Ground Breakers: Canberra says lithium and base metals will rival coal sales by 2028

Pic: Alan Thornton/The Image Bank via Getty Images

- Lithium and base metals to grab rising role in Aussie resources exports to rival coal

- Despite recent falls in lithium prices, Canberra boffins see battery metals becoming a major part of Australia’s dominant mining sector

- Wyloo declares $760m Mincor offer best and final in the absence of a competing proposal for nickel miner after product quality whiff

Canberra predicts in five years lithium, copper, nickel, zinc and aluminium exports will be worth as much to Australia’s economy as met and thermal coal combined in a major shift in the balance of power in the resources industry.

Record coal, oil and gas prices through the first half of the financial year have led energy and resources earnings to a forecast $464.2 billion this year according to this morning’s rendition of the Office of the Chief Economist’s Resources and Energy Quarterly.

Compiled by analysts from the Department of Industry, Science and Resources, the latest projections from their crystal ball show earnings from energy exports will outweigh resources, including iron ore, this financial year.

Total earnings will lift from $452b in 2021-22, which comprised $233.3b in resources sales and $218.7b in energy exports.

Those numbers have flipped to $226b and $238.2b respectively.

The biggest mover in growth terms however was lithium, up from $5b in 2021-22 to $19b in 2022-23 on the back of expanding volumes and prices, with average spodumene prices forecast to almost triple from US$1488/t last year to US$4104/t in FY23 and spodumene sales volumes from the world’s largest lithium producing nation to rise from 2.25Mt to 3.08Mt.

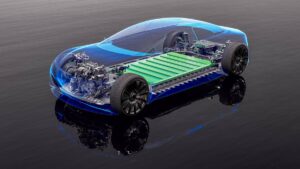

Combined with base metals, commodities centred around the EV revolution, batteries and the energy transition will pull in $47b in 2022-23, rising to $54b in FY28. At the same time the Feds think coal demand will wane, with export values from met coal and thermal coal falling from $63b and $65b respectively this year to $30b and $19b in 2028.

“Base metals and critical minerals such as lithium are crucial components of clean-energy technologies such as batteries, solar panels and wind turbines, which will help the world lower emissions and meet net-zero commitments,” Federal Resources Minister Madeleine King said.

“The latest Resources and Energy Quarterly underlines the importance of our critical minerals sector and Australia’s ambition to become a clean-energy superpower.

“The Resources and Energy Quarterly forecasts that exports of lithium and base metals (and their raw material inputs) will equal the export value of combined (thermal and metallurgical) coal exports by 2027–28.”

Iron ore on stronger footing

Iron ore exports are also expected to lift by $8b this year compared to previous forecasts and $7b in 2028.

They are expected to fall from $121b this year to $100b next year and $75b in 2028.

That comes with an expected slide in overall resources and energy earnings to $395b in 2023–24, and $346b in 2024–25 as prices continue to moderate from pandemic highs.

Iron ore prices have rebounded in recent months, with forecasters from the Department now expecting a shallower fall in prices from US$107/t in 2022 to US$100/t in 2023 and US$78/t in 2024, but dropping as low as US$63/t in 2028.

But supply growth could be more muted than iron ore bears fear. While Rio Tinto and its Chinese partners are planning to resume work this year on the stalled 150Mtpa ‘Pilbara Killer’ Simandou, department analysts think Brazil and Australia will also be major contributors to a 2.3% annual growth rate in supply.

Global iron ore exports are expected to lift from 1.56Bt in 2022 to 1.79Bt in 2028, with Australia’s sales to rise from 896Mt this year to 989Mt in five years’ time, owing to growing volumes from the Pilbara majors.

Brazilian supply is expected to lift strongest from 355Mt in 2023 to 491Mt in 2028, a CAGR of 6.1%.

Lithium supply forecast to grow

Mined lithium supply is expected to rise above 1Mt of lithium carbonate equivalent for the first time in 2024, lifting from 737,000t in 2022 to 964,000t this year and 1.167Mt in 2024.

