Great Southern unlocks true potential of Cox’s Find with early drilling success

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Maiden drilling at Cox’s Find continues to prove fruitful for gold hopeful Great Southern, with early exploration delivering new high-grade zones.

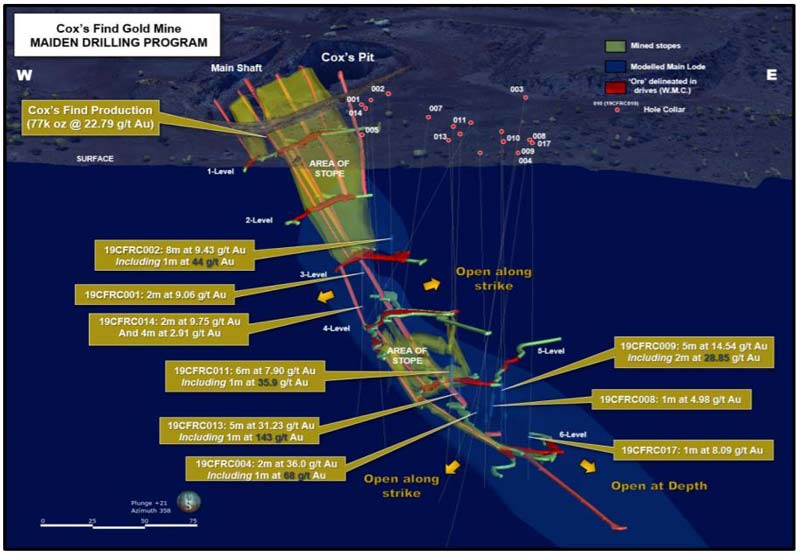

Great Southern (ASX:GSN) says high-grade zones have been identified in the “exceptional drilling results” returned from first drilling so far.

This preliminary drilling was focused on shallow high-grade gold mineralisation.

And this valuable piece of land just so happens to surround a past producing mine.

The historic underground workings delivered ~76,000 ounces of gold at an average recoverable gold grade of 22.6 grams per tonne (g/t) between 1936 and 1942.

But while former owner Western Mining Corporation (WMC) had mined down to depths of nearly 140m, drilling below 60m depth is virtually non-existent.

And with this extensive and extremely valuable collection of historic mining and exploration data from the past 80 years, Great Southern was able to pinpoint new drill targets.

The very first drill attack has already delivered extremely high grades of up to 143g/t, establishing Cox’s Find as “one of the highest, if not the highest, grading deposits along the immediate strike”, according to executive chairman John Terpu.

READ: Cox’s Find continues to unveil its high-grade gold riches for Great Southern

All this work has culminated in the company’s highly skilled technical team being able to update the geological model with definition of the high-grade mineralisation trends.

And Great Southern says this is “the first stage in unlocking the true potential of the Cox’s Find gold project and creating value for shareholders”.

Just as importantly, the grade and width of the intersections in the drill holes confirms that the mineralisation style and grade is consistent with what was mined by WMC between 1936 and 1942.

Terpu told investors Great Southern now had a far better understanding of the Cox’s Find deposit, its geology and the existence of the remnant ore.

Potential near-term development option

Cox’s Find also represents a potential near-term development opportunity for Great Southern.

READ: Great Southern eyes early cashflow from stockpiled ore at high grade Cox’s Find

This is because of the potentially profitable abundant stockpiles, leach pads, and historic material on surface.

Great Southern previously undertook work towards delivering a JORC 2012 compliant resource on this easy-to process surface material and is examining monetisation options.

Using a third-party mill, those ore stockpiles represent significant near-term cash for Great Southern at today’s +$2,150/oz gold price.

“We are progressively delineating some exciting structural and regional targets to test as well as examining some near-term development scenarios around potential monetisation of the remnant mineralisation,” Terpu said.

“GSN is the first company to explore the project systematically, using modern exploration methods, in nearly three decades.

“Following our disciplined and measured approach to the exploration program we will now interpret the significant amount of data acquired and prioritise targets for our planned extensional drilling program in early 2020.”

>> Gold stocks guide: Here’s everything you need to know

Read more:

Great Southern comes up trumps with its maiden drilling expedition at Cox’s Find – and it’s just the tip of the iceberg

Great Southern more than doubles gold drilling at Cox’s Find

Institutions, high net worths jump into Great Southern ahead of company making drill program

This story was developed in collaboration with Great Southern, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.