Ground Breakers: Wartime volatility sends nickel price parabolic

Pic: Getty

Nickel did this yesterday.

WTF? #Nickel jumps to record high as supply risk sparks short squeeze. pic.twitter.com/waMx17vOdL

— Holger Zschaepitz (@Schuldensuehner) March 8, 2022

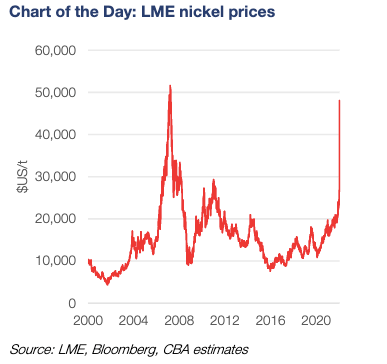

As of this morning the gain on nickel’s three month LME contract, the most traded contract for the metal used in the production of stainless steel and lithium ion batteries, was up a barely believable 76% to US$51,000/t.

At more than US$17,000/t, it was the largest single day gain for the metal in the LME contract’s history. By a country freaking mile.

#Nickel’s move today was like 30 standard deviations. One of the most unlikely events ever in financial market history. A black swan of black swans!

— Mark Thompson (@METhompson72) March 7, 2022

These are levels not seen since 2007 when, amid a historic boom in Chinese economic growth, nickel scaled heights above US$54,000/t.

That year BHP’s Nickel West division, just two years removed from the miner’s $9.2 billion takeover of Australia’s first nickel giant Western Mining Corporation, made a larger profit than its iron ore business.

BHP (ASX:BHP) produces so much iron ore now that even at current prices that would be impossible – at around US$160/t iron ore is also not far off historic highs.

But it does shine a positive light on the mining behemoth’s decision to keep its nickel assets in the fold a few years ago, having initially promised staff it would close the division down by the end of the last decade in 2014 when not a single company wanted to buy it.

BHP share price today:

&nsbp;

Russia the cause

Russia’s war with Ukraine is the straw that broke the camel’s back on the extraordinarily volatile metals prices seen in recent days.

Nickel’s salvation has been its new found use as a metal for lithium ion batteries used by electric vehicle makers like Tesla, a previously insignificant slice of nickel demand which is growing by the day.

That has seen stocks of class 1 nickel like nickel sulphate and nickel briquettes deplete, with the London Metals Exchange falling to its lowest inventory levels since 2019 earlier this year.

Russia’s Norilsk Nickel holds a 17% share of the supply of class 1 nickel as the world’s largest nickel sulphide producer, making it a key cog in the battery supply chain.

Fears of sanctions or boycotts of Russian nickel have driven price fears, something that will increase demand for Australian nickel.

“Australia accounts for 6-7% of global nickel supply, and like Russia, has a more pronounced impact onclass 1 nickel supplydue to the type of deposits mined from Australia,” Commbank’s Vivek Dhar said.

“Mined nickel supply from Australia is expected to grow 36% from 2020-21 to 2022-23, above the pace of growth in global nickel supply.

“High nickel prices, the demand prospects of EV batteries and the high reliability and low geopolitical risk of Australia nnickel supply may see Australian nickel production grow more strongly than expected this decade. For now, nickel is a very small share of Australia’s export offering, accounting for ~0.8% of Australia’s goods and services exports in 2020-21.”

Ironically, record prices for nickel, met coal, copper, palladium and a bounce in gold in the direction of US$2000/oz did little to bring joy to mining companies on the ASX today, with the volatility of the price spiral drawing timidity from investors.

Major nickel stocks BHP, Mincor (ASX:MCR), Panoramic (ASX:PAN), Poseidon (ASX:POS), IGO (ASX:IGO) were in the red or largely unmoved. Indonesian-based Nickel Mines (ASX:NIC) was down almost 5%.

Small caps were a different story with Estrella (ASX:ESR) up more than 20% on high grade nickel sulphide assays, with Azure Minerals (ASX:AZS) and Widgie Nickel (ASX:WIN) also big gainers.

Nickel share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.