GTI connecting the dots on its Utah uranium middle ground

Pic: John W Banagan / Stone via Getty Images

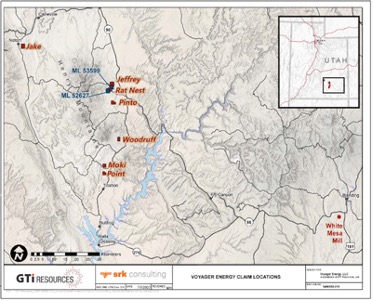

When GTI Resources struck a deal in October last year to secure the land between its Rats Nest and Jeffrey uranium projects in Utah, it took hold of a prospective uranium canvas.

The package of land, acquired from Anfield Energy, consolidated GTI’s (ASX:GTR) landholding over a contiguous 5.5km interpreted mineralised trend at its Utah projects – a means by which the company could look to connect the dots between the promising signs at its already-held projects on either side.

Home to some substantial historic workings, the ground in the middle had some serious claim to exploration in its own right – work currently being undertaken by the GTI team.

“The package of land we bought has quite a significant underground development on it – it’s probably one of the most recently mined parts of that area,” GTI executive director Bruce Lane told Stockhead.

“Section 36 was mined in the 1970s and maybe even into the 1980s.

“What we’re doing is exploring the ground between our known mineralisation in Jeffrey and Rats Nest to piece together an exploration target, heading towards understanding what it would take for us to put together a JORC resource on the overall area.

“The drill results to come from the recently completed program of 40 new holes will give us a better understanding of how everything is pieced together when combined with the downhole data from over 80 historical holes near the old mine workings.”

Initial downhole gamma eU3O8 assay results are expected later in July, with chemical assays including vanadium assays anticipated in August.

The company also carried out a series of downhole geophysical logging designed to assist with its drill targeting.

Broader uranium narrative plays out

Drilling on Section 36 – which includes two historic mines and more than 1300m of underground workings – comes against a backdrop of growing optimism in the US of the prospects for the once-maligned commodity.

“This story has been playing out for a while but it has remained very current,” Lane said.

“There’s a growing crescendo of acknowledgement and awareness that nuclear power has a big part to play in the world’s carbon-neutral future.

“The US Administration and the Department of Energy has clearly renewed its focus on nuclear power, and therefore also domestic uranium mining exploration and business – there is now genuine bipartisan support for the nuclear industry. This is backed up by growing investor interest in the sector and recent moves by Sprott to take control of Uranium Participation Corp (OTCPK:URPTF) and seek a US listing of its units. This move is tipped to make a big impact on the uranium market in general by increasing buying pressure in the uranium spot market,”

Earlier this year the Biden administration took further steps to re-establish strategic uranium reserve, first proposed under the Trump administration, through which it plans to buy up the commodity from US domestic producers.

The pricing and contracting details are yet to be clarified and will be critical in the success of any such plan, but Lane believes GTI’s positioning in Utah leaves it one of few ASX-listed uranium explorers with potential to fully realise value from the US government’s plans.

“I think the US angle really exposes us to that theme, and there’s plenty of good news coming out of the US in regard to nuclear power,” he said.

The Utah assets are proximate to Energy Fuels’ White Mesa uranium mill – the only conventional mill of its kind with a licenced capacity of +8 million pounds of uranium per year.

“If we can define an asset it will have a value in the ground, and it will all be about how the commodity price moves and how the industry transitions over the next six months to two years,” Lane said.

GTI’s portfolio also incorporates the Niagara gold project at Kookynie in WA. Lane said work was ongoing at the project, with heritage negotiations underway and the company evaluating and refining its understanding how best to tackle and fund any future exploration on the ground.

This article was developed in collaboration with GTI Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.