year.

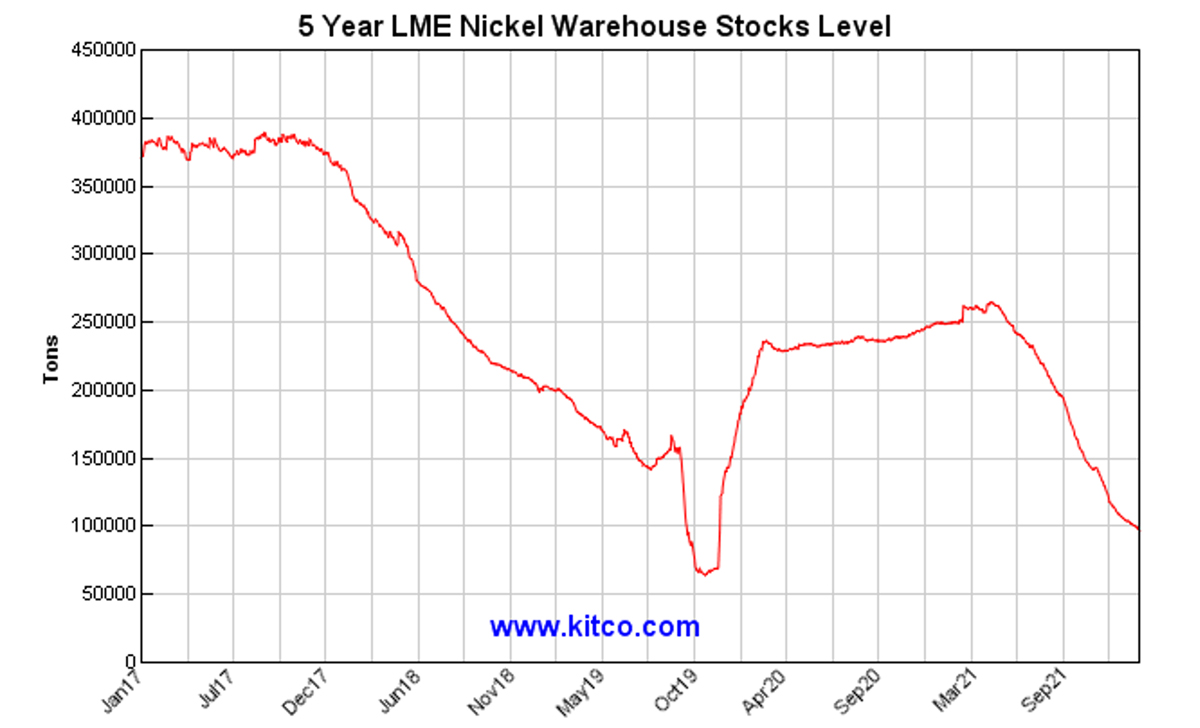

Tin was the best performing metal with a meteoric rise of 90% average, just over US$32,500 tonne, last year while the largest inventory fall was nickel, dropping 220,000 over the year or 8% of annual global consumption.

