Ground Breakers: Liontown Resources secures Korean giant LG as maiden lithium customer and most metals lift

Pic: Mark Brake/Getty Images

Electric vehicles and decarbonisation have emerged as the meta narratives dominating the mining and metals landscape over the past year and at the centre of it all is lithium.

The world’s biggest electronics companies and carmakers are scrambling to lock up long-term supplies of the new energy metal as expectations of persistent supply shortages dog the downstream EV and battery sector.

That has provided enormous tailwinds for lithium stocks, with industry fundamentals appearing to be lighting up a yellow brick road to the promised land of production.

Lithium carbonate prices have skyrocketed in recent months, along with other chemical products like hydroxide and raw materials price for spodumene concentrate, which is at record levels.

Liontown Resources (ASX:LTR) is one of the best performing stocks on the ASX in recent times, growing from a penny stock to a $3.4 billion company as it has progressed plans to start mining its Kathleen Valley lithium deposit in 2024.

That will produce around 500,000tpa of spodumene concentrate in its first stage, featuring a 2.5Mtpa concentrator, and the WA company has already signed up its first major customer via an offtake term sheet.

Korean electronics giant LG will buy 100,000dmt of spodumene from the $473 million Kathleen Valley project in the first year of a five-year deal in 2024, rising to 150,000dmt per year for the remainder of the deal, which has an option for another five-year term.

The deal represents around a third of Kathleen Valley’s start-up capacity, which is expected to increase to ~700,000tpa after a second stage expansion a few years after operations begin.

Under current plans being studied by the ASX-listed company, that could precede the development of a refinery to produce battery grade lithium chemicals from the Kathleen Valley concentrate.

Pricing linked to market

Liontown says using today’s pricing the contract terms for 6% spodumene concentrate, which will be linked to prevailing hydroxide prices, are greater than assumptions used in its recent DFS of US$1,287/t.

Managing director and CEO Tony Ottaviano said the “historic” first offtake deal for Kathleen Valley highlighted its “Tier-1 credentials”.

“We have been steadfast in our strategy to negotiate terms that we believe accurately reflect the significance of our position in the global lithium market, as well as the quality and location of our Kathleen Valley resource to ensure that we extract the best value for our shareholders,” Ottaviano said.

“Not only is this Offtake Term Sheet consistent with our strategy, it also represents a strong validation for the Tier-1 credentials of the Kathleen Valley Project as one of the world’s premier new spodumene projects.

“Having a customer of the calibre and standing of LGES endorse the project, by signing up to become a foundation customer, represents a significant vote of confidence in Kathleen Valley and in Liontown’s ambition to become a globally significant provider of battery materials for the clean energy market.”

The company says negotiations are also progressing with other potential Tier-1 global customers, but the company could also leave some of its planned output open to the spot market, which has demonstrated its capacity to shoot up suddenly in the emergence of supply shortages.

Liontown Resources share price today:

Markets today

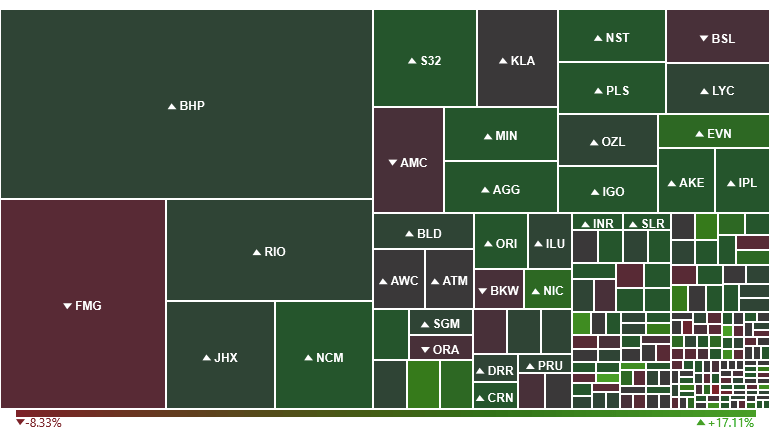

The materials sector was up around 1% with commodity price gains in gold, iron ore and nickel as well as ongoing enthusiasm for lithium miners which drove the market higher.

The major weight on the sector was Fortescue Metals Group (ASX:FMG), which sunk ~2% after analysts at Citi Group lowered their recommendation on the stock from a hold to a sell.

Citi’s analysts say FMG is overpriced compared to its peers, saying the maths is not there currently to support an implied $11 billion valuation on its green energy business Fortescue Future Industries.

Nickel meanwhile hit seven-year highs of US$21,400/t according to ANZ, based on “stronger electronic vehicle sales and restocking demand from auto manufacturers”. Tesla inked an offtake deal for 75,000t of nickel over six years from a proposed nickel mine in Minnesota owned by TSX-listed Talon Metals and Rio Tinto (ASX:RIO).

Indonesian focused Nickel Mines (ASX:NIC) led that sector of the market, up almost 6%.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.