GTI Resources is all over uranium tailwinds as Wyoming ISR launches for 2022

Tailwinds like nothing you’ve ever flown. Pic: Getty

Preparations are underway to complete a key drill program at GTI Resources’ Thor ISR uranium project in Wyoming’s Great Divide basin after early results from 2021 demonstrated its potential to become an economic uranium mine.

Field preparations are already under way, with exploration to recommence at the Wyoming ISR project on January 31. Two mud rotary drill rigs will be remobilised in the coming weeks to complete the last 60 holes of GTI Resources’ (ASX:GTR) first drill program.

Numbers to enjoy

39 of the 100 holes in the maiden 15,000m drill program in Wyoming were completed before the Christmas break with almost half (19) returning grades and widths comparable to UR Energy’s Lost Creek mine next door.

Lost Creek contains 18.3Mlbs at 0.044-0.48% estimated uranium oxide, enough for a 12-15 year mine life waiting for the uptick in uranium prices expected from a major looming supply shortage.

Rising prices for the nuclear fuel drove one of the mining industry’s best performing commodity classes last year, with market tightness expected to keep spot prices moving north going forward.

Compare the market – GTI’s ISR looking good

GTI is well placed to capture those tailwinds.

Results from the first 39 holes struck a consistent and well mineralised sandstone unit at 200ft deep that is 110-120 feet thick.

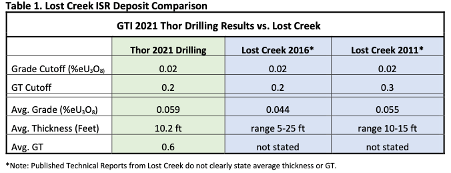

Its drilling, above a 0.02% grade cutoff, returned an average grade of 0.059% (above the Lost Creek estimate) and average grade thickness of 0.6GT, favourably comparable to Peninsula Energy’s (ASX:PEN) Lance project in Wyoming (GT 0.46).

“Drill results so far show that there is a strongly mineralised uranium system at Thor with potential for development,” GTI executive director Bruce Lane said.

“The mineralisation grade and thickness encountered in 19 of the first 39 holes appears to be comparable to that of our neighbour UR Energy’s 18 Mlbs production deposit at Lost Creek.”

“We’re looking forward to recommencing drilling in the coming weeks with the outlook for uranium in 2022 remaining very positive.”

This article was developed in collaboration with GTI Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.