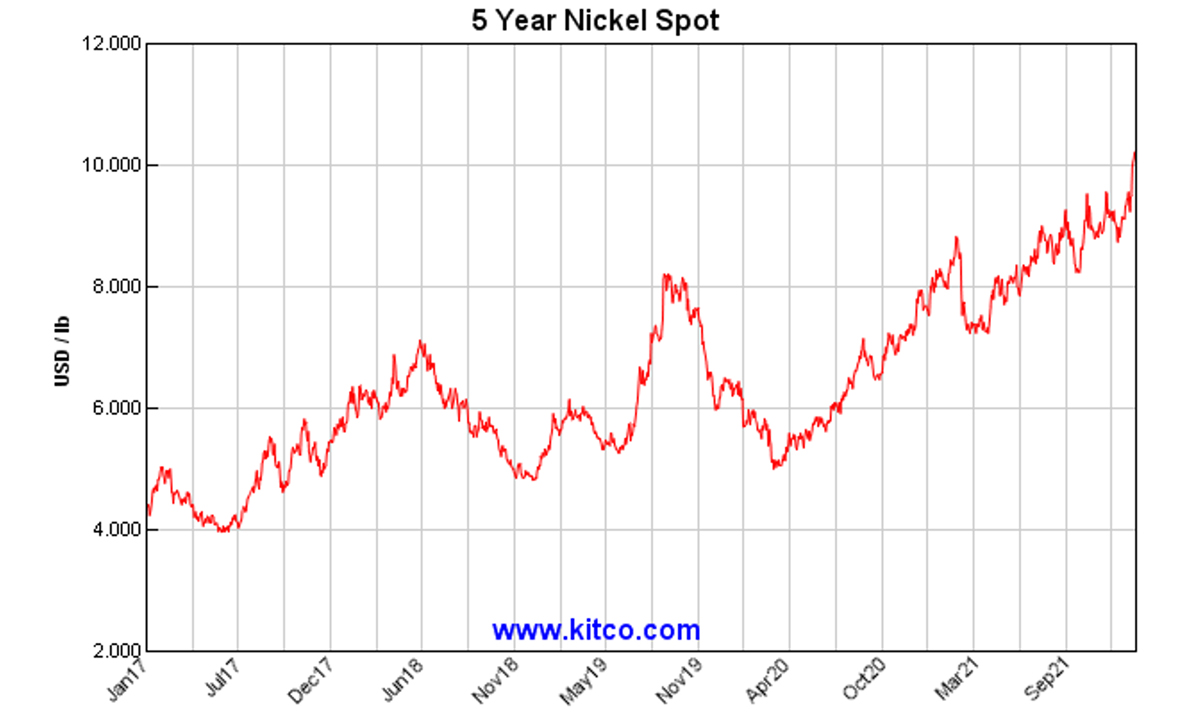

The good news however is that nickel prices (figure 1) have started the year with a bang and LME spot prices have risen to over $22,000/t, their highest level in 12 years, while LME stockpiles (figure 2) have been rapidly diminishing.

The strong price move has been spurred by positive sentiment towards nickel’s use in EV batteries. At the same time there has been plenty of activity in the exploration scene with BHP announcing a $50 million placement in Kabanga Nickel (Tanzania). The company is proposing to produce 40ktpa of Ni, 6ktpa of Cu and 3ktpa of Co from 2025.

