Guy on Rocks: Silver’s yo-yo week and could this nickel stock be Chalice 2.0?

Pic: Schroptschop / E+ via Getty Images

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

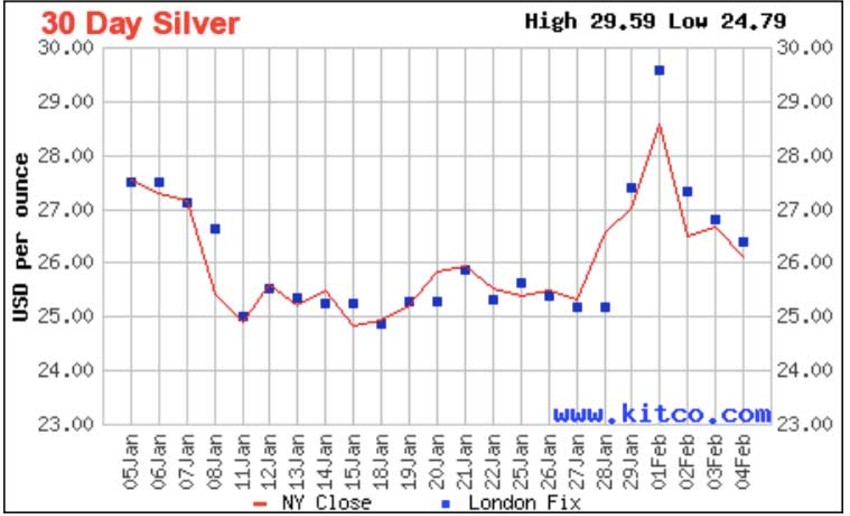

Over 1 billion ounces (three times daily average volume for late CY 2020) of silver were traded in London on Monday as prices punched through $US29/oz (figure 1) to eight-year highs before retail interest waned on Tuesday with scepticism about reddit comments about squeezing banks.

The upshot of all this is we are unlikely to see a replay of the GameStop trading activity that has dominated recent headlines. Given there was no short position in silver, it is curious as to what the traders were thinking.

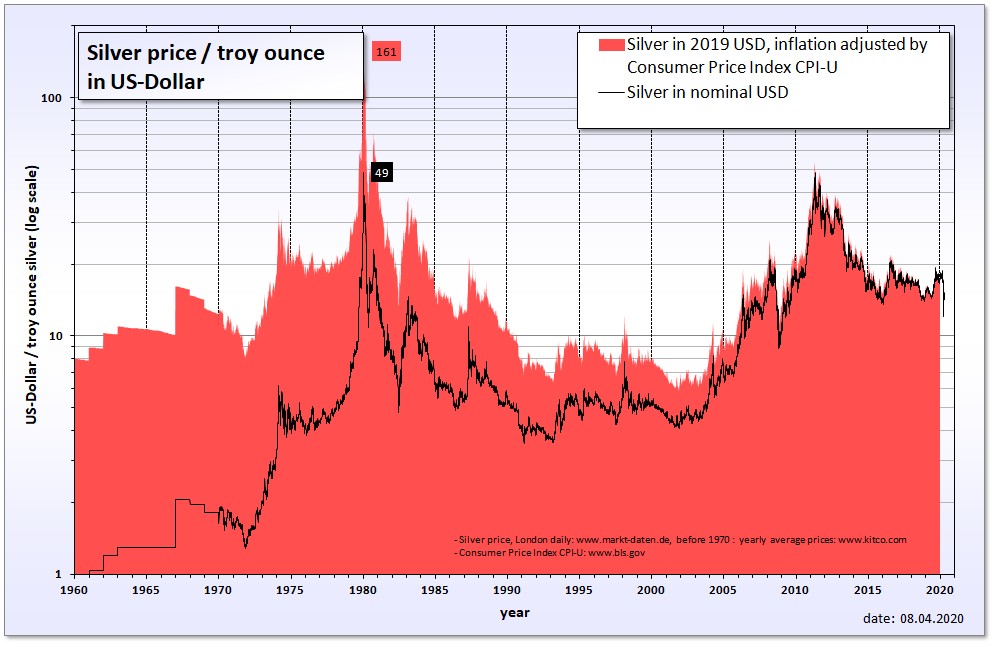

Some remember the events of silver Thursday on 27 March 1980 (figure 2) when the Hunt brothers leveraged themselves into $US7bn worth of silver only to have margin rules changed, followed by a bailout then ultimately bankruptcy in the late 1980s. The lesson here is anyone embarking on this sort of activity needs a large amount of capital, luck and to pray the exchange doesn’t change the rules mid-stroke.

