Guy on Rocks: Cobalt looking to break through $US50,000/tonne any day now

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions: Lump and pellet margins widening; copper to test $US9,00

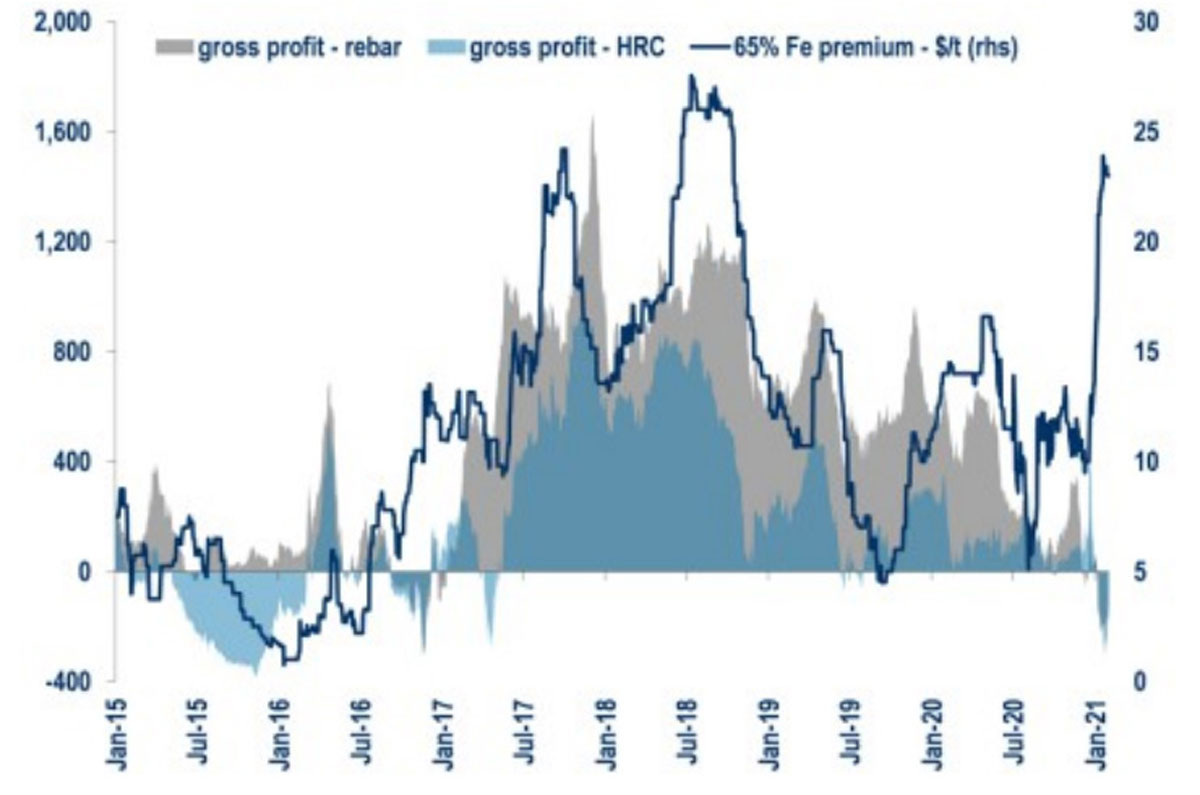

Despite diminishing steel margins, the 65 per cent iron ore fines premium has widened to 15 per cent ($24/t), from 6 per cent ($10/t) in late 2020 (figure 1).

Supplies of both lump and pellets have been tight with seasonal sintering restrictions in China supporting direct charge products. Shrinking margins would historically have seen a preference for lower grade iron ore, however the high coke and metallurgical coal prices have steered mills towards higher-grade iron ore while reducing coke consumption.

With spot coke prices at $US490/t, Morgan Stanley (2021) estimates that using 65 per cent instead of 62 per cent iron ore would save just $5/t on coke costs.

Cyclone season in the Pilbara together with supply concerns from Vale’s high-grade Carajas mine have helped to maintain the current level of spread. It remains to be seen whether China’s goal of limiting steel output by tightening restrictions on new capacity could impact overall iron ore consumption.

