Graphite miner Peninsula just nabbed its first key deal with a big Korean battery anode supplier

Pic: Schroptschop / E+ via Getty Images

Peninsula Mines has shaken hands with a big Korean tech company that makes the materials for lithium-ion battery anodes.

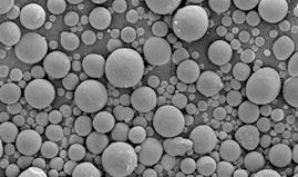

The graphite explorer (ASX:PSM) has signed an MoU with Tera Technos Co, which specialises in the production of high performance carbon composite silica oxide anode materials — a modified and enhanced version of spherical graphite.

Batteries are made up of an anode (positive) electrode and a cathode (negative) electrode and the electrical current flows between the two.

Spherical graphite, processed from natural or fine flake graphite, is used in the anodes of lithium-ion batteries.

>>Here’s everything you need to know about graphite

“This MoU represents a toe-hold in the world’s most dynamic lithium-ion battery industry in South Korea,” managing director Jon Dugdale told investors this morning.

Tera Technos is collaborating with research institutes around the world to produce an anode material that has a high capacity, high retention ratio, and excellent stability for improving the range and charging efficiency of an electric vehicle.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

The anode maker will undertake initial tests on graphite concentrate samples from Peninsula’s flagship Gapyeong project and possibly its Eunha project.

“The company will now look to complete ground breaking spheroidisation and eletrochemical testing, in parallel with advancing its key graphite projects towards development and production,” Mr Dugdale said.

Spheroidisation is a heat treatment carried out on the graphite to convert it into spherical shapes.

If Tera Technos is happy with the results, the two companies will negotiate a cooperation and off-take deal, giving Peninsula subsidiary Korea Graphite “first priority” to supply Tera with flake graphite concentrate.

Previous metallurgical tests have shown Peninsula can produce 97 per cent concentrate (plus-95 per cent is the target) from its projects in South Korea.

From there the concentrate will be used to produce spherical graphite and purification to 99.95 per cent.

Tera Technos, which supplies majors like POSCO Chemtech, is aiming to start full production of its anode materials by the end of this year.

Mr Dugdale says that while it is not yet known how much Tera Technos will be producing at full capacity, the expectation of demand is for up to 36,000 tonnes.

“That’s based on indications from groups like POSCO Chemtech, who are now producing spherical graphite as well,” Mr Dugdale told Stockhead.

“They’re looking to bump up their production of coated spherical graphite, so they need the basic spherical product, up to 36,000 tonnes per annum.

“So we’re aiming to generate one, two or maybe even three agreements with various anode manufacturers or spherical graphite producers.”

South Korea is the largest producer of lithium-ion batteries in the world and a major consumer of graphite, lithium and other metals for its high-tech industries.

The country is aiming for a fivefold increase in its renewable energy generation to 58.5GW by 2030.

South Korea was the world’s largest graphite producer until the 1970s.

According to Benchmark Mineral Intelligence, spherical graphite was fetching as much as $US4400 ($6160) per tonne by late 2018 – up from $US3600 at the start of the year.

“We have seen sharp price increases for spherical graphite during 2018, during which 15 micron uncoated material (99.95%) prices are up 20 per cent,” Benchmark said in mid-December.

“However, the rapid price increases seen for spherical graphite grades through 2018 have slowed in Q4, with the majority of prices stabilising within existing ranges.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.