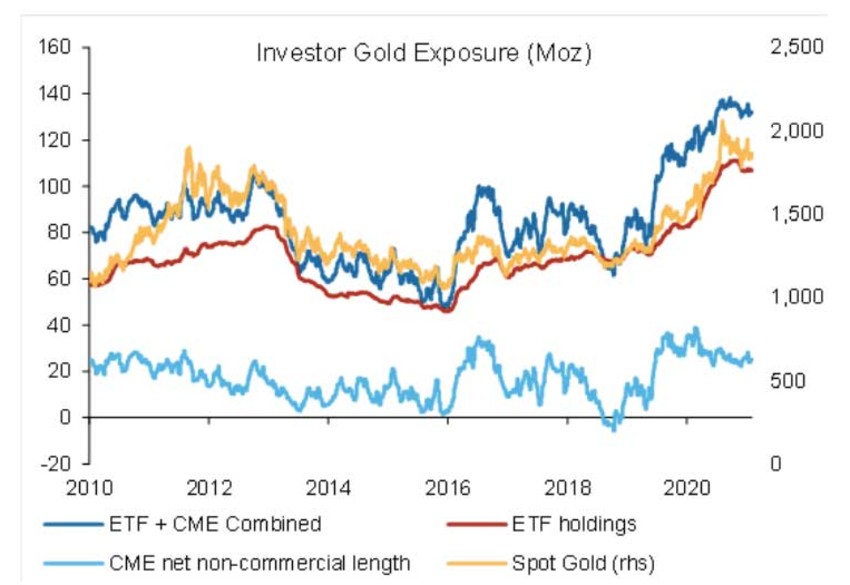

Gold investment flows (predominantly ETFs) remain the dominant market driver of gold over the last 12 months, which has seen some near-term volatility on the back of the silver price spike earlier in the week. Near term many are standing on the side lines as long end rates move higher and general economic conditions improve.

Zinc highlights the difficulties in metal price forecasting, with our perceived shortfall moving into CY 2021 upended by an increase of 100,000 tonnes of zinc to LME warehouses (now at three weeks consumption) together with rising inventories in Shanghai.

Zinc has retreated to $US2,547/t, however a finely balanced concentrate market and the prospect of undisclosed zinc stockpiles provides less confidence of any upward pressure on the price.

