Guy on Rocks: Copper to receive an electric shock

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

For those looking to make big money in resources, playing the long game is the way to go and I am going to be talking about the demand for battery metals, which will present some interesting supply-demand dynamics across copper, nickel, silver, cobalt, platinum and palladium over the next 20-30 years.

This draws partly on some of the excellent work of Matt Watson from Precious Metals Commodity Management LLC.

While I am not 100 per cent convinced that electrification is the ultimate energy solution longer term, due to the case for uranium and the more recent emergence of hydrogen technology (although this is probably 10-20 years off due to storage and transport challenges) as viable alternatives, it is certainly going to play a big role in motor transport for the foreseeable future.

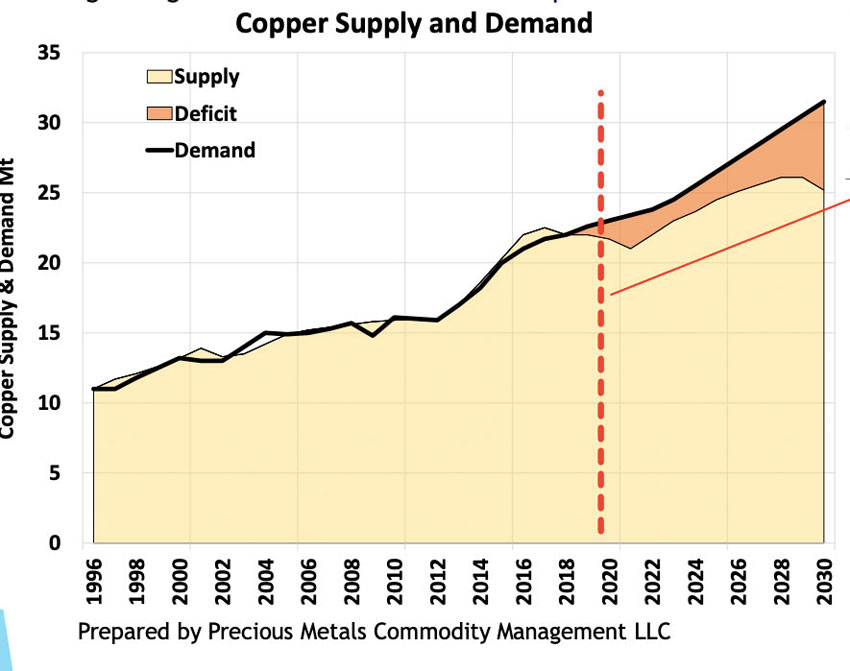

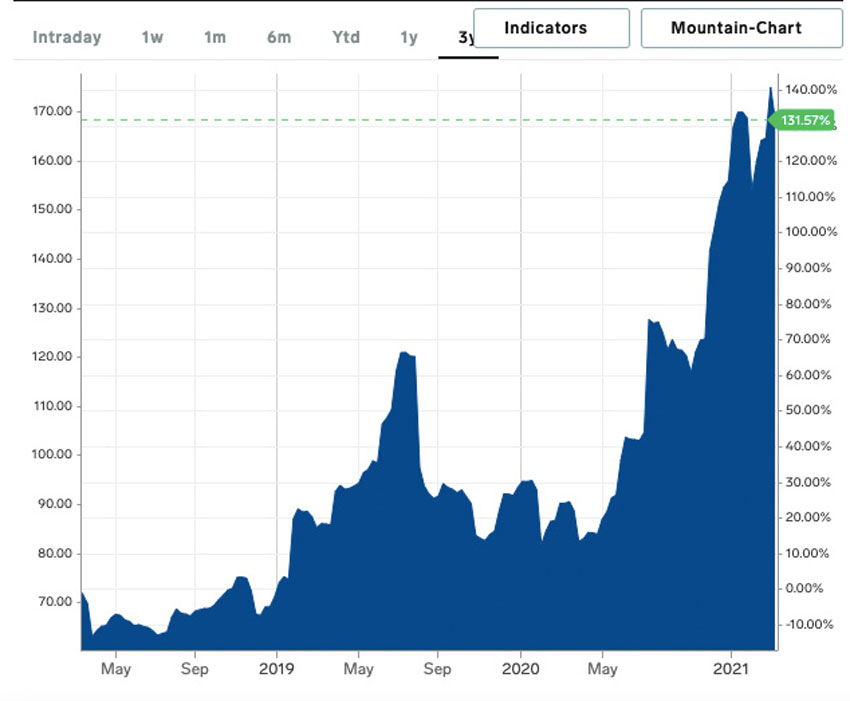

I thought copper (figure 1) would be a good place to start. There appears consensus (always concerns me when analysts agree on something) for a short-term spike over $US10,500 (Macquarie Resources, March 2021), attributable to shortages of copper scrap and an increase in global consumption.

