Ground Breakers: Where’s the bottom? New lithium miners face uncertainty heading into 2024

Pic: Via Getty

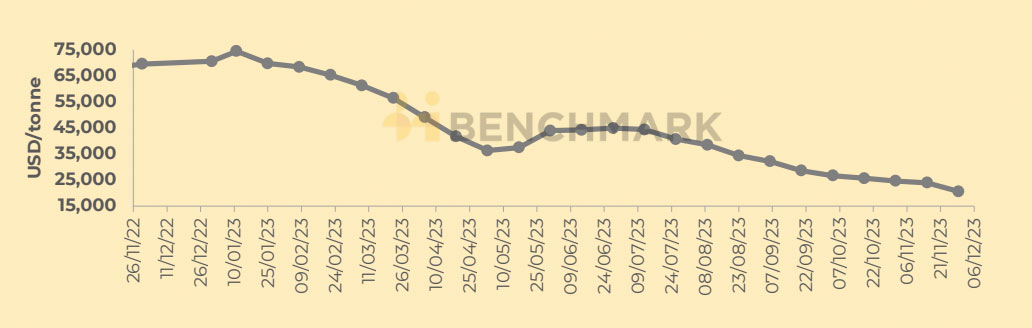

- Spot lithium prices down 80% year to date, now at their lowest level since Sept 2021

- Lithium prices could fall further in the shorter-term: E&P Capital, Benchmark

- The new class of ASX lithium miners: sink or swim?

Another week, another fall in lithium prices.

Sluggish demand from Chinese buyers pushed down local carbonate and hydroxide spot prices another ~15% and ~10% this week, respectively, to an average of US$17,350/t.

That’s a precipitous ~80% drop since a peak of ~US$80,000/t in January this year.

Spot market prices haven’t been this low since about August-September 2021.

There could be more pain to come, says Benchmark Mineral Intelligence, but the bottom is probably around the corner.

“Contacts reported to Benchmark that whilst cathode manufacturers maintain minimal inventory levels of approximately a week, some smaller buyers had begun to pick up low volume spot purchases due to the attractively low-price level; larger customers were yet to procure additional spot material,” reports the pricing agency.

“Moreover, market participants expressed that while prices may continue to fall in the short term, they expected some support before chemicals prices reached RMB 80,000/tonne ($11,200), given that production costs at many projects now sit above this level.”

Where is the bottom?

Lithium permabear Goldman Sachs said most Australian producers’ all in sustaining costs remain well below its long term real SC6 concentrate price of US$1000/t.

But weak pricing is not great news for new miners and advanced project developers looking for cash, who would’ve plugged far higher average prices into their feasibility studies.

“The pace of the lithium price pull-back and equity correction has come quicker than we were forecasting,” E&P Capital wrote earlier this week.

“[The] challenge from here is that lithium prices could fall further in the shorter-term, even though medium-term fundamentals remain sound.

“We sense some appetite is building but picking the bottom here is challenging. Our recent discussions suggest near-term demand headwinds across EVs are likely to persist.”

The new class of ASX lithium miners: sink or swim?

Like the last mini cycle, strong, well-capitalised companies will ride out the downturn. Others, if the weakness persists, may not.

Liontown (ASX:LTR) is ~60% of the way through construction of the monster +$1bn Kathleen Valley hard rock mine, with first production pencilled in for mid 2024.

Barring any curveballs during ramp up (there are always curveballs during ramp up) Kathleen Valley will have an average cash cost of US$475/t, against a current spodumene concentrate price of ~US$1600/t.

Still profitable, LTR chair Tim Goyder said during his late November address to shareholders.

Sayona (ASX:SYA) and Piedmont (ASX:PLL) are ramping up production at the historically troubled North American Lithium (NAL) hard rock operation, which bankrupted previous owners in 2014 and 2019.

They have hit some managerial and processing roadblocks during ramp up but had a comfy $233m cash cushion at the end of September.

It reported an average selling price $1985/t against costs of $1231/t for its maiden shipments.

Freshly minted Northern Territory miner Core Lithium (ASX:CXO) has likewise endured challenges during ramp up of its Finniss hard rock operations.

Initially expected to deliver 175,000t of 6% Li2O spod con a year, the mine is currently forecast to ship 80,000-90,000t at a lower grade of 5.5% Li2O in FY24.

After eking out a small profit for FY23, CXO reported $21.6m revenues from customers against $43m in production costs for the September quarter.

On the positive side, it has $202m in the bank and no debt.

Then there’s troubled Malian miner Leo Lithium (ASX:LLL), which is confronting both operational and jurisdictional risk.

The developer of the Goulamina mine — the first major spodumene project to be developed on the African continent – is languishing in a deep shade of red after the new Malian Mines Minister wasn’t on board with LLL’s plan to sell DSO lithium from Goulamina in its early days.

This torpedoed guidance and early cashflows.

LLL and partner Ganfeng could also see as much as US$45-50m in unplanned import duties and taxes in government actions “not consistent” with the exemptions it previously had for importing equipment.

And finally, while LLL will remain the operator of the 500,000tpa Goulamina mine, Ganfeng will move to a 55% ownership stake by sole-funding US$137.2m of Goulamina’s capital costs rather than taking equity in LLL, knocking LLL’s economic interest in the project down to 45%.

LLL remains suspended “following a failure to respond to ASX queries adequately”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.