Golden Swan “a stepping stone to bigger things” for Poseidon, says Argonaut

Argonaut Securities has labelled Poseidon Nickel’s recent Golden Swan discovery in Western Australia as an “across-the-cycle nickel find” and a “stepping stone to a bigger play” in initiating coverage on the company.

Poseidon (ASX: POS) confirmed the discovery of Golden Swan at its Black Swan Project 50km north-east of Kalgoorlie last year with three drill holes intercepting significant massive sulphide nickel mineralisation.

Those holes were testing an electromagnetic conductor identified in downhole surveying parallel to, and 400m south of, the Silver Swan underground mine, which has produced 138kt of nickel historically and currently contains a resource of 16kt of nickel at a healthy grade of 9.5%.

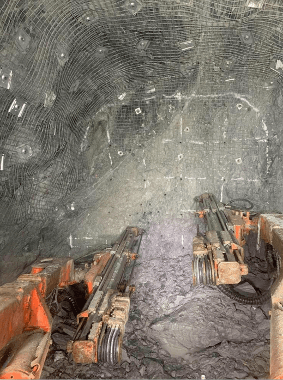

Poseidon is poised to start the first close range drilling of Golden Swan in April following the completion of a 440m exploration drive extending from the Silver Swan workings and Argonaut sees strong potential for the discovery to grow.

“On early evidence, confined to a 170m by 60m window to the contact, Argonaut estimates circa 10kt extractable nickel at +5% average Ni grade, as a minimum initial target,” analyst John Macdonald wrote in his initiation note.

“The potential up dip, down dip and along strike of the window remains open, with the temptation to measure it against Silver Swan’s 138kt Ni production history.

“In any case, Golden Swan is likely to be an across-the-cycle nickel find that opens up opportunities for the group.”

Toll treatment first up

Rather than recommission the 2.2Mtpa Black Swan plant to treat ore from Golden Swan, Poseidon is likely to go down the lower cost route of mining the discovery as part of a toll treatment operation. Discussions with third parties with mill capacity began in February.

Macdonald noted that BHP’s Kambalda concentrator 100km away would be an obvious location to treat the high-grade, high Fe:MgO Golden Swan ore, but it could end up further afield at somewhere such as Western Areas’ Cosmos plant as well.

Under this scenario, cashflow from Golden Swan would then be utilised to explore and develop resources across the Poseidon portfolio, to the point where the company could justify re-starting the Black Swan concentrator.

“High grade komatiite-hosted nickel discoveries in Western Australian are sweet, particularly when their exploitation coincides with firm nickel prices,” Macdonald said.

“Golden Swan, as it stands, looks like a stepping stone to a bigger play and our valuation of 9cps only partly reflects that potential.”

Along with Black Swan, Poseidon’s WA assets include 149kt of nickel in resource at Windarra and 52kt of nickel in resource and a 1.5Mtpa processing plant on care and maintenance at Lake Johnston.

The company is also looking at options for monetising 180koz of gold in tailings at Windarra and recently acquired an option to treat a further 62koz of gold in tailings at nearby Lancefield to beef up this project.

In reaching his valuation for Poseidon, Macdonald ascribed the bulk of the value to Black Swan, modelling nickel production of 9,000t of nickel in concentrate a year for six years from Golden Swan and Silver Swan.

Argonaut has recommended the stock as a “speculative buy”.

This story was developed in collaboration with Poseidon Nickel, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.