Greenvale adds fourth uranium project to growing NT portfolio

The new Elkedra project contains multiple shallow walk-up drill targets, offering the potential for cost-effective exploration using shallow drilling methods. Pic: Getty Images

- Greenvale adds fourth uranium project to portfolio

- Elkedra spans 566km2 and comprises multiple walk-up drill targets

- A proposed exploration program including airborne magnetic surveys and field mapping is in the works

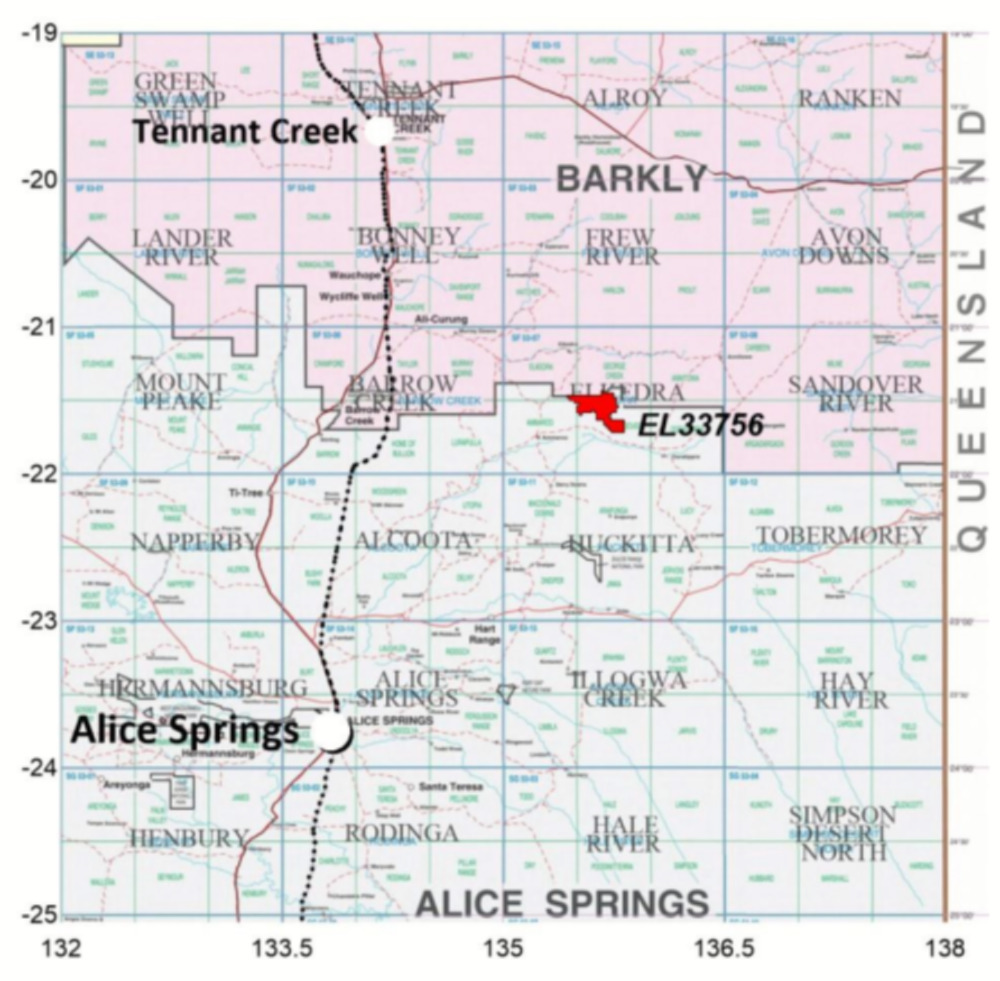

Special report: Greenvale has entered into a binding heads of agreement with Gempart to acquire an 80% interest in the Elkedra uranium project, 300km northeast of Alice Springs.

The acquisition strengthens the company’s growing Australian uranium portfolio, complementing its recent acquisition of the Douglas, Tobermorey and Henbury uranium projects.

All four projects contain walk-up drill targets and offer the opportunity to utilise shallow, cost-effective exploration methods.

Elkedra comprises one large exploration licence, EL33756, and is highly prospective for sandstone-hosted and unconformity type uranium mineralisation.

The package includes an extensive uranium/thorium ratio and coincident uranium anomaly occurring over an 8km strike length, immediately south-east of the fertile metamorphosed halo of the Elkedra granite.

Uranium stocks on the up

Uranium stocks have gained momentum this week after a statement on Friday from Russia’s Government over Telegram that it would restrict enriched uranium exports to customers in the United States.

That comes ahead of a now legislated post-2028 ban supported by both normally highly adversarial sides of US politics in response to Putin’s invasion of Ukraine.

Having outsourced much of its commodity needs for decades, onshoring became a serious imperative under the outgoing Democrat Joe Biden, whose signature industrial policies like the Inflation Reduction Act largely focused on subsidising local supplies of critical materials.

These potential supply risks to utilities operating American reactors has helped increase the spot price of uranium to US$81.85/lb.

Now that Greenvale Energy (ASX:GRV) has secured the rights to acquire an immediate 80% interest in Elkedra, the company plans to leverage the attractive geological setting to conduct shallow air-core drilling programs.

That style of drilling is typically low in cost and effective at finding orebodies close to surface.

The large-scale sandstone-hosted uranium deposits on the exploration licence makes the project easy to access and explore, allowing GRV to advance it rapidly.

GRV incurred a small upfront cost of ~$10,000, payable to Gempart, as reimbursement of data acquisition costs to secure its 80% interest in the tenements by completing a definitive feasibility study.

There is no time limit on completing the DFS and GRV will maintain the tenement in good standing for duration of earn in period.

Exploration to begin shortly

“We are delighted to have secured the acquisition of another high-potential uranium asset, the Elkedra project represents another significant addition to our growing Australian energy portfolio,” GRV CEO Mark Turner said.

“Elkedra has proven prospectivity for large-scale sandstone-hosted uranium deposits in an attractive geological setting and comes with multiple high-priority exploration targets.

“It is also prospective for unconformity type uranium mineralisation.

“We are looking forward to getting on the ground and commencing exploration activity as soon as possible.”

This article was developed in collaboration with Greenvale Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.