GTI wraps up sampling ahead of first gold drilling at Niagara

GTI has completed an expanded auger soil sampling program at its Niagara gold project Pic: Getty

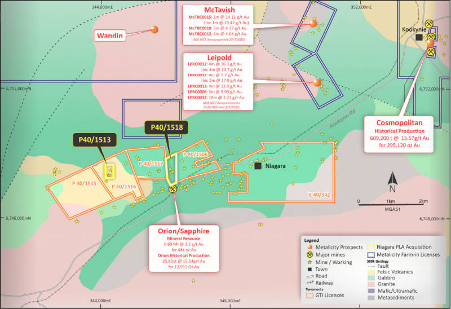

Special Report: GTI has completed an expanded sampling program and is now gearing up for its first drilling campaign at the Niagara gold project near Kookynie, Western Australia.

Results from 1,000 hole auger soil sampling program, which is intended to refine and extend previously defined multi-element anomalies, are due in two weeks.

GTI Resources (ASX:GTR) said the structural trend at Niagara has been confirmed through surface expressions and historical workings.

Work is currently underway on integrating historical data, field observations, newly acquired geophysics and geochemistry, to develop a lithogeochemical and exploration targeting model.

“We look forward to combining these results with the existing data sets to help us target the first drilling campaign of about 50 aircore holes now confirmed for the third week of September,” executive director Bruce Lane said.

“Our neighbours at Kookynie continue to produce encouraging drilling results and we are excited at the prospect of being able to drill test the Niagara project soon.”

Neighbouring gold activity is heating up

Metalicity (ASX:MCT) is currently carrying out its Phase Two drilling to step-out (extend) and confirm gold hits from previous drilling at its Kookynie project.

Initial results have been encouraging with a top hit of 2m at 21.03 grams per tonne (g/t) gold from a depth of 111m within a broader intersection of 10m at 7.44g/t gold from 108m and 2m at 35.23g/t gold from 124m.

This initial success has also attracted other explorers, with Carnavale Resources (ASX:CAV) joining the party after picking up a 80 per cent stake in (a separate) Kookynie project within the central position of the historical mining centre.

Cashed up for gold exploration

The completion of the auger soil sampling program comes after GTI completed its fully-underwritten share purchase plan, which raised $978,000 before costs.

Applications for 11.1 million shares priced at 3c each totalling $334,000 were received from shareholders and the remaining 21.47 million shares will be placed by the underwriter CPS Capital Group.

Since reporting cash of $2,089,000 at the end of the June 2020 quarter, GTI has subsequently raised an additional $2,789,000 before costs by way of the recent placement and SPP, totalling cash of $4,878,000.

This article was developed in collaboration with GTI Resources, a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.