(Source: Morgan Stanley Research, 15-2-2021)

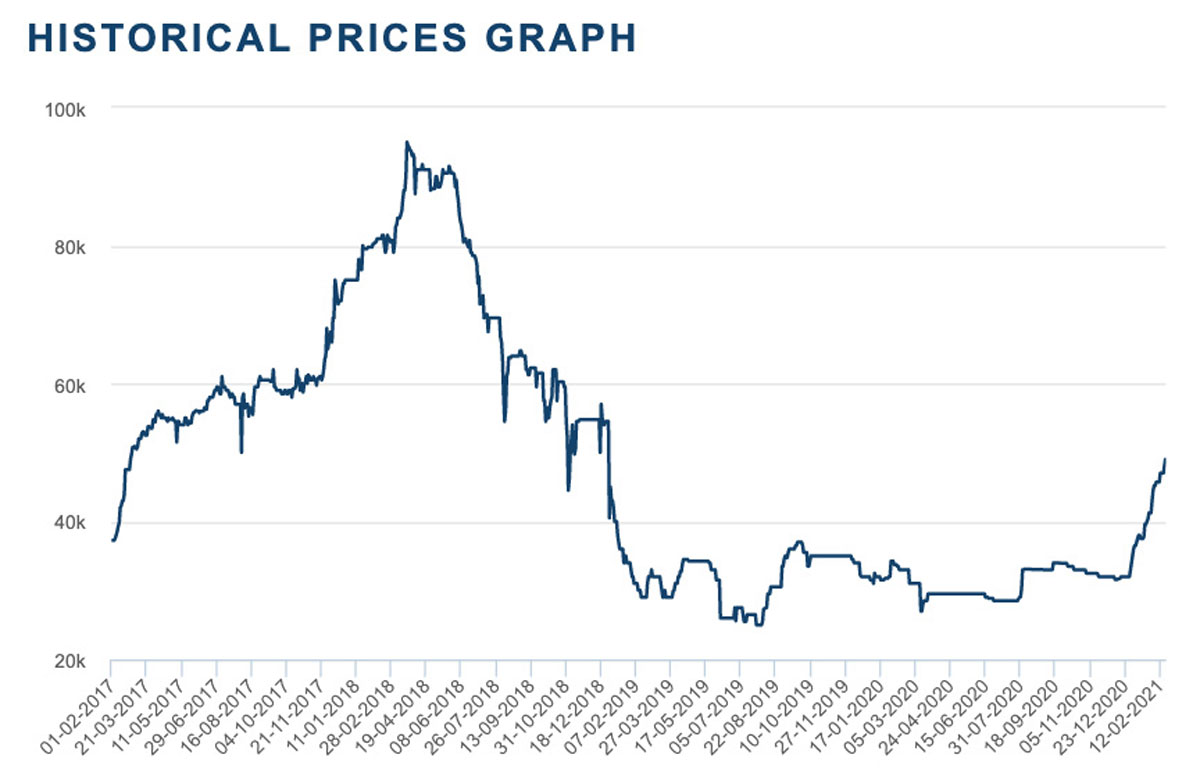

A projected 2021 copper deficit (>500,000 tonnes in late CY 2021) appears to be underpinning higher copper prices (figure 2), which are now trading at over $US8,800/tonne with $US9,000 (and probably $US10,000 later in CY 2021) well in sight.

The world’s drive towards decarbonisation is also another key driver for copper, underpinned by recovering global growth. Inventories are now a mere 1.5 weeks’ consumption.

In addition, the marginal cost of Chinese NPI remains high at around $US17,000/t. Supply side pressure could also emerge from New Caledonia, which supplies 40,000t in ore and ~100,000t refined/intermediate supply.

Gold appears to have suffered (at $US1,786, down US$87 over the last month) from strong gains across world indices providing a sense of optimism, which is understandably benefiting base metals. Battery metals have been the biggest beneficiary of course with the stellar rise in lithium a prime example.

