Ground Breakers: This miner’s on fire as copper price plumbs new lows

Pic: Mathias Clamer/Stone via Getty Images

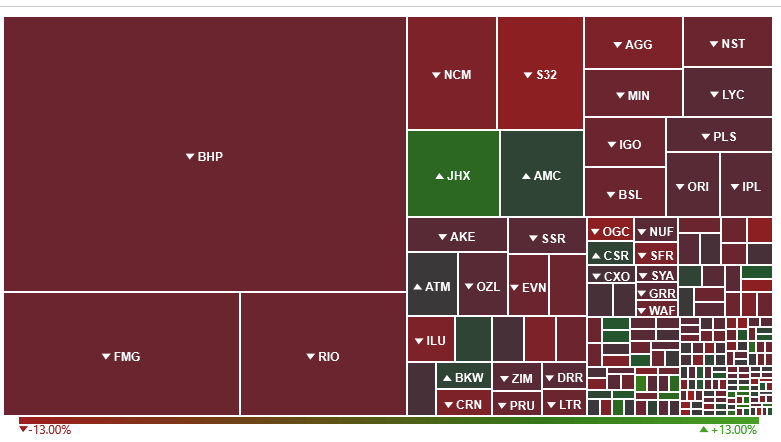

- Tumbling oil, copper and gold prices send miners to the dogs on a poor morning of trade

- Gold Road Resources and Gold Fields post record quarter at the Gruyere gold mine in WA

- Alkane Resources smashes guidance at Tomingley, one of the few miners unscathed from today’s wreckage

Commodities have powered an incredible run for Australian listed companies in recent years, with the mining heavy ASX 200 driven to new highs in 2022 on the back of soaring prices and short supplies of a host of metals.

The outcome of that run in commodity prices is that Australian businesses are in a rosy health not seen in years, with company debt falling a massive 21.5% over 2021-25 against a global fall of 1.9%.

Two-fifths of that, according to Janus Henderson, came from BHP (ASX:BHP) alone as miners printed cash and rebounding profits sent the debt-to-equity ratio of Australian companies to their lowest level in eight years.

Janus Henderson says operating profits globally rose 51.4% to a record US$3.36 trillion in 2021-22, funding capital expenditure, record dividends, share buy-backs and debt servicing and repayment.

It says net debts are now a fifth lower than in 2014/15, when mining companies took on loans and issued bonds to manage slumping cash flow during the downturn.

As they say however: all good things …

Metal demand has been particularly weak, largely owing to China’s time-travelling Covid-Zero policy, which seems trapped in 2020, while yesterday was among the toughest overnight sessions for miners in many, many moons, with the Bloomberg Commodity Index falling 4.5%.

There were few sanctuaries to be found.

Already sold off with extreme prejudice, iron ore did catch caught the slightest whimsical bump with the suspension of Simandou and lower than expected Brazilian exports, but the base metals complex next door was hammered after new Covid cases bubbled up in Shanghai.

Oil prices collapsed.

NYMEX light sweet crude dropped well over 8% to come in under US$100/bbl for the first time since everything went totally balls up.

Copper and gold may have been the biggest concerns, with the bellwether commodity falling 4.2% to a 19 month low of US$7670/t and spot prices for the precious metal off 2.5% to US$1765.96/oz.

The red metal in particular is closely watched by economists due to its status as a barometer of the health of the global economy.

There were few winners across the mining and energy sectors, with materials down 3.4% and energy falling a whopping 4.3%.

Ouch.

More records for gold miners

The drop in the gold price to six month lows will do little to assist the ASX gold miners, who have been Tiny Tim timid in 2022.

But at least operations at the leading mid-tier miners seem to be on the mend after a year so far of cold sweats, nausea and athletes head caused by Covid, inflation and labour shortages.

Gold Road Resources (ASX:GOR) reported a record 85,676oz from its Gruyere JV with South Africa’s Gold Fields in the June quarter, up from 71,135oz in March.

Production remains on track to hit the miners’ 300-340,000oz target in 2022, with Gold Road selling a record 44,526oz from Gruyere at an average price of $2496/oz, something impacted by 8700oz sold into hedges at $1977/oz.

Gold Road has $161.3m in the bank, up from $138m at March 31, despite copping ~$11m in finance and transaction costs around its takeover of DGO Gold (ASX:DGO).

That deal will give Gold Road a 14.4% holding in De Grey Mining (ASX:DEG), the owner of the exciting Hemi discovery in the Pilbara.

There was good news also on the east coast, where Alkane Resources (ASX:ALK) was one of the few mining stocks in the green.

That is because the $400 million capped miner produced 66,804oz at the Tomingley mine in New South Wales, beating its guidance of 55,000-60,000oz.

Huzzah!

Somewhat against the inflationary theme across the rest of the industry, Alkane says its preliminary all in sustaining costs will be slightly below its guidance of $1500-1650/oz.

Alkane, which also released a resource recently for its closely-watched Boda porphyry deposit, finished the quarter with $124.3m in cash, bullion and investments at June 30.

“Tomingley continues its outstanding performance, consistently meeting or exceeding guidance.

With approvals in progress to extend the life of Tomingley to at least 2031, at increased production rates, and our excellent initial Boda resource, we’re looking forward to the year ahead,” MD Nic Earner said.

“Alkane’s Board and management acknowledge and thank the employees and contractors of the Company for their strong and continued commitment to safety, production and exploration performance.”

Gold Road (ASX:GOR) & Alkane Resources (ASX:ALK) share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.