Guy on Rocks: Nickel’s back on top of the chart picks for 2021

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

Well, it’s the end of a volatile year on metals markets characterised by strong inflows into commodities from the height of the coronavirus pandemic in April 2020.

The exception of course was Brent oil, down 24 per cent over CY2020.

The big question for resources on the back of four years as the best performing sector on the ASX is: can it continue?

Based on what we are seeing in China with a supportive macro backdrop is, probably yes.

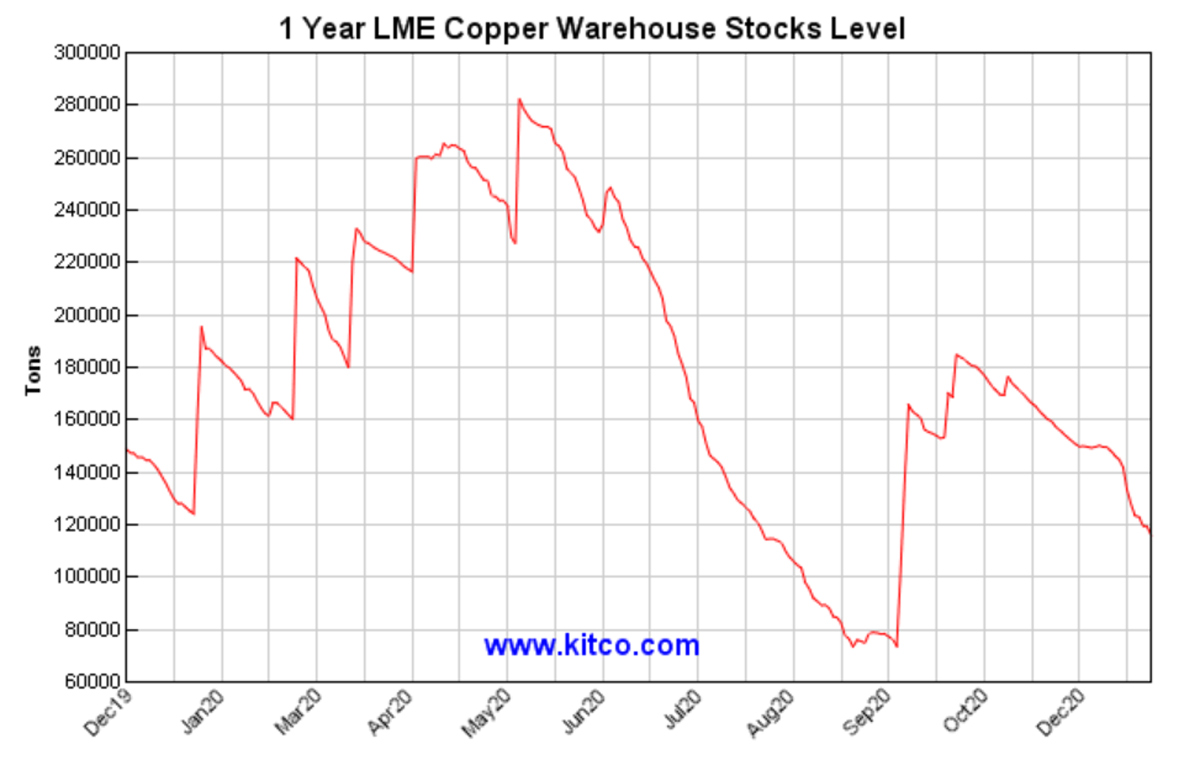

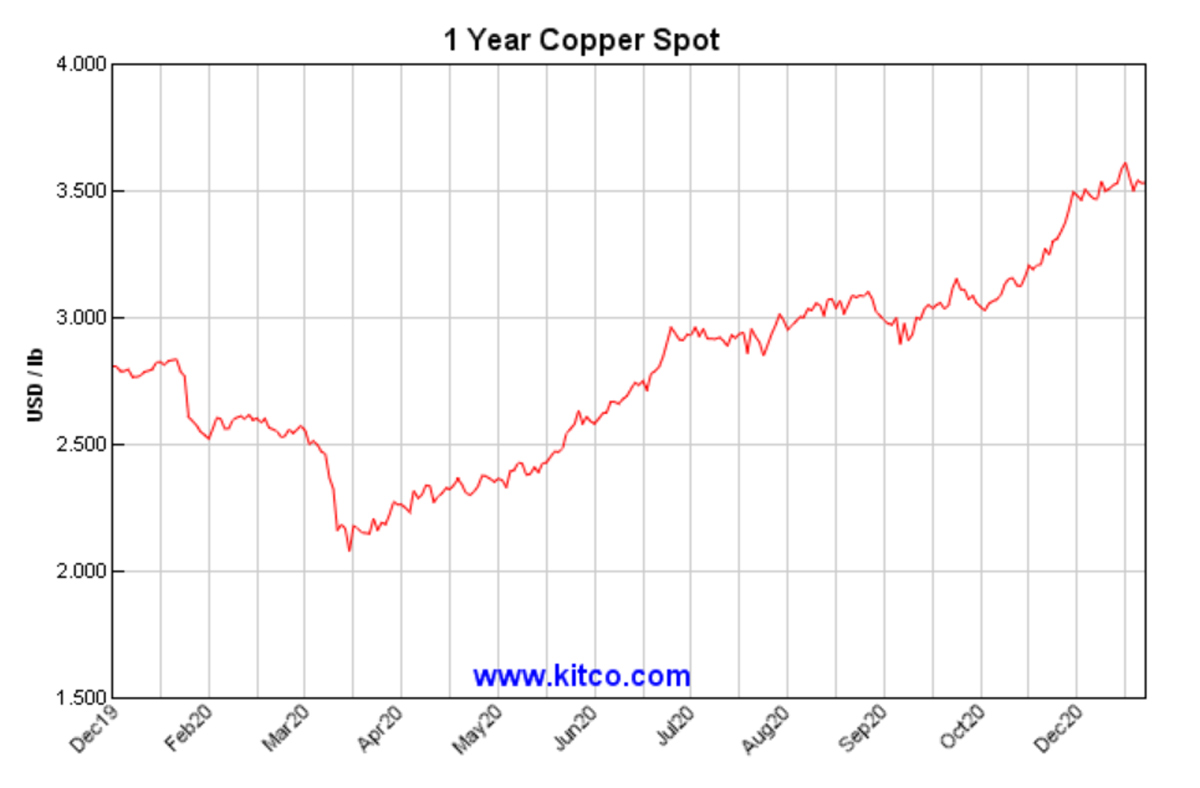

Copper has had a stellar year rising to just over $US3.5/lb and is certainly one to watch in 2021 with 1.2 per cent increase in consumption and just under 4 per cent increase in refined demand over 2021.