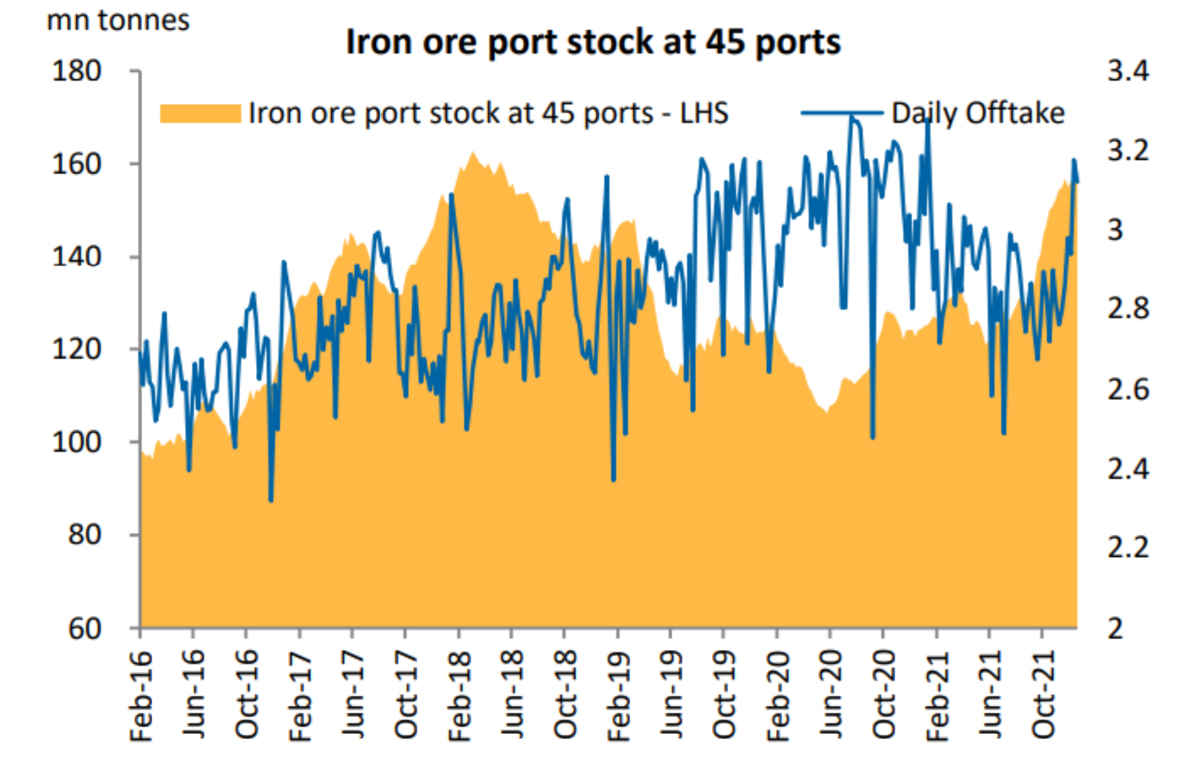

Iron ore (figure 3) has also staged a comeback after dipping below US$90/tonne (62% fines) last year and is trading around US$124/tonne (after reaching highs around US$130/tonne in early January), representing a 6% rise last week.

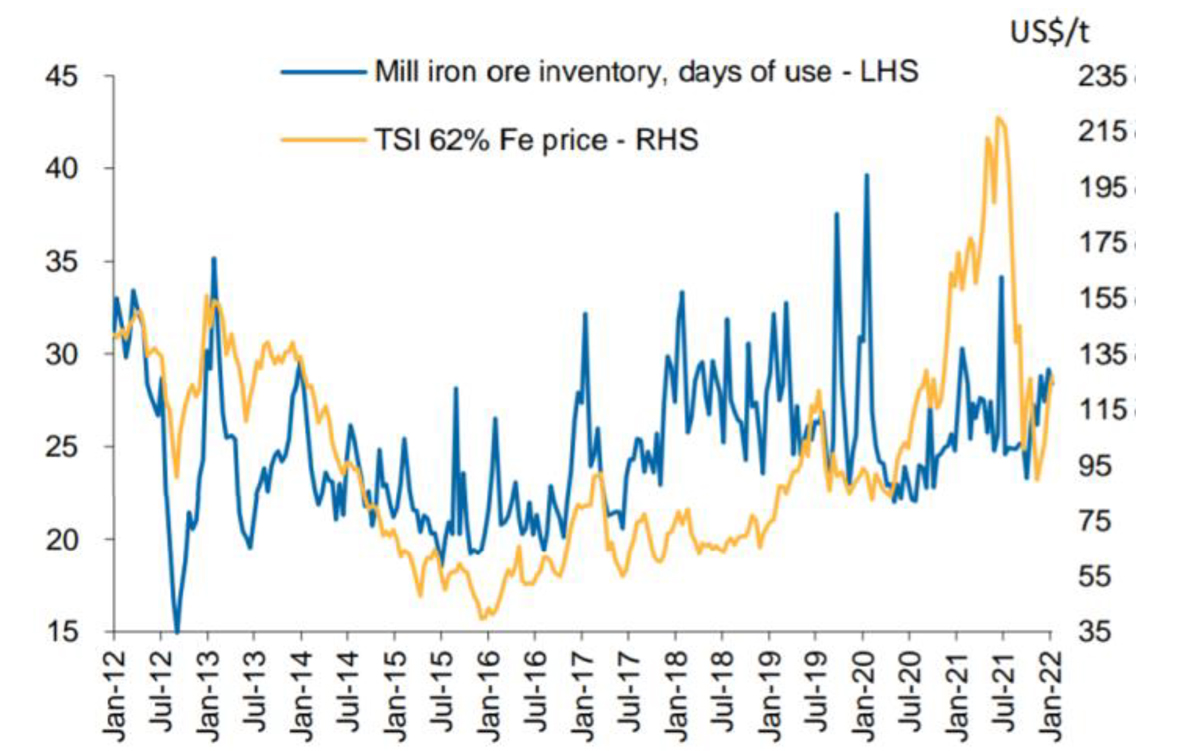

Speculative buying and winter re-stocking have seen China add around 156 million tonnes at its ports, up 920,000 tonnes last week (figure 4). At the same time Chinese steel mills have increased production (and inventories – figure 5) with steel mill inventories falling 2.2% last week. Shipping out of Western Australia (Rio, BHP and FMG) has been off 7% from December average shipping rates.

