Guy on Rocks: This $90m capped gold miner has paid out $38m in dividends since 2021

Picture: Getty Images

- Gold prices up but volatile, uranium holds steady above US$80/lb

- Spodumene prices crater, but Goldman Sachs believes lithium prices will likely bottom in 2025

- Stock of the Week: Beacon Minerals (ASX:BCN)

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

After hitting all times highs of US$2,150/ounce last week gold pulled back more than 3% (figure 1) to close on Friday at US$2,004/ounce, before slipping to US$1,979/oz in late trading on Wednesday. It bounced hard again Thursday, sitting at US$2040/oz at time of writing.

The last seven days have seen the most volatility in gold since mid-August 2020.

Hopes of further rate cuts had driven gold to new highs however a more bullish US jobs report added 199,000 jobs last month old dampened these hopes.

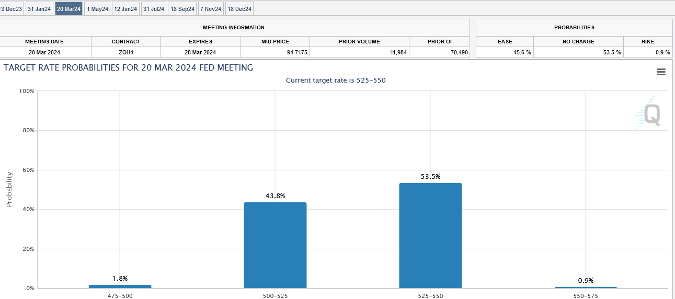

The unemployment rate also fell from 3.9% to 3.7%. The next move in gold will no doubt be heavily influenced by this week’s inflation report and interest rate decision by the Federal Reserve, however any rate cuts are unlikely until March next year if the CME Fedwatch tool is anything to go by (figure 2) with sentiment above 90% for no change for the Dec and January meetings and more or less evenly split for a rate cut in March next year.

Silver prices retreated just over 3% for the week to close at US$23/ounce. Palladium was down 5.5% to close at US$929/ounce for a six year low after a tough year which has seen year to date declines of around 45%, despite Chinese passenger car sales growing by 25% in November.

Platinum fell US$16 to close at US$918/ounce.

Copper finished at US$3.79/lb, up 2 cents on the week, as Chinese exports grew for the first time in six months during November, with copper imports growing 10.1% to two-year highs.

In late trading on Wednesday copper had slipped to US$3.75/lb. Together with a weakening US dollar, there is scope for copper to go higher with China likely to ease rates at its upcoming CEWC meeting that should also see an increase in urban village redevelopment and affordable housing projects to offset the drag from the struggling housing sector.

Domestic demand of copper however remains strong in China with copper/alloy output nearing record highs.

Completions of property this year have remained reasonably strong (+18% YTD) according to Morgan Stanley with some supply side disruptions (production cuts in Yunnan, copper supply disruptions in Chile/Panama) putting a floor on copper prices.

China’s key economic indicators surprised on the downside for November with inflation coming in at -0.50%, with consensus forecasting ranging from -0.1 to -0.2%, the lowest figure returned in over 12 years.

The elephant in the room is the lag effect that rising interest rates have had on economic growth as increasing debt servicing burdens run a significant risk of recessions in developed markets next year.

The US and China, along with over 60 countries are apparently behind a longer-term plan to triple global renewable energy capacity by 2030, which would require ~21% CAGR of renewable capacity between 2023-2030.

Obviously good news for copper which could add a further 4.0mt of demand by 2030 according to some market commentators.

I personally don’t believe these targets will be met given the current renewable energy policies of most major economies have no way of achieving this.

The headlines from the summit read like a Monty Python script with dozens of people flying in on jets (can someone remind me what powers them?) and then banging the table on phasing out fossil fuels while China and India are increasing coal power capacity to make more lithium batteries (which are themselves a potential environmental problem). What a circus.

According to the honourable Anthony Albanese today “We have experienced 2023 as the hottest year on record. We continue to break these records and that’s why my government is determined to act on climate change.” Of course, the Stockhead faithful will be aware that records go back to 1910 so that makes 113 years out of 4.5 billion years. I am sure the statisticians would agree this is a representative sample…

“Today, with the high heat levels, it’s a time to ensure we look after each other and stay safe. Climate change is a threat to people’s health as well as to our environment.”

I think the real threat is we are digging up vast amounts of metal in pursuit of a self-destructive and unsustainable energy policy.

COP28: all about nuclear power

Of course, there was some sensible discussion at the conference with 22 countries from four continents declaring a goal to triple nuclear capacity by 2050.

