Greenland’s riches tickle fancy of US but Australians have key to success

Australian companies are progressing their respective projects in Greenland. Pic: Getty Images

- Greenland offers strategic wealth of rare earths, other minerals on North America’s doorstep

- US keen to exploit its riches to secure supply chains for valuable minerals

- Australian companies have been making good progress on their Greenland projects

Greenland captured plenty of attention earlier this year when US President Donald Trump expressed interest in annexing the autonomous territory of Denmark.

Legalities (and no small amount of incredulous looks and outright rejection) aside, the reasons for his interest are believed to be two pronged.

One, Greenland sits right on the doorstep of the US – indeed it is part of the North American continent, making it valuable from a strategic perspective.

Secondly, the world’s largest island is known to have a very rich mineral bounty, particularly in critical minerals such as rare earths, graphite, uranium, copper and nickel.

REEs are valued for a range of applications including aerospace alloys and permanent magnets used in electric vehicle motors and wind turbines.

They also see use in advanced defence, which further enhances their value to the US given China’s dominance of REE supply and processing.

The other critical minerals are no less valuable, which no doubt adds to the attractiveness of securing a nearby source.

In pole position

While the US considers how best to exploit this significant resource in its backyard by seemingly trying to step on as many toes as possible, Australian companies have already been operating in-country for some time and have clearly figured that working with Greenlanders is the best way forward.

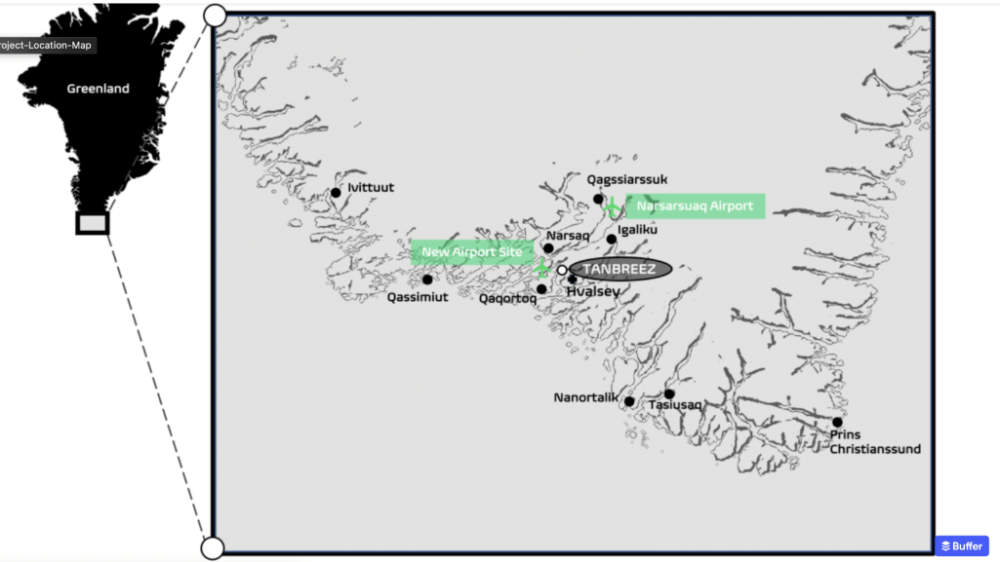

European Lithium (ASX:EUR) and Critical Minerals Corp (NASDAQ: CRML), which is ~68% held by EUR, own 7.5% and 42% (with a right to earn up to 92.5%) of the giant Tanbreez rare earths project.

The project has a resource of 45Mt grading 0.38% TREO within the Fjord deposit though this covers just a small part of the kakortokite host rock.

Exploration to date has also flagged the potential for the project to host other valuable elements such as tantalum, niobium, hafnium and zirconium.

Speaking to Stockhead, European Lithium executive general manager George Karageorge said Tanbreez was regarded as one of the largest rare earths deposits in the world with the US Geological Survey recognising it as the second most significant REE project globally based on the unique heavy rare earth oxides and overall tonnage.

“The light-heavy rare earth oxides and metal oxides are contained within strata bound Ilimaussaq igneous alkaline host rock kakortokite unit of 4.7 billion tonnes with mineralisation from surface and measured drilling intercepts of 338m deep,” he said.

“The Tanbreez deposit has been explored for over half a century and multi-million-dollar exploration programs including over half a million samples and 500 deep drill holes have yielded a multi-billion-dollar opportunity to extract the highly desirable mineral commodities.

“The project is realising final stages of Greenland Government Approval to Mine, mining, processing and export approvals and has indicative finance approvals via US EXIM Bank and the Company expects [to] complete other final investment decisions before [the end of the] year.”

Highlighting the support received from the Greenland Government, Tanbreez has already secured a 30-year exploitation licence with only final permitting before finance and a decision to mine – expected by the end of this year – left to go.

Karageorge noted the company had advanced all requirements and appointed a Greenlandic in-country CEO to satisfy legislation on having Greenlandic management and meeting in country regulation for operation readiness.