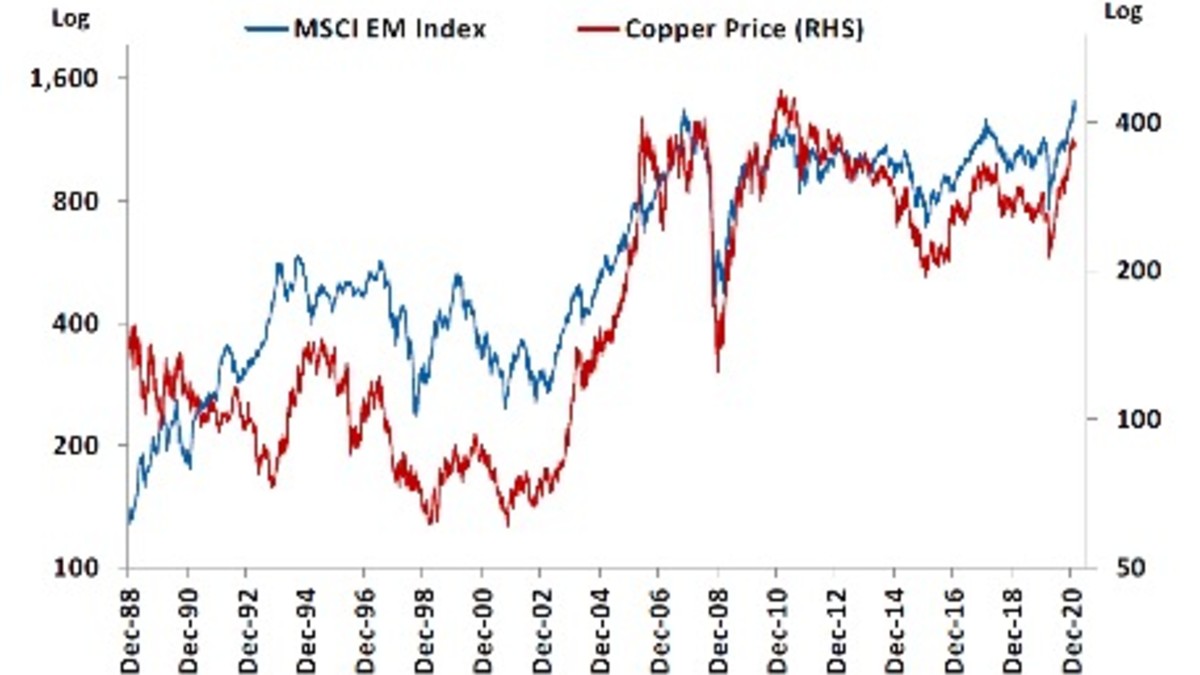

A final chart to look at is the correlation between MSCI Index and copper, both appear to be in an upward trajectory.

2020 in review

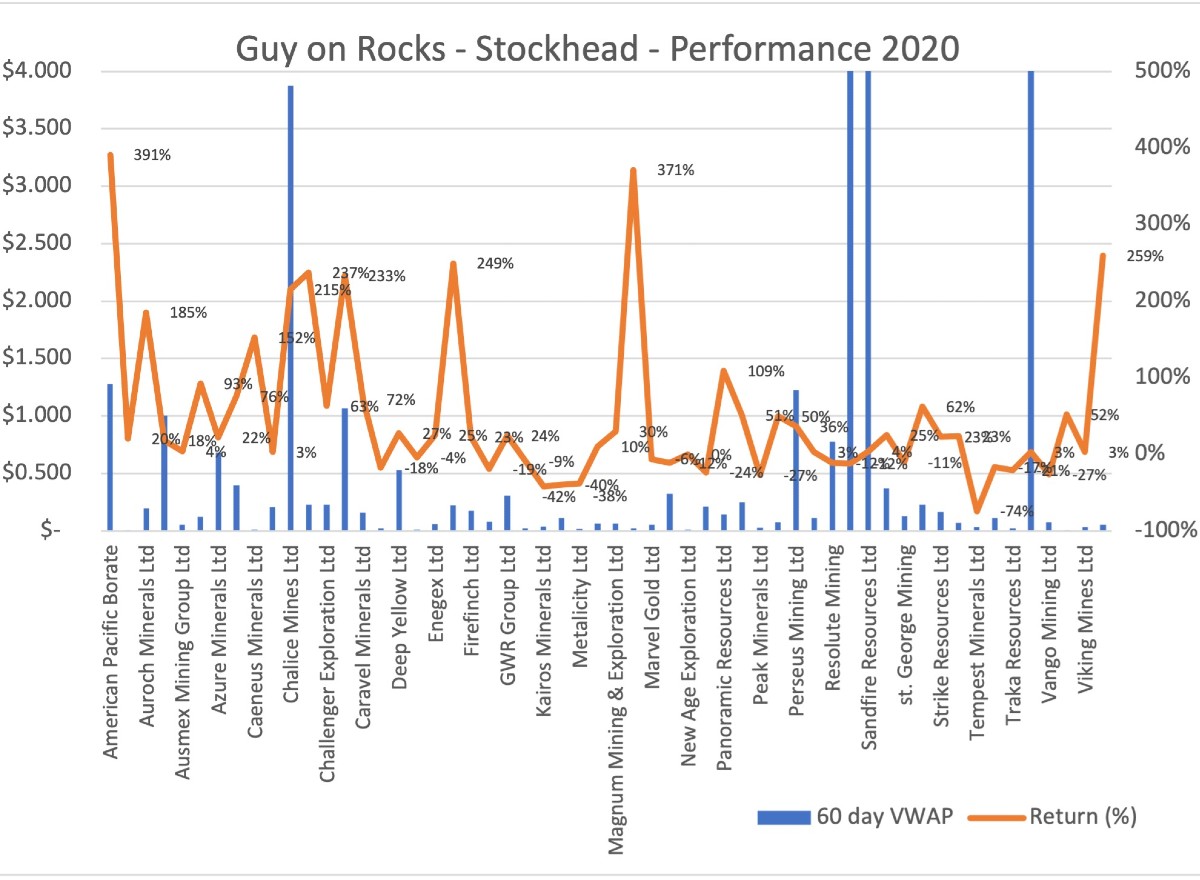

We had the wind in our sales last year, also helped by many stocks coming off low valuations. This is evidenced by figure 5 below which sets out the 2020 performance for Guy on Rocks featured companies that returned an average 57 per cent over 30 days and 51 per cent over 60 days (based on a volume weighted average price).

