‘Grab the tail and hang on’: Ardiden pursues high grade gold monsters at Pickle Lake

Pic: John W Banagan / Stone via Getty Images

Special Report: The multi-million-ounce gold discovery opportunities at Pickle Lake ‘are truly exciting’, Ardiden’s Rob Longley says.

North America is now the land of opportunity for Aussie gold explorers and miners.

The big miners are picking up high quality gold assets. In 2018, Northern Star Resources’ (ASX:NST) bought the 10 million ounce Pogo mine in Alaska for $347m.

This was followed by the multimillion ounce Atlantic Gold ($768m), Red Lake ($551m), and Red Chris ($1.2 billion for 70 per cent) acquisitions in Canada by St Barbara (ASX:SBM), Evolution Mining (ASX:EVN), and Newcrest (ASX:NCM) respectively in 2019.

For Aussie explorers, the opportunity to pick up an unloved, underexplored gold project in Canada is similarly enticing.

Since 2018, ~$12.5m market cap Ardiden (ASX:ADV) has amassed a dominant 664sqkm landholding in the unexplored Pickle Lake region in Ontario, Canada.

This is elephant country. The Pickle Lake project is comparable in size and geology to Evolution’s producing 30-million-ounce Red Lake gold district, right next door.

“We have been busy building a cheap, high-quality exploration portfolio that has size to it,” Ardiden managing director Rob Longley says.

“You can’t do that here in WA.”

There’s a lot of activity in the area. In June, the Tolga Kumova-chaired European Cobalt (ASX:EUC) moved into Ontario with the acquisition of the Edleston gold project, where old drilling hit grades like 5.3m at 81.39g/t gold, 110m from surface.

Ardiden’s neighbour is market darling Auteco Minerals (ASX:AUT), which is up an incredible 1500 per cent so far in 2020.

Auteco – spearheaded by the same team that made Bellevue Gold (ASX:BGL) such a success — has just defined a 830,000oz at 11.6 g/t gold resource at their Pickle Crow project.

“With the Bellevue guys coming in, investors now know where Pickle Lake is and the prospectivity of it,” Longley says.

“[Auteco] have obviously scoured the planet for under loved areas and have singled out Pickle Crow out as being one of those old, underground mines that can be reinvigorated.

“Their path is different to ours, but I think we have compatible stories. The ground is exactly the same.”

Building a multimillion-ounce resource

Traditionally made up of a patchwork of smaller claims and mining operations, Ardiden wants to look at the region as whole and “connect the big picture”.

“We have managed to put together an area that stretches 100km east to west and – with experts like Southern Geoscience –examine the different styles of mineralisation,” Longley says.

“There are magnetised areas, demagnetised areas, porphyries – what geophysical techniques work best to look for these targets?

“You still have to apply the best science you have and give yourself the best chance of making a discovery.”

When Ardiden does unearth something at Pickle Lake it is significant, for a couple of reasons.

Firstly, one of the interesting things about Pickle Lake is that there’s no deep weathering of the rock like in Australia.

Anything that was weathered has been scraped away by glaciers and had a thin ~2m layer of clay – called glacial till – dumped on top.

That means there’s no ‘sniffs’ of low-grade gold mineralisation to indicate whether a company is close to a potential deposit. You either hit gold or you don’t.

“Once you are through that cover you are straight into fresh rock, so the geology once you hit it is pretty nice – you don’t have to deal with all the regolith and dispersion halos,” Longley says.

“You’re either in mineralisation or you’re out of it.”

Also, a lack of rock outcrop, which acts as ‘signpost’ for explorers and prospectors, means the old, deep high-grade gold systems had very small surface ‘footprints’.

