Guy on Rocks: I see red… metal supplies diminishing as Chile courts a leftie president

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

Copper closed at US$4.51 a pound, up 2c for the week (ironically with copper futures still looking flat) with China now selling base metals stocks to curb speculators and prices to end users.

A sea of red is flowing across the world’s largest copper producers such as Chile and Peru, with a tide of socialist change setting the scene for tax hikes, more stringent environmental laws ultimately and in my view, such measures will lead to a reduction in copper output.

Chile’s established political elite were soundly defeated by the left in the recent constitutional elections six months out from the all-important presidential elections in November this year.

Across two days of voting, Chileans cast votes for the 155 delegates who will write a new constitution to replace Augusto Pinochet’s 1980 document and the neo-liberal model it enshrined.

Sebastián Piñera’s Chile Vamos coalition fared poorly, securing only 37 seats in the assembly. The 155-member assembly, in line with the newly adopted gender parity laws, includes 47 independent candidates and 17 representing the country’s 10 indigenous groups, whose participation was guaranteed for the first time in Chile.

Peru’s presidential election favourite, the Marxist Pedro Castillo, is closing in on victory. He is an elementary school teacher by trade who is a strong advocate for poorer, rural Peruvians who has also pledged to nationalise the mining industry.

Chile and Peru account for just under 40 per cent of world production so we need to keep an eye on South American politics.

While the development of open pit mining in Chile in the early 1970s heralded the end of that super cycle, it appears politics may be steering us in the opposite direction.

Citi has calculated that based on effective tax rates in Chile of 80 per cent (which they consider unlikely), +US$6/lb copper would be required to deliver a 10 per cent internal rate of return (IRR). The current Chilean tax proposals are unfavourable compared to other mining jurisdictions.

Reviewing past cycles, Citi thinks there’s another three to six months before a scrap response could fill the gap between supply and end-use consumption.

However, unforeseen fluctuations in demand and loose cannons on deck such as Peru and Chile could change that equation.

Again, I am betting against the house and think that Citi’s copper price forecast will err on the conservative.

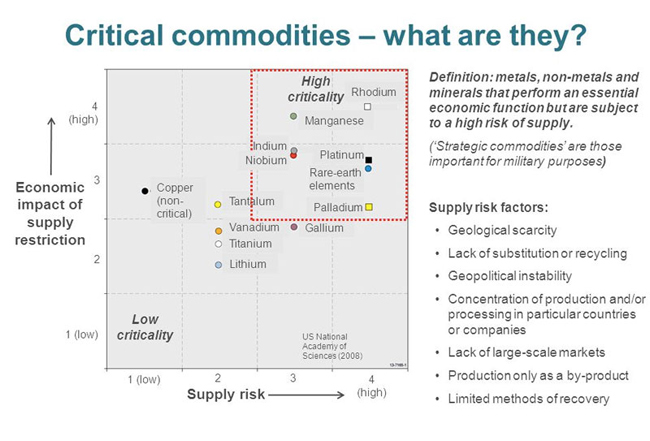

I think the bullish outlook for copper will be played out across a range of metals, notably the critical metals required to meet the US$51 trillion drive across the US and Chinese economies as the transition from fossil fuels to the electric economy unfolds.

In Europe a raw materials association has been formed, and in the US there is a policy now in place for the securing of a home-grown lithium supply.

Richard Adkerson, CEO and chairman of Freeport McMoRan, recently commented that if you double the price of copper, the world will see no new supply for five years!

There wasn’t much action in the precious metals, with gold finishing the week at US$1,877, down US$15, and silver closing up 13c to US$27.91/ounce.

Of note were gold ETF inflows of 61.3 tonnes over May, reversing three straight months of outflows.

Over the last 20 years the northern hemisphere period has generally been good for gold. With last weeks’ US inflation coming in at a whopping 5 per cent (inclusive of food and energy) I would have thought this would have given gold more of a lift