2021 will no doubt prove more challenging, however if metal price volatility continues then there should be some good opportunities among our favoured exposures such as nickel, copper, cobalt, REEs and uranium.

The recent surge has also brought lithium explorers/developers back in the spotlight with this second wave spurred on by green policies and surging EV demand.

Movers and shakers

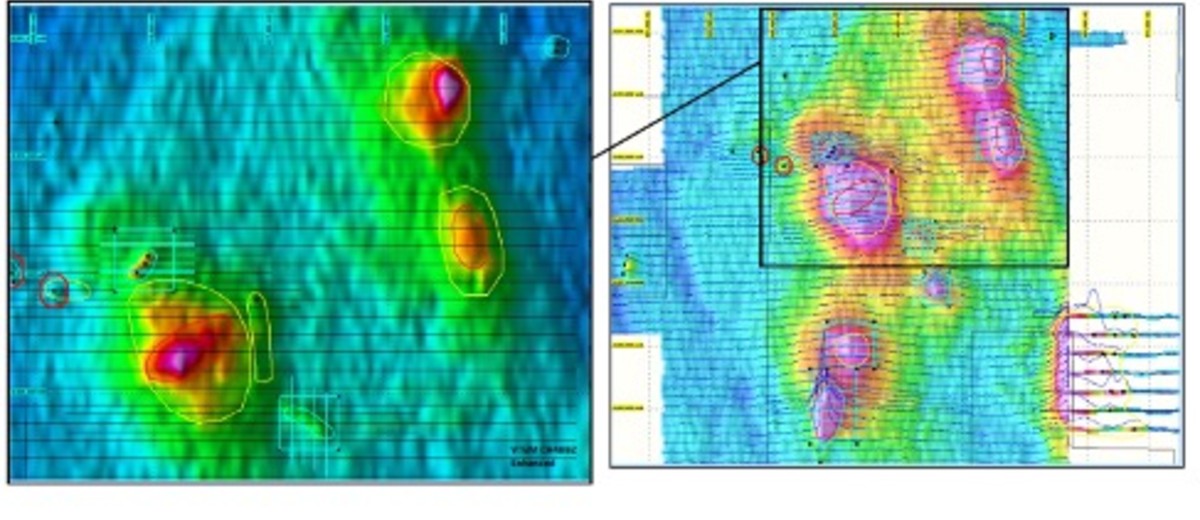

Blackstone Minerals (ASX:BSX) this week announced an intersection (figure 6) of 9.4m of sulphide mineralisation, including 1.18m of massive sulphide mineralisation, from its maiden drilling program at the King Snake prospect that was following up an EM target.

Looks like the Ta Khoa nickel project has plenty left in the tank and we await the assays with interest. Notably six of the first seven holes intersected massive sulphides along with associated disseminated sulphides.

Odyssey Gold (ASX:ODY) put out some impressive high-grade gold assays this week on previously un-assayed diamond drill core (2015) from its Tuckanarra Project.

These results confirm the potential for extensions of high-grade gold mineralisation at the Cable West prospect (15MTKDD001), which returned intercepts of 6m at 22.4 grams per tonne (g/t) gold from 34m and 1.7m at 13.4g/t gold from 59m suggesting mineralisation remains open down plunge.

Not much movement in the stock (7.2c), however ODY has been caught up in the downdraft of a declining gold price which will likely reverse in the medium term.

Hot stocks to watch

For many of you who followed Chalice Mines (ASX:CHN) last year you may wish to take a look at Aldoro Resources (ASX:ARN), which recently detailed some of its proposed induced polarisation survey targets anticipated to start in three to four weeks at the 100 per cent-owned Narndee nickel-copper-platinum group elements (PGE) project.

This includes a survey over five key targets (figure 9) that will hopefully explain the VTEM anomalism from earlier surveys ahead of drilling in the coming months.

It’s early days, but with only 66.9 million shares on issue and an enterprise value of $14.9m the stock isn’t necessarily cheap but is bound to respond to good news. The recent loyalty options issued (13 million exercisable at 30c) may put a short-term lid on the company under 30c, however any reasonable level of success will see this as a minor road bump.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.