Great Southern – a gold explorer with early development opportunities and large-scale upside

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Great Southern Mining has three gold projects in Queensland and Western Australia that comfortably stand on their own as sensational exploration and development opportunities.

Great Southern Mining (ASX:GSN) is led by John Terpu, former head at Conquest Mining when it discovered the Mt Carlton gold-silver-copper project in Queensland in 2006.

Mt Carlton is now one of the highest-grade open pit gold mines in the world, producing up to 105,000oz in FY19 at an all-in sustaining cost of between $670 and $720 per ounce.

That’s industry leading stuff.

Terpu is now hunting for his second company-making tier 1 deposit at Great Southern’s Edinburgh Park project, just 20km from Mt Carlton.

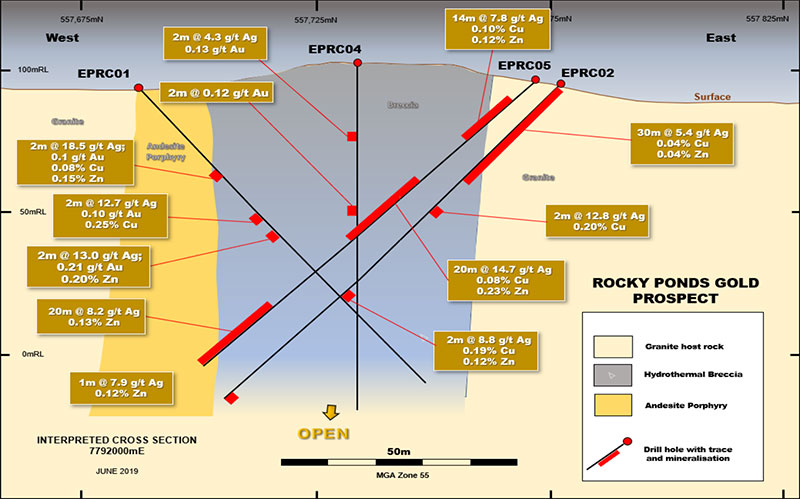

In February, the explorer discovered a new intrusive related gold system (IRGS) at Edinburgh Park. Follow-up drilling earlier this month intersected what could be the edges of a massive, Mt Carlton-like gold-silver-copper system.

Fresh drilling at the discovery, called Rocky Ponds, intersected significant zones of mineralisation including gold up to 0.2 g/t, silver up to 49.7 g/t, and copper up to 0.44 per cent.

These are very promising drill results from what was just a reconnaissance drill program, and planning for follow-up exploration has already kicked off.

“We have only just scratched the surface of this system when you consider the depths of gold mineralisation in other breccia systems such as Mt Wright and the Welcome breccia pipes,” Terpu says.

“We are busy planning detailed mapping and geophysics programs in the second half of 2019 to delineate more structures and understand the size potential of the system.”

WA: early cashflow opportunities

But Great Southern also has two exciting near-term development opportunities in the Laverton region of Western Australia.

Great Southern’s head of exploration Bryce Healy is a structural geologist with over 19 years’ experience in exploration and project evaluation.

He says Great Southern went into WA looking for unloved assets that it could turn around and get into production quickly.

“We wanted projects we could monetise quickly so we could be a little self-sufficient, rather than continually coming back to the market to raise money,” says Healy.

“That’s always been part of our strategy.”

These projects – Mon Ami and Cox’s Find – in the gold rich Laverton District represent early development opportunities andlarge-scale upside.

Healy says Great Southern chose the Laverton projects with development options in mind.

“Strategically, if you can go into areas that are well serviced by infrastructure, that have existing mining operations, then you can rapidly monetise even modest finds,” he says.

Mon Ami: the next Ida H

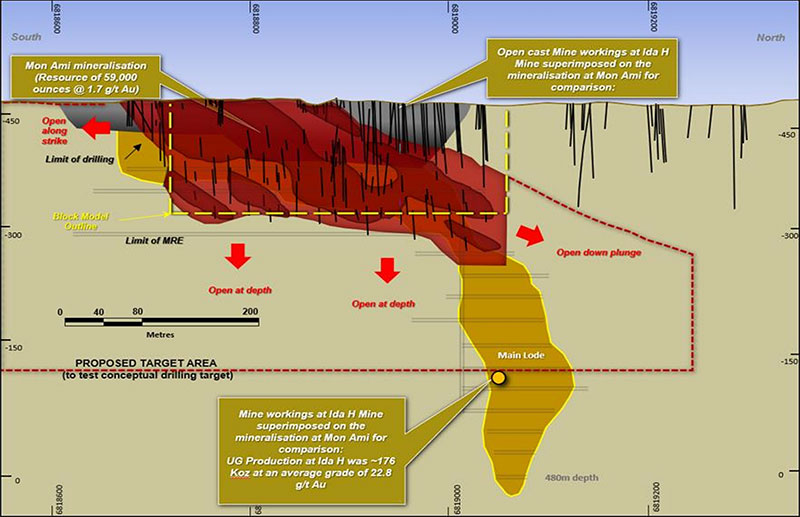

In November last year, Great Southern released a very conservative 60,000oz resource estimate for the newly discovered Mon Ami deposit, based on just 10,052m of drilling.

But Great Southern has barely scratched the surface.

Healy says Mon Ami mirrors significant deposits along strike, like the historic Ida H mine which produced 172,000oz at 22.6 g/t down to 480m in the early 1900s.

“Ida H started out as a small open pit and progressed into a high-grade underground development,” he says.

“There’s enough data to suggest that high-grade element is there at Mon Ami, and we have north plunging shoots — just like Ida H.”

There is not a single drill hole deeper than about 150 vertical metres at Mon Ami, says Healy.

“Our focus moving forward will be closing off the mineralisation along strike, and then drilling some deeper holes to chase that Ida H analogue — trying to build several hundred thousand ounces at high grades.”

One development option for Mon Ami is a small open cut moving into underground development, going after those high-grade shoots, he says.

But in the near term, Great Southern are looking to drill a spread of holes to depths of about 400m.

“This wouldn’t give us a resource, but they would give us a fairly solid exploration target and an understanding of the potential scalability at Mon Ami.”

Cox’s Find: high-grade, walk-up drill targets

In June, Great Southern entered into an agreement to acquire three granted mining leases near Laverton hosting the historic high-grade Cox’s Find gold mine.

Cox’s Find, which produced 77,000 ounces at more than 21 g/t between 1935 and 1942, was Western Mining Corporation’s (WMC) first foray into Australian gold production.

The mine has been dormant for over 30 years under private ownership.

This means Great Southern will be the first company to apply modern exploration and development techniques to this poorly understood, and ultimately underexplored, high-grade deposit.

Healy says there were clear limitations that stopped initial mine development and led to lack of exploration in the area.

“We are fairly confident that we can drill, focussed in on the deposit, and start putting ounces on the books straight away,” he says.

“One of the exciting things about Cox’s Find is that the historic production cut-off grades were around 15g/t.

That cut-off grade got higher and higher as WMC went deeper, to the point where all of a sudden it was uneconomic.

“You’re going back to when gold was the equivalent of $300 to $500/oz.”

As the economics change, so does the incentive to explore around and redevelop these mines into bigger projects, says Healy.

Great Southern has also defined two very good gold soil anomalies which trend parallel to the Cox’s Find pit.

“These could be two repeat high-grade reefs – just like the original pit — and we will be drilling these as a priority,” Healy says.

“When you find these high-grade reefs you can start adding a lot of ounces very quickly.

“If we could put 500,000oz on the books at Cox’s Find we would be very happy.”

This story was developed in collaboration with Great Southern Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.