Guy on Rocks: Iron ore is on a tear and the juniors are making their move

Iron ore train on its way to port. Picture: Getty

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions…iron ore on a tear

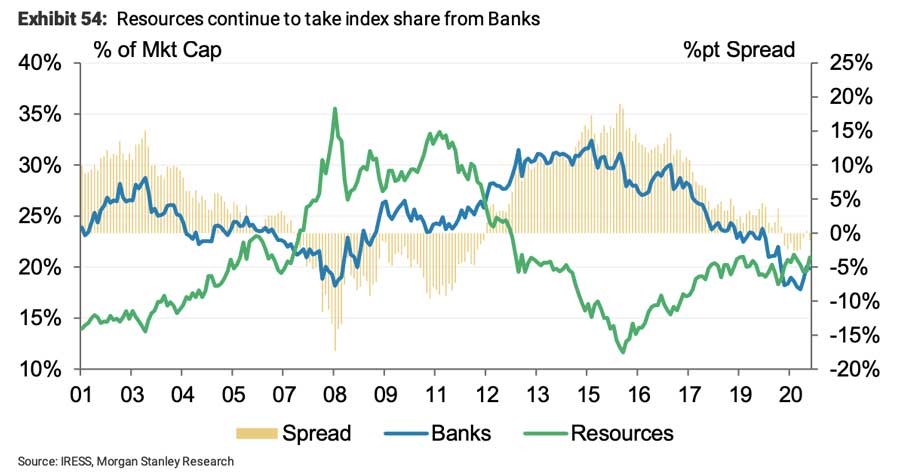

The ASX 200 was stronger in December, closing 1.21 per cent higher, with the ASX 200 Resources index returning 8.5 per cent compared to the ASX 200 Industrials index falling 0.6 per cent.

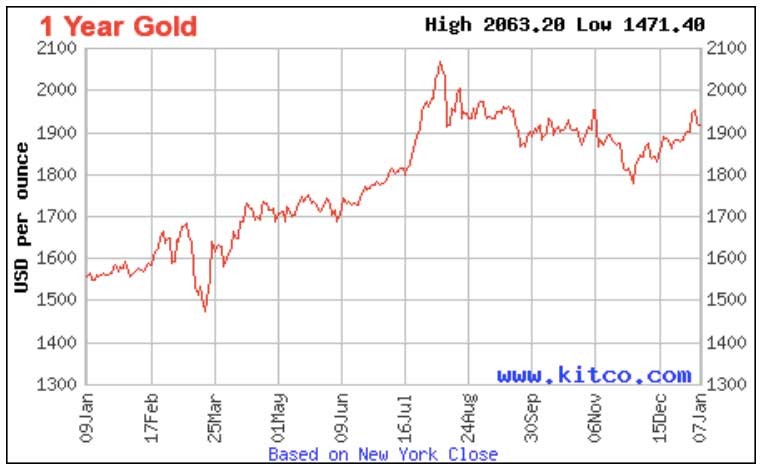

Gold took a hit on Friday as the US dollar strengthened and US yields surged in spite of weak US payroll data. However, I remain optimistic of the US dollar weakening further on the back of treasury bond issues over the remainder of 2021.

A key driver has been the recent US dollar weakness, hitting a fresh 33-month low while US yields surged higher, and a flow of funds back into risk assets. Stronger than expected US manufacturing data helped buoy yields and weighed on the US dollar.

2021 has started with a bang for iron ore again, surprising on the upside with 62 per cent fines trading at just under $US167 per tonne, edging closer to the record $US187 per tonne reached in February 2011.

Talk of an iron ore tariff is yet to materialise (seemingly a more important topic of discussion than the coronavirus in WA) and the surging share prices of BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG) are also pulling up the junior sector, which has risen on average 27 per cent since early December 2020.

Bloomberg reported last week that China’s Ministry of Industry and Information Technology was looking to source at least 45 per cent of its iron ore from Chinese controlled suppliers by 2025, an ambitious target by any measure given around 70 per cent of its iron ore is currently supplied by Australian and Brazilian producers.

I have serious doubt given that alternative sources are more likely to be sourced from countries such as Guinea, where Simandou was supposed to be in production by 2015 and is little advanced since then.

The recent expropriation of mining permits from the recently delisted Sundance Resources (Mbalam‐Nabeba iron ore project, straddling the border of Cameroon and the Republic of Congo) and Equatorial Resources’ (ASX:EQX) Bandondo project (Republic of Congo) are a sobering reminder of the sovereign risks faced in various African countries and why I believe supply, not demand issues, will feature more prominently in the medium term.

Overall, we are seeing good momentum for metals since early December 2020 (nickel $US8.10/lb — up $US1/lb, copper $US3.70/lb — up $US0.51, zinc $US1.29/lb — up $US0.09, and lead $US0.91/lb — up $US0.06) as risk-appetite continues to firm. Uranium (spot $US29/lb) with a looming supply shortage amid a scramble to meet 2050 renewable energy targets, and cobalt ($US35,000/tonne) remain the dark horses for the remainder of 2021.

Movers and shakers

Plenty of movement on some of our previous recommendations from 2020, with Greenland Minerals (ASX:GGG) touching 30c and enjoying some tailwinds from a resurgence in interest in rare earths with the company’s community consultation period due to wrap up in mid-April 2021 — the penultimate step ahead of the granting of a mining licence.

In December 2020 Traka Resources (ASX:TKL) commenced drilling in Ravensthorpe.

Fenix Resources (ASX:FEX) is due to begin shipping stockpiled ore from Geraldton in late January/early February and based on spot prices (discounting lump premiums) are on track for net cash flow in excess of $150m on a rolling 12 months (based on feasibility production rates). Given a fully diluted market capitalisation of $138m at 27c, there’s plenty of upside here.

Apollo Consolidated (ASX:AOP) is due to upgrade its JORC inferred and indicated resource (775,000oz of gold) at the Rebecca project on the back of results from a successful 15-hole reverse circulation drilling program announced in mid-December 2020.

On the M&A front Saracen Minerals Holdings (ASX:SAR) is due to vote on its $16bn merger with Northern Star Minerals (ASX:NST) on Friday 15th January 2021 which is set to transform gold production in Kalgoorlie.

Hot stocks to watch

With new sulphide nickel developments still relatively thin on the ground Centaurus Metals (ASX:CTM) is definitely one to keep an eye on. The company is due to update its JORC resource of 48 million tonnes at 1.08 per cent nickel (517,000 tonnes contained nickel) at the Jaguar project in Brazil ahead of completing a scoping study later in 2021.

Continuing on our uranium theme, Vimy Resources (ASX:VMY) has also come on to our radar with its Mulga Rocks project, one of the more advanced uranium projects in Australia with a completed definitive feasibility study (DFS).

The DFS estimates Mulga Rocks would produce 3.5Mlb/annum over a 15-year life on the back of a 42Mlb U3O8 reserve delivering a post-tax net present value of $US393m assuming a life of mine price of $US55/lb.

Vimy also holds the high-grade Alligator River uranium project in the Northern Territory, which hosts a JORC resource of 26Mlbs at 1.3 per cent U3O8. At a market capitalisation around $67m this company is well placed for any recovery in uranium markets, which — given the number of coal-fired electric cars on the road — is long overdue.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.