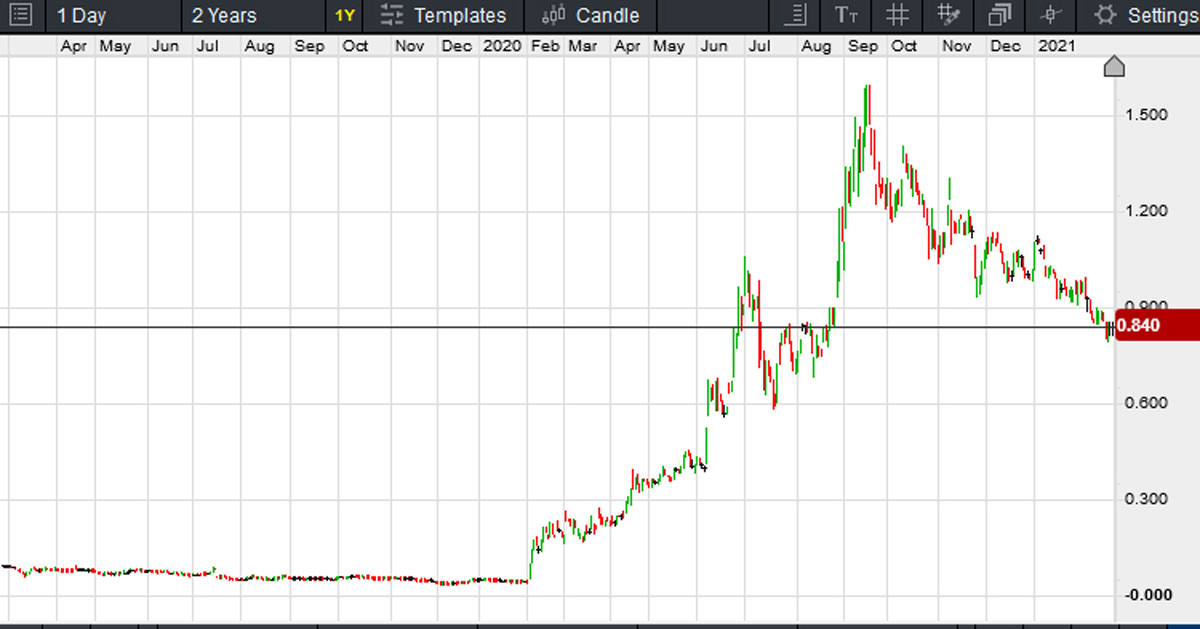

Again, keep an eye on cobalt (figure 4) which is looking to break through $US50,000/tonne any day now.

Movers and shakers: Lessons in mineral valuation

An enthusiastic gathering at the RIU conference in Fremantle saw over 100 exhibitors, all with fairly bullish plans for 2021.

Many of the companies mentioned in this column over the last 12 months featured prominently – Chalice Mining (ASX:CHN), De Grey Mining (ASX:DEG), Estrella Resources (ASX:ESR), Blackstone Minerals (ASX:BSX), Poseidon Nickel (ASX:POS), Venture Minerals (ASX:VMS), Apollo Consolidated (ASX:AOP) and Vimy Resources (ASX:VMY).

I can’t say I identified too many new undervalued stand-out buys but suffice to say the aforementioned companies are forging ahead at a cracking pace.

The pull back in gold mining valuations (particular in the gold space) and an anticipated recovery (my theory) should present some interesting buying opportunities.

De Grey’s market capitalisation (figure 5) has come off from around $1.8bn to $1.1bn (enterprise value of $1bn), which would still imply some fairly compelling project economics to justify.

I notice Argonaut’s research note (15 January 2021) is valuing De Grey’s exploration acreage at over $300m, which at $50/oz would imply the potential for a further 6 million oz of gold (my calculations) over and above the 3.7 million oz JORC Resource (anticipated) at Mallina.

Anyway, a fantastic discovery that has plenty of room to grow and if the valuation is still a little high, well this is a problem everyone would like to have!

We also got a lesson in mineral valuations with the release of an excellent set of stage-one feasibility numbers (ASX Announcement, 18 February 2021) from Bellevue Gold (ASX:BGL).

The study showed a pre-tax NPV of around $900m (post tax circa $600m or thereabouts) at an all-in sustaining cost (AISC) of a very respectable $1,079/ounce of gold.

The presentation is well worth a read, however the shares came off from over $1 to around 72c, equating to a market capitalisation of $612m (down from $850 million) — i.e. equal to the post tax NPV of stage 1.

Note this author did his honours project on the old Bellevue mine (Spargos Mining NL) back in the late 1980s and clearly missed the mother lode, so if readers are sensing sour grapes, I’m not going to argue with you.

