GTI makes potentially game-changing move with entry into US uranium market

Pic: Schroptschop / E+ via Getty Images

Special Report: GTI Resources has struck a potentially lucrative deal to get into the US uranium market, which is starting to heat up.

The move is well timed, with the US government cracking down on its security of supply and looking to boost its domestic uranium production to supply its own nuclear power plants.

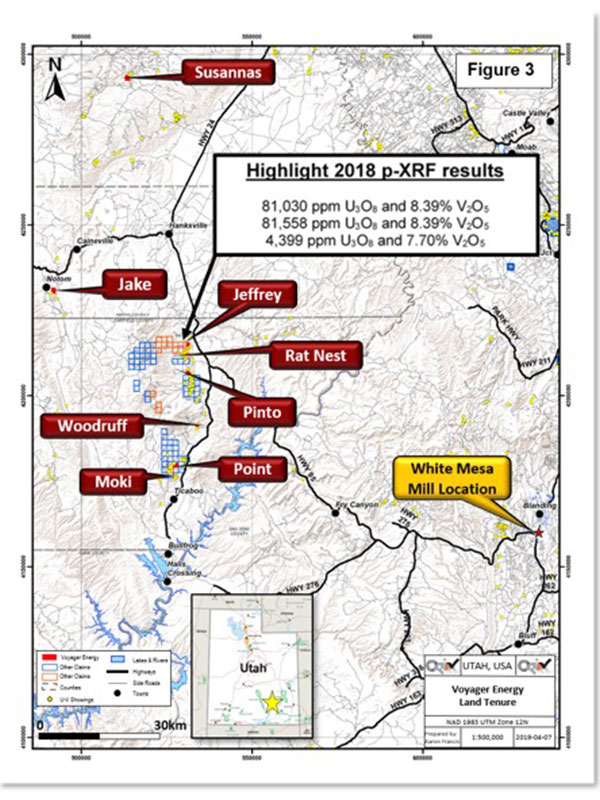

GTI (ASX:GTR) has inked a binding all-scrip agreement to acquire private firm Voyager Energy, which has the exclusive right to acquire eight highly prospective uranium and vanadium exploration projects in Utah, one of the most mining friendly states in the US.

The deal will cost about $1.08m, which GTI will settle with the issue of 90 million shares at a deemed price of 1.2c each.

The projects are located in the Henry Mountains mining district of south eastern Utah – a region that has produced 92 million pounds of uranium and 482 million pounds of vanadium.

The Henry Mountains are located within Garfield County — the fourth largest producer of uranium and vanadium in Utah.

The region forms part of the prolific Colorado Plateau uranium province which has historically provided the most important uranium resources in the US.

US looking to shore up supply

A couple of US-based uranium miners submitted a petition to the US government calling for an investigation into security of supply concerns.

The US currently imports more than 90 per cent of its annual domestic uranium demand, with a large percentage supplied from Russia and Kazakhstan, which poses a national security concern.

Ur-Energy and Energy Fuels want the government to impose a restriction that requires US utilities to source 25 per cent of their supply from freshly mined US uranium.

To put that into context, the US would have to produce 12 million pounds of uranium each year to meet that requirement, but right now the country produces less than 2 million pounds.

This “Section 232” investigation has been concluded and a confidential report and set of recommendations has been forwarded by the Department of Commerce to President Donald Trump.

The outcome of the report is expected to be announced in August.

Energy Fuels’ Tony M mine is located adjacent to the projects that GTI is acquiring and has a remaining 10.9-million-pound resource at 2,183 parts per million (ppm).

Strategic advantage

Right now, there are just two ASX-listed companies with uranium projects in the US, and GTI will become the third.

The company has a strategic advantage with the acquisition of Voyager Energy because the projects it has the right to acquire all host known high-grade uranium and vanadium mineralisation that could potentially be much higher grade than the average 2,400ppm uranium and 1.25 per cent vanadium produced in the region in the past.

Sampling taken from the projects returned high grades of up to 81,558ppm of uranium and 8.39 per cent vanadium.

The mill is also again producing vanadium from tailings dams to complement the existing uranium processing operations.

Energy Fuels has in the past accepted toll milling agreements as well as done other deals to process ores from third party mines.

GTI said this could represent a low-cost opportunity for producers in the region to utilise existing infrastructure, eliminating the significant capital requirement of developing a mill.

Strong tailwinds

Arun Sengupta, executive director at Canary Capital, told Stockhead last month the uranium market had “good tailwind fundamentals”.

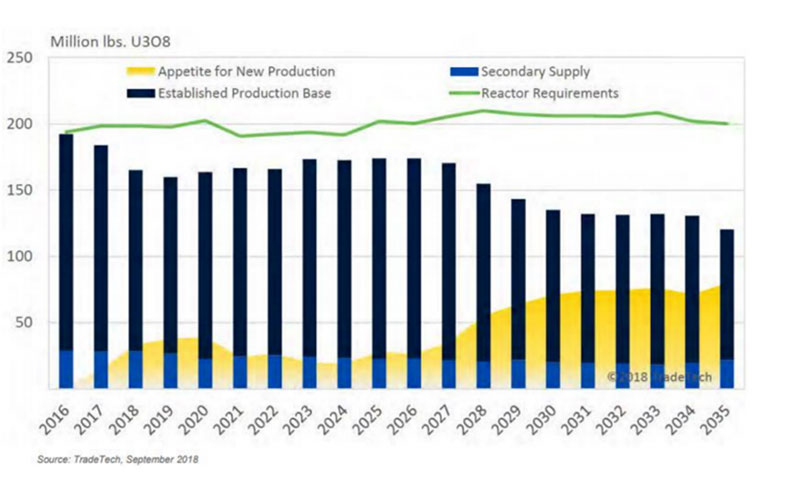

There are 57 new nuclear reactors under construction globally, with an additional 134 ordered and 383 proposed.

Uranium demand is forecast to increase by 44 per cent in the next 15 years.

But due to the depressed uranium market over the past decade, very few projects have entered the development pipeline leading analysts to predict a major supply shortage in the coming years.

“If you go back five years or 10 years ago, there was 450 uranium companies in the world, actual uranium producers,” Sengupta said.

“There are now 40. You’re going to need uranium to run your nuclear power plant. The number of people producing it has decreased exponentially.”

GTI plans to undertake two placements and rights issue to raise just over $2m, which will allow the company to get cracking on exploration straight after completion of the acquisition.

At least $1m of the cash is assured, with CPS Capital Group agreeing to fully underwrite the rights issue.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with GTI Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.