I have talked extensively about copper in the past and the red metal appears to be holding steady around US$4.41/lb despite the weakening economic outlook in China.

Not surprisingly the PBoC vice governor said the bank will roll out more policy measures to stabilise growth as downward pressures persist. In addition to this, the PBoC’s vice governor indicated that the bank will increase cross-cyclical policy adjustments this year with “relatively big” room for macro policies with more policy tools in reserve.

The PBoc lowered its one-year loan prime rate by five basis points to 3.8%, its first interest rate cut since April 2020.

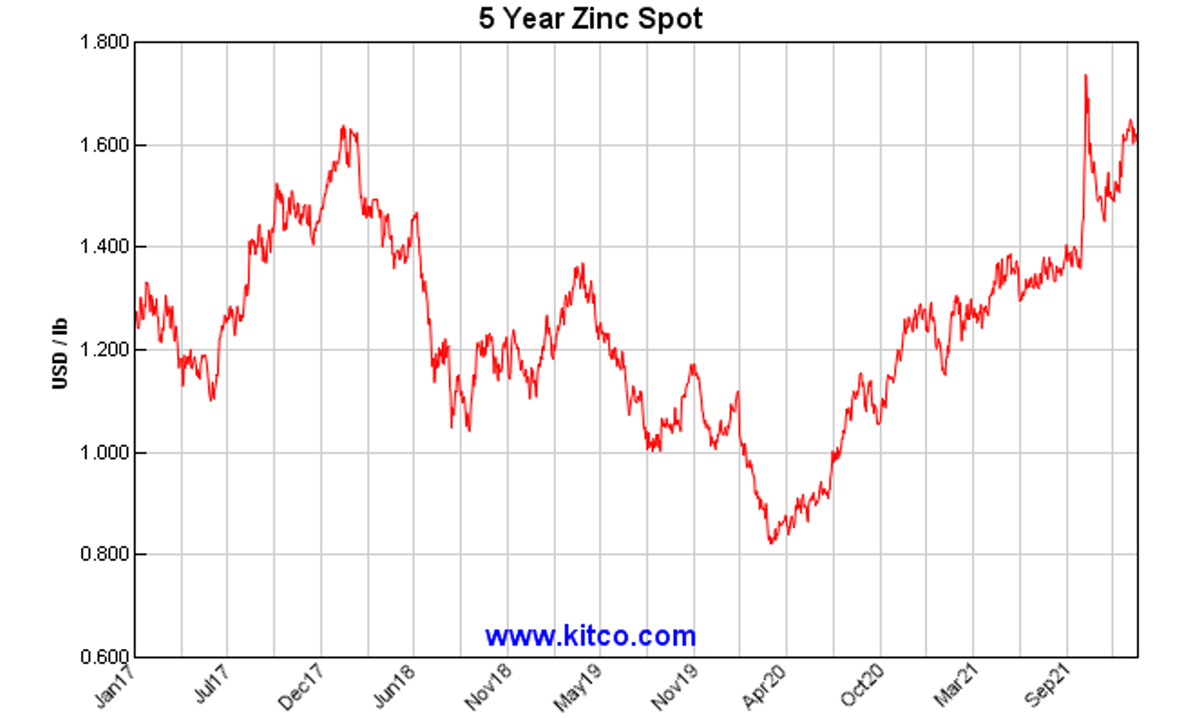

Zinc came out of nowhere last year and is expected by many analysts to reach around US$3,700/tonne over CY 2022 with the global deficit equal to LME stocks. Battery metals such as lithium and cobalt have also been strong.

As for gold the underlying uncertainty around the pandemic, radical fiscal and monetary policies, have seen price support above US$1,800/ounce. With inflation out of control (7% annualised rise last month in the US), anything could happen from here…

As Joe Foster (Van Eck) pointed out in a receipt article for Kitco:

“There have only been two other inflationary periods in the last 50 years. The first was in the seventies, the second from 2003 to 2008. In each of these inflationary periods, gold underperformed commodities in the first half and outperformed in the second half. It seems that markets don’t take inflation (or gold) seriously until it proves to be intractable.”

