Graphite demand grows as Novonix wraps up $146m capital raising

Graphite materials battery company Novonix has raised $146m of fresh capital. Image: Getty

- Novonix pulls in $146m of fresh capital to scale up production of its battery anode

- ‘The only qualified producer in North America of high grade anode material suitable for lithium-ion batteries’

- Other graphite battery material companies EcoGraf and Syrah Resources progress their production plans

Graphite demand is real. Battery materials and technology company Novonix (ASX:NVX) this week completed one of the largest capital raisings for a small cap company in recent years at $146m to progress its expansion plans.

The raising is a strong testament to surging investor interest in the graphite materials sector which is well-represented on the ASX by several companies.

“The company remains well positioned as the only qualified producer in North America of high grade anode material suitable for lithium-ion batteries for EVs and Energy Storage Systems,” chairman, Tony Bellas, said.

At $2.90 per share, the placement was priced at a near 12 per cent discount to the Novonix share price on Wednesday.

Approximately $115m of the raised capital came from institutional and sophisticated investors, and another $15m was derived from a share purchase plan for existing shareholders.

An additional $16.45m of of new capital was provided by some Novonix directors, adding up to a total of $146m for the capital raising.

Anode production to be scaled up

Novonix said it will use the capital raised to scale up production of its battery anode material to 10,000 tonnes per year and plans to reach an annual production rate of 40,000 tonnes by 2025.

Battery technology solutions is the primary business of the company which involves specialty battery materials and battery cell and pack production.

The company has key relationships with two major manufacturers of lithium-ion batteries, Sanyo Electric of Japan and Samsung of South Korea.

Its products are used by a wide customer base including automakers Honda and Toyota, energy storage systems company Bosch, and battery makers LG and Panasonic.

Novonix is also exploring new opportunities to establish anode production capacity in Europe, the Middle East and Asia to service these rapidly growing markets.

The US Department of Energy has awarded Novonix a grant of $US5.6m for its work in developing a lithium-ion battery supply chain in North America.

Novonix is a leader in developing technology for the “million-mile battery” that extends the time or distance travelled between recharging, and seen as a crucial product feature.

Four critical elements are required for the so-called million-mile battery: advanced research and development testing, long-life anodes, long-life cathodes, and long-life electrolytes.

Novonix said it has product capability in all four critical elements after developing its proprietary technology and demonstrating its superior performance.

Anode, cathode and electrolytes are the main elements of a lithium-ion battery with graphite featuring in the anode part.

Electric vehicle growth fuels graphite demand

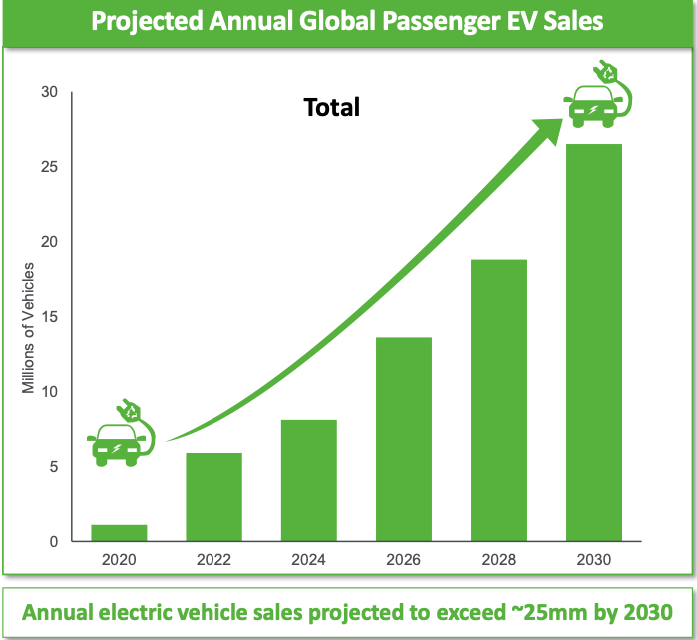

EV sales are forecast to grow exponentially in the current decade and to reach 25 million vehicles per year by 2030 from a very low base currently, aided by carmakers’ plans to go all electric.

Jaguar Land Rover said it wants an all-electric vehicle line by mid-decade, and Ford is to sell only EVs across its whole product range from 2030.

This is creating huge demand for lithium-ion battery materials such as lithium, graphite and other cathode materials such as cobalt, manganese and nickel.

For example, Novonix estimates that 3.78 million tonnes of graphite will be consumed in lithium-ion batteries annually by 2030, up from around 890,000 tonnes in 2020.

“Novonix continues to leverage its team and their expertise by investing in research and development and commercialisation programs, including the scale up of its cathode business utilising its proprietary dry particle micro granulation technology,” Bellas said.

Graphite production has been dominated by China with 78 per cent of global production in 2019, but end user customers are seeking to diversify their supply sources.

This is because of the perceived risk to North American, European and Middle Eastern supply chains from issues including trade tensions, logistical risks and logistical costs.

EcoGraf uses capital raising for production expansion

Another company in the battery materials space is EcogGaf (ASX:EGR) which also completed a capital raising in February that was for $54.5m to fund its production expansion.

As with Novonix, EcoGraf’s capital raising in mid-February also attracted cornerstone investment from significant institutional investors wanting to support its high-purity graphite business.

The funds raised are going toward the construction and commissioning of commercial operations at its first production facility in WA for graphite for the lithium-ion battery market.

The plant will have an initial production capacity of 5,000 tonnes per year, before expanding to 20,000 tonnes per year to cater for expected demand growth from Asian countries.

When combined with EcoGraf’s European production base the company will have a total production for battery-grade graphite of 40,000 tonnes per year by around 2025.

The company is scouting several European locations as a site for its second production facility and is working closely with Germany’s economic development agency German Trade and Invest.

The environmental credentials of EcoGraf’s HF-free purification process for graphite strongly aligns with European legislation for battery production and supply chains.

Mozambique graphite operation of Syrah Resources to restart

Syrah Resources (ASX:SYR), with its Balama graphite operation in Mozambique and downstream battery anode material project in the US, is also making strides in the industry.

The company said this week it was in a position to restart production at Balama after halting operations in March last year with the onset of the COVID-19 pandemic.

Travel restrictions had limited the mobility of its Balama workforce, and it experienced reduced customer demand for its graphite anode material.

In July 2020, the company announced it was restructuring its labour force at Balama and took other action to preserve its cash during the period its production was halted.

Syrah Resources said this week it was now able to manage its Balama operations within current travel restrictions, and that market conditions were supportive for a production restart.

“Syrah will now progress the recruitment of labour required to restart operations at Balama, with first production expected within two to three months,” said the company.

At the end of last month, Syrah Resources successfully completed a capital raising for $18m through a share purchase plan for existing shareholders that was heavily oversubscribed.

“Approximately 34 per cent of Syrah’s shareholder base applied to participate in the SPP, with approximately $63.7m received in valid applications versus the SPP target raising of $12m,” said the company at the time.

ASX share price for EcoGraf (ASX:EGR), Novonix (ASX:NVX), Syrah Resources (ASX:SYR)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.