Movers and shakers

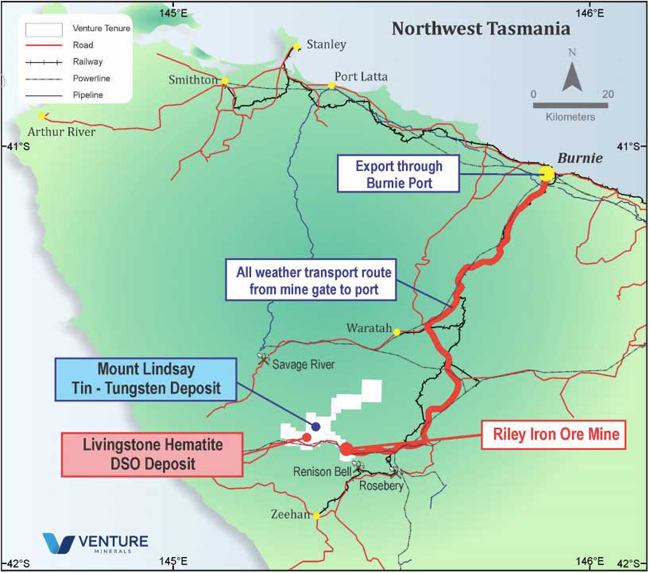

Venture Minerals (ASX:VMS) finished the week at 15c (figure 4) on heavy volume, probably attributable to news that it is about to start drilling at the Mount Lindsay tin-tungsten project in Tasmania (JORC resources of 13 million tonnes at 0.3 per cent tin and 0.2 per cent tungsten at a 0.45 per cent tin (equivalent) cut-off grade, along strike from the Renison Bell tin mine (figure 5).

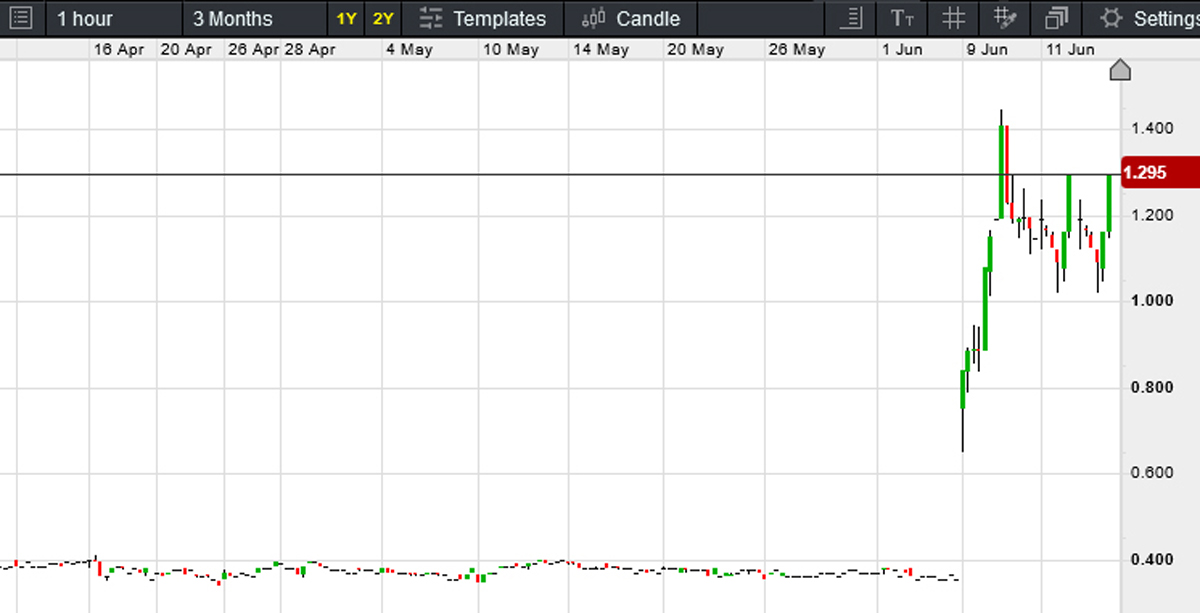

Undoubtedly the big news last week was the latest resources unicorn Coda Minerals (ASX:COD) closing at $1.295 on $3.2m of stock traded (figure 6).

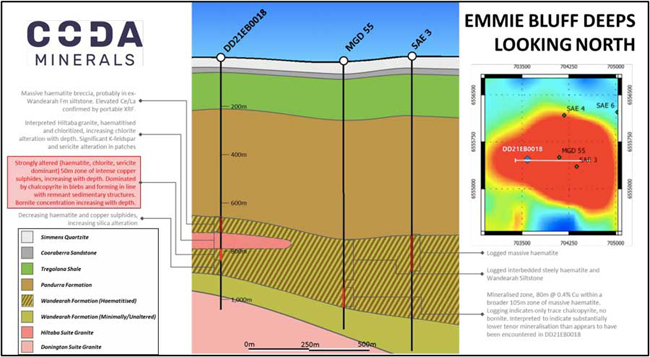

COD announced an intensely hematite altered (including chlorite, baryte, sericite, potassium feldspar) 200m intersection from DD21EB0018 at its 70 per cent-owned Elizabeth Creek project in South Australia (figure 7).

The intersection (figure 8) also included about 50m of copper mineralisation at the Emmie Bluffs Deeps prospect (including chalcocite, chalcopyrite and bornite), which is interpreted to be part of a larger intrusive oxide copper-gold (IOCG) system.

