Ground Breakers: Vale inches to lower end of guidance as iron ore price climbs again

It's been a tough couple years for Vale. Pic: Laurence Griffiths/Getty Images

Brazil’s Vale has failed to take the crown of the world’s No 1 iron ore miner from Rio Tinto (ASX:RIO), inching to the lower end of its updated production guidance.

Numbers tabled by Vale overnight show the Brazilian miner produced 315.6Mt of fines in 2021, up 15.2Mt on a year earlier but just scraping in its production guidance for the year after reducing its range from 315-335Mt to 315-320Mt late in 2021.

Vale also produced 31.7Mt of pellets, up 2Mt on a year earlier. Its production levels have been subdued as it recovers from the safety related suspensions which followed the Brumandinho dam disaster in 2019.

The Brazilian’s iron ore fines and pellet sales totalled 309.8Mt, up 23.7Mt on a year earlier but nowhere near the flood of supply often feared from the miner.

Not all of those sales are made on the seaborne market, with a small portion of Vale’s iron ore sold domestically. By contrast virtually every tonne produced by BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG) is shipped to Asia and primarily China.

Vale has an ingrained advantage on prices against Australian producers due to its higher average ore grade, which came in at 63.1%.

Iron ore fines are generally priced on a 62% Fe content basis with premiums and discounts to that price depending on impurities and grades either side of the benchmark.

But it is also exposed higher costs for shipping, exacerbated by high freight prices last year, due to the distance between its Brazilian operations and China compared to the Pilbara.

As prices collapsed in the second half of 2021, Vale reduced sales of some lower value and higher alumina fines in response to market conditions.

Vale says it has hit a capacity of 340Mt at its iron ore operations in Brazil and is still on track to hit a capacity of 370Mt by the end of 2022, something that would make it a bigger market player than Rio. But that has already been revised down from the 400Mtpa capacity it has long promised but never delivered.

Vale’s set production guidance of 320-335Mt of iron ore production in 2022, identical to Rio, which exported 322Mt in 2021. But analysts had been expecting 346Mt in the run up to that announcement last November, leading to improved price conditions for the commodity.

It lost 2Mt of production from the recent floods in Minas Gerais, but said that will not change guidance because seasonal conditions have already been factored in.

ASX listed iron ore miners were broadly up as the Materials sector gained a low 0.11% by 12pm AEDT.

Iron ore miners share prices today:

Prices up again as traders prepare for end of Winter Olympics

Iron ore prices pushed higher on Thursday, reversing a brief drop on Wednesday after the Chinese economic monitor the NDRC issued some tough words on price speculation.

Price setters Fastmarkets reckons the rally is about plans to ramp up steel production once pollution restrictions at Chinese steel mills unwind after the Winter Olympics and Paralympics.

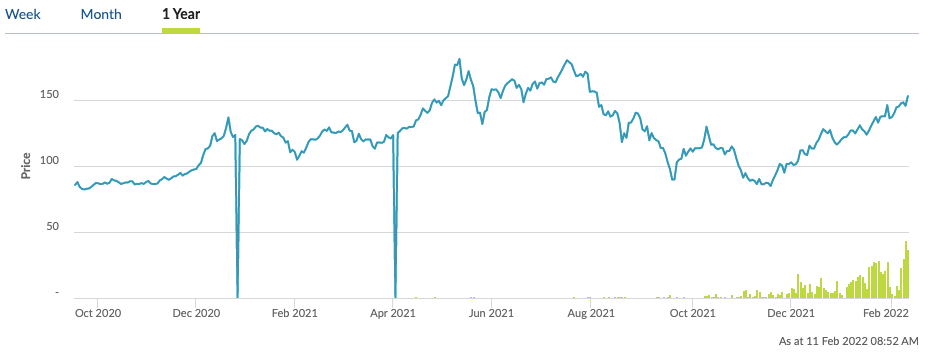

March contracts suggest as much. The Singapore March swap was up 1.74% to US$155.60/t and has looked particularly healthy since falling to US$84.84/t on November 18 last year.

Iron ore prices were up 4.6% to US$153.55/t according to Commbank, a price level that would have seemed impossible in late 2021 when waning steel output in China sunk prices below US$87/t in a record pace fall from all time highs of US$237/t in May.

Vale’s no alarms, no surprises quarterly and outlook will likely mean few spooks for investors.

RBC’s Europe analyst Tyler Broda said Vale’s results, including better sales in the fourth quarter, should be taken positively by the iron ore market “as this, in theory, means marginally less tonnes to come in 2022 from Vale shipments.”

Commbank’s Vivek Dhar meanwhile said steel output would have more impact on prices than Chinese Government jawboning.

“The NDRC’s intervention may have a short-term negative impact on iron ore prices, but ultimately China’s steel output trajectory will dictate iron ore prices this year,” he said.

“Without strict steel output cuts, like we saw in H2 2021, it is likely that China’s steel output will be determined by steel mill margins.

“These have remained quite healthy since mid-December and highlight that steel prices are high enough to absorb high coking and iron ore prices. We expect China’s steel output to lift in Q2 2022 due to higher margins.

“In the second half of 2022, we think China may look to steel output cuts to ensure production remains at 2021 levels. Enforcement will likely intensify if steel output and steel-sector emissions have increased notably in H1 2022.

“This is similar to what took place in H2 2021.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.