Watson is projecting a 29-million-tonne (Mt) copper deficit over 2021-2030, with 1.2Mt of additional capacity required to keep up with growing EV demand.

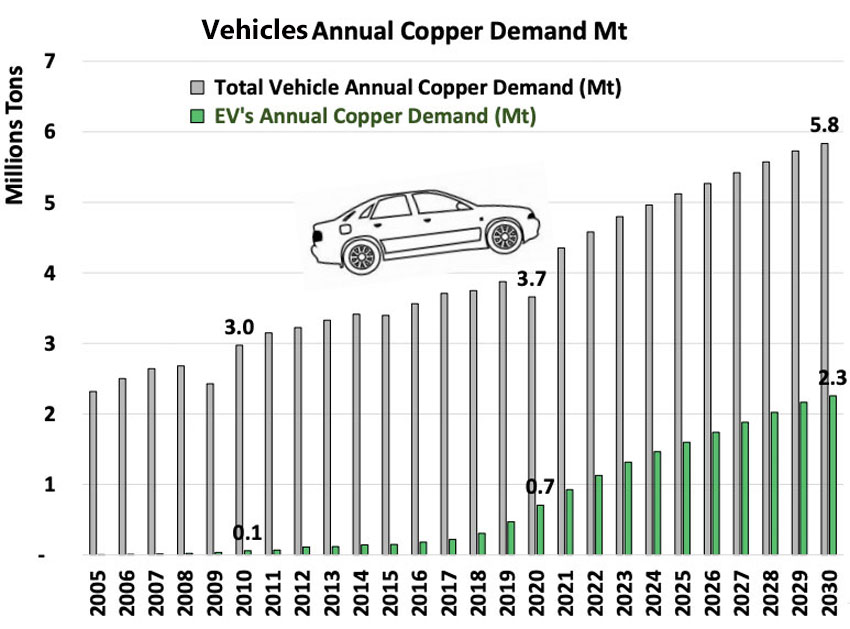

He is basing bullish copper forecasts (figure 2) (and other battery metals) on the electrification of “everything” from electric vehicles, 5G wireless networks, smart buildings/cities, heavy industries, consumer electronics, semi-conductors and the list goes on.

