Growth options abound as broker slaps buy label on zinc producer Broken Hill Mines

There are some bargains on offer in Broken Hill, according to Blue Ocean Equities. Pic: Getty Images

- Broken Hill Mines shares pop after ringing endorsement from east coast broker

- Blue Ocean Equities initiates $130m capped BHM at $1, 104% up on its 49c price last week

- The company has growth options at the Rasp Mine in New South Wales, where it controls the ground on which BHP was founded

Shares in Broken Hill Mines (ASX:BHM) have surged on Tuesday, lifting more than 9% to 60c just days after its initiation by east coast broker Blue Ocean Equities.

Blue Ocean Equities’ Carlos Crowley Vazquez and Elaine Faddis have slapped a $1 price target and buy rating on the very much ‘does what is says on the tin’ miner. That’s 104% higher than the prevailing share price on August 20, when the note was released.

BHM operates the Rasp zinc mine and Pinnacles JV in New South Wales’ original mining city of Broken Hill, and controls the ground where the world’s biggest mining company, BHP (ASX:BHP), was founded in 1883 on the original line of lode.

The Patrick Walta-led firm is on track to produce 10,100t of zinc, 13,7005 of lead and 578,000oz of silver in FY26, according to Blue Ocean’s numbers – generating $142.2m in revenue.

