Great Northern Minerals reckons Camel Creek also has a solid antimony resource – and it’s worth $17.5k a tonne

The company plans to deliver an initial JORC resource and scoping study at Camel Creek early next year. Pic: Buena Vista Images (Stone) via Getty Images.

Great Northern Minerals reckons that gold is looking strong headed into 2022 and is confident that positive influences like inflation and the ongoing pandemic will increase the support for the commodity.

Speaking to Stockhead, managing director Cameron McLean said that in the meantime, the company is progressing its three Queensland projects towards “commercially beneficial outcomes”.

“Our gold mineralisation at Camel Creek is associated with a mineral called stibnite, which is the main antimony mineral, which is currently worth about $17,500/tonne – a significant increase over the last 12 months.

“Our Camel Creek deposit contains appreciable amounts of antimony and the ability to extract this could result in a significant increase in the in situ value of our ore.”

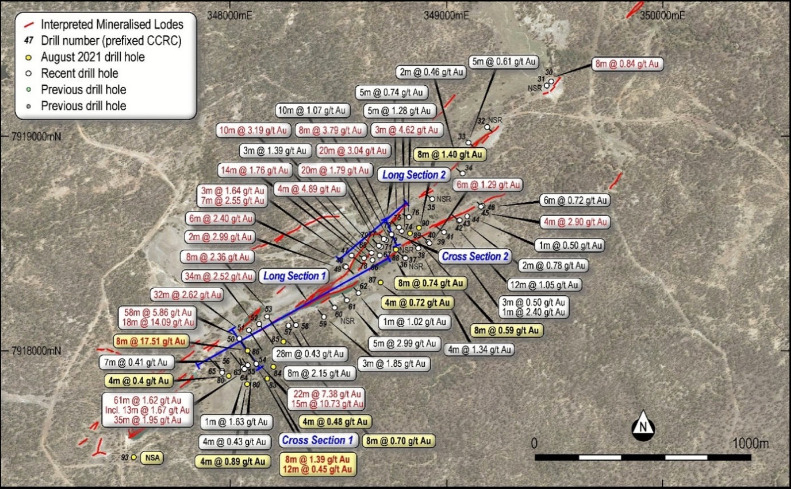

The company has enjoyed a productive – and successful – year of exploration at Camel Creek which confirmed the continuity of the gold system.

Hinge Zone discovery at Camel Creek

In May the new zone at Camel Creek delivered the best assay results ever seen at all three projects and uncovered the previously untested Hinge Zone.

The four-metre composites included:

- 56m at 4.14g/t gold (CCRC50) from 152 including 20m at 10.87g/t;

- 40m at 2.31g/t (CCRC51) from 160m; and

- 36m at 2.15g/t (CCRC52) from 128m.

Great Northern Minerals (ASX:GNM) also returned impressive one-metre assay results in June which confirmed high grades at Camel Creek, including:

- 58m at 5.86g/t (CCRC50) from 155m including 18m at 14.09g/t;

- 1m at 153.89g/t from 191m; and

- 22m at 7.38g/t (CCRC54) from 154m including 15m at 10.43g/t.

Gold system potential confirmed

Then in October, Great Northern flagged drill hole CCRC86 which included 1m at 105.46g/t from 127-128m – which can be directly correlated with the down dip intersection in CCRC54 of 3m at 23.84g/t from 166-169m and further down dip again with 1m at 153.89g/t from 191-192m in CCRC50.

This high-grade structure has now been confirmed over 100m of vertical down dip continuity.

Initial JORC resource and scoping study

The company recently closed a $3 million placement and plans to use the funds for an initial resource estimate at Camel Creek, followed by a mining and processing scoping study for the project.

“We now look forward to the assays from the recent diamond drilling and the first resource estimate for Camel Creek early 2022,” McLean said.

The company also expects to release the Camel Creek scoping study in April 2022.

Big Rush and Golden Cup exploration

Great Northern is also planning to drill test the Mikes Anomaly at the Big Rush mine and test at depth the high-grade zones at the Golden Cup project.

Earlier this year the company increased the Big Rush resource by over 220% to 154,000 ounces – which didn’t just increase the combined GNM resources to 184,000 ounces, it also identified several significant intersections that remain to be tested at depth.

Plus, high-grade gold was identified in a large arsenic anomaly at the project, with a maximum value of 26.64g/t gold.

The company plans to drill the anomaly in April 2022.

McLean also said the plan at Golden Cup is to replicate the Camel Creek campaign, with deeper RC drilling at the high grade zones scheduled for April.

This article was developed in collaboration with Great Northern Minerals Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.