Nuclear power has surged to the top of world headlines at COP28 in Dubai, where leaders from 22 countries on four continents came together on 2 December to announce a declaration to advance a global aspirational goal of tripling global nuclear energy capacity by 2050 to meet climate goals and energy needs.

Importantly this declaration invited the World Bank, regional development banks and international financial institutions to include nuclear in their lending.

“If you want to reconcile jobs creation, strategic autonomy and sovereignty, and low carbon emission, there is nothing more sustainable and reliable than nuclear energy,” President Macron stated.

It must be good news given there was unanimous support from the Cigar Social Climate Change Sceptic Committee (CSCCSC) at the Friday Christmas Party.

With the spot uranium price holding above US$80/lb (figure 5), M&A activity is starting to pick up in the uranium sector with ASX listed explorer 92 Energy Limited (ASX: 92e) part of a three-way merger deal with Energy Limited, one of the largest tenement holders in the Athabasca basin namely ATHA Energy Corp (CNSX: SASK).

Under the proposed scheme, 92E shareholders will receive 0.5834 ATHA shares for every 92E share held on the record date, representing a 78% premium to the last closing price of 36.5c. ATHA has also entered into an arrangement agreement with Athabasca basin and Labrador explorer Latitude Uranium.

Spodumene prices plummet, but the best miners still have margin to play with

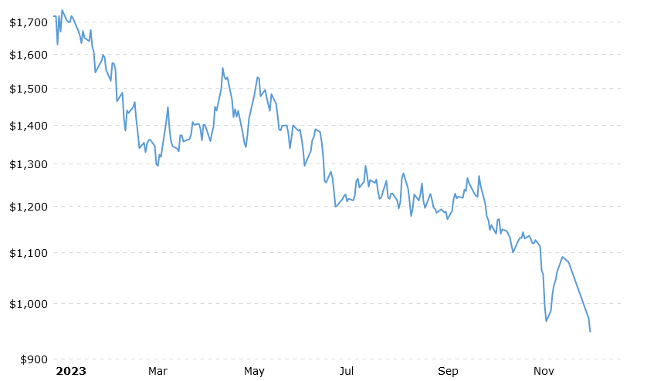

Aside from the CSCCSC Christmas Party, (where various awards included Biggest Climate Denyer, Biggest Gas Guzzling V8) there was a lot of chatter around lithium price volatility which saw lithium carbonate fall to US$13,843/tonne, representing an 80% decline over CY 2023 and its lowest levels since mid- 2021 on the back of declining EV sales.

Spodumene concentrate prices also dropped to just under US$1,600/tonne not far off the “incentive prices” in the range of US$1,300 to US$1,500/tonne.

Mind you, with all in sustaining costs of around US$850/tonne for Pilbara Mines Ltd (ASX: PLS) and around US$500/tonne (projected) for Liontown Resources Ltd (ASX: LTR), the better-quality assets still have plenty of margin to play with.

In a recent report however, Goldman Sachs believe lithium prices will more likely bottom in 2025.

Stock of the Week: Beacon Minerals

Beacon Minerals Limited (ASX: BCN) (figure 6), run by local mining identities Graham McGarry and Geoff Greenhill, has established itself as a successful small scale miner at its 100% Jaurdi Mine located around 30km north-west of Coolgardie in Western Australia (figure 7).

Total JORC Resources stand at 8.3Mt @ 1.17g/t gold for a total of 315,000 ounces and recent acquisitions including the purchase of the Lady Ida gold project earlier in the year has seen the mine life extended from three to eleven years.

While costs have risen and eaten into operating cash flows in recent year, the Company still managed to return a solid EBITDA of $21.3 million ($35 million FY 2022) for the 2023 financial year (table 1) and remains in a strong financial position with around $4.4 million in cash and 4,500 ounces of bullion.

The Company has paid out over $37 million in dividends (33% payout) since 2021 and is currently yielding just under 5% based on this year’s dividend.

I think Mt Dimer could add some significant ounces to production in the short-medium term, with multiple high grade targets worth following up.

While the company doesn’t have the leverage of some other ASX listed explorers/developers with a relatively modest production profile, it is well positioned to take advantage of opportunities in the goldfields, particularly given the paucity of competent operators and the lack of available capital to fund new gold plants in the region Kalgoorlie/Coolgardie districts.

I believe there are many attractive open pit opportunities within trucking distance of Jaurdi that has put BCN in a very good position.

The company was finally awarded some concessions in East Timor (figure 8) that are prospective for copper so that may well provide some blue sky.

At an enterprise value of just over $80 million BCN represents a good income stream from their existing Jaurdi plant based on their recent operating history, with good prospects of increasing the resource base from their recent acquisitions.

East Timor could provide some exploration upside in what should be a stronger copper market moving into 2024 …

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.