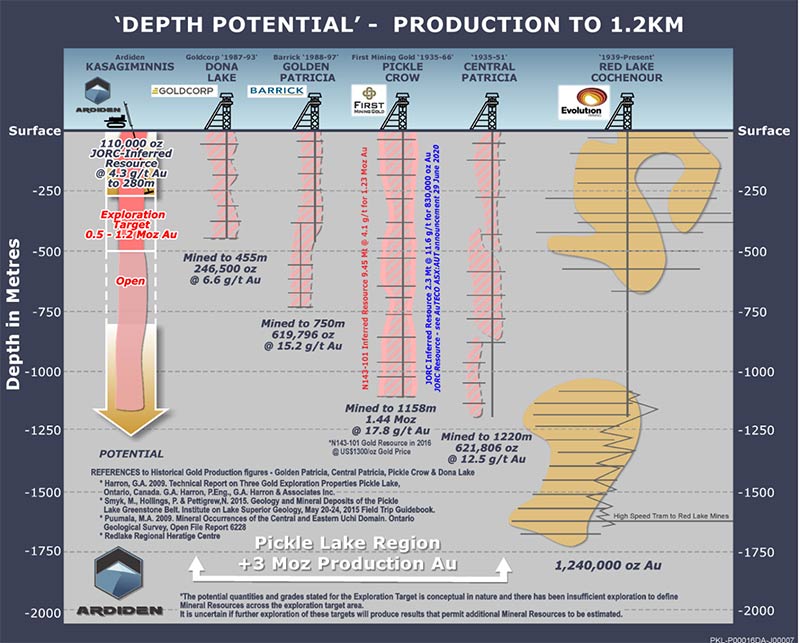

“There are four historic high-grade underground gold mines which were operated between the 1930s and the 1990s by different companies,” Longley says.

“Some of them go down 450m; two of them go down over 1km.”

These are very deep lode systems.

“It might not have much surface expression but once you find these things it’s ‘grab the tail of the dog and hang on’,” Longley says.

These deep high-grade mineralised systems are what Ardiden is hunting for.

Target #1: Kasagiminnis

Newmont’s producing 5moz Musselwhite underground gold mine, 150km to the north, has a small surface footprint similar to Ardiden’s advanced, high grade Kasagiminnis target.

A 2018 drill program by Ardiden at Kasagiminnis returned thick, shallow, and high-grade intercepts like 21m grading 3.97 grams per tonne (g/t), 67m from surface.

This drilling culminated in a maiden high-grade resource of 790,000 tonnes grading 4.3g/t for 110,000oz of gold in September 2019.

That resource is only estimated over a length of 600m and to a maximum depth of 280m below surface. All up, the drill bit has never gone below 305m depth.

That’s a tiny footprint in the overall scheme of things. especially if you consider that companies like Evolution are now mining 2km below surface.

The gold at Kasagiminnis also remains ‘open’ (a.k.a ‘we don’t know where the gold ends’) to the east and west, but historical spaced drilling already indicates that the gold mineralisation trend continues in both directions.

The upside is clear. Ardiden believes Kasagiminnis is already displaying early stage similarities with some of these big regional mining operations.

Ardiden now plans to start testing a high-grade exploration target of between 500,000oz and 1.2moz for Kasagiminnis with a phase one drilling program, due to kick off in July.

But Kasagiminnis is just the start

While Kasagiminnis is a logical starting point for Ardiden to start building ounces, it is just one of multiple ‘deposit-scale’ targets and advanced gold prospects within the company’s 100km of underexplored strike.

“When you look at Kas as a potential million-ounce deposit, then you look at the broader belt and the potential – that’s what really excites me as a geologist,” Longley says.

By combing over old data Ardiden has, so far, identified 19 gold deposit and prospect areas to progress systematically.

There are two high-grade gold deposits called ‘Dorothy’ and ‘Dobie’ – less than 40km from Kasagiminnis – which come with a combined non-JORC estimate of 99,600oz gold at 5.7 grams per tonne (g/t) gold, less than 150m below surface.

More target areas will be identified as mineralisation models and analysis of ‘controls’ evolve, Ardiden says.

It’s nice to have a solid pipeline of good prospects and targets that deserve work, Longley says.

“We have been approached to sell some of these off, but I have absolutely no intention of offloading anything — if anything, we might do a little bit more building,” he says.

“We have a style of package that a lot of companies want.”

What this space over the next summer and winter to see what Ardiden is capable of doing, Longley says.

“Right now, we are flying under the radar –but we believe the Ardiden story will grow strongly.”

This story was developed in collaboration with Ardiden Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.