Ground Breakers: Iluka could take Aussie rare earths further downstream than it’s ever been before

Pic: Lee Cohen/Corbis Documentary via Getty Images

- Iluka Resources has slashed its dividend after costs and falling revenue saw profit fall 45%

- Its pivot to rare earths is showing no signs of slowing down, with a $15m study on a metallisaton facility approved

- Would build on its $1.2 billion 4000tpa Eneabba refinery, currently heading into construction

Iluka Resources (ASX:ILU) shares were smashed after the ASX 100 mineral sands producer slashed its half-year dividend by 88% to 3c, a year after making a bumper 25c per share payout.

It is the latest large-scale miner to cut payouts as companies both see the end of boomtime pricing, and lick their wounds from a year of being gouged by inflationary pressures.

But it also comes amid massive capital expenditure plans across the industry as miners who have focused squarely on returns invest to retool and capture the opportunities of the energy transition.

Iluka saw revenue from its mineral sands operations in WA and South Australia fall 10% to $712m in the first half, with EBITDA falling 22% to $353m, and unit costs on goods sold rising 26% to $1062/t.

That saw profits fall 45% to $204m, with operating cash flow down 53% to $228m and free cash flow down from $350m to negative $55m.

It is currently completing the front end engineering design work on the $1.2 billion Eneabba rare earths refinery, the first of its kind in Australia and funded via a $1.25 billion low cost loan from Canberra, as well as the Balranald underground deposit in New South Wales, where an investment decision was made in February.

But it could go even further with its rare earths refining plans, today announcing a $15 million study to be completed by 2025 which could see Iluka become Australia’s first producer of rare earths metal, among the first outside China to do so.

Iluka says as much as 1.5-2kg of rare earth fed permanent magnets are in each EV, with as many as 40 million to be sold annually by 2030. Each of those cars will need 0.5-0.7kg of rare earth oxides, principally neodymium and praseodymium.

At 17,500-30,000t of NdPr oxide, EVs alone would require between 4-7 times the capacity of Eneabba.

“Metallisation is the next stage of value addition after the production of rare earth oxides and is significant strategically,” Iluka MD Tom O’Leary, a big advocate for onshoring downstream processing in Australia, said.

“If developed, a commercial scale metallisation facility in a Western jurisdiction would remove the need for customers to process oxides through third party tolling facilities, as is often the case today.

“This capability would broaden Iluka’s potential customer base and further enhance our marketability as a sustainable producer of light and heavy rare earths with traceable product provenance.”

Market conditions proving more challenging

But the immediate challenges facing the miner, despite strong mineral sands pricing, are obvious.

Rising costs have impacted profits at the same time as free cash needs to be squirrelled away for major projects.

“Iluka delivered increased prices and strong margins in the first half against a backdrop of evolving market dynamics. Global macroeconomic uncertainty is leading to more subdued levels of demand for mineral commodities, including Iluka’s products, relative to the immediate years post COVID-19,” O’Leary said.

“We have been aided through this period by our leading market position, Australian production base, sustainable pricing approach and premium product offering. Iluka’s operational performance in the first half was strong and it was achieved alongside an important reduction in our TRIFR.

“In keeping with the company’s track record over many years, Iluka will continue to focus on optimising the value of what we produce, coupled with market discipline and a deliberate approach to reinforcing the positive supply-side fundamentals for high quality zircon and high grade titanium feedstocks.”

That market discipline has included a decision to pause production over four months from the end of September at the SR1 synthetic rutile kiln in Capel, WA, which has an annual production rate for 110-120,000t and was restarted after 13 years on care and maintenance in December 2022.

But both it and the 225,000tpa SR2, which is undergoing planned maintenance over the same period and needs workers from the SR1 plant, will be restarted in January.

“Restarted in December 2022, SR1 is unique in the mineral sands industry as a premium swing production asset for high grade titanium feedstocks,” O’Leary said.

“Its pause will coincide with the planned major maintenance outage at SR2, which will occur over the same four month period. This enables Iluka to leverage the expertise of our SR1 workforce to SR2 maintenance works and, in doing so, reduce associated external costs by ~$4 million.”

