GT1’s lithium strategy validated by $8m investment at 95% premium

Mining

Mining

Special Report: Green Technology Metals’ strategy to become the first integrated lithium producer in Ontario has attracted a significant $8m investment from South Korean electric vehicle battery metals producer EcoPro Innovations.

While the lithium market may be depressed in the short-term, the deal is a vote of confidence in GT1’s strategy and the long-term outlook market participants have for the growth of the lithium-ion battery, energy storage and electric vehicle markets.

The corporate equity investment was made via a two-tranche placement priced at 12.5c – a 40% premium to the 90-day volume weighted average price of the company’s shares or 95% to the last traded price.

That’s particularly impressive in a weak equity market in which most ASX listed explorers are being forced to accept significant discounts to raise capital.

The investment is accompanied by a framework agreement that provides a foundation for EcoPro to partner with Green Technology Metals (ASX:GT1) across its projects.

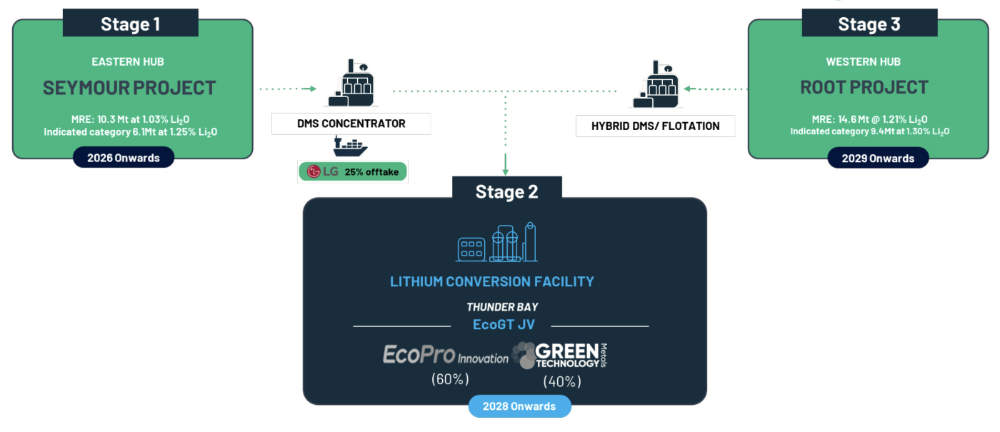

Both agreements cover proposals for both upstream – mining and raw material extraction – and downstream – processing and conversion – activities such as the development of potential mines and a proposed lithium conversion facility, which is expected to be split 60:40 between EcoPro and GT1.

Besides the equity investment, EcoPro will have exclusive rights for up to 12 months to negotiate and agree on staged asset-level investments in the Seymour and Root mine developments in anticipation of negotiating joint venture agreements to advance the projects.

The two companies will also negotiate a comprehensive agreement including the co-funding of a pre-feasibility study on the proposed lithium conversion facility in Canada, which will underpin a future JV for the completion of a definitive feasibility study and final investment decision.

EcoPro is a leading producer of EV battery metals in South Korea and has extensive experience in lithium hydroxide production along with patented technology for lithium extraction.

The South Korean company is also globally recognised as the top manufacturer of cathode materials for electric vehicle batteries by production volume, making it an ideal partner to advance GT1’s strategy.

Proceeds from the subscription agreement will fund the DFS on the Seymour lithium project and the PFS for the lithium conversion facility.

The deal has been 12 months in the making, according to GT1 MD Cameron Henry.

“Our teams have dedicated countless hours working jointly on understanding and expanding on GT1’s strategy to be the first integrated lithium chemical supplier in Ontario,” Henry said.

“Attracting a top-tier partner like EcoPro along with the investment at a premium provides further validation of our company, team, assets and ability to progress our assets and projects towards production.

“EcoPro has been assessing the North American market for some time and it’s with great optimism that we enter this new phase of GT1’s development and we look forward to finalising these significant agreements and developing our projects in partnership.”

Henry said EcoPro would bring ‘invaluable experience’ in downstream battery materials processing.

“EcoPro stands out as a top-tier strategic partner, bringing invaluable experience in owning and operating, not only successful lithium conversion facilities but also nickel pre-cursor and cathode active material facilities globally,” he said.

“Their global scale and expertise in manufacturing and supplying battery-grade lithium chemicals will greatly benefit GT1 as we advance our integrated strategy in North America.

“This investment and partnering strategy now paves the way forward, both financially and technically, to continue with our development strategy.”

During the exclusivity period, the two companies will negotiate binding JV agreements for both the Seymour and Root lithium projects in Ontario that will include EcoPro acquiring an initial 10% interest in each project at a value to be determined during negotiations.

EcoPro will also have the option to acquire an additional 25% at the final investment decision stage for Seymour.

On the release of a DFS at Root, it will also be entitled to minority shareholder JV rights, and the right to negotiate a separate offtake agreement to acquire part of GT1’s concentrate share above the share each party is entitled to under the JV.

Additionally, both companies will establish capital funding committees for each project to coordinate debt and government funding strategies whilst agreeing on pricing formulas for the JVs.

The first project to be developed by GT1 is Seymour, which sits just north of the industrial hub of Thunder Bay and currently has a resource of 10.1Mt at 1.03% Li2O.

The company is currently focusing on permitting, approvals and the DFS for the Seymour mine before reaching FID in early 2025. Concentrate produced from Seymour will be transported ~320km via road to Thunder Bay where GT1 intends to construct its lithium conversion facility with EcoPro Innovation.

Root is GT1’s second and larger project, west-north-west of Seymour, with a current resource of 14.6Mt at 1.21% Li2O. Whilst Root is still in its exploration stage, the company plans to boost the current resource with drilling in the coming months to test deeper extensions to Root Bay and follow up targets on Root Bay East.

GT1 has initiated permitting and approvals for the Root project, planned as long-term feed for the proposed conversion facility in Thunder Bay, Ontario.

A lithium conversion facility is key to completing Ontario’s EV supply chain. The Federal Government is providing substantial funding packages for the development of a conversion facility that can potentially cover up to 50% of the CAPEX.

GT1 and EcoPro have collaboratively submitted a joint application to Invest Ontario for government funding for the development of their proposed lithium conversion facility.

Together, they bring significant advantages, including extensive experience in mine and chemical facility development, as well as unparalleled EPC and operational expertise across the entire battery supply chain.

Further engagement is planned with Invest Ontario as well as the Federal Government to secure complementary funding through the Strategic Innovation Fund over the coming months.

This article was developed in collaboration with Green Technology Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.