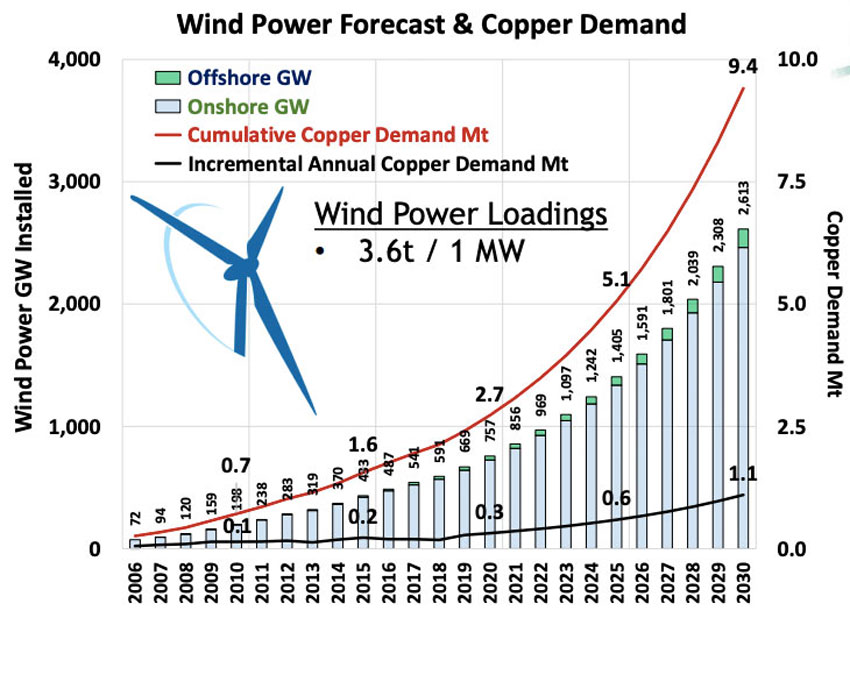

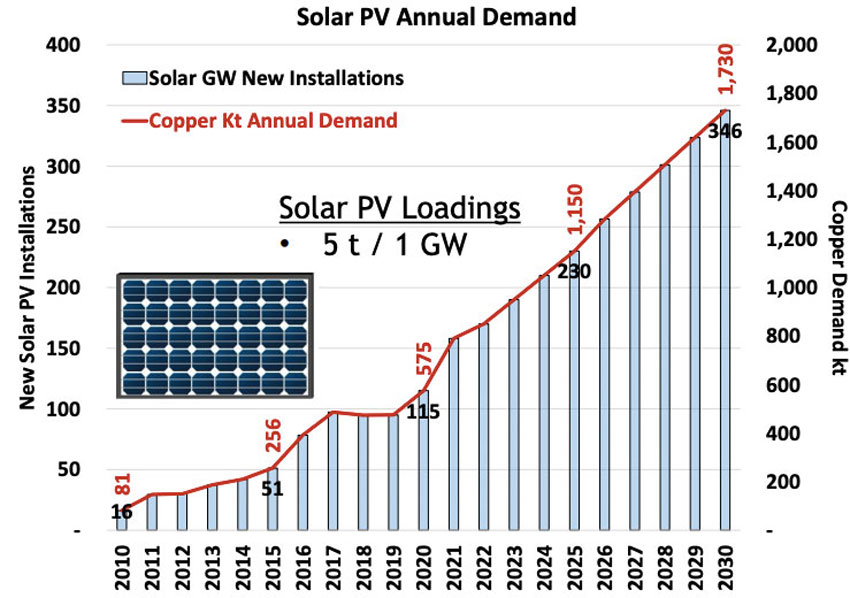

While 75 per cent of copper is currently used in industrial equipment, electrical power and power distribution, the rising use in EVs, wind and solar, as figures 3-5 demonstrate, are set to change the copper landscape for the longer term.

Iron ore prices (figure 6) finished the week around $US171/tonne (62 per cent fines) with shipments from Australian majors off 4 per cent week-on-week, and Brazilian miner Vale down 18 per cent week-on-week.

Chinese Tanshan is looking to cut steel emissions 0.3-0.2 per cent this year (according to Morgan Stanley’s analyst Rachel Zhang) potentially placing the iron ore market back into surplus with a potential steel reduction of around 60Mt (1,430Mt annualised).

This could see a previously projected 40Mt iron ore deficit back in balance. Again, China will have to trade off between economic growth and emission reductions. So, I will let the reader decide which objective will prevail.

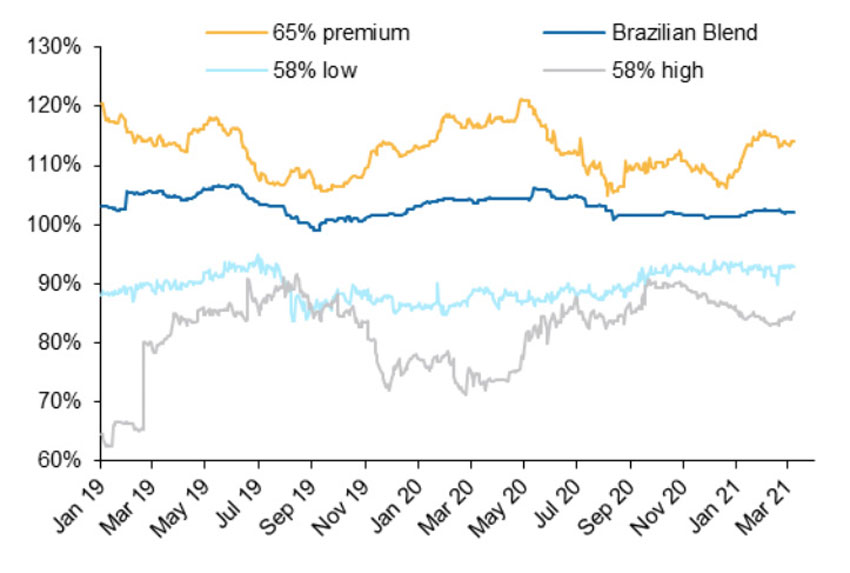

While there is a case for a reduction in the 62 per cent benchmark for iron ore, there is an equally strong case for rising premiums for pellets, lump and high-grade ore (figure 7), as these products reduce the need for sintering (polluting) activity and reduce the reliance on coke consumption.

That’s good news for some of our emerging junior producers such as Strike Resources (ASX:SRK), GWR Group (ASX:GWR) and Fenix Resources (ASX:FEX), which all have a reasonable component of high-grade and lump in their resource inventory.

Movers and shakers

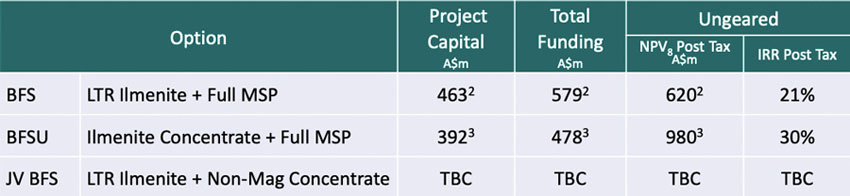

It has been a long journey for the Thunderbird mineral sands project (situated half-way between Broome and Derby) owned by developer Sheffield Resources (ASX:SFX) and led by mining veteran Bruce McFadzean.

