Ground Breakers: Miners bowled over and Rio Tinto hasn’t given up on Jadar just yet

Pic: Spike Mafford/UpperCut Images via Getty Images

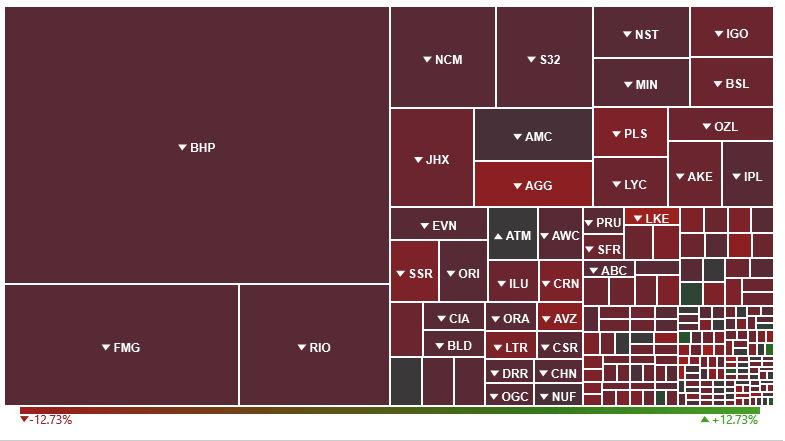

- Miners hammered as materials sector joins broader market sell-off

- China continues its “Dynamic Zero Covid” approach to the pandemic, hitting demand for metals

- Rio Tinto’s top brass still thinks it can sweet talk Serbia on its suspended Jadar lithium mine

This is what resources investors are looking at this morning.

Absolute carnage.

A broader market sell off is at play, with the benchmark ASX 200 down a cavernous 2.39% after the NASDAQ dropped almost 5% and S&P 500 in the States lost 3.56% overnight.

But some poor commodity moves didn’t help. Gold prices tumbled, sending basically that whole sector deep into the red with the All Ordinaries Gold index off 3.4%.

Iron ore miners and industrial metals continue to be towelled up by China demand concerns as lockdowns in Shanghai and Beijing persist and communiques from the CCP suggest a swift exit is not on the cards.

Calls for the Chinese people to persist came out loud and clear from yesterday’s Politburo meeting.

“The leadership is stuck in a terrible dilemma and until they get the vaccinations into almost everyone who is vulnerable they can not loosen without undermining everything they have achieved over the last two years,” China expert Bill Bishop said in a note from his Sinocism blog.

“But persisting with this policy risks undermining everything they have achieved over the last two years.

“I do not see how they get out of this without many more months of grinding through the problem.”

Iron ore prices rose slightly, with benchmark 62% fines fetching US$143/t, enough to keep juniors in business and majors printing fat wads of cash.

“Iron ore manage to push higher, with investors shrugging off weak economic data to focus on support from the (Chinese) government,” ANZ’s Kishti Sen said in a note.

“China Securities Regulatory Commission will support the financing of real estate companies. This follows the government’s commitment to bolster infrastructure investment.”

Chinese demand remains extremely important for commodities and the broader economy, something touched on by new Rio Tinto (ASX:RIO) chairman Dominic Barton at Rio’s AGM in Melbourne yesterday.

Asked if Rio would consider stopping iron ore shipments to China a la Russian sanctions, he warned the interconnected nature of China with the global economy would spell serious consequences if it got to that point.

Rio not giving up on Jadar lithium just yet

Rio fielded plenty of questions from shareholders and media on a range of ESG issues at the AGM, with the overarching theme being its poor history of relations with local communities and First Nations groups, exemplified in the destruction of the Juukan Gorge caves in 2020.

It was in a similar context that Serbia’s government pulled support for Rio’s Jadar lithium mine earlier this year after complaints, protests and environmental concerns from the local community.

Elections have just wrapped up in the Balkan nation, returning the sitting Aleksandar Vucic to power, but Rio’s boss Jakob Stausholm remains hopeful Rio could yet develop the US$2.4 billion mine, which will be the largest lithium chemical producer in Europe and boasts its own unique manufacturing process to extract lithium and boron from the mineral jadarite.

“In the meantime we’re not standing still. We actually acquired the Rincon project in Argentina, so we are pushing full steam forward on producing lithium, but we have certainly not given up on Jadar because quite frankly, it’s a perfect project,” Stausholm said.

“I really do think that it has got impeccable ESG credentials around it. I cannot say that it doesn’t have an impact, but I think the impact has been very, very effectively minimised and it can create a lot of wealth for the Serbian nation.

“And in a wider sense Europe really, really needs this for production of batteries and electrical vehicles. I mean if we can get Jadar going it will at the beginning have … 90% of Europe’s lithium production.

“I’m very hopeful common sense will prevail and we will enter dialogue, but we also have to recognise this is a very fundamental thing for society with free elections and they have gone through an election process and they now have to set a new government.

“We have just basically said we are open to look at this and have all sorts of discussion.”

Outgoing chairman Simon Thompson said the challenge was accessing “critical minerals” while ensuring local communities are compensated.

“I think there’s a broader issue here, which is that I think there is a growing recognition by governments around the world that actually certain critical minerals could be the constraint on addressing the challenge of climate change,” he said.

“And of course, you cannot develop a mine anywhere, you can’t develop any industrial facility full stop anywhere without having local impacts on the environment and on communities.

“So I think the challenge that we all face in a sense is how do you enable that public good of accessing lithium or copper or rare earth elements, whatever the constraints are, to enable (fighting) climate change to take place whilst compensating those people who at a local level are being impacted by that mine.”

Rio Tinto (ASX:RIO) share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.