Company News

As forwarded in my last column of 2021, I ran into some of the Nexus Minerals (ASX:NXM) luminaries on Hay Street West Perth just before Christmas and was pleasantly surprised by the 5-minute pitch.

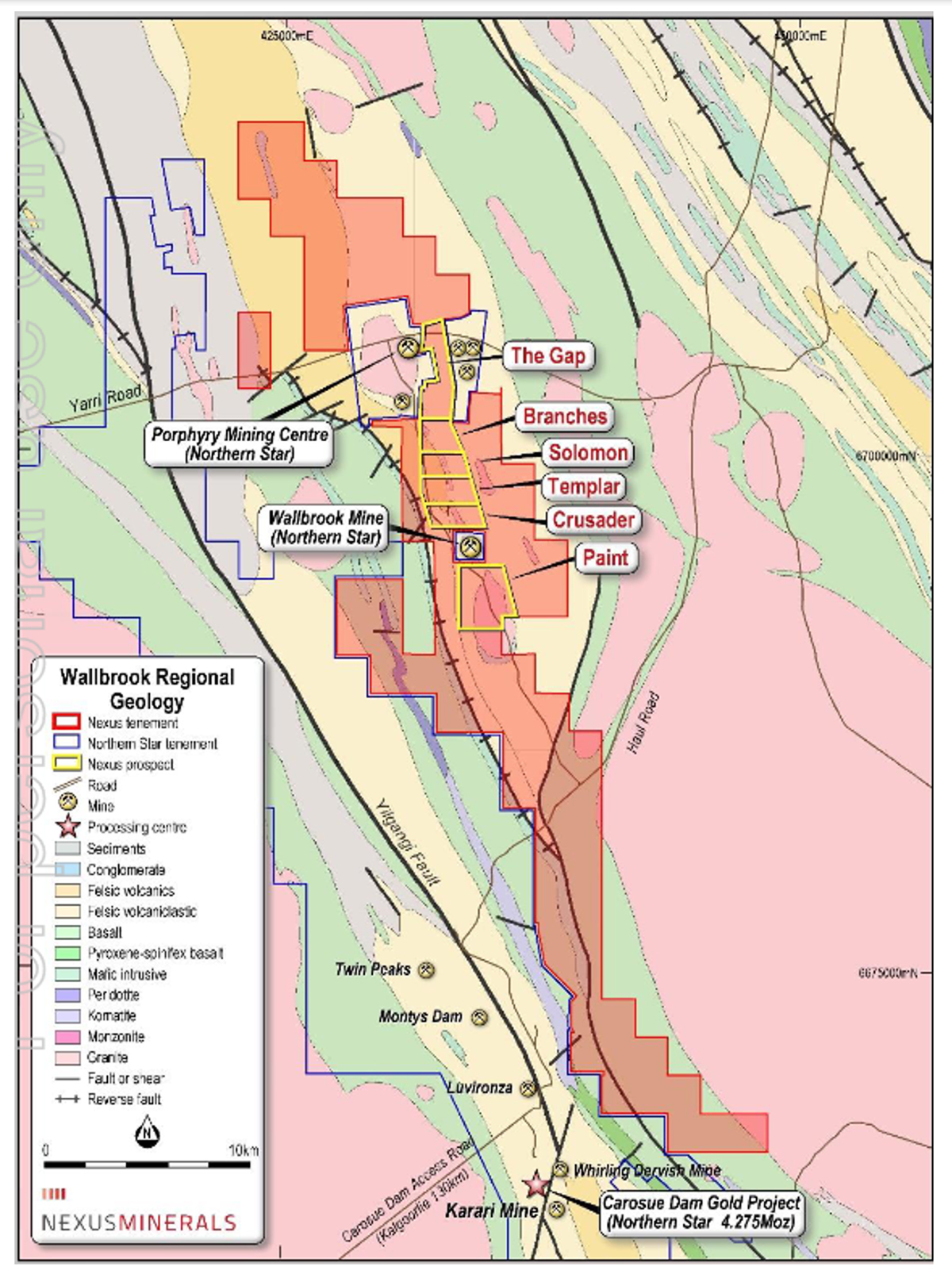

The company, led by geologist Andy Tudor (managing director) and former paper shuffler Paul Boyatzis (chairman), has a portfolio of projects in Western Australia (figure 8) of which the Wallbrook Project (figure 9) is showing itself to have +1Moz of JORC Resource potential this year with drilling outlining mineralisation for a strike length in excess of 1.6km.

