Ground Breakers: Forrest’s Fortescue finally lifts the lid on its green energy plans

Pic: Kemter/E+

- Fortescue lifts the lid on US$750 million in green investments

- Pit is Super, thanks for asking: Northern Star

- Sprott nabs 9x gains in uranium fund

After a year of uncertainty and snowballing questions from analysts and investors on the detail around Fortescue’s (ASX:FMG) green energy plans, Andrew Forrest’s $78 billion iron ore giant has finally given the green tick to three projects which will see US$750 million of investment over the next three years.

The largest chunk of that will be a US$550m investment in an 11,000tpa liquid green hydrogen plant in Phoenix called the Phoenix Hydrogen Hub, which will encompass an 80MW electrolyser and liquefaction facility and be in operation from 2026.

Fortescue will also spend US$150m on a 50MW green hydrogen plant in Gladstone in Queensland, due to start churning out the gas using its own electrolyser tech from 2025.

Finally FMG will also use green hydrogen and solar energy to invest US$50m in a green iron trial plant at its Christmas Creek iron ore operations, expected to produce more than 1500t of iron from 2025.

Projects in Brazil, Kenya and Norway have also been quote-unquote fast tracked by FMG’s board after a shroud of mystery which surrounded its long-mooted claim that five projects would reach FID in 2023.

FMG is calling them the first ‘green hydrogen deals’ to be progressed to FID in the US and Australia. But also come with the caveat that its Gibson Island green hydrogen and ammonia project will require further work ‘as Australia struggles to shed its petrostate status and still suffers structurally

high green electricity costs.’

The calls come on the morning of FMG’s AGM at the Crown complex in Perth, where Forrest and his key lieutenants will face investors with its share prices agonisingly close to an all time high on the continuing strength of iron ore markets.

“Diversity in technology and geography at conservative scales for Fortescue projects reflects our disciplined approach to learning while we do, prior to large scale investments,” Fortescue Energy CEO Mark Hutchinson said.

“The Phoenix Hydrogen Hub establishes Fortescue in one of the most attractive energy markets in the world, facilitated by the Inflation Reduction Act.

“The proximity to California, a primary heavy haulage trucking route and the most progressive US State to adopt and incentivise clean hydrogen, primes Fortescue well to deliver value into the US domestic market.

“The Gladstone PEM50 Project in Queensland will produce hydrogen at an industrial scale, allowing us to demonstrate the high quality of Fortescue’s own hydrogen systems.

“With a disciplined approach to capital allocation, we continue to target double-digit project returns. This is the start of a pipeline of green energy projects we are dedicated to delivering.”

FMG expects to spend US$500m in its energy division in capex this year, a lift of US$100m, with US$2.8-3.2b to be spent by its metals division.

“Fortescue is taking a proactive approach to green iron, including embracing innovative technologies that will help us step away from the use of fossil fuels,” Fortescue Metals chief Dino Otranto said.

“We are confident that our approach will drive growth for Fortescue through new, high value products being sold into new markets, ultimately leading to an increase in the number of iron units we sell.”

Fortescue has targeted a location near California for the hydrogen facility, which will initially be funded by FMG with project debt and equity arrangements likely to be completed later. Expected to qualify for a clean hydrogen production tax credit of up to US$3/kg, nearby Cali is planning to phase out diesel consumption from 2036, with a prohibition on the sale of combustion engine trucks.

Fortescue (ASX:FMG) share price today

Pit is Super, thanks for asking

Armed with over 20Moz of reserves and a more than 10-year mine life across three major production centres, Northern Star (ASX:NST) has flowered from a single mine operator under the entrepreneurial lead of Bill Beament in the early 2010s to the key gold exposure on the ASX.

While Newmont (ASX:NEM) has taken the reins at Newcrest, also netting it a secondary Australian listing in the process, history shows the majors don’t always keep that vestigial organ, no matter what they say at first.

NST is safely and reliably Aussie, with the bulk of its output coming from its network of mines around the Kalgoorlie region — including the famous Super Pit established by Alan Bond in the 1980s — and the Yandal operations in the Northern Goldfields, consisting of the 1990s vintage Jundee, Bronzewing and Thunderbox mines.

Found by Paddy Hannan, Dan Shea and Tom Flanagan in 1893, the Golden Mile was once known as the richest square mile on earth (actually two) and has delivered 60Moz or more of the precious metal, well over 20Moz since the Super Pit was formed.

A more than $1 billion investment to expand the Fimiston Mill is expected to turn the project back into one of the world’s biggest gold mines, churning out 900,000ozpa from around 2029.

A major exploration update today has shown Northern Star is continuing to find new sources of the precious metal in and around Kalgoorlie at a time when prices are hovering just beneath US$2000/oz (over $3000/oz Aussie).

NST has spent $28m of its $150m exploration budget so far this financial year, showing high grade gold continues to be found beneath the base of the now 130-year old discovery.

Within 300m of the underground drill drive at its Fimiston underground drilling, Northern Star has collected ‘exceptional results’ of 4.3m at 25.8g/t and 6.6m at 9.5g/t, while it is also progressing a stockwork discovery at Little Wonder — around 500m from existing workings at its Mt Charlotte underground mine (which has been in continuous operation since 1962).

