Greenvale Energy’s newest uranium pick-up has shades of the world class Rossing mine

Oasis is an intrusive (Alaskite) type deposit, which are generally large moderate grade deposits hosting approximately 10% of global uranium reserves. Pic: Getty Images

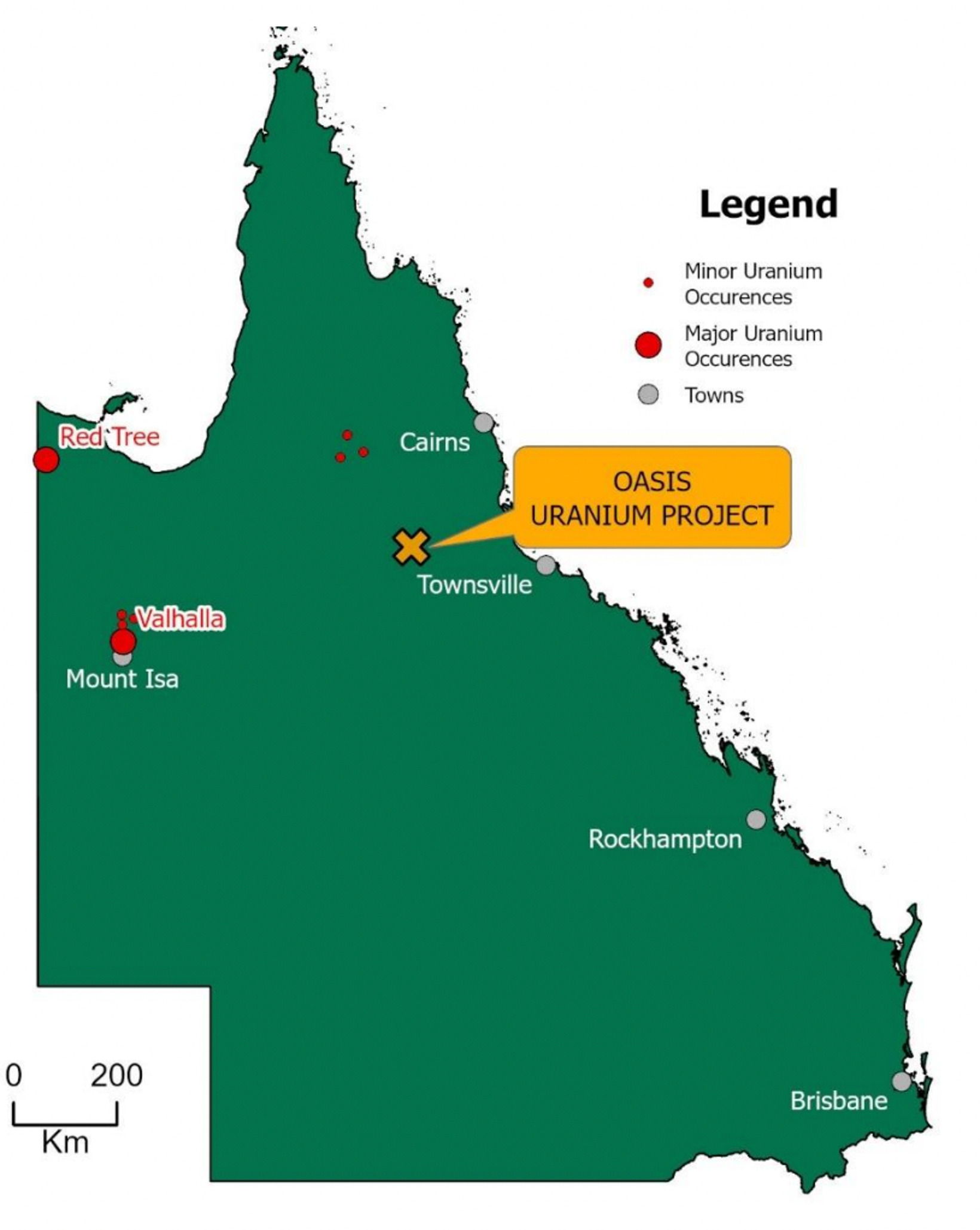

- GRV picks up Oasis uranium project in QLD for $200,000 and 20 million shares

- Nine historical priority targets identified plus 1m at 0.72% U3O8 intercept

- Company plans to upgrade Oasis to resource status this exploration season

Special Report: Greenvale Energy has acquired a new uranium asset in the Oasis project in Far North Queensland, a project boasting similar characteristics similar to the world class Rossing mine in Namibia.

This follows a broader move by the company to focus on uranium, with the acquisition of the Elkedra and Henbury uranium projects in November and October last year.

The Oasis project was discovered in the 1970s during a uranium exploration push by international companies, including Esso, with nine priority targets, the main being Oasis, identified by Terra Search.

Glengarry Resources then came along and validated the historic Esso data to confirm continuous high-grade mineralisation with intercepts up to 1m at 0.72% U3O8 (15.8lb/t).

In addition, Geoscience Australia have age dated the Oasis uraninite and associated alaskite intrusive bodies which are the likely drivers of the uranium mineralisation.

This has also strengthened the company’s interpretation the project hosts mineralisation analogous to the intrusive related alaskite mineralisation style, with alaskites accounting for around 10% of global uranium reserves.

They are generally large, moderate grade deposits, the most striking example being Rossing – the world’s longest running uranium mine – in Namibia in southwest Africa.

Greenvale Energy (ASX:GRV) says the acquisition adds “considerable weight” to its portfolio of uranium exploration projects and is expected to be rapidly upgraded to resource status during the 2025 exploration season.

Targeting a resource in 2025

The Oasis shear is interpreted to extend undercover for another 1.5km to the north and remains untested for extensions to mineralisation.

And only the Oasis deposit has been drill tested to date, with a further eight anomalies presenting compelling targets for the company, together comprising over 10km of strike length adjacent to – and apparently emanating from – the major terrane boundary delineated as the Lynd Mylonite zone.

Greenvale plans to conduct an aggressive 2025 exploration program at Oasis with the goal of bringing known and extended mineralisation at Oasis to JORC 2012 resource status.

This will be done in three stages:

- Geochemical testing of entire Oasis shear which extends under cover for 1.5km north of identified mineralisation by track etch technique and geological prospecting

- Geochemical testing of 8 priority coincident radiometric/structural anomalies by track etch technique in conjunction with geological prospecting and follow up drilling of identified targets; and

- Ground truthing and detailed mapping of all undercover structural splays emanating from the Lynd Mylonite zone where radiometrics don’t work and geochemical testing of identified splays with track etch technique.

Cashed up for exploration

Greenvale recently secured a $1.175m research and development rebate, which along with cash on hand, $250,000 from the sale of the EP145 project and a $3m loan facility yet to be drawn, means its geos are well placed to proceed immediately with planned work programs at its NT and QLD uranium projects.

These funds will also be used to start Stage 1 of the test program at its Alpha torbanite project (also in QLD) where the plan is for the University of Jordan to conduct a bulk sample test program aimed at maximising yield.

It is Greenvale’s expectation that after completing these experiments, the company would be in a position to produce bulk samples under the optimal conditions identified.

Mark Turner, former CEO of Greenvale, will manage the work on behalf of the company as an independent contractor.

This article was developed in collaboration with Greenvale Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.