The company claims to have around 50km strike of prospective lithologies.

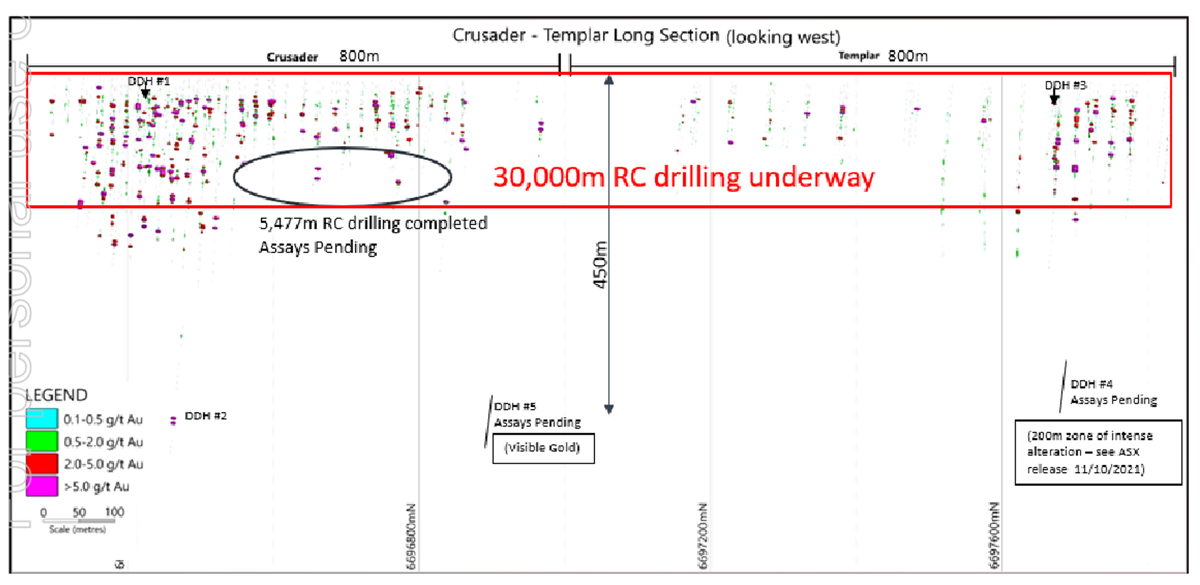

NXM is around a third of the way through a 30,000m RC drilling campaign that is designed to infill between the Crusader and Templar Prospects (figure 10).

Exploration over 2021 outlined three distinct mineralised zones (Supergene, Hanging Wall and Footwall lode) which should significantly increase ounces per vertical metre. The company released results of 28 drill holes which not only returned excellent grades and widths, but also showed the mineralisation was continuous across 1.6km of strike.

Better results released on 21 December 2021 at Crusader – Templar included:

- 29m @ 4.60g/t Au (within 71m @ 2.06g/t Au from 25m);

- 13m @ 5.17g/t Au (within 25m @ 2.95g/t Au from 109m);

- 10m @ 4.45g/t Au (from 74m);

- 16m @ 2.31g/t Au (within 68m @ 0.98g/t Au from 28m); and

- 5m @ 4.93g/t Au (within 8m @ 3.31g/t Au from 115m).

Three RC drill rigs and two diamond rigs are due to start this month and with an EV of around $95 million with $24 million in the bank, I believe NXM is in an excellent position to outline a 1-1.5Moz JORC Resource of good grade this year.

I think gold plays that can deliver +1Moz of open pittable mineralisation of decent grade (+1.5g/t Au), close to infrastructure are definitely worth having in the portfolio.

Anyway, after watching Seasons 4 and 5 of Billions (Season 6 is due out on January 23) I am feeling re-invigorated with a moral compass that has been re-aligned in the right direction. Next week I will be publishing the performance of my 2021 recommendations to see if I have added any value, or in the alternative, sent some of the Stockhead faithful down the “S” bend.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.