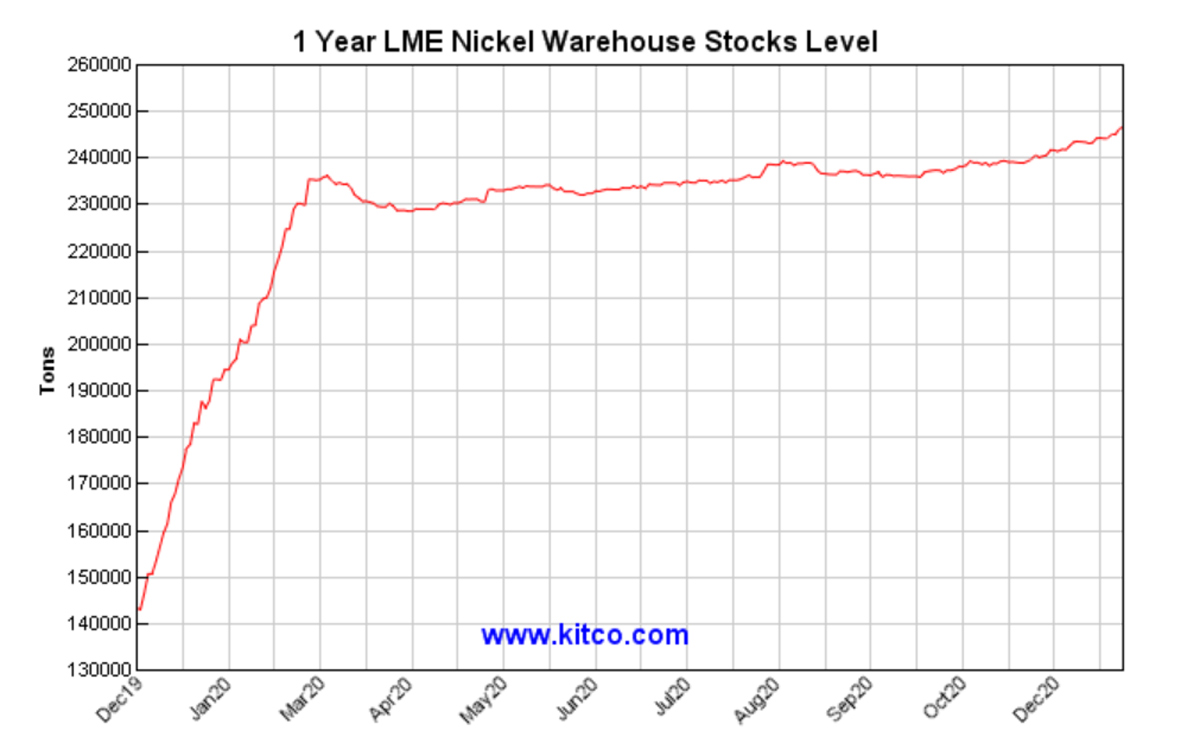

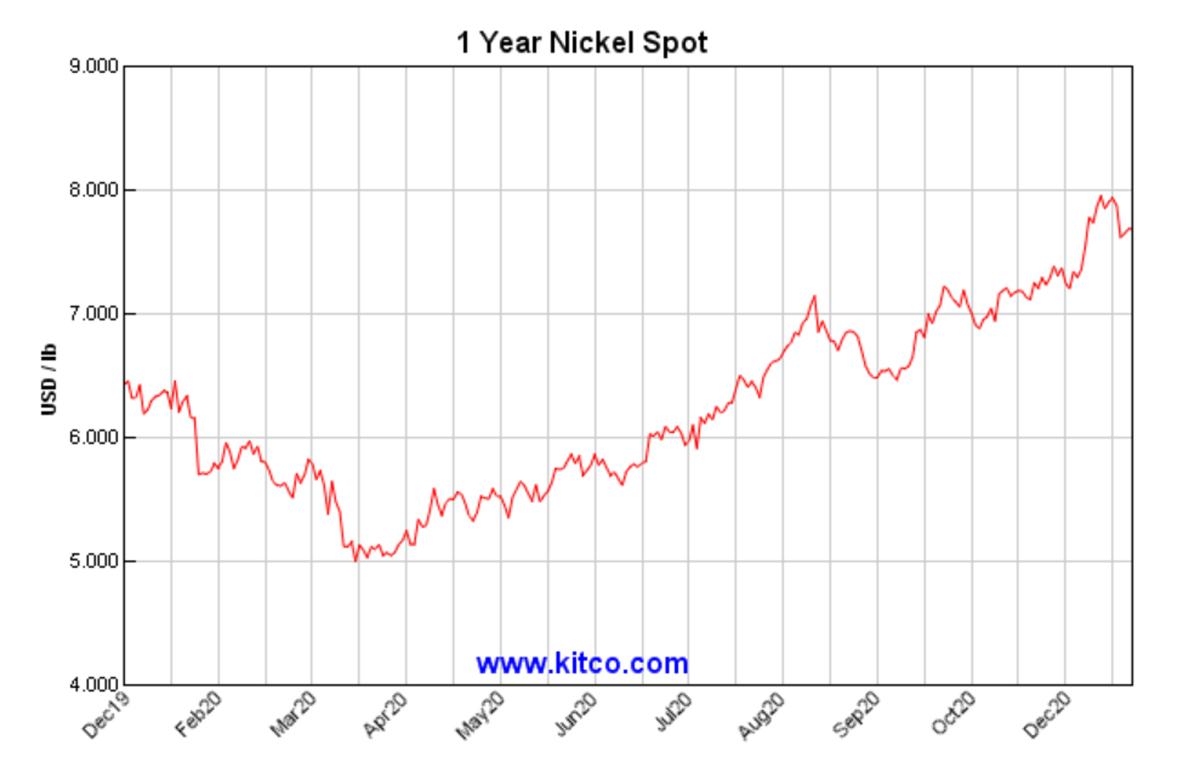

One of our other favourites for 2021 would have to be nickel recently touching $US8/lb.