The company announced on Friday that FIRB approval had been received, allowing China’s Yansteel to take a 50 per cent interest in the $478m project and receive an offtake deal on 100 per cent of ilmenite production.

The project is projected (2019 BFS) to produce about 500,000 tonnes per annum of titanium dioxide over a 30- year mine-life.

Yansteel is contributing $130m which, subject to the delivery of a positive feasibility study in late CY 2021, should see stage-one of the project receive the green light. This stage contemplates a 10.4Mt per annum mine and process plant producing a zircon rich non-magnetic concentrate and LTR ilmenite (56-58 per cent TiO2).

Project funding is further supported by loans for $95m from the Northern Australia Infrastructure Facility (federal government) and debt from Taurus Funds Management.

We mentioned SFX in mid-August last year when the company was trading around 30c and it looks like after a long wait, Thunderbirds really are go!

With an enterprise value around $135m and an ungeared project net present value of over $620m (table 1) there is plenty of head room left here. Or as Lady Penelope would say “Parker, I’d like to take a little ride”.

Hot stocks to watch

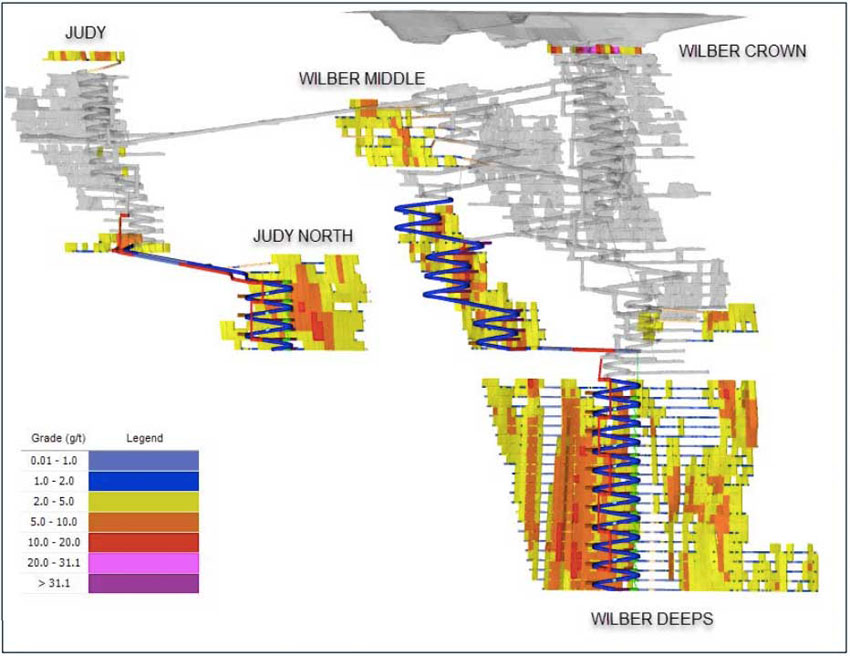

Latitude Consolidated (ASX:LCD) announced mid-February the completion of the acquisition of Andy Well and Gnaweeda gold projects from Silver Lake Resources (ASX:SLR), covering a combined 343sqkm in the Murchison Gold Fields in Western Australia.

Resources total 776,000oz of gold at 4 grams per tonne (g/t), with drilling commencing next month on a number of promising targets including:

- Wilber – open at depth (JORC Resource of 788,000t at 12.2g/t for 308,000oz)

- Judy – open to the north and at depth (JORC Resource of 678,000t at 6.4g/t for 141,000oz)

- Suzie – open to the north and at depth (JORC Resource of 351,000t at 4.8g/t for 54,000oz)

The company is working towards completion of a scoping study that would include open pit and underground ore sourced from both Andy Well (505,000oz resource) and the Turnberry open pit (271,000oz resource), with treatment options looking at both toll milling and Andy Well mill recommissioning options.

The restructured board (including Paul Adams — ex-Spectrum Metals’ Penny’s Find gold project) has plenty of technical skills and experience to pull this one off.

With an enterprise value (EV) around $21m (equating to an EV/oz of gold of just under $30/oz), about $10m in cash and plenty of news flow from drilling at Andy Well (figure 10), LCD is one to put on the radar.

Possibly a little overhang from the recent 2c placement by stockbroker Shaw and Partners, however it appears that these shares didn’t go to the lowest common denominators (LCDs), so the price (figure 10) is holding up well.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.