He also flagged the company’s strong relationship with the local community saying the company’s Australian personnel worked in unison with Danish and local Greenlanders from Qaqortoq on drilling, environmental and administrative programs using Danish engineering and local earthmoving, drilling and helicopter hire companies.

The company has held forums with local Qaqortoq community stakeholders and sponsors local community business while an architectural designed head office, workshop and core storage facility is in final stages before construction takes place using Qaqortoq local business who have designed and will construct the new facility.

Supply chains and sustainability

Tanbreez is expected to be a major supplier of rare earths into the West – particularly the US where its Department of Defense has been leading the charge of establishing new supply chains.

Recent drilling has also uncovered gallium, a highly valuable strategic metal essential for computer chip production and widely used in electronics, AI and defence that is urgently required by the US due to China’s export controls.

It is not just about the mineral wealth, either.

Tanbreez also benefits from the ability to produce a REE concentrate via magnetic separation – a process that is free of chemicals.

That the project contains very low levels of uranium and thorium makes it more environmentally sustainable and politically attractive.

Adding further interest, the processing and camp facilities will be powered by hydroelectric power with the grid only 4km from the mine site.

Southern riches

While EUR and CRML have progressed the Tanbreez project they are acquiring from Rimbal, another Australian company has been operating in Greenland for some years now.

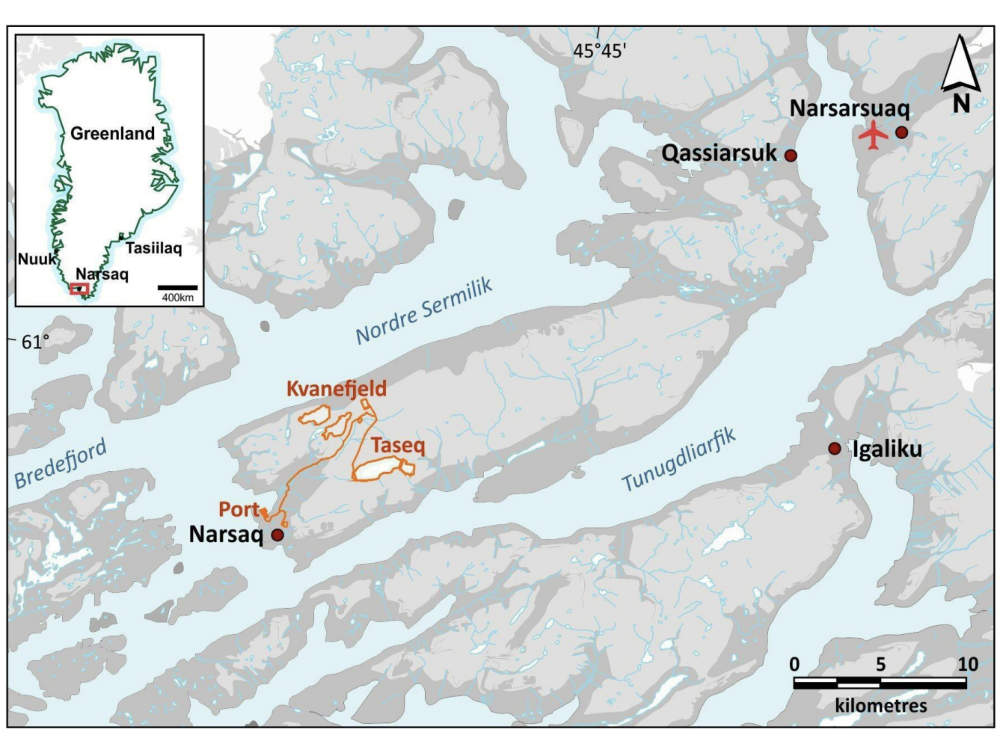

In both its previous guise as Greenland Minerals (and Energy) and now as Energy Transition Minerals’ (ASX:ETM), ETM has been steadily progressing its Kvanefjeld project in southern Greenland, an area with year-round direct shipping access.

To date, more than 1 billion tonnes of resources containing 11.1Mt of REEs and 593Mlb of uranium have been defined.

Kvanefjeld has a number of unique attributes that make it attractive as a development opportunity.

Mineralisation occurs as massive, mostly outcropping bulk mineral resources that translate to low mining costs while the ore is conducive to simple, cost-competitive processing.

The year-round shipping access is also expected to result in significant cost advantages to potential European customers.

Kvanefjeld will consist of a mine, a concentrator and refinery, producing a mineral concentrate containing 20-25% rare earth oxide that will be upgraded to high-purity intermediate rare earth products in the refinery.

The concentrator and refinery will also produce various by-products for sale, reducing the operating costs of the operation through revenue offsets.

Rare earth products are forecast to generate more than 80% of the project’s revenue, with by-products contributing to the balance.

The company is conducting geological mapping and rock sampling across the project to identify new targets at the Kvanefjeld, Sørensen and Zone 3 resource areas.

Initial activities have identified previously unknown surface expressions of rocks associated with REE mineralisation.

Of these, lujavrite and naujaite – both peralkaline rocks that host REEs – are of potential economic interest and have been noted in several unmapped occurrences.

At Stockhead, we tell it like it is. While European Lithium and Energy Transition Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.