“This rapid growth is forecast to be met by gains in output by Australia, Chile (via expansions to SQM and Albemarle brine operations) and Argentina (via new and expanded brine operations by Allkem, Livent and Minera Exar).

“Over the 5-year outlook, key sources of added supply include China, Brazil, Canada, DRC, Mali and Zimbabwe.”

While this will see a narrowing of the supply gap which has propelled prices to record levels in the past two years, before a recent pullback, Canberra sees prices remaining volatile.

“The large supply gap evident over the past 2 years is expected to narrow, as additional supply from mine and brine operations in Australia and overseas comes online,” the report authors led by editor David Thurtell said.

“However, prices are likely to remain volatile, given the immaturity of the lithium market and the potential for shortages — due to low lithium stockpiles.

“While stockpiles remain hard to ascertain — with some estimates of an average of 4-8 weeks for spodumene for hydroxide refiners — some refiners may have allowed stocks to run down in recent months, in order to minimise purchases of spodumene at recent high prices.”

Lithium production is forecast to exceed 2.067Mt LCE in 2028, a remarkable CAGR of 18.7%.

But demand is expected to keep pace, with a 17.2% CAGR helping the market swing back to a deficit in 2028 when demand will hit 2.13Mt.

Last year’s deficit was estimated at 87,000t LCE, narrowing to 25,000t this year and 200t in 2024 before a small 9000t surplus in 2024.

The department expect real spodumene prices to average US$4350/t in 2023 before dropping to US$2760/t in 2024 and US$1740/t in 2025 ahead of a rebound to US$2490/t in 2027 and US$2440/t in 2028.

Hydroxide prices are expected to average US$61,520/t this year and US$36,220/t in 2028.

Meanwhile, forecasters see Australia, the world’s biggest producer of lithium units at 53% in 2022, grabbing a share of the downstream processing market as great as 20% by 2028 as EV batteries end use grows from 80% of all lithium produced to 90% in five years.

“By the end of 2024, Australia could have up to 10% of global lithium hydroxide refining capacity, rising to over 20% of global lithium refining by 2028,” they said.

“However, there are risks over the outlook. These include approval and construction delays for new mines and processing plants and difficulties achieving ramp up to full output. There are also technical challenges associated with achieving the required product grade, purity and consistency, which could delay output and exports.

“Australian businesses are expected to continue their expansion into higher value-added activities over the 5-year outlook period. Potential avenues include moves up the battery value chain, from mining and refining into precursor chemicals for cathodes, electrolyte production, battery anode plants, battery cell research, and battery manufacturing.”

What’s happening on the markets this morning?

Something had to give after last week’s stellar run for ASX mining stocks. And the materials sector has emerged as the lone laggard today, down 0.42% as the energy sector leads the ASX 200 on a 0.8% run.

Energy is up 3% and more after OPEC+ moved to trim oil supplies, much to the dismay of central bankers around the world.

Lithium and gold stocks that performed so well last week led the falls, with the big four lithium stocks Pilbara Minerals (ASX:PLS), Allkem (ASX:AKE), IGO (ASX:IGO) and Mineral Resources (ASX:MIN) the worst performing large caps as lithium carbonate prices continued to fall in China.

Meanwhile, Andrew Forrest will press on with a $760 million bid to acquire Mincor Resources (ASX:MCR), despite the revelation the miner had been hit with quality issues in the nickel ore it supplies to BHP’s (ASX:BHP) Kambalda concentrator.

But it has determined its $1.40 offer will be best and final after Mincor’s disappointing product quality update last week, which saw it withdraw its FY23 guidance.

“Wyloo notes Mincor’s Operations and Guidance Update announced to the Australian Securities Exchange on 30 March 2023, and confirms that it was unaware of the material information contained within that announcement,” Wyloo CEO Luca Giacovazzi said.

“As a result of these developments, Wyloo has determined that the current offer price of $1.40 per share is best and final and will not be increased, in the absence of a competing proposal.”

Mincor’s targets statement is expected to land tomorrow.

Mincor Resources (ASX:MCR) share price today:

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.