The rise in nickel is on the back of destocking in China with producer margins still at a modest 5 per cent compared to zinc (+20 per cent) and copper (+30 per cent). With EV demand on the march, we anticipate sentiment to remain positive.

The bigger mover over CY2020 was clearly iron ore reaching $US163/tonne (62 per cent Fe) with iron ore developers and producers putting on an average of 183 per cent over CY 2020.

Iron ore was Australia’s standout export, contributing over $102bn over CY2020. Key drivers were production cuts by Vale and forecast production of 315-335 million tonnes for CY2021, rising steel demand in China with no new large-scale production on the horizon.

Everyone’s favourite, gold, also had a strong year with the valuations of Aussie gold miners peaking in October 2020. Producers/developers traded at 1.5x’s net asset value (NAV) followed by a pullback as gold failed to maintain $US2,000/oz.

While market premiums retreated in late CY2020 with the ASX:SGD index off 27 per cent from its August highs and support for gold above $US1,800/oz I can see value returning here across junior, mid cap and large cap producers/developers.

The junior iron ore sector has fired up with an impressive 246 per cent gain over CY2020 including several we mentioned over the year such as Venture Minerals (ASX:VMS), Fenix Resources (ASX:FEX), GWR Group (ASX:GWR) and Magnum Mining and Exploration (ASX:MGU).

ASX small cap iron ore stocks to December 23

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| LCY | Legacy Iron Ore | 0.048 | 200 | 586 | 2300 | $312.4M |

| FMG | Fortescue Metals Grp | 23.55 | 6 | 39 | 115 | $74.0M |

| MGX | Mount Gibson Iron | 0.935 | 5 | 27 | 1 | $1.1B |

| MIN | Mineral Resources. | 35.06 | 1 | 17 | 109 | $6.6B |

| AKO | Akora Resources | 0.34 | 0 | 0 | 0 | $18.6M |

| FEX | Fenix Resources Ltd | 0.24 | -1 | 70 | 428 | $105.6M |

| EUR | European Lithium Ltd | 0.047 | -4 | 12 | -37 | $34.1M |

| CIA | Champion Iron Ltd | 4.84 | -5 | 11 | 66 | $2.5B |

| MAG | Magmatic Resrce Ltd | 0.175 | -5 | -19 | -19 | $31.2M |

| SRK | Strike Resources | 0.145 | -6 | 21 | 209 | $35.8M |

| ADY | Admiralty Resources. | 0.012 | -8 | -25 | 50 | $13.9M |

| TI1 | Tombador Iron | 0.056 | -11 | 22 | 166 | $39.9M |

| MGT | Magnetite Mines | 0.012 | -14 | 9 | 221 | $34.3M |

2021 What’s hot?

We expect nickel, copper and zinc to fire up in 2021 with uranium (a viable source of clean energy) thrown in as a wildcard. Rare earths is expected to gain more traction as EV demand picks up. Political instability (spurred on by ETF buying) will drive gold, while supply constraints and rising steel demand will underpin iron ore.

Here is a sample of what to watch out for in 2021…

- Greenland Minerals (ASX: GGG): Potentially worlds’ largest REE project with NPB >$US2.0bn. Strategic location, Shenghe (shareholders) likely developer and mining license grant imminent.

- Fenix Resources (ASX: FEX): Project net present value (NPV) (8) approximately $430m (77 cents per share) and currently trading at 25c.

- Caeneus Minerals (ASX:CAD): Large landholding wrapping around the northwest of De Grey Mining (ASX:DEG). Drilling likely to commence April/May 2021.

- Paladin Energy (ASX: PDN): Restart of Langer Heinrich mine should provide excellent leverage to recovery in uranium prices.

- Tribune Resources (ASX:TBR): Value of cash, stockpiles, bullion and liquid investments over $7 per share! Resource growth in Ghana (projected to +3Moz) and Philippines (+1Moz) to drive growth outside of the East Kundana JV with Northern Star Resources (ASX:NST).

Next week

A review of our hits and misses over 2020. That is what we got wrong and what we got right!

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.