Guy on Rocks: Bitcoin is winning the battle against gold… but for how long?

Pic: Tyler Stableford / Stone via Getty Images

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

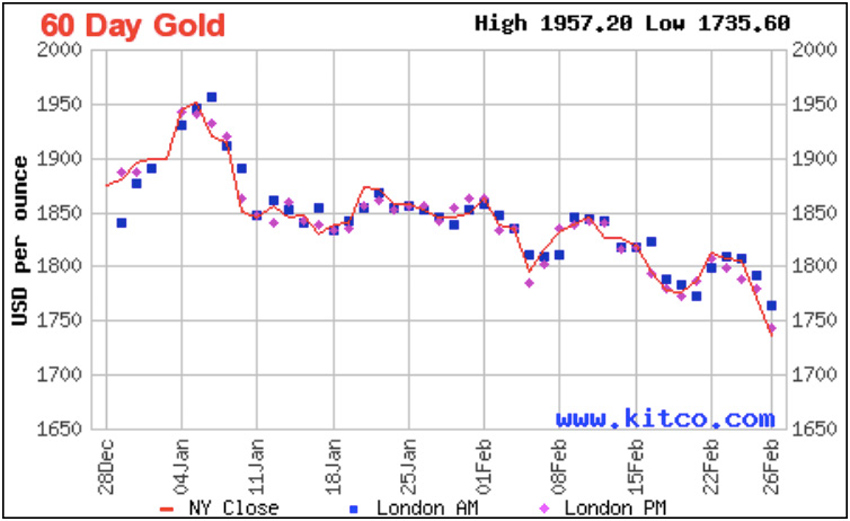

Bitcoin (up 57 per cent in CY2021 – figure 1) appears to be winning the battle against gold (down 11 per cent CY2021 – figure 2). Figure 3 is showing strong exchange traded funds (ETF) outflows over the last few months with figure 4 showing a negative 30 per cent year-to-date (YTD) correlation with gold bullion holdings.

Chinese demand for copper has remained strong just after Chinese New Year, with Shanghai Futures Exchange copper and nickel open interest advances of 220,000 tonnes and 58,000 tonnes respectively within two days, resulting in 9.3 per cent and 7.5 per cent price increases.

While the Bitcoin rally, fuelled by Wall Street institutional participation, corporate interest and retail interest (not to mention Tesla’s $US1.5bn purchase) appears to be moderating, it will be interesting to see if the fortunes of gold are due to reverse its recent trend (figure 4).

Inflation is yet to put the brakes on the broader economy; however, mining companies appear to be in the midst of rising input costs. Notably Citi’s Mining Cost Index is pointing to a +30 per cent year-on-year cost inflation (highest since 1975), which is not surprising given the reliance on steel rubber and diesel.

It’s a good reason to stay with higher-grade, lower-cost operations providing a buffer to rising costs. I note there are many “mid-range” deposits coming across my desk of modest grade and tonnage that are looking good in the current period of high metal prices, however higher-grade, better quality deposits provide more headroom when the cycle swings in a downward direction.

On a final note, our quiet achiever cobalt has just broken through $US50,000 a tonne.

Movers and shakers

Traka Resources (ASX:TKL) released some results from drilling at its Ravensthorpe project that showed some reasonable grades but narrow widths.

Altogether a little under-whelming but early days, and hopefully with neighbouring gold developer Medallion Metals’ $12.5m IPO back on the cards (fully underwritten by Argonaut Capital), Traka can hit some decent grades and widths.

There is a lot of chatter about Estrella Resources (ASX:ESR), which will be conducting a field trip next Friday (5 March 2021) ,with plenty of interest in the company’s electromagnetic survey and step-out diamond drilling program at Carr Boyd, where T5 recently intersected massive sulphide mineralisation.

Greenland Minerals (ASX:GGG) put out a clarifying statement (ASX Announcement 16/2/2021) on the approval process and evolving political situation in Nuuk (Greenland), which is due for another round of elections mid-year.

There is some uncertainty as to the intent of various political parties’ commitment in respect to their ongoing support of the mining licence approval process at Kvanefjeld (11.1 million tonnes of rare earth oxide, 593 million pounds U3O8).

Mixed messages have seen the share price retreat from around 33c to 15c at the time of writing.

Given Denmark is supporting Greenland with approximately $US700m per annum, I would have thought there would be a desire to see Greenland stand on its own two feet (or four feet if you are a polar bear) by bringing a world class REE-U mine on-line that complies with stringent environmental conditions.

Blackstone Resources (ASX:BSX) has taken the advice of its Chinese philosopher Ti-Ming, who suggested finding a large nickel-sulphide deposit in a rising nickel market.

From the company’s latest announcement (25 February 2021 – figure 6) it looks like the Taipan Discovery Zone intersected 39.7m of disseminated sulphide, semi-massive sulphide vein and massive sulphide vein from 15.15m downhole, following up another untested anomaly at the Ta Cuong prospect (Vietnam), based on surface mapping and electromagnetic conductors.

Follow-up drilling is being planned and the timing on building a JORC resource inventory sufficient to turn on their 450,000-tonne-per-annum concentrator looks encouraging. It looks like the market also approved (figure 7).

Hot stocks to watch: Graphite back in favour

Unfortunately the coronavirus, among other factors, appears to have slowed down the financing of Triton Minerals (ASX:TON) Ancuabe project in Mozambique.

While graphite has been out of the headlines for a few years, the rising price — up over 6 per cent in December 2020 (tracking the rise in lithium) — has peaked interest along with some real demand pull from the battery market.

There is a lot to like about this project (figure 9) — high-purity, large flake graphite (JORC Resources of 24.9 million tonnes at 6.2 per cent total graphitic carbon) and excellent logistics in a proven graphite region (Cabo Degado, north-eastern Mozambique).

The 2017 bankable feasibility study returned an unlevered pre-tax net present value of around $US300m based on annualised production of 60,000 tonnes of graphite over a 27 year mine-life.

Triton’s largest shareholder, Jigao International Investment Development Co. Ltd (a subsidiary of Jinan Hi Tech), is engaged in arranging finance/offtake.

We will have more to say about Triton down the track, however it is worth putting on the radar with a market capitalisation of around $60m and with a looming graphite supply shortfall the timing could be right for a re-rating.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.