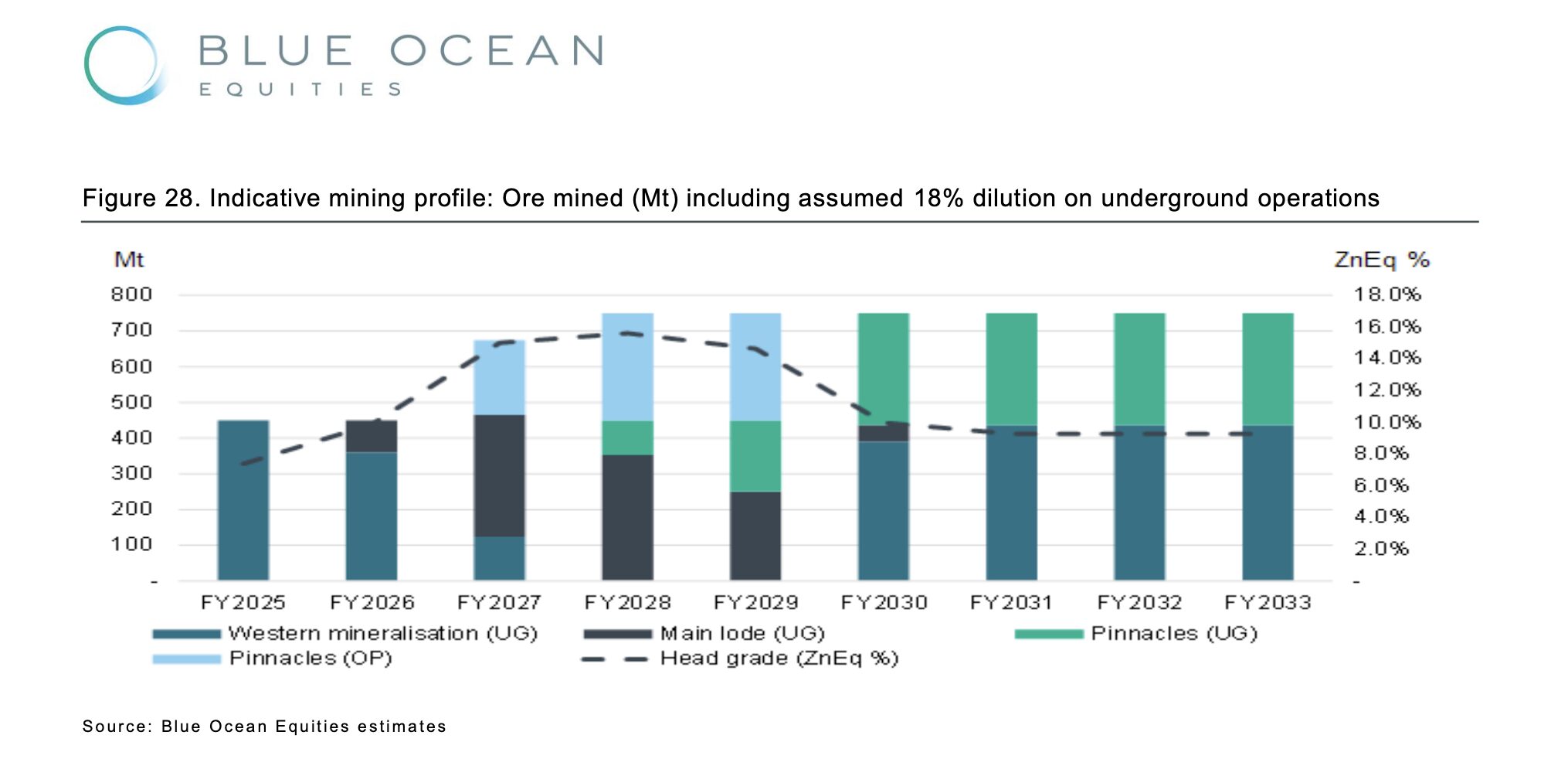

But there are major growth catalysts on the horizon, with production expected to rise to 28,900t zinc, 31,700t lead and 1.85Moz silver in FY27, and 31,200t Zn, 36,800t Pb and 2.29Moz Ag in FY28.

That growth rate would see the firm’s price to earnings ratio slide from 3.5x to 1.4x over two years with its EV/EBITDA multiple trimmed from 2.2x to 0.8x over two years.

As the 70% owned Pinnacles comes online, a project that until now has been operated only at small scale by a local family, Vazquez and Faddis say its silver grades sit among some of the best on the ASX, with the development of the satellite mine to take BHM’s silver revenue to 35% of its total.

That will bring “much sought after exposure” to non-Latin American silver on the ASX.

Blue Ocean’s number crunchers say they see “strong potential for exploration and resource upside which could ultimately extend mine life beyond 10 years”.

“We expect the outcome of optimisation and organic growth options to reflect a materially higher profitability driven by higher metal output (higher grades and volumes mined and processed) at lower unit costs delivering LOM average production of 50ktpa ZnEq at average EBITDA margins of 50%,” the firm wrote.

The right market

While they’re not the most prominent resources markets for ASX investors to peruse, Vazquez and Faddis see a strong growth outlook for silver and zinc demand over the coming years.

Silver prices have surged 32% YTD, but after gold’s miracle run across 2024 and early 2025, the ratio between the two metals remains wider than the historical norm, sitting at 90x compared to a decade long average of 80x.

It is also supply constrained at a time demand is emerging from technology markets – silver is a key input in solar PV – and as a safe haven investment.

“Over the last 10 years, the average gold:silver ratio has been ~80:1. Despite the recent higher prices in silver, the discrepancy in the gold:silver ratio has expanded to around ~ 90 currently, which may signal a breakout in the silver price of +10%, driving further silver investment demand,” Vazquez and Faddis said.

“Supply is expected to remain constant near term, pointing to deficits further increasing. Supply is also heavily reliant on Latin American countries, many of which are currently experiencing a wave of resource nationalism that could further challenge growth of new mine supply.”

The zinc outlook ‘remains bullish’, with Blue Ocean estimating growth in demand from 13.9Mt in 2025 to 15.4Mt in 2030.

While a 2% contraction in Chinese usage last year (half of the global end market) and tariff uncertainty in the US has kept a lid on prices, supply side pressure is building up.

“Supply-side constraints are tightening the market: treatment charges (TCs) have fallen sharply—from ~$280/t in 2023 to ~$50/t in 2024 — due to zinc concentrate shortages following mine closures and smelter expansions,” Vazquez and Faddis wrote.

“Global mine output dropped 2.8% in 2024 due to ore grade depletion and operational disruptions.”

Value proposition

Rasp contains a 750,000tpa zinc and base metals concentrator which has been running since 2012.

But the plant has only been running on a touch over half its capacity in recent times, with a couple of key catalysts on the way including the development of the higher grade Main Lode and future development of the Pinnacles deposit.

Underground operations at Main Lode are expected to begin when development accesses the orebody in late October 2025, with the Pinnacles underground to come online from mid-FY27, according to current development timelines.

Infill drilling is ongoing at Pinnacles to upgrade its current exploration target of 6-15Mt at 2-4% zinc, 3-6% lead and 40-125ppm silver.

