Greenstone validates growth strategy with hefty 57% upgrade to gold ounces

Pic: Getty Images

Greenstone has clearly demonstrated the wisdom of adopting a resource growth strategy with the upgrading of its global gold resource by 57% to 520,134oz.

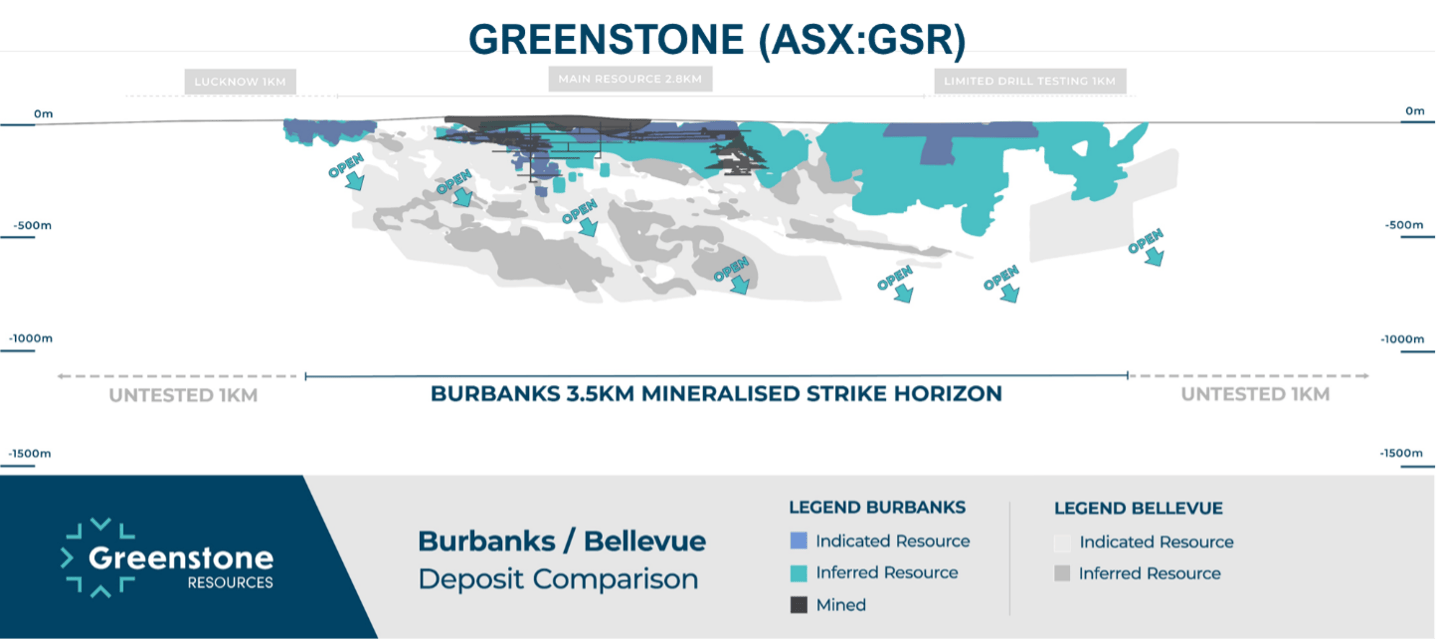

The company, which shifted away from small scale mining some 12 months ago, upgraded the resource at its Burbanks project in Western Australia by 68% to 6.05Mt at 2.4 grams per tonne (g/t) gold to 465,567oz of contained gold (indicated & inferred) on the back of an additional 10,000m of drilling completed as part of its Phase 1 campaign.

And while the latest update means that resources at Burbanks have grown at a compounded annual growth rate of 104% since exploration resumed in November 2021, Greenstone Resources (ASX:GSR) has only just warmed up its exploration engine.

The reason for this is simple. While the Phase 1 drilling has been hugely successful, just 30% of the mineralised horizon at Burbanks above 500m has been tested to date – a strong indicator that there is likely a lot more gold left to be found.

Efforts to continue this growth trajectory are already in place with the company expecting the Phase 2 drill campaign to resume early this month once drilling is completed at the Phillips Find project, which has a resource of 732,960t at 2.3g/t gold for 54,567oz of contained gold that has remained unchanged – for now.