This is an encouraging alteration and mineral assemblage in the “boiling zone” that you are also likely to see at the nearby Oak Dam (BHP, 16km northeast) and Carrapateena projects (OZ Minerals, 50km east).

In the ASX release, chairman Keith Jones referred to “elephant country” (with the biggest elephant being the nearby Olympic Dam copper-gold-uranium project).

The mineralisation is quite deep (+600m, figure 8) with adjacent holes returning broad zones of copper mineralisation including 80m at 0.4 per cent copper. However, there was no record of chalcocite or bornite in these holes which are high-grade copper minerals often found high-up in the system and associated with supergene mineralisation that will hopefully boost the grade in this intersection.

In order to mine at this depth, I would prefer to see something in the order of 2-3 per cent copper equivalent, so let’s see what happens when the assays come in!

Hot stocks to watch

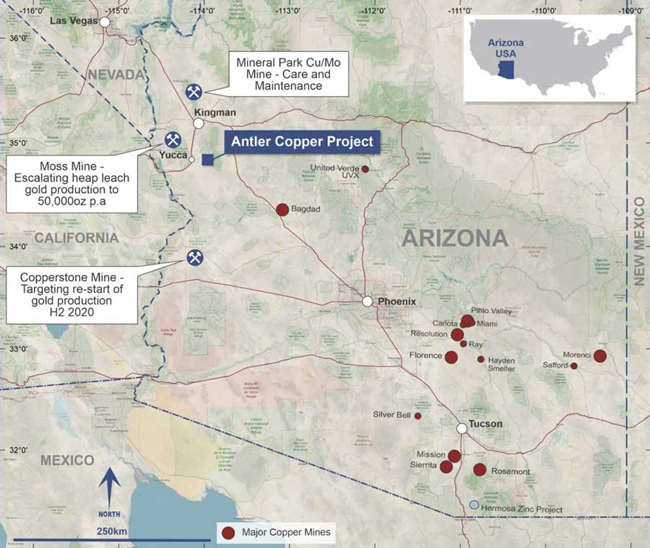

For those who believe in copper, you need look no further than New World Resources (ASX:NWC), an ASX-listed explorer-developer that has been publishing some impressive results from its high-grade Antler copper project in Arizona (United States).

The project (figure 10) produced around 70,000 tonnes of high-grade copper-zinc (5 per cent equivalent) between 1916 and 1970.

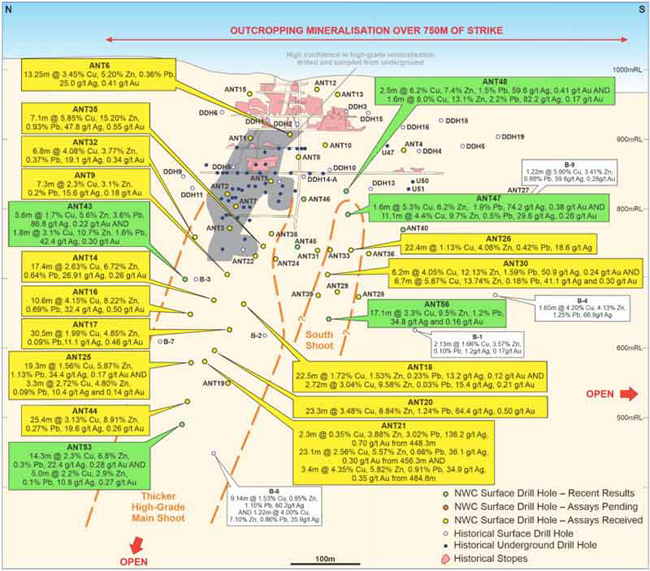

The project currently has a non-JORC resource of 4.7 million tonnes at ~3.4 per cent copper equivalent, with NWC having completed around 20,000m of drilling over the last 12 months.

Canaccord Genuity recently estimated a JORC resource target in the order of 7.25 million tonnes at 3.5 per cent copper equivalent, with results outstanding for a further 13 holes.

Such a resource, according to Canaccord may, subject to a positive mining study, be capable of supporting a 1-million-tonne per annum operation producing about 30,000 tonnes per annum copper equivalent over a six-year mine life at a US$160m CAPEX.

What I find encouraging (figure 11) is the increase in grades at depth and not surprisingly the market has reacted favourably (figure 9).

A JORC resource is due out sometime in July-August this year, so I am optimistic of a re-rating here. Based on its peer review, I think Canaccord’s valuation target of 30c (or $530m market capitalisation) is not unreasonable.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.