Thick intercepts have also been found beneath the base of the old Mt Percy pits to Mt Charlotte’s north including 40m at 3.9g/t, 77.8m at 2.2g/t and 95.2m at 2.8g/t at the Sir John/Union Club and Mystery prospects. Small, high grade hits have been struck also at Joplin, 300m from the Velvet mining area at Kanowna Belle, including 9.9m at 7.1g/t.

There’s more across the Yandal, Kalgoorlie and Pogo operations (the latter is over in Alaska), but it would take forever to dig into all the detail. Mass moves mass, and the $13.3 billion gold miner has the heft, cash and ground to add significantly to its 57.4Moz resource base, especially on these results.

“Exploration and capital investment in our largest asset, KCGM, is generating and enhancing returns for our shareholders. We are rapidly growing near-mine opportunities close to underground infrastructure, which has the potential to add higher-margin ounces to the existing Reserve profile that underpins strong economic returns for our Mill Expansion,” NST MD Stuart Tonkin said.

“Dedicated exploration efforts by Northern Star at this global-scale asset have delivered excellent results so far, which highlight the growth potential that exists at KCGM and across the broader Kalgoorlie region.

“At Yandal, we are seeing encouraging results at key deposits and other prospects to potentially support mine-life extensions and further enhance value from the recently expanded Thunderbox processing plant. At Pogo, drilling results continue to impress with near-mine opportunities underpinning the mine life and investment thesis for this Operation.

“The disciplined and returns-based approach we take to exploration continues to yield results. Importantly, the continued success demonstrates the significant organic optionality at all stages across our portfolio.”

Northern Star Resources (ASX:NST) share price today

Sprott’s uranium gamble secures an early win

Sprott’s counter-cyclical move into uranium has proved a winner so far, with the value of its physical uranium trust bounding beyond US$5 billion yesterday.

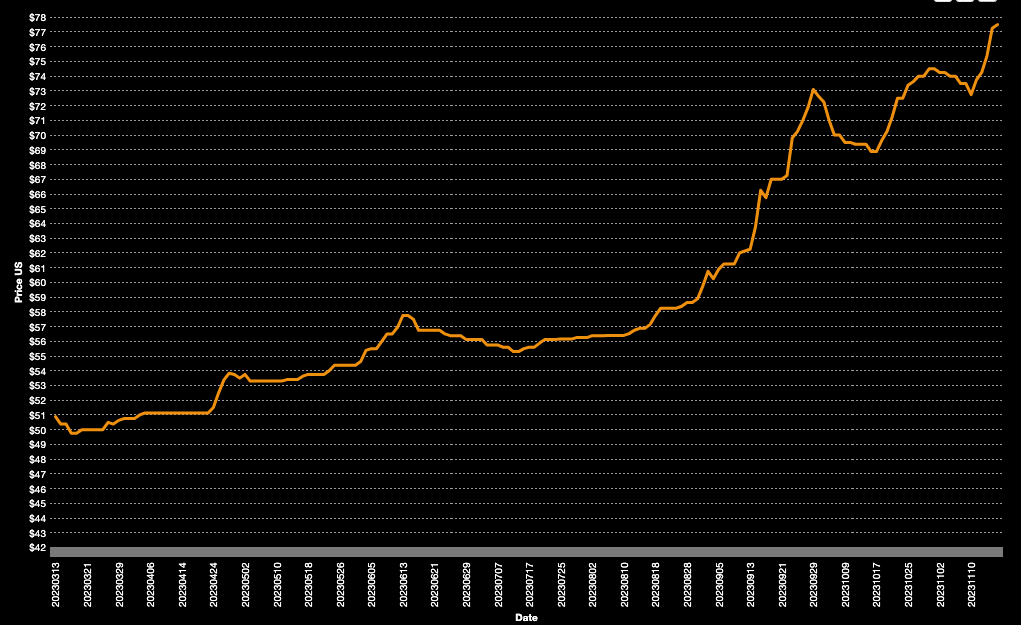

The fund, designed to buy up yellowcake on the spot market and soak up the secondary supply which had helped depress contracting, was started in 2021 when prices were around the US$30/lb mark.

Those are levels all but the largest, lowest cost producers would go broke on and even those giants — Cameco, Kazatomprom — scaled back in an act of ‘supply discipline’.

Now prices are at multi-year highs of US$77.5/lb, thus far the top in class mining sector of 2023.

Conceived with an NAV of US$630m in July 2021, Sprott now says that number is over US$5b. Its securities have traded up 105% since inception as well.

Sprott Asset Management CEO John Ciampaglia believes the world remains in the early stages of a uranium bull cycle, with over 62Mlb of U3O8 now stored by the trust.

“Since SPUT’s launch, there has been a growing recognition that nuclear power is an essential component in achieving global carbon reduction targets while providing energy security. We are proud that our relentless focus on education helped investors globally to better understand the uranium investment opportunity,” he said.

“We continue to believe it is the early stages of a uranium bull market as global support for nuclear energy grows and the utility contracting cycle accelerates.”

On the Australian bourse, iron ore prices rising to almost US$133/t inspired a rally among the big boys, with hopes of stimulus measures in China powering them and lithium stocks to gains.

The materials sector gained 1.18% in morning trade.

Ground Breakers share prices today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.