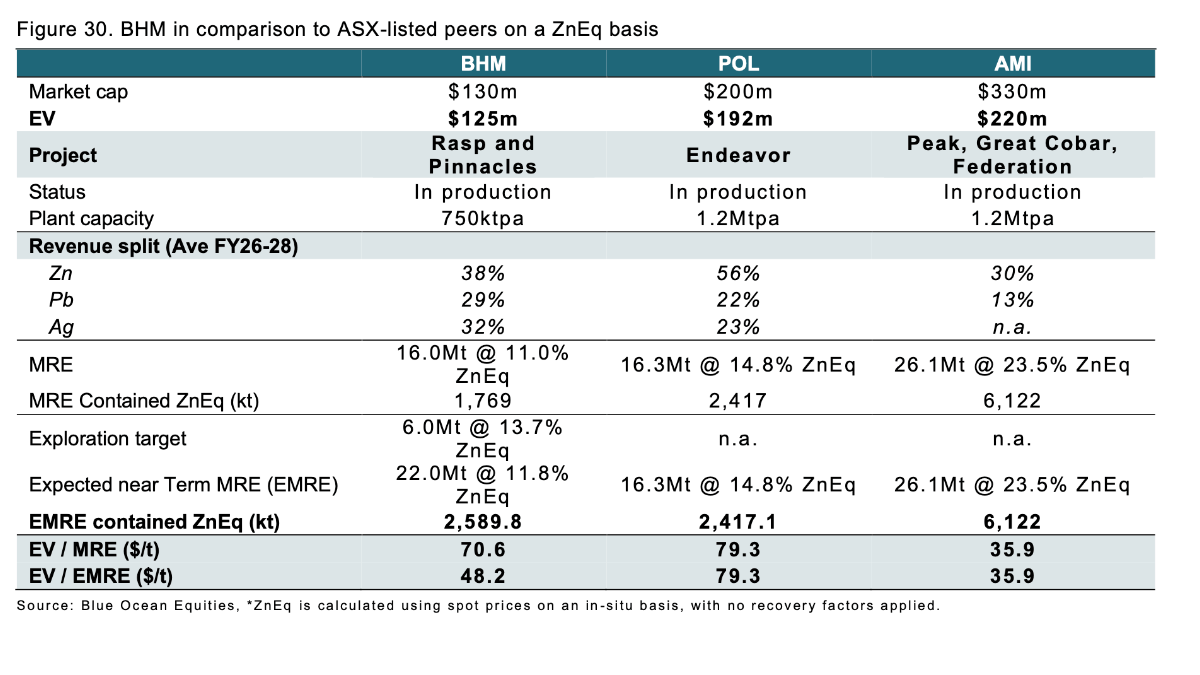

According to Vazquez and Faddis, BHM is trading at just 0.5x of its net asset value, short of the 0.6-0.8x level normally seen among junior producers on the ASX.

If drilling converts the firm’s exploration target into a resource, Blue Ocean estimates at Monday’s market value, Broken Hill would be running at $48 per zinc equivalent tonne, against the $79/ZnEq tonne valuation of its nearest comp: New Cobar region producer Polymetals Resources (ASX:POL).

But the broker thinks Rasp’s best days could be ahead of it.

“Historically when Rasp operated at nameplate capacity (750ktpa), it achieved 40-50ktpa ZnEq (milling ore at ~8% ZnEq), resulting up to $70m annual operating profit,” Vazquez and Faddis said.

“We believe it is reasonable for BHM to improve on that performance, driven by higher-grade ores at Main Lode and Pinnacles within the next 18 months, supporting our risked valuation of $254m NPV of Rasp and Pinnacles.”

The other growth option looming in the shadows is the potential consolidation of the historic Broken Hill field into a single operation, with Chinese owned Perilya Zinc running its own 2.8Mtpa concentrator next to the historic NSW border town at under 40% capacity.

“Perilya continues to operate the underground Southern Operations , adjacent to Rasp. Ore is processed at Perilya’s Southern Operations concentrator, which produces both lead and zinc concentrates (processing capacity of ~ 2.8 Mtpa),” Vazquez and Faddis said.

“Although a merger between (previous Rasp owner) CBH Resources and Perilya was proposed in 2008, it was ultimately not completed. As previously indicated, there may be strategic merit in consolidating the assets along the Line of Lode, to capture operational synergies and increase scale.”

The analysts believe BHM could expand future production from Pinnacles to unlock latent capacity at Perilya’s South Mine plant if a merger comes to fruition.

At Stockhead, we tell it like it is. While Broken Hill Mines is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.