Iluka produced 368,000t of zircon, rutile and synthetic rutile across the first half, but has adjusted its synthetic rutile output down from 305,000t to 255,000t for 2023 on the back of the decisions at Capel.

It has also begun a DFS at its Wimmera project in Victoria, a zircon rich mineral sands asset with rare earths by-products that could feed into the Eneabba refinery.

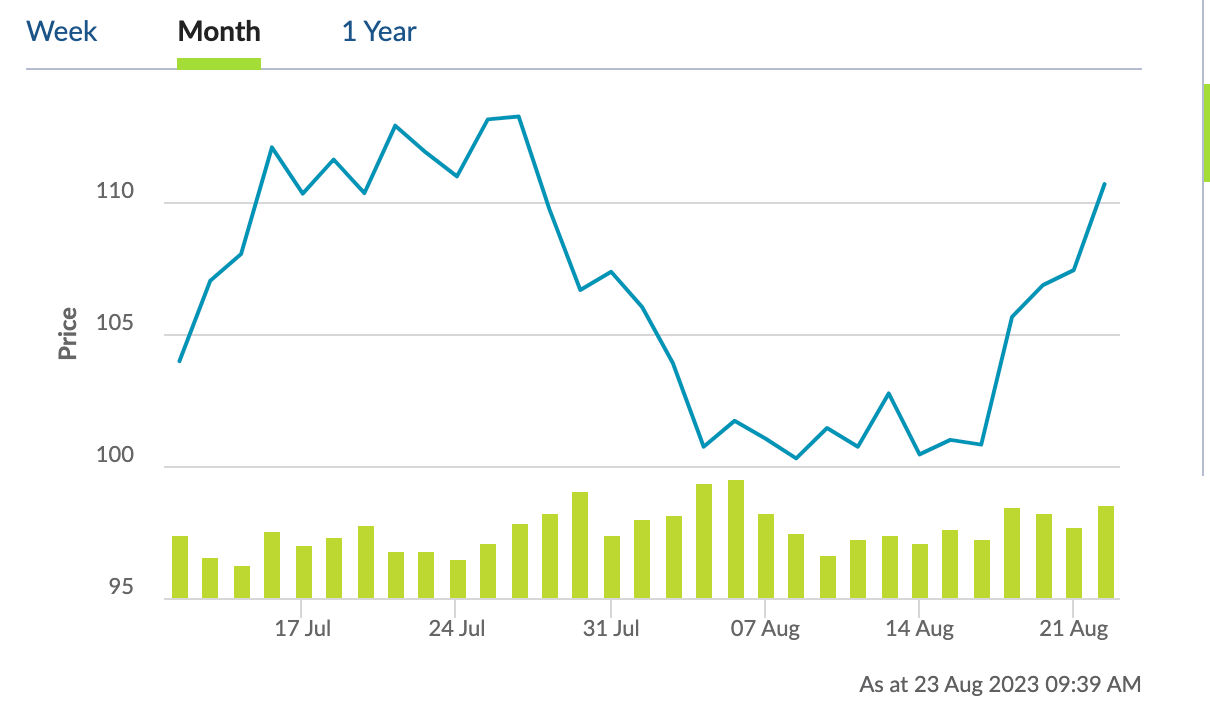

Iluka Resources (ASX:ILU) share price today

And on the markets?

Iron ore is absolutely stonking.

That’s the Singapore exchange showing iron ore futures running up almost 3% today to over US$113/t.

Fertile conditions for the materials index, which is up 1.68% this morning led by the triumvirate of BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG), all of whom look pretty bullish this morning on the lifting prices.

Dalian futures are even more speculative this morning, running up almost 5% to a tick under US$115/t on the most traded January contract. It came alongside moves across base metals and other commodities as China made moves to strengthen the yuan.

“Iron ore futures rose for a fourth consecutive day amid expectations of stronger demand,” ANZ senior economist Adelaide Timbrell said in a note.

“The improved funding comes ahead of the key construction period. The market is also buoyed by the absence of government directives to cut steel production.”

Ground Breakers share prices today

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.