So are the shares fair value? Getting close but don’t ask me because I failed at the first hurdle.

Hot stocks to watch

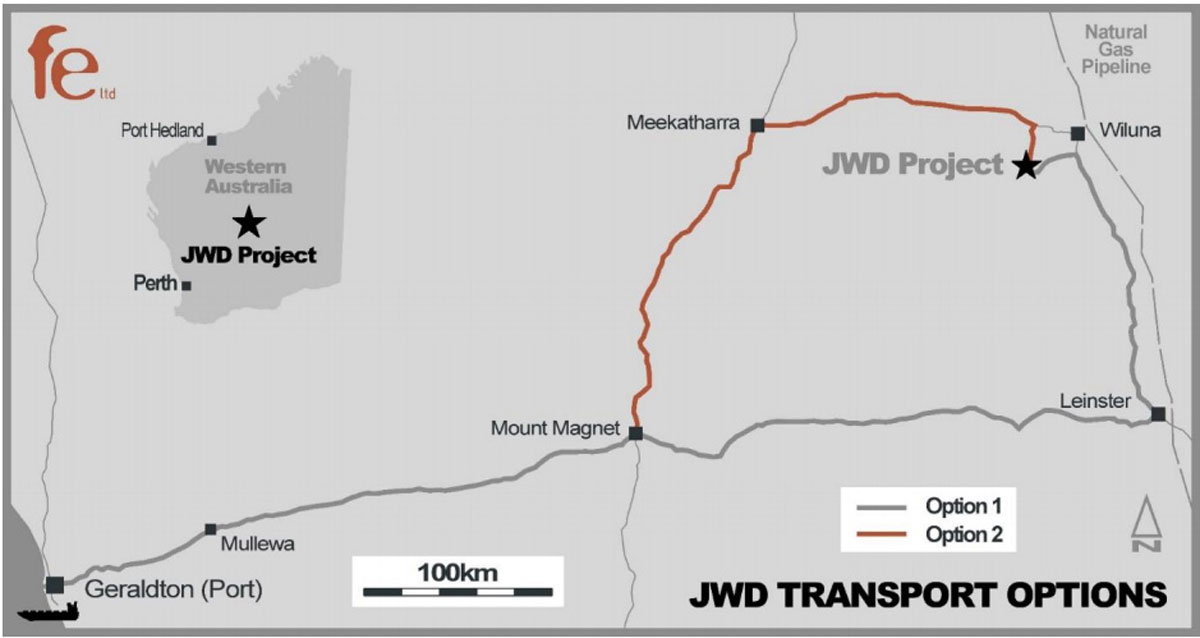

Fe Limited (ASX:FEL) is another aspiring producer (figure 6) looking to benefit from surging iron ore prices. The company has an enterprise value of around $20m and a 51 per cent interest in the Gold Valley Iron Ore Mining Rights Agreement over the Wiluna West JWD deposit — part of GWR Group’s (ASX:GWR) Wiluna West project — with a JORC indicated resource of 10.7 million tonnes at 63.7 per cent iron ore.

The first shipment (figure 7) is due in September 2021.

The development plan is set out as follows:

Stage 1: Test pit, right to extract up to 300,000t, with FEL targeting commencement of mining Q1 2021.

Stage 2: Up to further 2.7 million tonnes to be extracted if economic to do so upon payment of option fee of $4.25m.

Stage 3: FEL has option to continue to mine any remaining economically recoverable JWD tonnes subject to payment of $3.50/t of iron ore.

The approval process appears on track for production in the September quarter this year, so assuming the iron ore price holds up, the project looks like it has a real chance.

The key will no doubt be transport costs, which given the 700km or so will be up around at least $60-$65/tonne (my estimate).

However, levering off GWR’s infrastructure should lessen the costs. Mind you $223/tonne iron ore (assuming no lump premium) leaves plenty of room to absorb the high transport costs.

Like Fenix Resources (ASX:FEX), GWR Group and Strike Resources (ASX:SRK), these sorts of remote, high-grade plays rely on high iron ore prices which are notoriously difficult to forecast. So, it’s anyone’s guess where they are going to end up, but assuming you have access to port space and decent grade ore, the numbers are more than compelling.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.