To top it all off, Burbanks is the only undeveloped high-grade resource of more than 450,000oz of gold located within 100km of Kalgoorlie and is surrounded by a number of mid-tier and major gold producers.

Managing director Chris Hansen said the upgrade validated the company’s long standing conviction in Burbanks, which now has total endowment – including historical production – exceeding 850,000oz of gold in largely the upper 300m.

He added that with resources more than tripling since the company adopted the revised strategy focused on resource growth by unlocking the latent value at Burbanks and the wider Coolgardie portfolio, Burbanks was now one of the most significant undeveloped gold deposits in the region.

“Importantly, with only ~30% of the mineralised horizon above 500m tested to date, there is significant potential for future growth which will be tested as part of the upcoming Phase-2 drill campaign”

“The recent resurgence of M&A within the gold sector over the past months serves to highlight the scarcity of high-quality predevelopment projects, as exemplified by Ramelius Resources $201m bid for Musgrave Minerals, or Northern Star Resources $61m offer for Strickland Metals Millrose Gold Project, both of which have occurred in the last week alone.” he noted.

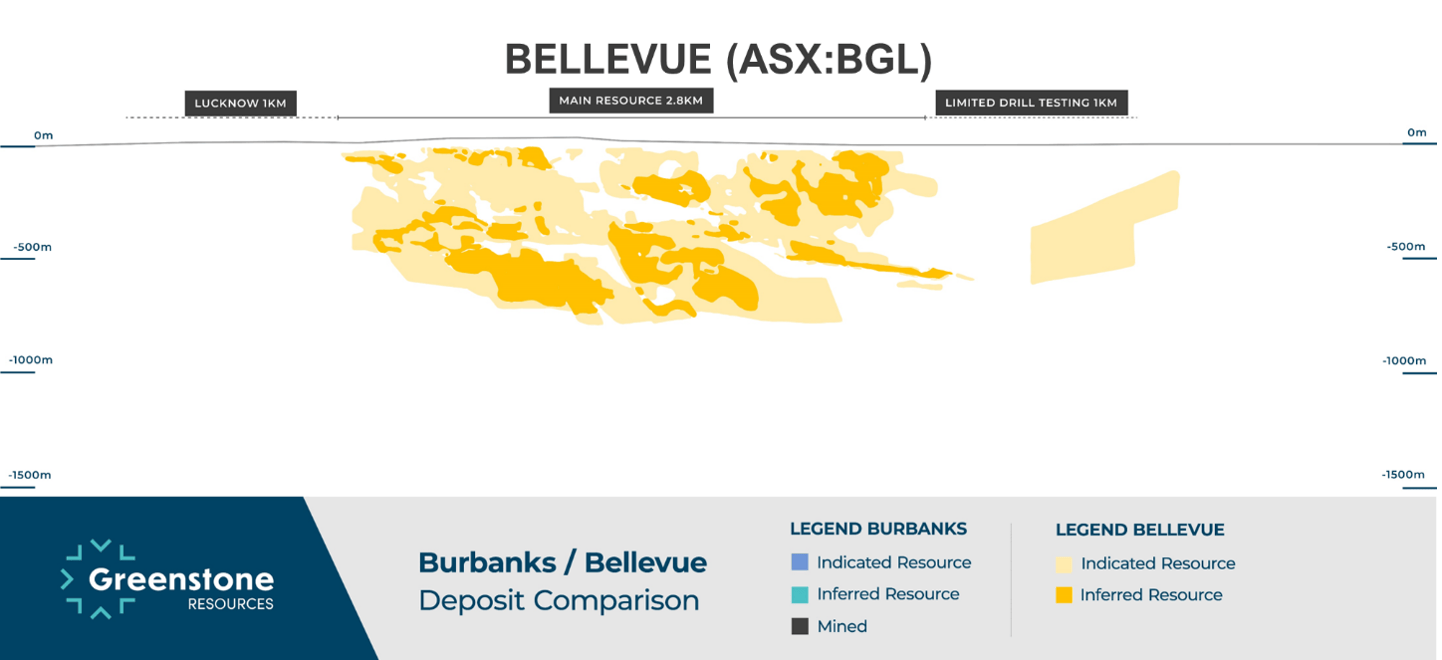

The potential for future growth is striking when compared to other historic and previously untested mining centres like Bellevue Gold (ASX:BGL) flagship project.

This article was developed in collaboration with Greenstone Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.